45C trade ideas

$CRWD: Relative outperformance compared to its peersCybersecurity is one of our favorite themes. This is known to all who have been following this blog space. We have been bullish on the tech sector AMEX:XLK and specifically in the sub sectors within the tech sector. Cybersecurity is one of them. Within Cybersecurity we have some stocks which have outperformed the rest of its peers. One such name is Crowdstrike. NASDAQ:CRWD after suffering a 50% correction last year outage which took its price to 200 $ has recovered the loss and has recovered all the losses and then some. The stock is up almost 140% from its lows.

An outperformer in an outperforming sector. In the chart we also look at the ratio between NASDAQ:CRWD to $HACK. The ATH for the ratio chart was 6. Currently we are @ 5.6 in the ratio chart. The price chart of NASDAQ:CRWD alone looks bullish. If we plot the Fib retracement level just before the 2024 downturn then the next level in the price chart is 520 $. My price target is 520 $ before we can target 700 $ in the medium term.

Verdict : Go Long NASDAQ:CRWD for medium to long term. 520 $ first then 700 $.

CrowdStrike’s Chart Is Showing Caution Signs Ahead of EarningsCloud-based cybersecurity firm CrowdStrike Holdings NASDAQ:CRWD is set to release fiscal first-quarter results after the bell next Tuesday (June 3). Let’s check out the company’s technical and fundamental picture heading into the report.

CrowdStrike’s Fundamental Analysis

I'm not going to lie -- I’ve been long CRWD for a while and the stock has been very, very good to me. However, I see some reasons to be cautious moving forward.

At last check, the Street was looking for the firm to report $0.66 in fiscal-Q1 adjusted earnings per share on $1.11 billion of revenue. That would compare less than favorably to the $0.93 in adjusted EPS that CrowdStrike reported in the same period last year.

On the other hand, $1.11 billion in revenue would represent 20% year-over-year growth for the firm.

However, look at those two figures together and they appear to point to some margin compression. Additionally, 20% y/y sales growth -- while nothing to sneeze at -- would represent sequential deceleration of growth from the quarter just prior.

As a matter of fact, that would mark a fourth consecutive quarter of slower year-over-year growth from the prior 13-week period.

If that's not enough of a concern, all 32 sell-side analysts I can find that cover CrowdStrike have lowered their earnings estimates for the current quarter since it began.

CrowdStrike’s Technical Analysis

I charted CRWD for a different publication a month ago and pointed out what looked at the time like a “double bottom” pattern of bullish reversal.

That set-up worked like a charm, but I’m less confident in what the stock’s chart is showing us now:

True, readers will see still the double-bottom pattern of reversal that I mentioned, marked with two green boxes at left and showing a $392 pivot that stretched from late February into mid-April.

But at CrowdStrike’s recent $474.23 high, the stock was up 28% from that pivot. That’s often close to or even better than what one can expect to get out of a breakout.

And now, we see a so-called “rising-wedge” pattern of bearish reversal developing on the chart’s right side, as denoted with a red box above.

True, CRWD took back its 200-day Simple Moving Average (or “SMA,” marked with a red line above) as it climbed from the stock’s early April lows. The stock also retook also its 50-day SMA (marked with a blue line) and 21-day Exponential Moving Average (or “EMA,” denoted by a green line) during that period.

All of that means the stock should historically see some support on the way down, but we're still talking about a 13% drop before the 50-day line comes into play.

Meanwhile, CrowdStrike’s Relative Strength Index (the gray line at the chart’s top) remains strong, but its daily Moving Average Convergence Divergence indicator (the black and gold lines and blue bars at bottom) is sending mixed signals.

The MACD’s 9-day histogram (the blue bars) has been flipping back and forth in and out of negative territory for almost a month, while the 12-day EMA (the black line) has been wrestling with the 26-day EMA (gold line).

When the gold line is on top of the black line, that can be bearish, especially when the 9-day EMA slips below zero.

For the bulls to win out, it appears necessary for CrowdStrike to hold onto both the rising wedge’s bottom trendline and the stock’s 21-day EMA. And for the bears, those two points would serve as your downside pivots.

Should you take profits here? That's up to you.

But at the very least, the above chart seems to show that CrowdStrike investors should proceed with caution.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle was long CRWD at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

CrowdStrike Poised for AI-Driven Upside Momentum

Targets:

- T1 = $470

- T2 = $489

Stop Levels:

- S1 = $440

- S2 = $412

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in CrowdStrike.

**Key Insights:**

CrowdStrike's strategic integration of AI into its cybersecurity solutions has significantly bolstered its competitive advantage. The ability to harness AI in real-time threat mitigation and enhance operational efficiencies positions CrowdStrike as a leader in the cybersecurity industry. As demand grows for sophisticated enterprise solutions, CrowdStrike is well positioned to capitalize on this trend. Its technology innovations reduce response times to cyberattacks while managing costs effectively, a factor critical for corporate adoption in today’s complex security environment.

The broader adoption of AI technologies across industries further adds to CrowdStrike's growth potential, as enterprises increasingly prioritize intelligent security measures to combat evolving cyber threats. The company’s continuous focus on product development ensures its offerings remain relevant and differentiated in a competitive landscape.

**Recent Performance:**

In recent months, CrowdStrike stock has displayed strong upward momentum fueled by positive earnings reports and increased demand for its AI-driven cybersecurity platform. Trading volume has been consistent, with the stock consolidating near $455 levels before showing signs of bullish continuation as buyers return. Such behavior suggests sustained investor confidence in its long-term growth trajectory, particularly as it aligns with broader technological trends.

**Expert Analysis:**

Market analysts have applauded CrowdStrike's proactive approach to advancing its AI-driven solutions. Many have attributed its market strength to successful integration of cutting-edge AI mechanisms, which not only differentiate it from competitors but also address critical pain points for enterprise customers. As AI adoption accelerates globally, experts foresee robust revenue growth and increasing dominance for CrowdStrike in the cybersecurity domain. Additionally, its ability to maintain partnerships with key industry players strengthens its foothold in this rapidly evolving sector.

**News Impact:**

Recent announcements of CrowdStrike enhancing its AI capabilities and launching new strategic partnerships have underscored the company’s commitment to innovation. Positive sentiment surrounding these developments, coupled with its recognition as a top player in cybersecurity and AI integration, continues to drive investor optimism. With geopolitical uncertainty amplifying cyber risks worldwide, CrowdStrike’s solutions are increasingly viewed as indispensable, creating tailwinds for sustained stock performance.

**Trading Recommendation:**

Based on the above factors, CrowdStrike presents an appealing long opportunity at its current price of $455.59. Targets are set at $470 and $489, with stop loss levels at $440 and $412 to manage risk effectively. Investors seeking exposure to AI-led growth in the cybersecurity domain should consider CrowdStrike for their portfolios. Its proven ability to combine innovation with execution positions it as a prime candidate for strong upside potential.

CRWD – Flat Top Breakout to All-Time HighsCrowdStrike ( NASDAQ:CRWD ) is breaking out of a flat top consolidation, pushing to new all-time highs — a clean momentum setup that’s hard to ignore.

🔹 Price has been compressing just under ATHs with multiple tests of the same level — a classic flat top breakout pattern.

🔹 Today’s breakout candle is strong, with solid volume and follow-through.

🔹 This setup is all about price acceptance at new highs — and the bulls are showing up.

My Trade Plan:

✅ Entry: On breakout through the flat top

⛔️ Stop: Just below today’s low — keep risk tight

🚀 Target: Ride momentum — trail stop as price extends

Why I like this setup:

Clean structure, strong trend, defined risk

ATH breakouts often lead to trend acceleration if supported by volume

panw had their earnings today and gapped down it still has broken loose this is a good sign

CrowdStrike Holdings, Inc. – AI-Native Cybersecurity Powerhouse Company Snapshot:

CrowdStrike NASDAQ:CRWD remains a top-tier cybersecurity leader, redefining endpoint and cloud protection through its AI-powered Falcon platform, securing some of the most critical digital infrastructures in the world.

Key Catalysts:

Falcon Platform – AI-First, Cloud-Native 🧠☁️

Unified security architecture: endpoint, identity, cloud, and data

Leverages real-time analytics, automation, and continuous threat hunting

Widely recognized as a gold standard in modern cybersecurity (GigaOm, Gartner)

Elite Partnerships = Ecosystem Synergy 🤝

Named Google Cloud’s 2025 Security Partner of the Year

Deep collaborations with AWS, Microsoft Azure, and NVIDIA

Embedded in cloud-native DevOps workflows = high stickiness and TAM expansion

AI + Cyber = Next-Gen Growth Tailwind 🚀

Integrating generative AI and autonomous detection to proactively prevent threats

Strategic positioning at the intersection of cloud security and AI operations

Key enabler of Zero Trust architectures for global enterprises

Massive Market Opportunity 🌍

Global cyber budgets rising amid escalating threats

CrowdStrike well-positioned for land-and-expand growth via Falcon modules

Expanding presence in identity protection, XDR, and managed services

Financial Edge:

Consistent 30%+ YoY revenue growth

High gross margins (~77%)

Strong free cash flow generation, underpinning long-term profitability

📈 Investment Outlook

✅ Bullish Above: $370.00–$375.00

🚀 Upside Target: $600.00–$620.00

🎯 Thesis: Platform leverage, elite partnerships, and AI innovation make CrowdStrike a core cybersecurity growth leader for the AI era.

#CrowdStrike #Cybersecurity #AI #CRWD #FalconPlatform #CloudSecurity #NextGenTech

CrowdStrike (CRWD)... Time to disperse ?On a technical basis one victim of a continued market tariff downturn maybe CrowdStrike (CRWD) providing a selling/short opportunity.

Particularly if DJT's tariffs start applying to services.

IMHO two bearish technical formations support this:

1. A Bearish Harmonic Shark formation

2. A Bearish Wolfe Wave

Additionally there is emerging RSI bearish divergence. (bottom panel)

Today the Fed speaks so perhaps this will provide this opportunity.

Optimally the $440 level may provide this selling opportunity.

Also let the overall direction and tone of the market should color your decision.

This is just my opinion. Do your own due diligence.

I will follow up with a short recommendation as warranted.

Good Luck

$CRWD : Exceptional performance. Next stop 500 $. Very few stocks can claim the performance and resiliency of Crowdstrike. NASDAQ:CRWD not only resisted the recent downturn in the volatile markets but also is above it previous multi cycle highs. The stock was @ 400 $ when the major global outage happened, and the stock touched the lows of 200 $ before it had a massive bull run from the lows of 200 $. Before the major ‘Liberation Day’ volatility the stock touched an all time high of 450 $. Since then, the stock has reversed almost all its losses.

This can not be said about many stocks in the market. Even within the Tech sector the subsector Cybersecurity showed a great deal of resilience in the recent market turmoil. In this space we discussed the relative performance of AMEX:HACK vs SMH multiple times. But within the Cybersecurity subsector there are stocks like NASDAQ:CRWD which are trying to reclaim the ATH. Very few stocks in the Tech sector are at or near their ATH. At 430 $ NASDAQ:CRWD is just 5% away its ATH. The RSI is still not in overbought condition which is hovering at 60s. Next stops are 450 $ and then the 1.61 Fib retracement level which magically lies at 500 $.

Verdict : Stay long $CRWD. Next target 500 $.

CRWD: in main resistance for one more leg down Price has now reached an ideal resistance zone, aligning with the 2024 summer top, where a bounce (wave B) is to complete itself.

As long as price remains below the 425 level, I see the odds favoring another leg lower, targeting the macro support zone around 300–270.

Thanks for your attention and best of luck with your trading!

CrowdStrike: Member of a Small ClubThe broader market has been tumbling for months, but CrowdStrike has stood its ground.

The first pattern on today’s chart is the March 10 low of $303.79. While the Nasdaq-100 has revisited levels from over a year ago, CRWD has held lows from a month prior. Support at such a recent level may reflect positive sentiment.

Second, Wilder’s Relative Strength Index (RSI) made a higher low as the cybersecurity company made a slightly lower low. That positive divergence could also be viewed as a bullish signal.

Third, the 50-day simple moving average (SMA) had a “golden cross” above the 200-day SMA in November and has stayed there since. Is a longer-term uptrend still in effect?

Speaking of SMAs, CRWD is above its 20- and 200-day SMAs. That puts it in relatively elite clubs: Only 104 members of the S&P 500 are above their 20-day SMAs and just 138 are above their 200-day SMAs, according to TradeStation data.

Those points may also suggest sellers have been less active in the name.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

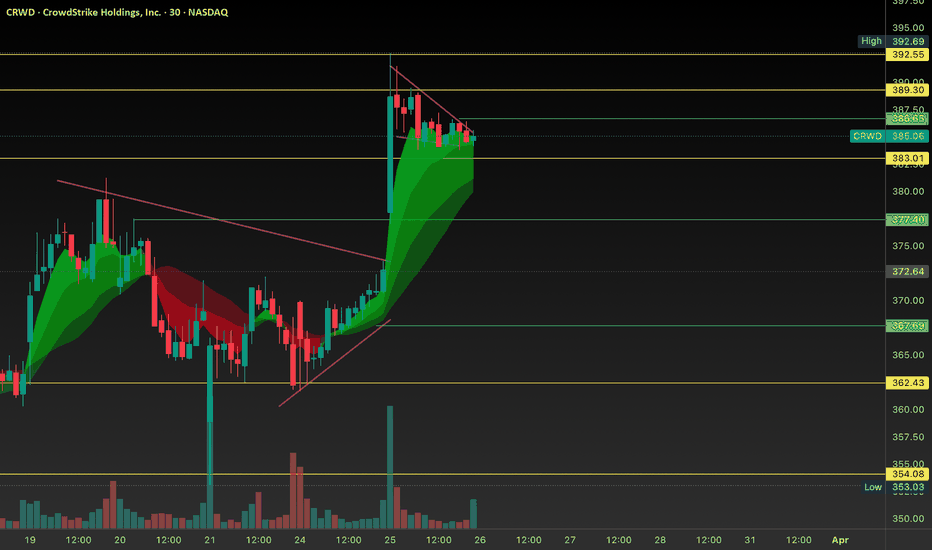

CRWD 3 hours idea expecting exact up and downThis analysis provides insights into the future movement of Pulp (CRWD) stock based on the 3-hour chart. By examining key technical indicators, price action, and support/resistance levels, we anticipate potential price fluctuations in the short term. The 3-hour chart offers a closer view of the stock’s momentum, helping traders make informed decisions on entry and exit points. Keep an eye on upcoming price patterns and trend shifts that could indicate potential opportunities for profit or risk management.

Long on CRWD: Focus on Strategic Entry Within Range

-Key Insights: CrowdStrike Holdings, Inc. is currently seen within a strategic

trading range between $300 and $400. Recent market activity places it mid-range

with momentum to potentially capitalize on buy opportunities as it approaches

the lower support boundary. The security's market attention alongside other

sector leaders like Tesla adds to an optimistic outlook in the cybersecurity

field.

-Price Targets: Next week, consider a long position with target 1 (T1) at $380

and target 2 (T2) at $395. Manage risk with stop level 1 (S1) at $340 and stop

level 2 (S2) at $320, ensuring disciplined trading execution.

-Recent Performance: CrowdStrike closed recently at $362.24, indicating it is

within a consolidation phase. This midpoint suggests monitoring for either a

breakout above the resistance or a pullback to support, offering possible entry

or exit points.

-Expert Analysis: Analysts highlight CrowdStrike as a stock aligned with market

sentiment driven by cybersecurity needs. Its association with notable stocks to

watch, such as Tesla, reinforces its positioning as integral within strategic

sector portfolios.

-News Impact: While unspecified, any fluctuation observed may relate to

overarching market trends or sector-specific developments impacting investor

sentiment. It underscores the necessity of staying informed on both

macroeconomic signals and technological advancements affecting cybersecurity

demand.

Consider Going Long on Crowdstrike: A Strategic Insight - Key I- Key Insights: CrowdStrike remains a formidable player in the cybersecurity

market, buoyed by the AI-driven Falcon platform. Despite recent market

fluctuations, its growth trajectory and strategic innovation suggest

potential for future recovery, making now a possible entry point for long-

term investors interested in cutting-edge cybersecurity solutions.

- Price Targets: For those considering a long position, next week’s targets are

as follows:

- T1: $363.00

- T2: $375.00

- S1: $340.00

- S2: $330.00

These levels suggest potential upward movement while defining risk thresholds.

- Recent Performance: CrowdStrike has shown mixed performance amidst robust

growth and innovation. Recent sell-offs have tested institutional support

levels, reflecting a period of volatility. This requires vigilance from

investors to identify optimal entry and exit points and underscores the

importance of timing in trading strategies.

- Expert Analysis: Market experts are optimistic about CrowdStrike's recovery

potential, emphasizing its AI technological strengths. Alongside peers like

Planet Fitness and Microsoft, CrowdStrike is expected to benefit from

industry advancements. Despite technical volatility, its foundational

strength poses a viable opportunity for investors.

- News Impact: The latest fiscal Q4 2024 earnings report, which exceeded

expectations with a non-GAAP EPS of $0.13, underscores CrowdStrike's

strategic growth and operational effectiveness. This positive financial

performance aids in alleviating some investor concerns following continued

fluctuations in stock prices, reinforcing its leadership in the

cybersecurity arena.