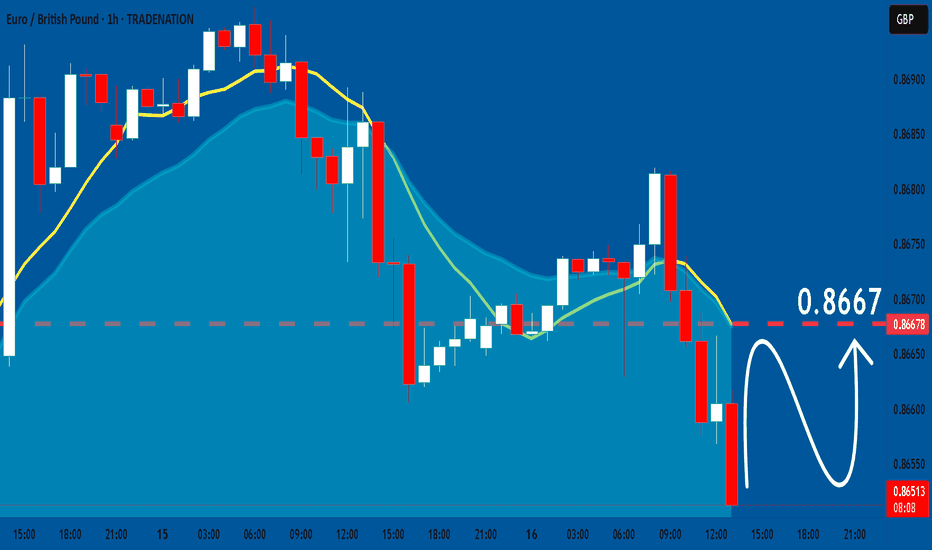

EURGBP: Expecting Bullish Movement! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPEUR trade ideas

The Day AheadUnited States

June PPI: Not released yet — important for inflation outlook.

Industrial Production (June): –0.2% month-on-month (weaker than expected).

Capacity Utilisation: Fell to 77.4% from 77.7%.

NY Fed Services Business Activity (July): Awaiting release.

United Kingdom

CPI (June): +3.6% year-on-year — higher than May’s 3.4%. Driven by food and air travel.

RPI (June): +4.3% year-on-year — unchanged.

House Price Index (May): Home prices +3.9% YoY; rents +6.7% YoY — showing persistent housing inflation.

Eurozone / Italy / Canada

Italy & Eurozone Trade Balance (May): Not released yet.

Canada Housing Starts (June): Awaiting release.

Central Banks

Federal Reserve:

Beige Book due today — expected to provide insights into regional economic conditions.

Speeches from Logan, Hammack, Barr, Williams, Barkin — may influence interest rate expectations.

Earnings Reports (Major Companies Today)

United States:

Johnson & Johnson

Bank of America

ASML

Morgan Stanley

Goldman Sachs

Kinder Morgan

United Airlines

Alcoa

Europe:

Sandvik (Sweden)

Market Takeaways

Key Theme Market Relevance

US Output Weakness May support dovish Fed tone, bond yields could ease.

UK Inflation Surprise Could delay Bank of England rate cuts; GBP may gain.

Central Bank Watch Fed speeches and Beige Book in focus for policy clues.

Earnings Season Major US banks and industrials could drive equity volatility.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

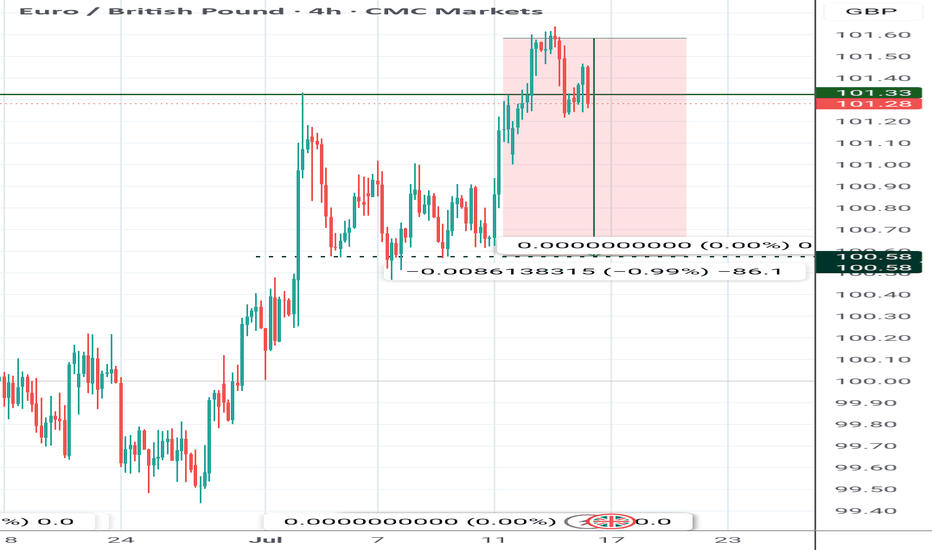

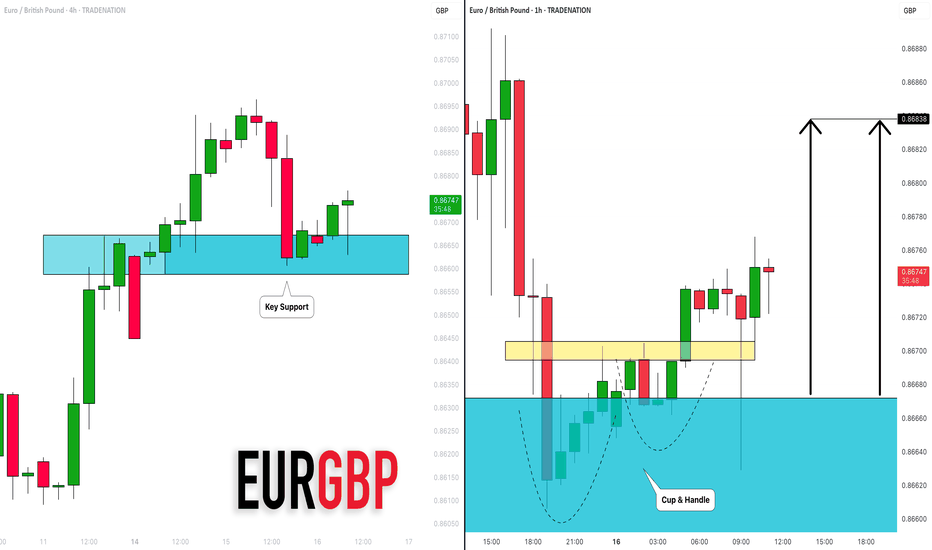

EURGBP: Bullish Move From Support Confirmed?! 🇪🇺🇬🇧

There is a high chance that EURGBP will bounce

from a key intraday horizontal support cluster.

The market looks bullish after UK CPI release this morning.

Goal - 0.8684

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Analysis : Bullish Setup + Support & Reversal Zone Ahead🔍 Overview:

This analysis explores a well-developed Mid-Market Cycle (MMC) pattern playing out on the EUR/GBP 8H chart. The price action has transitioned from accumulation to markup, forming a classic cup-shaped recovery structure supported by a parabolic ARC curve. With strong volume contraction, historical interchange zones, and clean breakouts, this setup indicates bullish momentum heading into the next reversal zone.

Let’s walk through each component in detail and build the case for this trade setup.

🧩 1. MMC Cycle Framework

The chart structure aligns with the MMC (Mid-Market Cycle) model:

Phase 1 – Accumulation:

From April to late May, price formed a rounded bottom resembling a "cup" — a known sign of smart money accumulation. The downward momentum stalled, and sellers were gradually absorbed by larger participants.

Phase 2 – Breakout & Expansion:

Early June saw price breaking out of this base, beginning an aggressive uptrend supported by rising structure. This marks the transition to the markup phase of the MMC.

Phase 3 – Pullback & Continuation:

Price pulled back slightly into previous resistance (now turned support), forming a bullish continuation triangle and breaking out again. A textbook MMC continuation.

🧠 2. Technical Confluences

✅ A. ARC Support Curve

The curved support line (ARC) acts as dynamic demand.

Price has bounced multiple times off the curve, reinforcing its strength.

ARC patterns often signal increasing bullish acceleration, reflecting market psychology as traders gain confidence with each higher low.

✅ B. Interchange Zones

The concept of Interchange refers to zones where support becomes resistance or vice versa.

This chart features two key interchange levels:

First interchange formed after the April high.

Second interchange was retested and held cleanly after the breakout.

These areas indicate institutional interest, and their successful retests confirm trend continuation.

✅ C. Volume Contraction

Volume has been shrinking during the markup, which is counterintuitive but strategic.

In Wyckoff theory, this shows absorption of supply — institutions deliberately suppress volatility to accumulate before the next breakout.

Once the contraction ends, explosive moves often follow.

🎯 3. Target Zone: Next Reversal Area

Price is now heading into a clearly defined resistance zone around 0.87400–0.87500.

This level was respected in prior price history (April peak) and may trigger short-term selling or distribution.

The chart shows a possible liquidity grab scenario at the reversal zone, followed by a corrective move (mini bearish ABC).

📈 4. Price Projection & Scenarios

Bullish Case (High Probability)

Breakout Above 0.87500: Triggers a major leg upward.

Potential extension targets:

0.87850 (Fibonacci projection)

0.88200 (next higher timeframe resistance)

Bearish Case (Short-Term Pullback)

Rejection at Reversal Zone:

A corrective leg toward the ARC or prior interchange.

Ideal re-entry for buyers near:

0.86400–0.86600 zone

Or curve retest near 0.86000

🧭 5. Trade Strategy

🔹 Entry Options:

Breakout Entry: Above 0.87500 on strong candle + volume.

Retest Entry: On dip toward ARC curve or interchange.

🔹 Stop-Loss Ideas:

Below ARC line (~0.86000)

Below last bullish engulfing (~0.86250)

🔹 Targets:

TP1: 0.87500

TP2: 0.87850

TP3: 0.88200 (longer-term swing)

💡 6. Trader Psychology in This Chart

This chart represents a controlled bullish structure — a hallmark of smart money participation. Here’s why:

The rounding base was methodically built without sudden volatility.

Each breakout was followed by healthy retests (no fakeouts).

Volume stayed low during markups, reducing retail confidence and allowing institutional loading.

The ARC curve reflects increasing confidence and participation — buyers consistently stepping in on higher lows.

📌 Conclusion

This EUR/GBP setup is a textbook MMC/ARC structure with multiple confirmations:

Smart accumulation

Curve support respected

Volume and structure aligned

Clear next resistance zone

Whether you’re swing trading or monitoring for breakout scalps, this is a high-quality setup worth tracking. Be ready to act at the reversal zone, as it will either confirm continuation or offer a lucrative retest entry.

🔔 Follow for More:

I post regular MMC, structure-based, and Smart Money trade setups. Drop a like, comment your thoughts, or ask questions below!

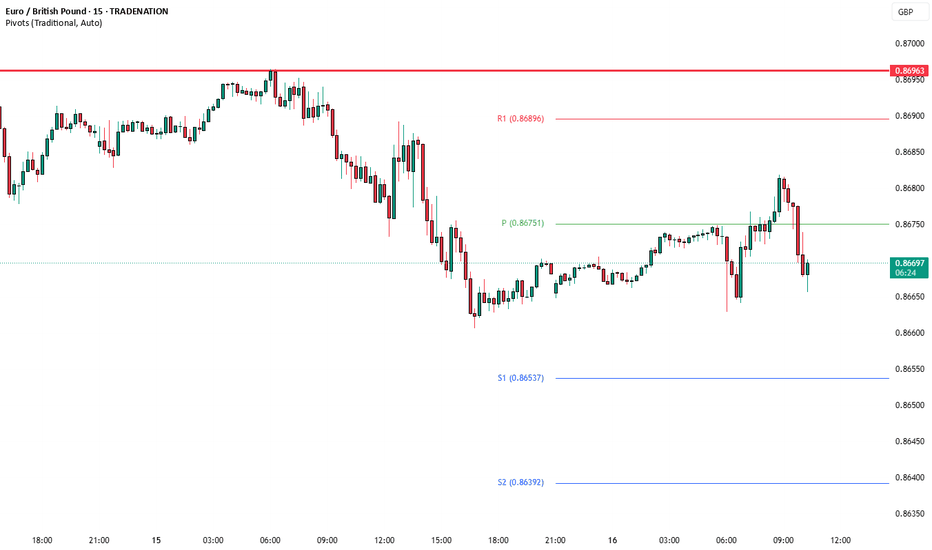

EUR-GBP Strong Bullish Breakout! Buy!

Hello,Traders!

EUR-GBP is trading in a

Strong uptrend and the

Pair made a bullish breakout

Of the key horizontal level

Of 0.8659 so we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP: Bears Will Push Lower

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURGBP pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP Bullish continuation breakout supported at 0.8620The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at:

0.8700 – initial resistance

0.8715 – psychological and structural level

0.8740 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8620 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8600 – minor support

0.8590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8620. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DeGRAM | EURGBP broke out of the descending channel📊 Technical Analysis

● Price has punched through the month-long descending-channel roof and is holding the break, carving a tight bullish flag along a fresh up-trend line.

● Rebound from the 0.861 demand created an inverted H&S; its 1 : 1 projection aligns with the 0.8681 pivot and the March high at 0.8703, while RSI remains mid-range, leaving upside fuel.

💡 Fundamental Analysis

● Softer UK wage-growth and uptick in jobless claims revived talk of an August BoE cut, whereas a surprise rise in the Euro-area ZEW expectations index hints at stabilising growth, nudging rate-differential momentum toward the euro.

✨ Summary

Long 0.8650-0.8665; sustained trade above 0.8640 targets 0.8680 → 0.8703. Invalidate on an H1 close below 0.8610.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP – Waiting for the Market to Come to UsWe are patiently waiting for price to correct

and reach our level.

📌 If the price touches the level and gives us a valid signal,

we will buy.

📉 But if the level is broken, we don't panic —

we simply wait for a pullback and enter a short position.

🧠 No guessing, no stress.

We let the market come to us, and then we react — according to plan.

EUR/GBP BEARS ARE STRONG HERE|SHORT

Hello, Friends!

We are going short on the EUR/GBP with the target of 0.863 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP In a Clear Bullish TrendEURGBP In a Clear Bullish Trend

EURGBP Is moving in a clear bullsh trend for a long time.

A few days ago, the price broke out of another and clear bullish pattern.

If the volume grows further and the price respects this new pattern EURGBP may rise to 0.8710 and 0.8770 during the coming days or week.

The data we have this week could support this movement.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Short Trade Risking 1% to make 1.3%OANDA:EURGBP Short swing trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Risking 1% to make 1.35%

Don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Ready to Raid the Chunnel? EUR/GBP Bullish Strategy Unveiled!🔥🤑 "THE CHUNNEL HEIST: EUR/GBP BULLISH LOOTING SEASON!" 🏴☠️💸

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

(Hi! Hola! Ola! Bonjour! Hallo! Marhaba!)

Based on the 🚨THIEF TRADING STYLE🚨 (a ruthless mix of technical & fundamental analysis), we’re plotting a major heist on EUR/GBP "The Chunnel"—time to LOOT THE BULLS!

🚨 HEIST BLUEPRINT (LONG ENTRY) 🚨

🎯 Escape Zone: High-risk RED MA Zone (Overbought? Reversal? Trap? Bears lurking? Cops are waiting!).

🏆 Take Profit & Run! You’ve earned it, outlaw! 💰🔥

🔓 ENTRY: "VAULT IS OPEN—SWIPE THE BULLISH LOOT!" after the breakout

Pullback Entry near the Moving average @0.84850

Buy Limit Orders preferred (15-30min timeframe).

Swing Low/High Pullbacks = Perfect Stealth Entry.

⛔ STOP LOSS (SL): "DON’T GET CAUGHT!"

📍 Thief SL: Recent swing low (4H timeframe) @ 0.84000 (Scalping/Day Trade Basis).

⚠️ Adjust based on your risk, lot size & multiple orders!

🎯 TARGET: 0.85850 (OR ESCAPE EARLY IF HEAT’S ON!)

📢 WHY THIS HEIST? (BULLISH CATALYSTS)

💥 EUR/GBP is BULLISH—backed by:

Fundamentals (COT Report, Macro Data)

Sentiment & Intermarket Trends

Quantitative Edge (Check out for full intel! 👉🌎🔗)

🚨 TRADING ALERT: NEWS = DANGER ZONE!

📉 Avoid New Trades During High-Impact News!

🔒 Use Trailing Stops—Lock profits, evade volatility traps!

💥 BOOST THIS HEIST! (SUPPORT THE MISSION)

🔥 Hit the "LIKE" & "BOOST" button—strengthen our Profit Robbery Squad!

🤑 Daily Market Heists = Easy Money (Thief Trading Style FTW!)

Stay tuned for the next heist plan! 🚀🐱👤💖

EURGBP EUR/GBP Pre-Market Top-Down Analysis

Date: July 13, 2025

Session: London Pre-Market

Analyst: Sub Saharan

🕰️ 1H Chart Overview

EUR/GBP is currently trading around 0.86652, with bullish momentum pushing toward the previous high at 0.86704, marked as HH (Higher High) on the chart. This level is a significant resistance, and a confirmed break and close above it could signal further bullish continuation.

🔍 Structure Breakdown

Key Levels and Market Structure:

HH (Higher High): 0.86704

LL (Lower Low): 0.85997

Recent HL (Higher Low): Series of HLs forming support during the rally.

Break of Structure (BOS): Occurred on July 11, indicating a shift from bearish to bullish momentum.

Key POI (Point of Interest): 0.86586 – Marked for potential buy entries based on LH structure.

🔁 Scenario Planning

🔼 Bullish Continuation Scenario

Bias: Buy on retracement

Plan: If price pulls back and respects the LH zone (0.86586) without breaking below it, look for bullish setups with target around or above 0.86704.

Confirmation: Rejection candle or bullish engulfing at POI

🔽 Bearish Reversal Scenario

Bias: Sell if structure shifts

Condition: If price breaks below the last HL to form a Lower Low (LL), it may indicate weakness.

Plan: Wait for a pullback to the broken LH zone (0.86586) to re-test as resistance, then sell with confirmation.

Target: Mid-range or previous low near 0.85997

🧠 Trading Insight

The price is in a bullish correction phase within a rising trend.

Aggressive buyers may consider early entries at or above 0.86586, but conservative traders should wait for price action confirmation.

If a lower low prints, treat it as a signal for potential structure change and reposition for short-term sells.

🧾 Trade Management Tips

Use 0.86704 as your decision point. Break and hold = bullish continuation.

POI at 0.86586 is key for both buy re-entries or sell re-tests.

Set alerts for structural changes (new LL or break of HH).

📌 Summary

Bias Key Level Action

Bullish 0.86586 Buy on retracement (if HL forms)

Bearish Below 0.86586 Sell if LL forms, re-test at LH

Stay patient and react to structure—not emotions. London session volatility may provide the liquidity needed to trigger setups.

EURGBP SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURGBP SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.