GBPUSD trade ideas

GBPUSD Sellers In Panic! BUY!

My dear friends,

Please, find my technical outlook for GBPUSD below:

The price is coiling around a solid key level - 1.3638

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.3653

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

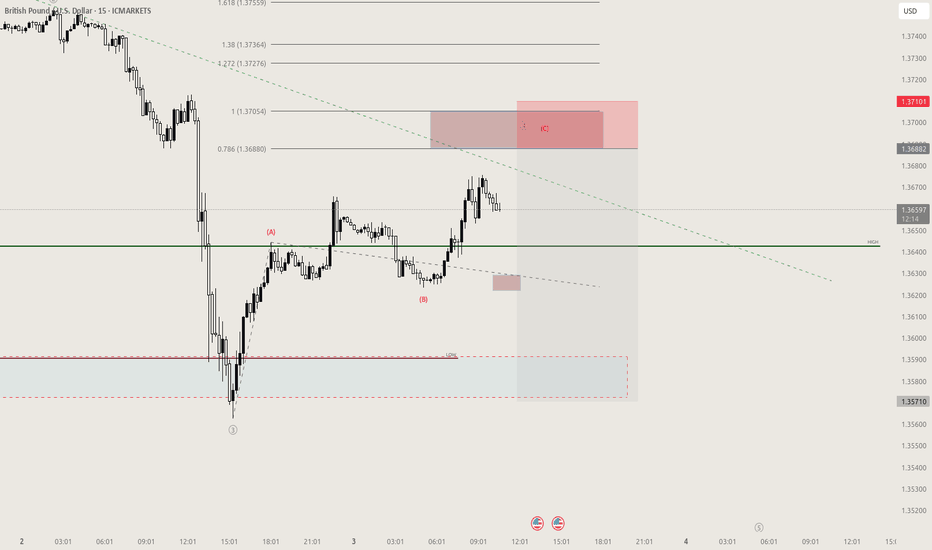

GU| - Bullish Ride in Motion | Key Zone Hold into New WeekPair: GBPUSD

Bias: Bullish

Timeframes: 4H, 2H, 30M

• 4H showing strong bullish momentum — price pushed aggressively, and we caught the move. Heading into next week, the bullish continuation is still valid unless price tells us otherwise.

• 30M gave a sweep from a refined OB zone — circled area shows the key move. Watching closely to see if bulls truly hold that ground.

• 2H gives a clear picture of structure — smooth directional flow confirming the bias.

🔹 Entry: After break of micro LH for confirmation

🔹 Entry Zone: Will be found within price flow — post-shift

🔹 Target: Structure highs — same continuation goal if bulls follow through

Mindset: No chasing. We wait, let price do the heavy lifting. Our job is to react with clarity, not emotion.

Bless Trading!

Cable H4 | Falling toward an overlap supportCable (GBP/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 1.3616 which is an overlap support.

Stop loss is at 1.3523 which is a level that lies underneath a pullback support and the 61.8% Fibonacci retracement.

Take profit is at 1.3770 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPUSD politics and the upcoming NFPFX_IDC:GBPUSD trading was influenced by politics in UK. The pair recovered half of the losses, but the downside risk still remains. NFP could be a trigger. Let's dig in.

MARKETSCOM:GBPUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GBPUSD – Pound Stumbles on Political Risk and NFP FearGBPUSD – Pound Stumbles on Political Risk and NFP Fear: Reversal or Breakdown?

🧭 MACRO SNAPSHOT – All Eyes on UK Politics and US Jobs

The British Pound came under renewed pressure on Wednesday, losing nearly 0.8% intraday, driven largely by escalating political uncertainty in the UK. Concerns over early elections, party leadership instability, and fiscal doubts have weighed on GBP sentiment.

Meanwhile, the US Dollar remains supported ahead of the June Non-Farm Payrolls (NFP) release. With recent labor data showing signs of weakness (ADP: -33K), today’s NFP is expected to shape short-term Fed expectations. A weak report may cap USD gains and provide a rebound opportunity for GBP – but risk is two-sided.

📊 TECHNICAL STRUCTURE – H4 Chart Insights:

Trend Channel: GBPUSD is still trading within an ascending channel, but recent rejection at 1.3769 raises caution.

EMA Signals: Price has broken below EMA 13 and 34, showing momentum loss. EMA 89 is the next possible support near 1.3570.

Fibonacci Zones:

0.382: 1.3543

0.5: 1.3466

0.618: 1.3390

Key Levels to Watch:

Resistance: 1.3681 – 1.3769

Support: 1.3570 – 1.3450 (golden pocket)

The price is likely to test the midline or lower bound of the channel before resuming a move higher, assuming macro tailwinds don’t intensify GBP selling.

🎯 TRADE PLAN:

🔵 Buy Setup (Reversal from Demand Zone):

Entry: 1.3450 – 1.3460

SL: 1.3390

TP: 1.3570 → 1.3680 → 1.3760

Bias: Counter-trend rebound from golden pocket & ascending trendline

🔴 Sell Setup (Short-term pullback):

Entry: 1.3680 – 1.3700

SL: 1.3765

TP: 1.3570 → 1.3450

Bias: Fade weak bullish momentum near prior high resistance

📌 Risk Context:

Today’s US NFP report is high-impact – expect volatility spikes and spread widening. UK political headlines could cause gaps or sharp reversals. Traders are advised to reduce size or wait for clear rejection/confirmation candles before entry.

GBPUSD 1.3600 support retestThe GBPUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend.

Key Technical Level: 1.3600

This level marks the prior consolidation range and now acts as pivotal support. A corrective pullback toward 1.3600 followed by a bullish rejection would reinforce the bullish trend, targeting the next resistance levels at:

1.3825 – Near-term resistance

1.3865 – Minor swing high

1.3900 – Longer-term bullish objective

On the other hand, a decisive daily close below 1.3600 would invalidate the bullish setup, shifting the outlook to bearish in the short term. This could trigger a deeper retracement toward:

1.3550 – Initial support

1.3500 – Key downside target

Conclusion:

As long as 1.3600 holds as support, the technical outlook remains bullish, favoring long positions on dips. A confirmed break below this level would signal a shift in sentiment and open the door to a corrective pullback phase.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/USD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/USD pair is in the downtrend because previous week’s candle is red, while the price is obviously rising on the 1D timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.333 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

The Day Ahead - US Employment, NFP in focus Thursday, July 3 – Market Focus

Key Economic Data:

US:

June Jobs Report – Crucial for gauging labor market momentum and Fed rate expectations.

ISM Services PMI (June) – Offers insight into the largest sector of the economy.

May Trade Balance, Factory Orders, Initial Jobless Claims – Together provide a fuller picture of external demand, industrial health, and labor market stress.

China:

Caixin Services PMI (June) – Reflects private sector service activity and post-pandemic demand strength.

UK:

June Official Reserve Changes – Could hint at FX intervention patterns or reserve rebalancing.

Italy:

Services PMI (June) – A regional gauge of Eurozone service sector strength.

Canada:

May International Merchandise Trade – Key for assessing external demand and commodity flow impact.

Switzerland:

June CPI – Critical for SNB policy outlook, especially post recent rate cut.

Central Bank Highlights:

ECB:

June Meeting Account – May provide clarity on the timing and pace of further policy normalization.

Fed:

Bostic Speaks – Watch for clues on his stance regarding rate cuts amid mixed data signals.

BoJ:

Takata Speaks – Important for any policy tone shift as the market eyes potential tightening.

BoE:

June Decision Maker Panel (DMP), Q2 Bank Liabilities & Credit Conditions Surveys – These offer insights into business inflation expectations and credit supply constraints, key for the BoE’s future policy path.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/USD Slides with Fiscal WorriesGBP/USD edged lower toward 1.3625 in Asian trading, pressured by a sharp selloff in UK government bonds and growing fiscal concerns.

Gilts suffered their biggest drop since October 2022 after the government’s decision to cut welfare benefits and mounting doubts over the Chancellor’s political future.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex LLC, noted: “The drop isn’t limited to the British Pound, UK gilts are also under heavy selling. It seems to be a broader crisis of confidence in the Labour government.”

Resistance is at 1.3675, while support holds at 1.3570.