Key facts today

HSBC maintains a 'buy' rating for State Bank of India (SBIN) with a target of Rs 960 per share, while CLSA sets a target of Rs 1,050, citing strong profit growth.

State Bank of India announced a final dividend of Rs 15.90 per share, effective May 16, 2025, continuing its trend of rising dividends over recent years.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.88 EUR

8.48 B EUR

71.96 B EUR

About STATE BANK OF INDIA

Sector

Industry

CEO

Rana Ashutosh Kumar Singh

Website

Headquarters

Mumbai

Founded

1921

FIGI

BBG00FGWZ3Y6

State Bank of India engages in the provision of public sector banking, and financial services statutory body. It operates through the following segments: Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business. The Treasury segment includes the investment portfolio and trading in foreign exchange contracts and derivative contracts. The Corporate/Wholesale Banking segment consists of lending activities of Corporate Accounts Group, Commercial Clients Group, and Stressed Assets Resolution Group that provides loans and transaction services to corporate and institutional clients and further include non-treasury operations of foreign offices. The Retail Banking segment refers to the retail branches, which primarily includes personal banking activities including lending activities to corporate customers. The Other Banking business segment focuses on the operations of all the non-banking subsidiaries and joint ventures of the group. The company was founded on January 27, 1921 and is headquartered in Mumbai, India.

Related stocks

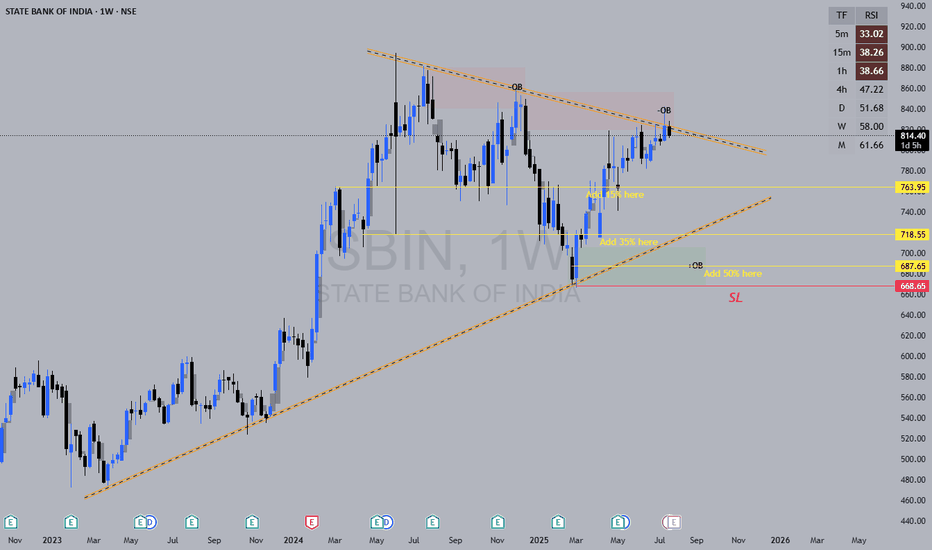

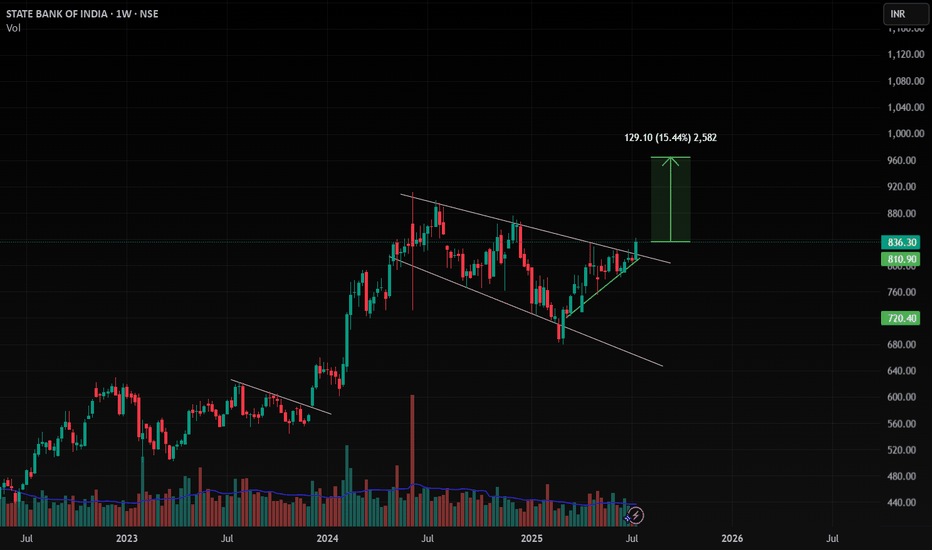

SBIN✅ Updated Trade Plan Summary

✅ Updated Trade Plan Summary

Metric Previous Value Updated Value

Entry 800 800

Stop Loss (SL) 757 775

Risk 43 25

Target 1256 1256

Reward 456 456

Risk-Reward (RR) 10.6 18.2

🔍 Implications of the Change

🔽 Risk reduced from 43 to 25 points

✅ RR improved significantly fro

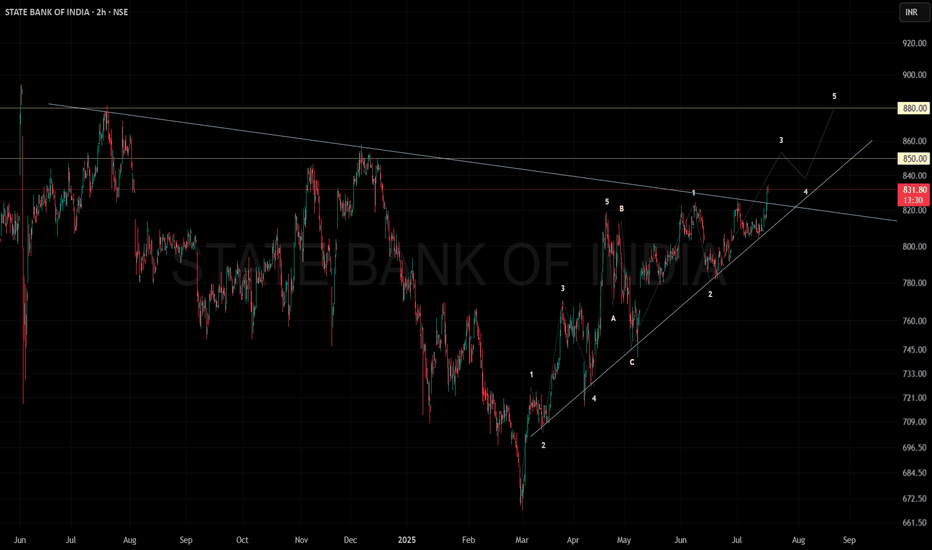

SBIN🧠 Technical Logics Highlighted

Qtrly BUFL Zone is respected – strong confirmation of demand at 765–705.

Weekly ASZ previously formed at 793, reinforcing buyer interest.

Engulfing Pattern with DMIP & SOE confirms buying strength.

Current price trades above Gann Level (766) – a technical sign of st

Importance of ATR(Average True Range)So idea here is to calculate risk.

understanding fear in the market ATR is an indication of volatility , not direction.

A smaller ATR range means low volatility.. tentatively market is consolidating.

A larger ATR range means the market is dealing with uncertainty so volatility has increased.

yo

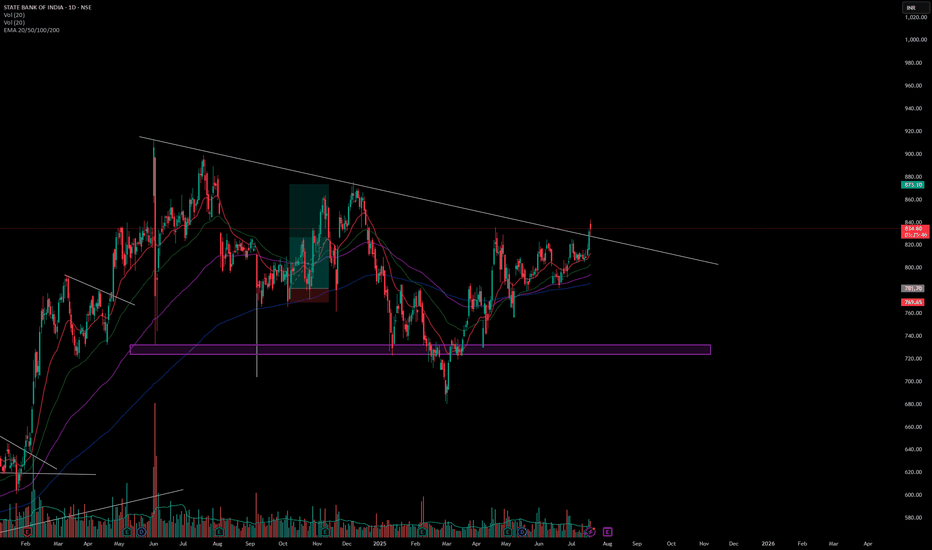

SBI - My Pick - No Financial Advice - VCP PatternAfter a recent upside rally SBI has retraced approx 8.5% from the resistance zone of 825-830, theafter second compression of 5% occurred. Thus I see sucessive Volatility contraction. Recent Golden Cross over clubbed with VCP is indication of good buying opportunity. Short to mid-term momentum is bul

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

S

SBIN5412137

State Bank of India (London Branch) 2.49% 26-JAN-2027Yield to maturity

4.93%

Maturity date

Jan 26, 2027

S

SBIN5114735

State Bank of India (London Branch) 1.8% 13-JUL-2026Yield to maturity

4.67%

Maturity date

Jul 13, 2026

S

SBIN5693776

State Bank of India (London Branch) 4.875% 05-MAY-2028Yield to maturity

4.61%

Maturity date

May 5, 2028

See all SID bonds

Curated watchlists where SID is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks