GBPJPY – Correction Pressure Is Building UpGBPJPY is still trading within a well-defined ascending channel on the H4 chart. However, recent signals suggest a potential short-term correction. The price has repeatedly rejected the upper boundary of the channel and is now forming a distribution pattern with lower highs. The FVG zone near 200.400 may act as a short-term take-profit area before price pulls back toward the support zone around 198.400, which also aligns with the lower trendline.

Additionally, the upcoming UK GDP data this week could strongly impact GBP. If the data comes in weaker than expected, downside pressure may intensify and reinforce the developing correction scenario. Traders should monitor price action around 198.400 for confirmation of the pullback.

GBPJPY trade ideas

GBPJPY - Bullish BiasHTF Overview (4H): Price broke bullish structure with clean directional intent. Order flow remains aligned to the upside with no immediate signs of weakness.

MTF Refinement (30M): Zoomed into 30M for deeper structure clarity. Observing price actively reaching for sell-side liquidity (SSL) below a key low — a classic inducement setup forming.

Execution Plan: Waiting for a liquidity sweep below the SSL. Once swept, I’ll monitor the nearby 30M OB for mitigation. LTF confirmations (1M/5M CHoCH or BOS) will be needed before committing to a long entry.

Mindset: Patience over prediction — let liquidity do its job, then ride with smart money.

Bless Trading!

GBPJPY sitting at resistance – Is a drop to 193.360 likely?GBPJPY is sitting right at a key daily resistance zone. This is a level where it has struggled to break through and reversed strongly to the downside. So this makes it definitely one to monitor, especially if you’re eyeing potential short setups.

If we start seeing signs that the price is getting rejected here: like long wicks, strong bearish candles, it could be the early indication of another move lower. My focus is on a moderate drop toward the 193.360 area, similar to what we’ve seen in past pullbacks. Nothing too dramatic, just a simple downside play if sellers step in again.

But if we get a strong breakout? That changes everything: it would hint that bulls are taking full control. This area is pretty important and could give us a better idea of where price is headed next.

Just sharing my thoughts on support and resistance, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY Rejection from Resistance Zone GBP/JPY Rejection from Resistance Zone 🧱📌 | Bearish Setup In Play 🔻💹

📌 Technical Analysis Overview:

The chart illustrates a clear rejection from the resistance zone around 198.460, where previous price action formed a double-top pattern (🔴 red arrow). This suggests a strong supply area with selling pressure building.

🔍 Key Observations:

📏 Trendline Break:

The upward trendline (blue) has been decisively broken.

This break signals a loss of bullish momentum.

🧱 Resistance Zone @ 198.000–198.460:

Price tested this zone multiple times but failed to break above.

Acts now as a strong resistance zone.

🟠 Support Turned Resistance:

Former support has now turned into resistance (highlighted in blue text: "SUPPOT").

📉 Bearish Projection:

The projected path indicates a possible retest of the resistance zone before a sell-off continuation.

Target area: around 194.500, marked as “TAEGET FAXS” (typo: should be “TARGET ZONE”).

🔄 Possible Scenarios:

✅ Bearish Continuation:

If price rejects again near 198.000, expect a bearish move toward 194.500.

⚠️ Invalidation:

A strong breakout above 198.460 would invalidate the bearish thesis and may resume bullish momentum.

🔚 Conclusion:

The pair is currently under pressure with a confirmed break in trend structure. As long as price remains below 198.460, the bias remains bearish with a target toward the 194.500 zone. 📉👀

GBP/JPY Rising Within Ascending Channel – Target in SightGBP/JPY is currently moving within an ascending channel, where price action is forming higher highs and higher lows. This pattern indicates a steady uptrend.

At the moment, the pair is approaching the upper boundary (resistance line) of the channel. Based on the current momentum and structure, we expect the price to continue its upward movement and test the upper trendline.

This upper line serves as our near-term target, where we may look to take profit or reassess the trade setup. As long as the price remains within the channel and respects the trendline structure, the bullish bias remains intact.

GBPJPYGBPJPY price is near the major resistance zone 200.186. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GBPJPY SHORT (swing)This is a trade setup based on a **Bearish Butterfly Harmonic Pattern**. The pattern meets all the key Fibonacci criteria for validity. Specifically, the AB leg retraces 80.8% of XA, which is close to the ideal 78.6% level and is considered acceptable, especially since it closed with a wick. The BC leg retraces 37.5% of AB, which is within the standard range of 38.2% to 88.6%. The CD leg extends 127% of XA, which is the minimum required for a valid Butterfly pattern, and also extends 252% of BC, which falls within the acceptable range of 161.8% to 261.8%.

What makes this setup stronger is that the Potential Reversal Zone (PRZ) at point D coincides with a **major resistance level**, adding significant technical confluence to the area. This increases the probability of a market reaction or reversal from that zone.

However, no entry will be taken immediately upon price reaching the PRZ. A trade will only be initiated **after the appearance of a confirmed reversal candlestick pattern** at or near the D point, such as a bearish engulfing.

This ensures that we enter with confirmation and not just based on pattern completion.

GBPJPY Elliott Wave AnalysisHello friends

We are witnessing the formation of a complete Elliott wave pattern on the GBPJPY chart. These waves from 1 to 5 are quite clear and you can even count their subwaves (especially the microwaves of the main wave 3). Now wave 5 is completing and moving inside an ascending channel.

At the moment, the microwaves of the 5th wave have not been completed, so we expect the price to grow within this channel. The minimum growth is up to 200.00, of course, it can grow even more.

But after the completion of the 5th wave, with the breakdown of the trend line drawn below and a return to it, we can expect the price to fall to the specified support. The first support is 196.00. Of course, the price decrease in the 5th wave is always accompanied by divergence and a decrease in the slope of the chart, as you can see that the slope of wave 5 is much lower than wave 3.

Good luck and be profitable.

GBP/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

It makes sense for us to go long on GBP/JPY right now from the support line below with the target of 198.556 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GJ-Thu-10/07/25 TDA-GJ pull back,good support created.Now what? Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Houses aren't built over night, it takes brick by brick, one step at a time.

Same for trading, one step at a time. You make mistakes, you learn, you improve.

You make more mistakes, you learn more, you should improve more.

If it's easy, everyone will do it realistically.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPJPY Profit TakingGBPJPY has given strong bullish momentum and hit swing high on previous day currently the traders are taking profit and GBPJPY is giving a pullback. We can see from the picture that there is fair value gap and demand zones. The possible move for GBPJPY will be to hit demand zones and again follow the same bullish momentum.

GBPJPY Wave Analysis – 9 July 2025- GBPJPY reversed from long-term resistance level 199.65

- Likely to fall to support level 198.00

GBPJPY currency pair recently reversed from the strong long-term resistance level 199.65 (former strong resistance from October, November and July) standing near the upper daily Bollinger Band.

The downward reversal from the resistance level 199.65 is likely to form the daily Shooting Star reversal pattern.

Given the bearish divergence on the daily Stochastic indicator and the strength of the resistance level 199.65, GBPJPY currency pair can be expected to fall to the next support level 198.00.

GBPJPY is Holding above the SupportHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/JPY SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

Previous week’s green candle means that for us the GBP/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 197.518.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

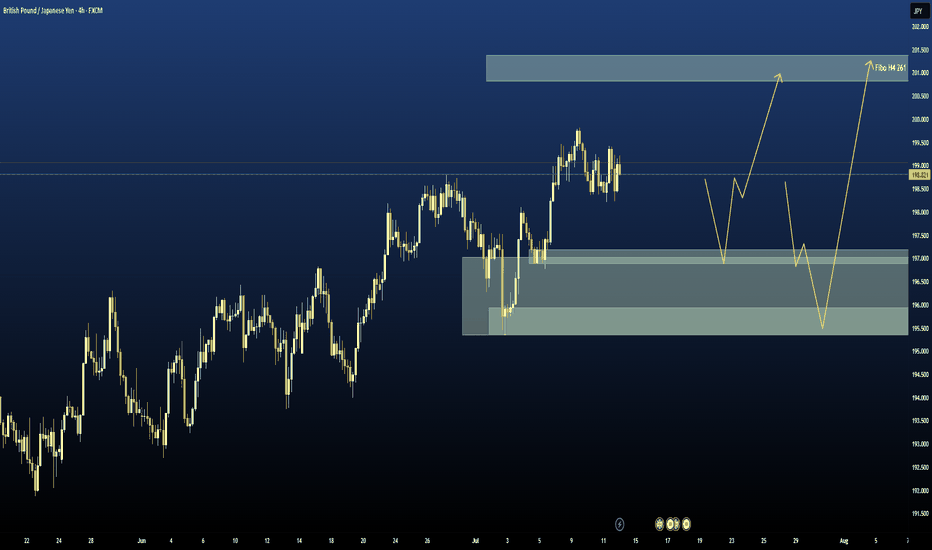

GBPJPY uptrend support at 196.75Key Support: 196.75

This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at:

199.20 – Initial resistance and short-term target

199.70 – Minor resistance zone

200.40 – Longer-term breakout objective

However, a daily close below 196.75 would invalidate the bullish scenario, potentially triggering a deeper retracement toward:

195.80 – Near-term support

194.80 – Key downside level in a bearish reversal

Conclusion:

As long as 196.75 holds, the bias remains bullish, favoring continuation toward the 199–200 zone. A confirmed break below this support would shift momentum, opening the door for a broader corrective decline.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.