GBP/JPY -H1- Channel Breakout (14.07.2025)The GBP/JPY Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 196.70

2nd Support – 195.53

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY trade ideas

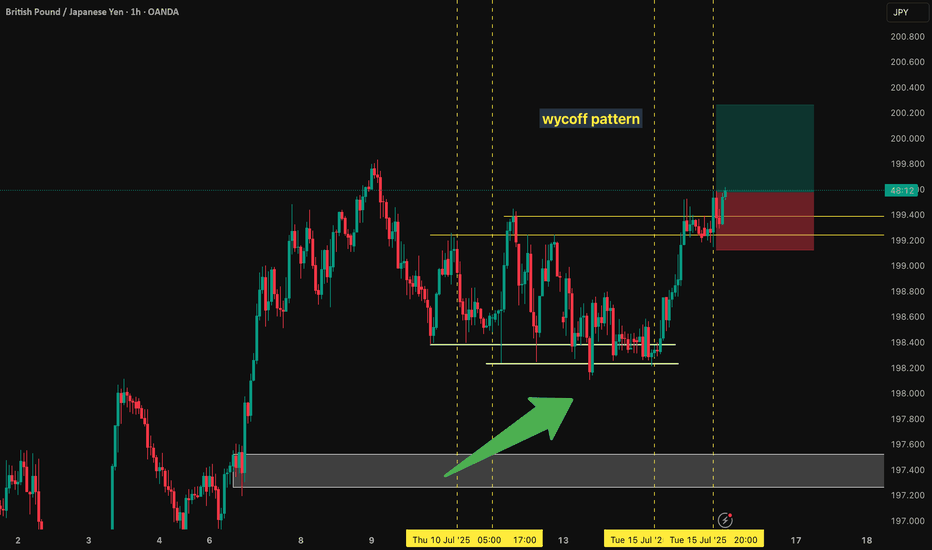

Lingrid | GBPJPY possible Pullback From Psychological LevelThe price perfectly fulfilled my last idea . FX:GBPJPY is testing the upper boundary of the resistance zone near the psychological 200.000 mark after a strong bullish impulse. Price is showing early signs of rejection from the red trendline and horizontal resistance, suggesting potential for a corrective move. If confirmed, a drop toward the 197.600–197.000 region becomes likely, aligning with the lower bound of the rising channel. A break below this level could expose deeper downside toward the 195.5 support.

📉 Key Levels

Sell trigger: confirmed rejection from 200.000 with bearish engulfing

Sell zone: 200.50–200.00 (key resistance zone and trendline touch)

Target: 197.600

Invalidation: sustained close above 200.500 flips structure bullish

💡 Risks

Strong bullish continuation above 200.000 would invalidate short setup

Yen weakness from BOJ policy shifts could drive GBPJPY higher

Support at 197.600 may cause bounce and false breakout scenarios

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

GBPJPY Surges as Trade Tensions Weaken YenGBPJPY Surges as Trade Tensions Weaken Yen

GBPJPY remains firmly in a bullish trend, having broken through two key resistance levels.

The first breakout occurred at 196.80, followed by a decisive move above 198.75 on Monday, signaling accelerating bullish momentum.

On July 7, the White House issued a strong letter to Japan’s Prime Minister, expressing concerns over the trade deficit and announcing a 25% tariff on Japanese goods, effective August 1, 2025.

This development has added pressure on the yen, and the weakness could persist in the near term.

However, the situation is still unfolding. Trump is expected to send additional letters today, which could inject further volatility into the markets.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

GBPJPY: floating at the top – is a drop being loaded?GBPJPY is hovering around 198.91 after an impressive rally, but now it's trapped between two key zones: 199.85 – a resistance level that keeps rejecting price, and 198.20 – a fragile support below. The price action reveals a tense sideways pattern, like a spring coiling up before release.

What’s concerning is that buyers have attempted to break above the high multiple times and failed – and each failure comes with weaker rebounds. With the Bank of England shifting toward a “pause” stance and the yen gaining mild support from rising risk-off sentiment, the market is starting to lean toward a correction.

If price breaks below 198.20, it could mark the beginning of a deeper slide back toward the lower boundary of the channel. Don’t be fooled by the silence – sometimes, calm is the precursor to a sharp fall.

GBP/JPY At Selling Area , Can We Sell It Now To Get 150 Pips ?Here is my opinion on GBP/JPY , The price at daily res area that forced the price to go down very hard last time and now the price retesting it , i want to see a good bearish price action on 4H T.F To get A Confirmation to can sell and i feel safe , we can enter now a sell trade with small lot size and when we have a good confirmation on bigger T.F We can add another entry , if we have a daily closure above my daily res then this idea will not be valid .

GBP/JPY) Bearish Analysis Read The captionSMC trading point update

Technical analysis of GBP/JPY on the 3-hour timeframe, suggesting a potential short-term pullback within a larger ascending channel.

---

Analysis Summary

Pair: GBP/JPY

Timeframe: 3H

Current Price: 198.883

Bias: Bearish move toward channel support

---

Key Technical Insights

1. Ascending Channel Formation:

Price is moving within an upward-sloping channel.

Current structure suggests price is heading toward the lower trendline support.

2. Support Level & Target Zone:

The yellow zone around 196.355 is a major support area and target point, coinciding with both structural support and the bottom of the channel.

3. EMA (200 Close):

Price is still above the 200 EMA (197.067), so overall trend remains bullish — but current move is a correction.

4. RSI (14):

RSI is neutral near 51.14, allowing room for further downward movement before becoming oversold.

---

Target Point

Target: 196.355 (support zone and bottom of channel)

---

Trade Idea

Direction Entry Stop-Loss Target

Sell 198.80–199.00 Above 199.70 196.35

SMC trading point

---

Summary

GBP/JPY is likely to retrace toward support at 196.35 before possibly bouncing within the larger bullish structure. This offers a short-term selling opportunity, with potential buy setups near the lower trendline later.

Please support boost 🚀 this analysis)

My View On GBP/JPYWhy I think the tops in

Elliott Wave Structure Completed

We’re now at the conclusion of a 5‑wave impulse (i→v) that tops off within wave (1), followed by an A‑B‑C corrective sequence. Wave C peaks right inside a major supply zone — classic exhaustion of bullish momentum.

Resistance & Trendline Rejection

Price hit a red supply/resistance area, tested it, and has already broken back below the short‑term upward trendline. That break is a reliable early signal that the uptrend is losing steam.

Bearish Continuation Pattern Forming

The drawn schematic suggests a sequence of lower highs is setting up—then a break toward the blue support zone near 196.60–197.40. All signs point to a deeper correction or even a fresh downtrend for wave (3).

Technical Confluence at Wave (2)

Wave (2) ends within multiple layers of resistance: a price zone, a wave count, and a rising wedge. Combined, this quadruple confluence is a textbook reversal scenario.

Macro factors support a top:

Central bank divergence is flattening

Yen may rebound on global uncertainty

Sterling faces domestic fragility

Will GBPJPY uptrend continue??Price is at a crucial point where traders are beginning to watch what’s likely to happen next in the market. Is market likely to continue to trade higher? From the technical standpoint, if price continues to rise and break the 200.000 level we will look for a buy opportunity in this market.

GBPJPY is in the Down Trend From Resistance LevelHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Volatile Times for GBPJPY: What’s Going On Behind the Moves?Good morning, Guys,

I’m anticipating a new short opportunity on GBPJPY once the pair reaches my sell zone level. From there, my target is set at 197.934.

Every like from you is what truly motivates me to keep sharing these insights.

Massive thanks to everyone who shows love and support!

Another Home Run Trade? Risky & Conservative ApproachesFollowing up a MASSIVE win on the OANDA:EURJPY we may now have a similar trading opportunity setting up on the OANDA:GBPJPY

The premise is the same for this one as we're looking at a potential violation of structure followed by a Bullish continuation setup.

In this video, we'll look at where we think price can extend to, what needs to happen before we can make that prediction, and both a risky and conservative technique to get involved in the move.

Please let me know how you would approach this setup!

Akil

GJ-Wed-09/07/25 TDA-Asian push, price hit our 4hR 199.723Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

When you have a specific trading time during the day,

it's can be frustrating when moves happen outside of

your trading time. But remember this is part of the game,

we will never catch every single move on the chart.

Don't force the entries, learn to get used to it.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPJPY - Multi Year SHORTS Coming! (Over 10,000pips)Here we have the 2 month chart of GBPJPY. We can see that we're in a massive ending diagonal made up of 5 waves.

We are currently on wave 4 and have almost completed. At the moment we are working within the parameters of a channel however we must be aware that we may exceed the channel. The channel is just there for us to use as a guideline.

In 2007, we have a really nice ending diagonal (expanding) before we made that ridiculous +13k pip drop.

See below for the 2D GBPJPY chart from 2007:

We can see that the lower timeframe diagonal broke down beautifully.

We are anticipating something similar this time round!

See below for the 2D GBPJPY chart of the current diagonal:

We've got an almost identical price action as 2007. We just got to wait a little and watch for the break of the red trendline and enter and hold.

See below for the 2week chart of GBPJPY:

Trade Idea:

- Watch for a break of the ending diagonal

- Alternatively, you can wait for a pullback after the ending diagonal breaks

- stop loss above highs once entry trendline breaks

- Swing Target: 100 (10,000pips)

What do you guys think?

Goodluck and as always, trade safe!

GBPJPY BULLISH OR BEARIS DETAILED ANALYSISGBPJPY has successfully broken out of a long-term falling wedge on the weekly chart, and the bullish momentum is unfolding as expected. Price has rallied from 190.00 to the current 197.00 level, delivering solid profits from the breakout zone. This continuation setup is extremely strong, with the market respecting the wedge breakout structure and forming higher highs. As long as we hold above the 190.00 support, the bullish bias remains fully intact, with 205.00 as the next key upside target.

Fundamentally, the British pound remains well-supported due to the Bank of England’s hawkish stance. Despite softer inflation data, the BoE has signaled a cautious approach to rate cuts compared to other central banks, maintaining underlying GBP strength. On the other side, the Japanese yen continues to weaken as the Bank of Japan sticks with its ultra-loose monetary policy. Yen weakness is further fueled by rising US and UK bond yields, widening the yield differential and attracting carry trades into GBPJPY.

Technically, the breakout is unfolding with textbook precision. Price has cleared descending resistance, retested it, and is now building a new leg higher. The volume profile is supporting this bullish breakout, and market structure is confirming further upside. The 200.00 psychological level may act as a minor resistance, but once cleared, 205.00 is well within range and aligns with major Fibonacci extensions.

GBPJPY is also benefiting from increased volatility in risk-on sentiment, as equity markets remain firm and bond yields rise globally. Traders are favoring high-yielding currencies like GBP while shorting low-yielders like JPY. With the fundamentals and technicals now strongly aligned, this trade is well-positioned to deliver continued profits toward 205.00 and beyond.

GBPJPY - Multi-Year Short Update! In our last setup for GBPJPY, we identified a massive diagonal pattern, with price completing wave 4 and preparing for a multi-year drop into wave 5.

Since then, price has played out exactly as forecasted — we've seen a clean impulse lower for wave 1, followed by an ABC correction for wave 2, which looks to have now completed.

This sets the stage for the next major leg — wave 3 of 5 — which historically carries the most power and momentum.

📉 See monthly chart here:

📊 GBP/JPY Wave‑3 Trade Idea

Background:

We’ve completed wave 1 down and wave 2 up (ABC correction).

GBPJPY is now positioned to start a powerful wave 3 down — the most impulsive leg in an Elliott sequence.

🔍 Current Price Action:

Price is rejecting major resistance (previous wave A high + shaded zone)

Structure shows a completed 5-wave move up within C, suggesting exhaustion.

A clean ascending trendline (red) has formed under wave v — a break here signals the first confirmation.

Option 1 – Aggressive Entry:

- Trigger: Break and close below the red trendline (~198.00–197.80 zone) on the daily.

- Entry: On candle close below trendline

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Option 2 – Conservative Entry (preferred):

- Trigger: Trendline break + correction

- Entry: On bearish confirmation and then a correction to indicate further downside

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Take Profit Levels:

- TP1: 192

- TP2: 180

- TP3: 175

- Final Target: Trail for extended move toward wave (3) lows (could be 10,000+ pips over long term)

🔐 Invalidation:

Daily close back above 200.00 or impulsive rally beyond the pink resistance zone invalidates the short bias in the short term.

✅ Summary:

This is a high-conviction, structure-backed setup with:

- Wave count + Fib confluence

- Bearish structure at key resistance

- Confirmation-based trigger (trendline break + retest)

- Excellent long-term risk-to-reward profile

📂 Previous GBPJPY Setups (Track Record):

📌 Free Setup (Big Picture Outlook) – Multi-Year Shorts Incoming (Wave 4 Completion)

✅ Swing 1 – 1,200 Pips (VIP GBPJPY Long)

✅ Swing 2 – 1,000 Pips (VIP GBPJPY Short)

✅ Swing 3 – 1,100 Pips (VIP GBPJPY Short)

✅ Swing 4 – 700 Pips (VIP GBPJPY Short)