Could Obyte finally got traction?Obyte failed to be profitable once the team stopped the initial free airdrop method. Since then, the most powerful and comprehensive DAG protocol in the cryptocurrency market has lost around 97% of its ATH value.

Nevertheless, the team continues to develop the protocol and has impressively extended its functionality with concepts such as sovereign identity, bounded stablecoins and more recently with liquidity pools and bridges with Ethereum, Binance and Polygon. Even an NFT platform has been released recently.

Several impressive rebounds occured in 2021 but each time it falls.

Several impressive rebounds occurred place in 2021 but each time the price fell back to the initial level. In a way, every fall was normal and predictable. Obyte is a third type cryptocurrency protocol that requires transactions to gain value, while decentralized blockchains (first type) have to spend electricity and centralized blockchains (second type) need to grow their user base.

So, could Obyte finally get the shy traction to get more transactions and see its price increase sustainably?

Either way, DAGs are the only sustainable option for cryptocurrencies and Obyte is obviously the real contender to challenge the Bitcoin protocol as king of cryptocurrencies although one can easily doubt that when looking at its performance.

GBYTEUSD trade ideas

OBYTE bullish@Obyte (#gbyte) very bullish.

Take profit from Fibonacci.

Playing above support(last resistance).

Big bounce OBYTEStill im waiting Gbyte big bounce. Strong weekly support is at level 21.08$ and daily trendline holds. In the end we can see big bounce up if we get hit from support or we break out from trendline and we get candle close above this line.

Right now i dont belive that we break weekly support and going more down.

Eyes on this chart.

Obyte about to explodeChecking weekly, bi-weekly and monthly charts. Obyte-USD is in compression for 1078 days, which is just under 3y.

I reckon that December will be explosive for this market pair and Obyte-USD will be trading between $200 and $300.

GBYTE longEasy as that, TW wants me to write something here so I do it. Nothing to explain actually.

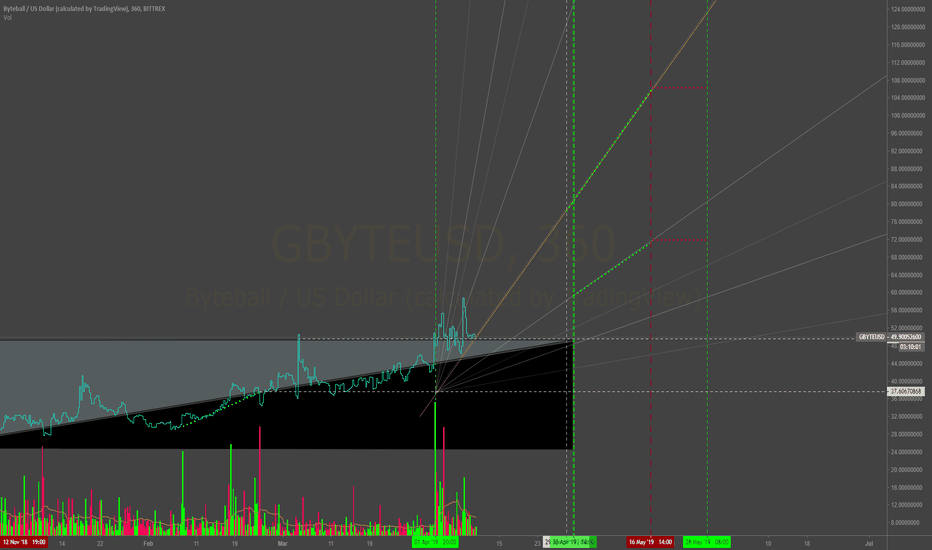

Gann Alignment Tool for DWEBThis is just one of the use cases for DWEB (Dynamic Weighted Equilibrium and Balance). In addition to giving you amazing data and visuals regarding the health and strength of an asset, this hybrid drawing feature adds a whole new dimension.

I call the dots "taps" and they signal very specific reactions based on price, balance, volume, and most importantly time. These taps hold data that allow you to find hidden trajectories and natural price action in the future.

The video will show you how to build very accurate Gann fans in seconds. Though this may be unconventional it's purposely built to provide easy, meaningful, natural, and very accurate fans that always provide valued data (if you know what to look for).

Choosing the best taps for alignment is the art but most of the time I use the longest and/or the most recent.

On smaller timeframes you can use the GREEN and RED taps together to find intersects that hold great data for levels, Fibonacci, additional Gann tools and geometry based charts.

Along with Bonfire (indicator) for squaring and pivots, users that put the time in to learn this system will be rewarded.

This is a pay for use indicator. Please contact me via message on TV or Twitter regarding payment via cryptocurrency.

Unbreakable bull trendThe BITTREX:GBYTEUSD known a violent price correction today. The target @ 34$US is still there. The bearish resistance is futile.

OByte Gbyte ByteBall Triangulation - Weighted Volume Method Gann, volume, and some magic. I might just be a little biased, really starting to like the fundamentals on this coin so take this with a Shill Pill.

$OBYTE $GBYTE

$OBYTE supply demand Obyte was hit hard by speculation during the last bull run, and with only 600,000 coins in circulation its no surprise it fell like a ton of bricks with the market. The good news is, the sharp decline also brought the MAs down quick so a sharp move up is possible. Obyte has made a lot of progress in the meantime from a dev perspective and is set to launch on BITZ anytime now... Therefore when the time comes, OBYTE will be able to have a nice cross up. Everything hinges on BTC and its price action so watch closely. Obyte is the same tech as IOTA but with smart contracts like ETH. Lots of potential here.

OBYTE Gann Fans short term trends Marked some points of interest and paths of least resistance. Please follow the trend lines as OBYTE moves and as the price aligns with the fans and intersections. Pretty easy- If it's on a trend line, respecting it as support, its heading that way because its a path of least resistance. If the price breaks the trend line, it should respect the the next support/resistance trend line up or down. When the price comes to a crossing of 2 lines, acting as a wedge , watch closely for a break up or down based on market conditions, BTC price, volume, AND/OR you're own indicators etc. This is a low volume, low supply coin with great potential but it's gains are directly linked to a BTC and a short history.

60% chance of small pullback buy, followed by 2nd push to $15060% chance of small pullback buy at about $67, followed by 2nd push to $150.

Then another small pullback buy down to $110, to $200

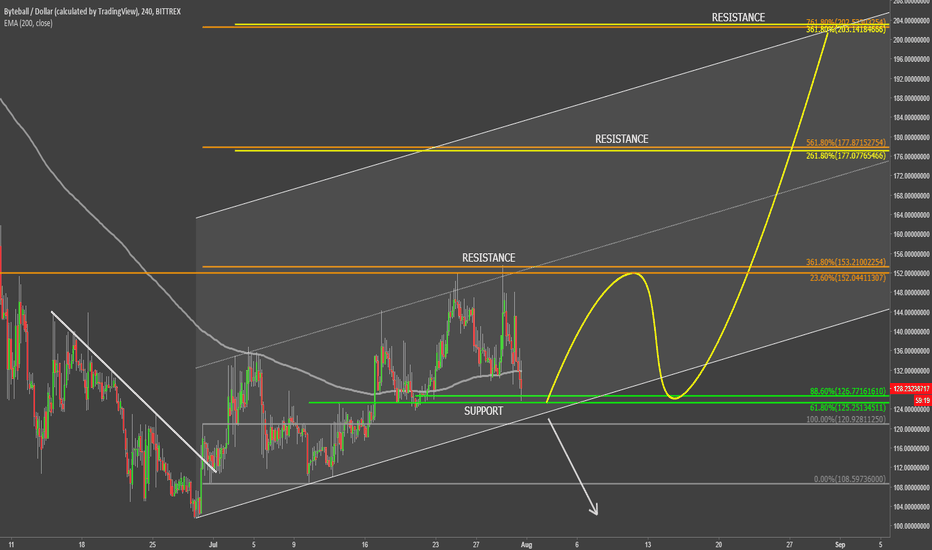

ByteBall at the Support - Uptrend Might ContinueAt the end of June Byteball has tested the low at $100, which is a strong psychological support. After bounce, price went up and broke above the downtrend trendline, corrected down, and went up again, this time breaking above the 200 Moving Average.

GBYTE/USD then bounced off strong resistance area at $150 and went down sharply. Currently it is trading at the $125 support, which could be the starting point for the uptrend continuation. It is worth mentioning that the 200 Moving Average is also acting as the support, as price still failed to break below with confidence.

If GBYTE stays above the $125 level, the uptrend is likely to continue, towards one of the Fibonacci resistance levels. First is at $177, and second is at $200 area, which is the next strong psychological resistance.

All-in-all, trend is bullish, but if the current support is broken, Byteball might once again move down towards the $100 area.

There is possibility for the beginning of uptrend in GBYTEUSD Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (114.00 to 95.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (114.00)

Ending of entry zone (95.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 137

TP2= @ 157

TP3= @ 191

TP4= @ 239

TP5= @ 287

TP6= @ 360

TP7= @ 518

TP8= @ 643

TP9= @ 777

TP10= @ 895

TP11= @ 1210

TP12= Free

There is possibility for the beginning of uptrend in GBYTEUSD Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (114.00 to 95.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (114.00)

Ending of entry zone (95.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 137

TP2= @ 157

TP3= @ 191

TP4= @ 239

TP5= @ 287

TP6= @ 360

TP7= @ 518

TP8= @ 643

TP9= @ 777

TP10= @ 895

TP11= @ 1210

TP12= Free

$gbyte longSolid af fundamentals & decent range for spot accumulation. If you think trex is going to be a vol-dead graveyard forever, you're only kidding yourself.

A trading opportunity to buy in Byteball is near...Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and Beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 36.

. While the RSI downtrend #1 is not broken, bearish wave in price would continue.

Trading suggestion:

. The price is in a range bound, but we forecast the uptrend would begin.

. There is a possibility of temporary retracement to suggested support zone (157 to 118). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (157)

Ending of entry zone (118)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 191

TP2= @ 239

TP3= @ 287

TP4= @ 360

TP5= @ 518

TP6= @ 643

TP7= @ 777

TP8= @ 895

TP9= @ 955

TP10= @ 1210

TP11= Free