GBPINR trade ideas

1H GBPINR 08.03.2020FX_IDC:GBPINR

1W and 1D chart interpretation are analysed in linked idea:

Continuation to 1W and 1D charts, 1H chart based trade setup is as follows

Trade Setup:

Time frame : 1H

Position type: Long

Entry: Upon price action retracing to "1H validated uptrend" line

Target 1: Until close below "1H validated uptrend" line in 1H chart

Stop loss: Below the future low at "1H validated uptrend" line.

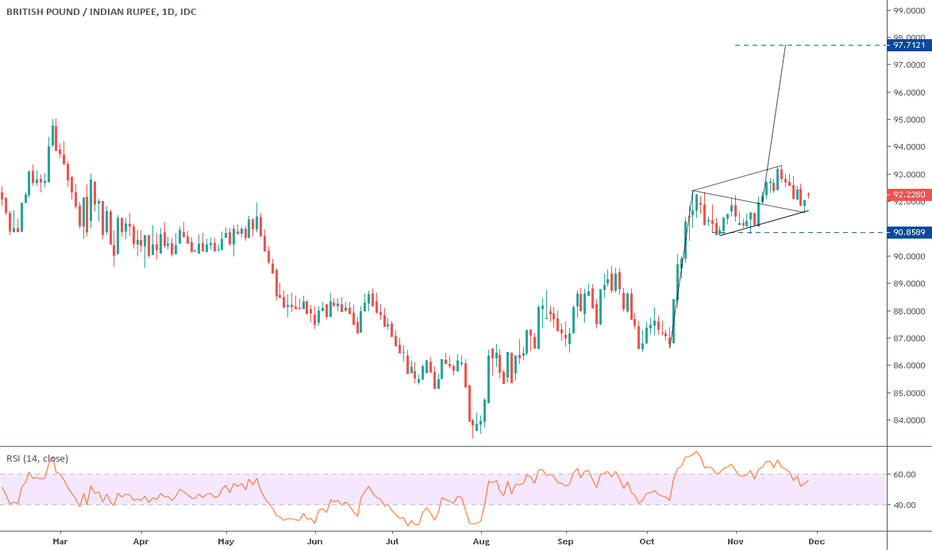

GBPINR analysis 08.03.2020FX_IDC:GBPINR

1W chart interpretation:

1. Price action closed above the validated red resistance trend

2. Expected resistance around 98.0

3. Next support around 94.0

1D chart interpretation:

1. Validated current uptrend line is labelled as "1D current uptrend".

Trade Setup:

Time frame : Day

Position type: Long

Entry: Upon price action retracing to "1D current uptrend" line

Target 1: 98.0

Target 2: Upon weekly close above 98.9

Stop loss: 1.0 point below the future low at "1D current uptrend" line.

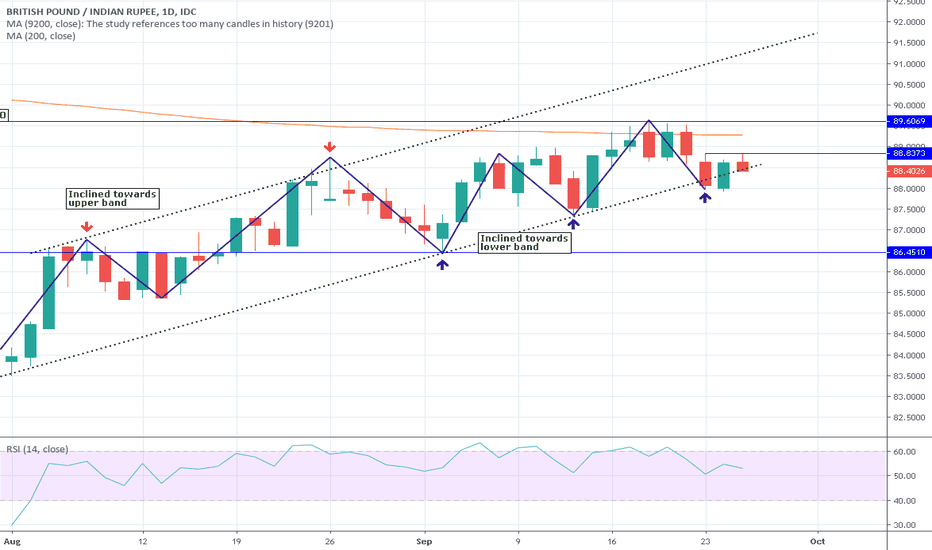

GBPINR ANALYSIS 04.01.2020FX_IDC:GBPINR

Daily chart interpretation 04.01.2020

1. Trend is Bullish inside recent green channel.

2. Price inside the green channel is under correction.

3. Correction trend is predicted to be inside yellow channel or blue channel.

4. Yellow channel is conforming.

5. Blue channel is yet to be confirmed and can be deleted if not confirmed.

6. As it is correction to uptrend, short or long positions can be possible opportunities inside correction channels in smaller time frames especially 1H.

7. Recent candles 30.12.2019 and 01.01.2020 inside the rectangle have tested resistance of yellow correction channel and are trending down.

8. Last candle on 03.01.2019 is blue candle which implies recent support. It can be used to spot correction to downtrend in 1H time frame and decide on entry and exit.

Hourly chart interpretation

Hourly chart interpretation

1. Interpretation of price action inside the yellow and blue major correction channels spotted in daily chart.

2. Price is under correction to downtrend and based on 03.01.2020 support candle spotted on daily chart, correction channel is expected to be inside dark blue channel.

3. Based on price action the downtrend is spotted inside the red channel. However it shall be confirmed only when the price breaks below dark blue correction channel.

Trade setup in Hourly chart

Position type: Sell

Entry: Break below dark blue correction channel

Target: Support trend line of yellow / blue / green channels spotted in daily chart (approx 92.0).

Stop loss: Above recent high

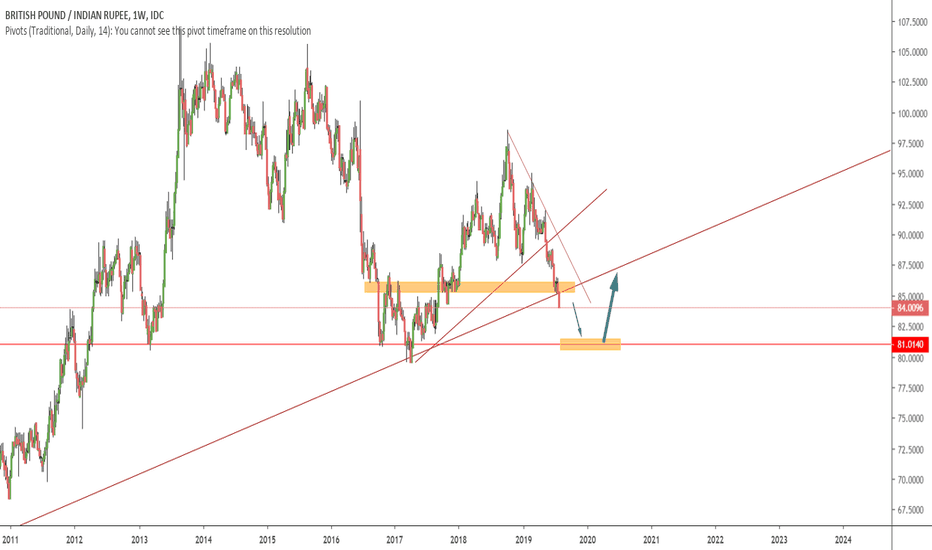

Complex Correction- Next Leg, down move GBPINR is in a complex corrective structure. The sub waves have been color coded for ease of spotting them. The next move could be a down move to finish the C wave of the current structure in making. On the 1 hour time frame, I guess there's one move down. AS the structure develops, we get a clearer picture.