GBPCHF Will Explode! BUY!

My dear subscribers,

GBPCHF looks like it will make a good move, and here are the details:

The market is trading on 1.0989 pivot level.

Bias - Bullish

My Stop Loss - 1.0948

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.1062

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF trade ideas

Rectangle ChannelHey traders, here’s one to watch closely 👇

GBPCHF is consolidating in a rectangle channel structure, marked by clear highs and lows — a classic coiled spring waiting for resolution.

📌 Key Notes:

Price has respected horizontal boundaries repeatedly

We’ve now broken above the top of the range with a reaction off point D

Both upside and downside breakouts remain valid — the key is confirmation

🔍 What to Watch:

A surge in volume and close above 1.10142 or below 1.09510 will confirm breakout direction

Fibs projected from XA and ABCD legs show both upside and downside targets

Range extension levels already plotted for reference

No prediction. Just structure and breakout readiness.

— C. Dela | #TradeChartPatternsLikeThePros.

GBPCHF Sell Opportunity: Strong Rejection Signals Across TF📉 Overview from Weekly Timeframe:

Price was rejected strongly from key resistance zone and the 50EMA, forming a large bearish rejection candle. This signals a potential momentum shift to the downside after a prolonged rally.

📉 Daily Chart Explanation:

Price has broken the ascending trendline and is now trading below the 50EMA, suggesting bearish control. Multiple rejection candles at the trendline retest indicate that sellers are defending the zone aggressively.

📉 4H Chart Explanation:

The 4H chart confirms the bearish bias with a clean trendline break and sustained movement below the 50EMA. The structure now favors lower highs and lower lows.

🔎 Plan

Bias: Bearish

Entry: On pullback to broken trendline or 50EMA area (confluence zone)

Targets:

TP1: Recent swing low

TP2: Weekly support zone

Invalidation: Break and close above the 50EMA on 4H

GBPCHF continuation of selling pressure below 1.1070The GBPCHF currency pair continues to display a bearish outlook, in line with the prevailing downward trend. Recent price action suggests a corrective pullback, potentially setting up for another move lower if resistance holds.

Key Level: 1.1070

This zone, previously a consolidation area, now acts as a significant resistance level.

Bearish Scenario (rejection at 1.1070):

A failed test and rejection at 1.1070 would likely resume the bearish momentum.

Downside targets include:

1.0910 – Initial support

1.0860 – Intermediate support

1.0810 – Longer-term support level

Bullish Scenario (breakout above 1.1070):

A confirmed breakout and daily close above 1.1070 would invalidate the bearish setup.

In that case, potential upside resistance levels are:

1.1125 – First resistance

1.1240 – Further upside target

Conclusion

GBPCHF remains under bearish pressure, with the 1.1070 level acting as a key inflection point. As long as price remains below this level, the bias favors further downside. Traders should watch for price confirmation around that level to assess the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF SHORTMarket structure bearish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection At AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 1.10500

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.17

Entry 110%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF: Will Start Growing! Here is Why

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPCHF pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

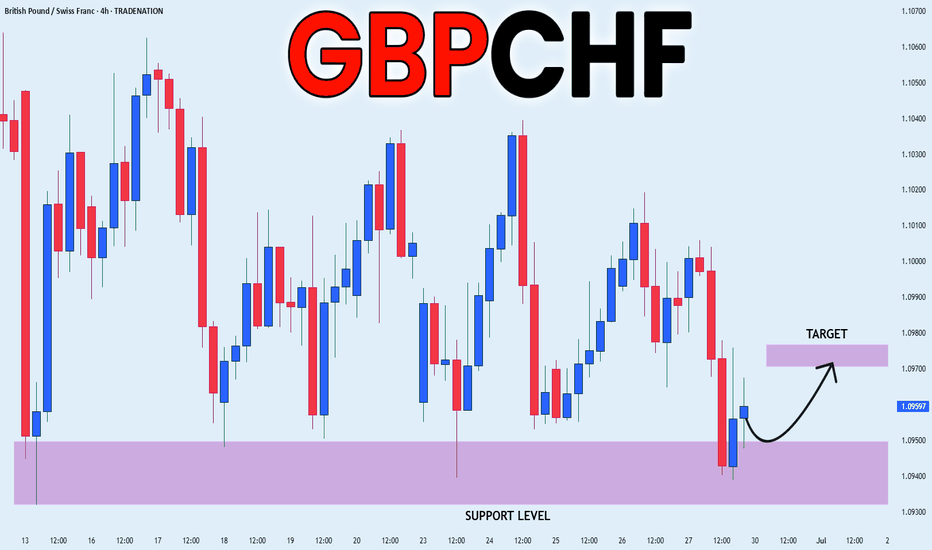

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF INTRADAY bearish below 1.1070Key Support and Resistance Levels

Resistance Level 1: 1.1070

Resistance Level 2: 1.1120

Resistance Level 3: 1.1170

Support Level 1: 1.0915

Support Level 2: 1.0865

Support Level 3: 1.0815

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF SHORT Market structure bearish on HTFs 3

Entry at both Weekly And Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 1.10000

H4 EMA retest

H4 Candlestick rejection

Levels 4

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GBP/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.094 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trade Idea: Sell GBP/CHF **📉 Trade Idea: Sell GBP/CHF**

**Bias:** 🔻 Bearish

**Timeframe:** Short-Term

---

### **📊 Why Sell?**

**🇬🇧 GBP Weakness:**

* UK economy slowing 🛑

* BoE might cut rates soon 🔻

* Pound under pressure across the board 😓

**🇨🇭 CHF Stability:**

* Dovish SNB, but still a safe-haven 🛡️

* Weak data, but no big downside 👣

* CHF holds up well in risk-off mood 🌫️

---

### **🧭 Technical View:**

* **Structure:** Lower highs forming ⏬

* **Break Level:** Clean rejection from 1.1300 resistance 🚫

* **Next Support:** 1.1150 zone 📉

* **Momentum:** Bearish bias under 1.1280 🔻

---

**⚠️ Risk:**

> Only invalid if price pushes back above 1.1350 and holds.

---

**🎯 Summary:**

GBP is soft, CHF is steady — trend favors downside. Clean setup if 1.1300 holds as resistance.

GBP-CHF Support Ahead! Buy!

Hello,Traders!

GBP-CHF keeps falling but

A strong horizontal support

Level is ahead at 1.0921

From where we will be

Expecting a rebound

And a local bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.