GBPJPY| Bullish Shift in ProcessGBPJPY broke its major lower high on the 4H, signaling a shift in directional intent to the upside. While external liquidity remains intact, I’m monitoring for a potential continuation setup.

On the 30-minute timeframe, price broke a significant high and internal structure is now aligned with bullish order flow. I’ve marked a near-term zone where price may pull back into — specifically watching for a sweep of short-term liquidity within an internal order block.

No rush. Just waiting for price to offer a high-probability entry aligned with refined structure and flow.

— Inducement King 👑

Bless Trading!

GBPJPY trade ideas

GBPJPY - Look for Long (INTRADAY) 1:4.5 and Short (SWING) 1:XXGBPJPY appears to remain in a distribution phase from the supply zone, making its way toward the next demand zone on the higher time frame. We might see a potential sell opportunity during any consolidation before the price continues trending toward the demand area.

Let’s wait and see how price action develops — there’s a chance for entries in both directions, but only if a clear consolidation forms. Otherwise, it’s best to remain patient and look for setups at the next key resistance level.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GJ Update - June 14 - 4HI don’t trade triangles, but I don’t ignore them either. A breakout to the upside is possible, but as long as price stays below a key resistance level, my primary bias remains short. Even if price breaks higher, I’ll stay cautious and operate on the 1H timeframe as usual. GJ is known for sharp drops. I expect a clear move within the next two weeks. On Monday, I’ll have a better view on my entry and exit for the week.

GBPJPY WEEKLY HTF FORECAST Q2 W25 Y25GBPJPY WEEKLY HTF FORECAST Q2 W25 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY : Could price break the resistance area?Looking at the 1-hour chart of GBP/JPY, price is currently trading around 195.53, caught between two significant zones. Immediate resistance lies around the 196.40–196.50 area, where price has previously rejected several times—this is a strong supply zone.

On the downside, the 194.40–194.60 zone acts as key support and demand, with price bouncing off this level multiple times, showing buyers are still defending it.

The overall structure still respects a higher low formation, supported by an ascending trendline from the end of May, suggesting bullish bias unless that structure breaks.

Next week, keep an eye on UK CPI and BOE rate decision—both could be big movers. If CPI comes in hot, it could spark bullish momentum and push GBP/JPY through the 196.50 ceiling.

On the other hand, dovish BOE commentary could reverse sentiment fast. For now, potential long entries could be considered near 194.60 support with targets toward 196.50, while shorts might be taken around the resistance zone with tight stops and confirmation.

Always watch for breakout or rejection signs at these levels before committing.

GBPJPY At the Top? Massive Liquidity Grab📈 1. Price Action & Key Technical Levels (Daily Chart)

Price reached a major supply zone between 196.0 and 197.0, showing clear rejection (weekly pin bar and a lower high structure relative to the previous peak).

The long-term descending trendline acted as resistance again.

A confirmed rising wedge pattern broke to the downside, with first target around 191.4, and extended target near 187.4 (key demand zone with historical confluence).

Weekly RSI shows a bearish divergence vs price highs – an additional signal of bullish exhaustion.

📊 2. COT Data (as of June 3, 2025)

GBP (British Pound)

Net long positions increased by +30,371 contracts (Commercial + Non-Commercial).

Non-Commercials: 103,672 long vs 68,457 short → net long +35,215 but the increase is relatively modest.

Commercials are increasing both long and short positions, but the net delta supports medium-term GBP resilience.

JPY (Japanese Yen)

Net short worsened by -13,566 contracts.

Non-Commercials are cutting longs and adding shorts → aggressive yen selling.

Commercials remain heavily short (275,659 vs 100,151 long).

➡️ COT Conclusion: GBP remains structurally strong, but the JPY is now extremely oversold, increasing the likelihood of a technical correction in favor of JPY (GBPJPY pullback).

📉 3. Retail Sentiment

72% of retail traders are short GBPJPY, with an average entry at 191.2.

Current price is above 195.8 → a liquidity sweep above retail shorts may have already occurred.

The order book shows a heavy sell cluster between 195.0–195.9 → potential zone of manipulation/liquidation.

➡️ Contrarian view: After sweeping liquidity above retail highs, we may now see downside pressure to clean out breakout longs.

📅 4. Seasonality

June tends to be neutral to bearish:

5-year average: +0.45% (weak gain)

10- and 15-year averages: -1.24% and -1.30%

Historically, the first 10 days of June often mark a local top, followed by a decline – consistent with the current price structure.

🧠 5. Macro-Technical Confluence

The broader setup points to a distribution phase between 195.5–196.5, with high probability of a technical pullback toward 193.5–191.4 in the short-to-medium term.

The yen's oversold conditions may ease temporarily, supporting a corrective GBPJPY retracement.

Break below 193.5 would confirm the move toward 191.4 and eventually 187.4 – an area of institutional interest.

🔍 Trade Setup Summary (Bias: Bearish)

Technical context: Short setup confirmed by structure break, divergence, and supply rejection.

Macro/sentiment context: Supports a corrective pullback on the pair.

Strategy: Look for intraday weakness below 195.0–194.5 → targeting 193.5, then 191.4.

Invalidation: Daily/weekly close above 197.0.

GBP/JPY Consolidates After Pushing Above May HighGBP/JPY consolidates after pushing above the May high (196.41) earlier this week, but the pullback in the exchange rate may turn out to be temporary as it holds above the monthly low (192.73).

In turn, a move/close above the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region may lead to a test of the January high (198.26), with the next area of interest coming in around the December high (198.96).

However, lack of momentum to push/close the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region may push GBP/JPY back towards the monthly low (192.73), with a break/close below the 192.40 (50% Fibonacci extension) to 193.50 (38.2% Fibonacci extension) zone bringing the May low (190.33) on the radar.

--- Written by David Song, Senior Strategist at FOREX.com

GBP_JPY LOCAL SHORT|

✅GBP_JPY has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 196.400

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY Strong rebound. Buy opportunity.The GBPJPY pair has been trading within an Ascending Triangle pattern. Today's geopolitics made the price form its latest Higher Low at the bottom of the pattern, which also coincided with a 4H MA200 (orange trend-line) test, and rebounded.

That was a clear buy signal on the 4H RSI Support that signaled the last three bottom buys. Our Target is the top of the pattern at 196.300.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBPJPY at a Turning Point: Triple Top Signals Potential DeclineGBPJPY at a Turning Point: Triple Top Signals Potential Decline

Fundamental Analysis:

GBP is showing signs of weakness against the Japanese Yen following the latest UK employment data. The UK unemployment rate rose to 4.6% for the three months ending in April, while the Claimant Count Change increased by 33.1K in May.

Meanwhile, hawkish expectations for the Bank of Japan (BoJ) continue to strengthen the Japanese Yen.

Technical Analysis:

GBPJPY has encountered strong resistance near the recent highs for the third time, increasing the likelihood of a decline, as seen on the chart. The price action suggests the formation of a triple top pattern, which could trigger a deeper drop from this zone.

Targets:

🎯 194.70 🎯 193.60 🎯 192.40

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY SHORT FORECAST Q2 W24 D13 Y25GBPJPY SHORT FORECAST Q2 W24 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅15' order block

✅Intraday breaks of structure

✅4H 50 EMA rejection

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPYI believe my analysis will help expose how the price moves in the market. It is clear that the price moves forming different patterns giving hints as to what we could expect next.

The price has been moving in an ascending channel, it got broken and retested, I believe the price will eventually fall towards my arrow head.

GBP/JPY trendGBP/JPY is trading within an ascending channel and has recently bounced strongly from the key support area around 193.77. As long as this level holds, the price is expected to push higher toward the resistance at 194.81 and potentially 195.45. A break below 193.77 would invalidate the bullish scenario and could indicate a shift to a more neutral or bearish structure.

GJ-Thu-12/06/25 TDA-GJ breaking 195.000 support levelAnalysis done directly on the chart

Follow for more, possible live trades update!

No strategy has 100% win rate, this is when

risk management comes in handy.

We are humans, we all make humans errors

if you are manual trading and executing the

trades.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPJPY follow the ascending channel selling from supply zoneGBPJPY Update – 1H Timeframe

Price is respecting the ascending channel and currently reacting from a key supply zone at 166.100. Sellers are stepping in!

🎯 Technical Targets: 🔻 1st Target: 195.000 – Major Demand Zone

🔻 2nd Target: 193.300 – Bullish Order Block / Demand Zone

Structure still bullish overall, but short-term correction in play.

💡 Smart money eyes the zones — are you ready?

👇 Don’t forget to:

💬 Comment your thoughts

❤️ Like if you caught the move

🔔 Follow for more real-time trade setups & market insights

Trade smart. Stay ahead.

— Livia 💋

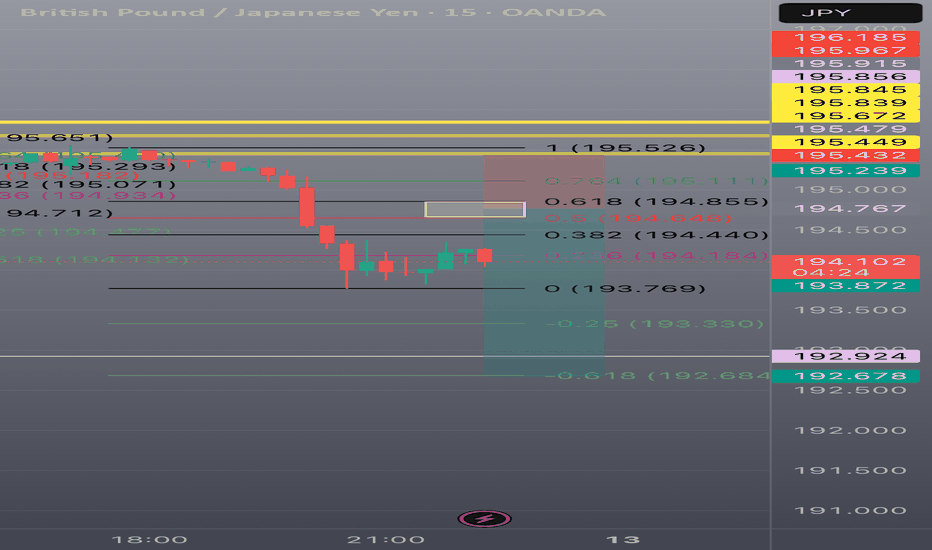

GBP/JPY Bearish Pullback to Key Fibonacci LevelsGBP/JPY shows a strong bearish move followed by a consolidation near the 0.236–0.382 Fibonacci retracement zone. I’m monitoring this area closely as price retests the 0.5 (194.648) and 0.618 (194.855) Fibonacci levels — classic zones for bearish continuation setups.

This setup suggests that price may reject the 0.618 zone, especially if volume and candle structure confirm resistance. My trade idea is based on short entries near 0.5–0.618 with a potential continuation toward 193.33 (-0.25) and 192.68 (-0.618 extension).

GBP/JPY - Triangle Breakout (12.06.2025)The GBP/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 194.34

2nd Support – 193.76

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Update GJ June 12No sell confirmation yet. Until then, I'm scalping — 20 to 50 pips a day.

Structurally, a swing higher wouldn’t surprise me, but anything can happen. Keep monitoring the levels.

Notice how price respected the levels I mapped out in advance — these are not random lines.

Stay prepared. Anticipate with patience!