GBP/USD ANALYSISGBP/USD 15M - As you can see price has traded down and into the Demand Zone we have marked out above, this is after price has cleared and absorbed a level of Supply in the market.

This tells me that there is more Demand in the market than there is Supply and price is still showing clear signs of bullish structure with it not breaking any protected lows.

This trade is currently running + 17 pips. (+ 0.77%) 0.77RR

Based on this I have gone ahead and placed a long position with my SL below the zone I have gone ahead and got involved from and my TP is set at a higher timeframe area of Supply where I feel it may shake price once it trades in.

Well done to those of you who jumped in on this trade, if you have any questions with regards to the analysis or the trade itself drop me a message or comment below!

GBPUSD.1.MINI trade ideas

GBPUSD SHORT FORECAST Q2 W16 D15 Y25GBPUSD SHORT FORECAST Q2 W16 D15 Y25

Morning Traders!

Let's await price action to tap into the weekly order block!

From then on, eyes open for 15' breaks of structure. Ensure that key higher low areas and double doubles for potential longs are broken before looking to short a fairly strong looking pound!

We simply await the pull back into s 15' order block that should be created post bearish move we have spoken of above. Upon the turn around in price action, we can be satisfied the bullish trend has exhaust somewhat.

Let's await the setup. No positions on GBPUSD until the above.

FRGNT X

GBP/USD: Bearish Divergence Flags Pullback Risk Bearish divergence between RSI (14) and price should have GBP/USD traders alert to the risk of a potential partial reversal of the recent bullish move.

Those contemplating the setup could look to sell around current levels or slightly higher, with a stop placed above the recent high of 1.3207 for protection. Bids may emerge around 1.3140—the high set last Friday—although 1.3045 screens as a more appropriate target, given the amount of price action seen either side of it over extended periods last year. While RSI (14) has diverged from price, MACD continues to generate a bullish momentum signal.

If the rally extends beyond 1.3207, the bearish setup would be invalidated.

Even though price and momentum signals favour upside, signs of stability in U.S. Treasuries and stocks—two markets that likely contributed to last week’s U.S. dollar weakness—may support the greenback in the near term.

Good luck!

DS

GBPUSD - Longs - Fundamental Analysis My trade idea for GBPUSD:

DXY (USD) News:

On 2nd April 2025, US president Donald Trump announced tariffs of 10% on most imports and up to 145% on Chinese goods. This has led to significant market volatility. Investors are increasingly concerned about the U.S.'s economic direction, prompting a shift away from dollar-denominated assets. This sentiment has been exacerbated by fears of a potential recession, as highlighted by JPMorgan Chase's forecast.

Major foreign investors, including those from China and Japan, are reportedly reducing their holdings in U.S. Treasury bonds. This retreat diminishes demand for the dollar, contributing to its depreciation.

Conclusion: We can expect a further decline in DXY price. Possible opportunity to long XXX/USD pairs.

BXY (GBP) News:

The UK economy grew by a faster-than-expected 0.5% in February, official figures showed.

Conclusion: With US placing tariffs globally, we can expect USD weakness over the next 2-3 weeks. GBP holds its ground with strong economic figures from Q1.

My trade position:

Between 14 - 18 Apr, I will be monitoring price action. Looking to buy below 1.32 with the first target being 1.35. 1.29 offers strong support.

GBP/USD Breaking Key Fib Level, Bulls Eye September HighsThe British pound surged through the 78.6% Fib retracement near 1.3149, extending its post-breakout rally with a +0.77% daily gain. Price is now on track to test the September swing high at 1.3440 — the next major resistance zone.

📈 Price has reclaimed both the 50- and 200-day SMAs

📊 MACD is showing bullish momentum above the zero line

📍 RSI sits at 64.98 — bullish, but nearing overbought territory

As long as GBP/USD holds above 1.3149, the path of least resistance remains higher. A clean break above 1.3440 would confirm a major trend reversal and open the door to a broader bullish cycle.

-MW

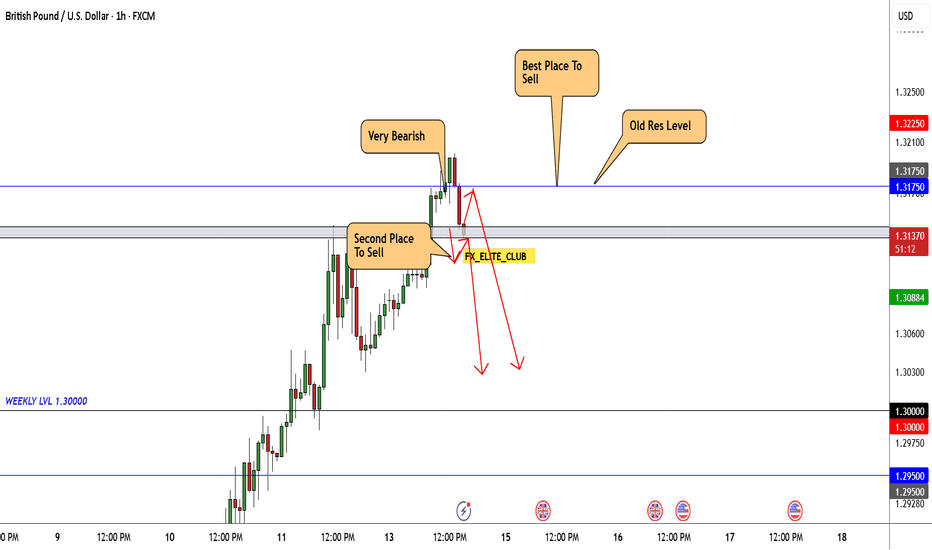

GBP/USD At Interesting Area To Sell , Should We Sell Now ?Here is my Opinion About GBP/USD , I Have an old res and the price respect it 100% and gave us a very good bearish P.A , So i think we have 2 places to sell it , first one if the price back to retest my res level 1.31750 and if the price give us a good bearish price action we can enter and targeting 200 pips . if the price didn`t back to retest the res level we can wait he price to close below support with 4h candle and then we can enter a sell trade with the same target .

GBPUSD - its breakout? what's next??#GBPUSD.. as you know guys our area was 1.3035 and in first go market boke that area but then drop towards bottom due to tariff implantation.

now market again break our area in today so if that is clear breakout then we can expect a further bounce towards 3400 and 1.3500

good luck

trade wisely

GBPUSD today should buy or sell?GBP/USD continues to build on its bullish momentum, reclaiming the 1.3100 level on Monday morning. The ongoing weakness of the U.S. dollar suggests that the path of least resistance for this pair remains to the upside.

The key monthly employment report is set to be released on Tuesday, followed by the latest consumer inflation data on Wednesday. In addition, investors this week will also face the release of U.S. monthly Retail Sales figures and pay close attention to a speech by Federal Reserve Chairman Jerome Powell — a speech that could play a crucial role in shaping the USD’s price dynamics. These events are expected to provide meaningful catalysts for the GBP/USD pair in the latter part of the week.

Fri 11th Apr 2025 Daily Forex Charts: 8x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 8x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a AUD/JPY Buy, XAU/USD Buy, AUD/USD Buy, XAG/USD Buy, NZD/USD Buy, NZD/CAD Buy, GBP/AUD Sell & GBP/USD Buy. I also discuss some trade management. Enjoy the day all. Cheers. Jim

What I'm expecting on the new week open..This is basically what my gut is telling me that is going to happen on Monday's open based on technical factors thought by ICT and my own spin on it.

TLDW; It looks like we are just going to start going up with very little retracement at the start of the week.

- R2F Trading

GBPUSD BIG DROP ?Market Structure Overview

Previous Trend: Strong bullish move after a long bearish trend.

Current Behavior: Price has entered a higher-timeframe supply zone (highlighted in green) and is showing signs of rejection.

Supply Zones:

Major Supply: 1.31750 – 1.32000

Minor Supply: 1.31000 – 1.31300

Demand Zones:

First Demand Zone: ~1.30380

Second Demand Zone: ~1.29919

📉 Trade Setup & Plan

🅰️ Primary Bias: Bearish Rejection from Supply

🔹 Scenario 1: Ideal Short Setup

Entry: Around current price (~1.30824) or after a retest of the 1.31000–1.31300 zone.

TP1: 1.30380 (first demand zone)

TP2: 1.29919 (second demand zone)

TP3 (extension): Below 1.29000 if momentum continues

SL: Above 1.31300 (to avoid fakeouts in supply)

🧩 Reasoning:

Price failed to break above supply with strong rejection wicks.

Break of structure + liquidity taken above local highs = possible start of bearish leg.

🔹 Scenario 2: Pullback Before Continuation Lower

Wait for Break of 1.30380, then look for pullback entries (break & retest).

Entry: On bearish confirmation after price retests 1.30380 zone from below.

TP: 1.29919, and if broken, continue to trail toward 1.2900s

✅ Extra Notes

Watch for rejection patterns (e.g., pin bars, engulfing candles) on the 15M or 30M to confirm entries.

Avoid entries during high-impact news, especially UK or US CPI, interest rate decisions, or NFP.

Manage risk wisely: Max 1-2% per trade.

GBPUSD potential buy zone in inverted head & shoulder!GDP in GBPUSD had spike in actual value with the forecast has boost in this pair. Prior to data release this instrument had a break of structure has given strong liquidity grab as it has broken from long term trend line. As the market structure remain intact we may see the price to bounce back to the daily resistance line. 15m timeframe already has formed an inverted head & shoulder which signaling potential breakout. Any liquidity grab may give us potential entry in this lower timeframe.

4/15/2025 GBPUSDPossible quick scalp, Price has touched HTF POI but price seems still bullish to reach higher. Used 1 hr BUllish POI for area for entry with ltf refinement. Not my highest probability since price did touch htf POI but i'll risk %.50 since it still looks good/ getting close to end of NY. TP is 50% of the HTF POI

UPDATE ON GBP/USD TRADEGBP/USD 15M - How we getting on people I hope you are all okay, as you can see price has played out very well for us overnight and we are seeing price really take off.

I have gone ahead and taken another partial here just to bank some profits from the trade which as a result removes risk from the market as well.

This trade is currently running + 100 pips. (+ 4.3%) 4.3RR

A big well done to all of you who jumped in on this position, if you have any questions with regards to the analysis or the trade itself then please drop me a message or comment below.

Its so important that you manage your trade correctly and you take partials throughout the position. As I have mentioned I have taken a partial here for 50% of my position.

1 correction to decrease recovery🔔🔔🔔 GBP/USD news:

➡️ The British pound (GBP) extended its intraday rally against the US dollar (USD) at the start of the week, with the GBP/USD pair climbing toward 1.3150 during Monday’s European session. It is now aiming to retest the six-month high of 1.3207, last seen on April 3, as investors continued to sell off the US dollar following the announcement of retaliatory tariffs between the United States and China.

➡️ The US Dollar Index (DXY), which measures the greenback’s value against a basket of six major currencies, dropped to around 99.00—its lowest level in three years.

Personal opinion:

➡️ Buyers are taking profits and pausing further upside momentum to monitor further news on the pair

➡️ The RSI is showing signs of falling after entering overbought territory.

➡️ Analysis based on important resistance - support and Fibonacci levels combined with SMA to come up with a suitable strategy

Plan:

🔆Price Zone Setup:

👉Sell GBP/USD 1.3180 - 1.3200

❌SL:1.3230| ✅TP: 1.3125 - 1.3050

FM wishes you a successful trading day 💰💰💰