TSLA bound to return to its GLORY. SEED now at 230 !TSLA'S 2024 year has been a glorious one after surging 2x its valuation from 200 area on Q3 of 2024 to reach a parabolic ATH high of 485.

From there on, the stock has spiraled down -- since TRUMP inauguration.

Slashing half of its market cap from a 1.5T+ company to just 700B. Price suffered most on the market bloodbath from its ATH of 480 back to tappin its pre-surge base zone at 200 levels.

Now, things has become more or less calm. And red days has become saturated hinting of possible reversal play to the upside.

Significant net longs has been registered this past few days conveying heavy accumulation at the current price range of 200.

A double bottom has been spotted on our diagram showing a strong support of the price line.

Current price range is an ideal seeding zone for trade entries.

A rare bargain opportunity for that growth prospect -- and a retap of its glory days back at peak levels.

Spotted at 230.

Target ATH levels at 480.

TAYOR. Trade safely.

TL0 trade ideas

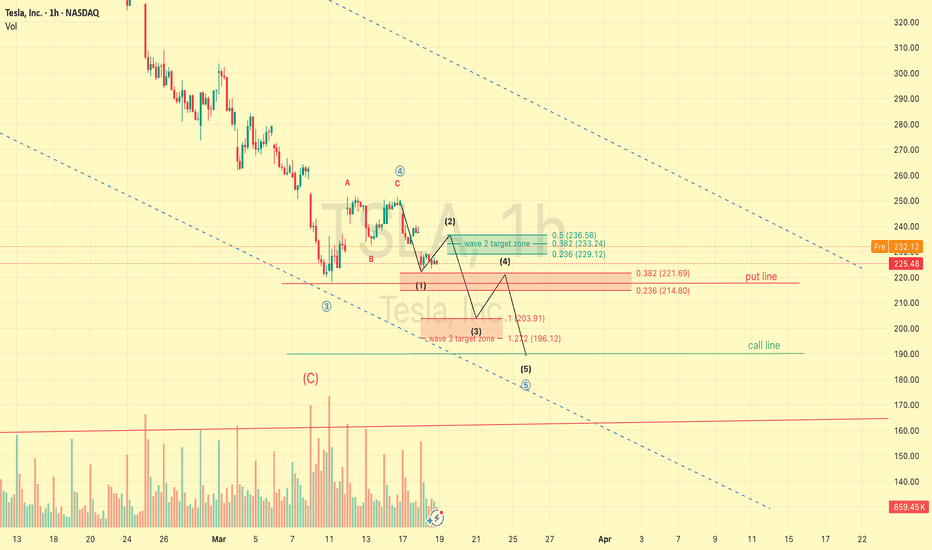

TSLA at a Pivotal Breakout! Will Bulls Take Control or Fake out?🔥Technical Analysis & Options Outlook

📌 Current Price: $239.92

📌 Trend: Bullish Breakout Attempt

📌 Timeframe: 1-Hour

🔹 Price Action & Market Structure

1. Bullish Momentum – TSLA is pressing against a descending trendline resistance, signaling a potential breakout attempt.

2. Break of Structure (BOS) Confirmed – Higher lows forming after strong demand at the $225 support.

3. Change of Character (ChoCh) Seen – Buyers are stepping in aggressively, but we need confirmation above $245 for a continuation.

4. Key Rejection Zone – $245–$252.50 CALL Resistance area could act as the first challenge.

5. MACD & Stoch RSI – Showing bullish momentum but nearing overbought levels, meaning a potential retracement before continuation.

🔹 Key Levels to Watch

📍 Immediate Resistance:

🔹 $245 – Key breakout level

🔹 $252.50 – Major CALL Resistance (likely profit-taking zone)

🔹 $260+ – Extreme CALL Wall & final bullish target

📍 Immediate Support:

🔻 $235.73 – Current breakout retest level

🔻 $225 – Strong demand zone & PUT Wall

🔻 $217 – Lower risk PUT Wall, deeper retracement zone

📊 Options Flow & GEX Sentiment

* IVR: 55.7 (Moderate Implied Volatility)

* IVx: 78.2 (-0.8%) (Volatility cooling off slightly)

* GEX (Gamma Exposure): Bullish ✅ ✅ ✅

* CALL Wall Resistance: $252.50 – $260 (Sell zones if price surges too fast)

* PUT Wall Support: $225 & $217 (High liquidity demand zones)

📌 Options Insight:

* Above $245, dealers may be forced to hedge by buying, leading to a possible gamma squeeze toward $252–$260.

* Below $235, risk increases for a pullback to $225 PUT liquidity zone before another bounce.

📢 My Thoughts & Trade Recommendation

🔥 Bullish Case: A breakout above $245 could trigger a short squeeze into the $252–$260 range.

⚠️ Bearish Case: If TSLA fails at $245 and retraces below $235, expect a dip to $225 for reloading opportunities.

🎯 Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Above $245 Breakout

🔹 Target: $252–$260

🔹 Stop Loss: Below $235

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $245

🔻 Target: $225 PUT Wall

🔻 Stop Loss: Above $250

🚨 Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

🔥 Final Thoughts: TSLA is at a crucial breakout zone. A strong move above $245 could send it soaring, while failure to break could trigger a rejection toward $225 before the next leg. Stay patient, trade smart! 🚀

Tesla May fall before it revives.We are in the middle of a demand area for Tesla. What does that mean? With the heavy selling, tons of demand is being fulfulled. We are getting close to the bottom of where there is strong demand (210-212). If We do not close below this area, there is a strong case for a rebound up to the 255 area. This may happen quickly.

With this "Players" Strategy, Participants, or "players" are able to be found out through pure price action and volume. Follow for more charting and happy trading!

TSLA 2 MoonTesla, Inc. is an American multinational automotive and clean energy company. Headquartered in Austin, Texas, it designs, manufactures and sells battery electric vehicles, stationary battery energy storage devices from home to grid-scale, solar panels and solar shingles, and related products and services.

MORE BAD NEWS OR NO?Since the Robotaxi event on October 11th, Tesla is up 38% , currently priced at $292 per share This is a return to the early November 2024 price level. But following the market correction over the last month, TSLA shares are down 23%.

This was somewhat expected, given that the Trump-Musk alliance boosted TSLA stock in the short-term, which now fizzled out. The political exposure is also a double-edged sword, which ends up impacting Tesla EV sales.

With protest going up on Elon musk we may see it go down a little ... and investors may view TESLA stock as highly speculative. However if 330 breaks we may see it rise up from there..

Tesla (TSLA) Shares Among the Biggest Losers AgainTesla (TSLA) Shares Among the Biggest Losers Again

As the chart shows, Tesla (TSLA) shares opened yesterday’s trading session with a bearish gap and closed more than 5% lower than the previous day’s close. Meanwhile, the S&P 500 index (US SPX 500 mini on FXOpen) also declined, but by only around 1%.

Why Tesla (TSLA) Shares Fell

The recent two-day decline may be part of a broader downtrend. As we noted earlier in March, one of the key bearish factors could be Elon Musk’s political involvement in the Trump administration. For investors, this may imply that:

→ A significant number of potential Tesla customers may be put off by Musk’s political stance, slowing sales.

→ The CEO may not be paying enough attention to the company at a time of intense competition. Notably, Chinese EV manufacturer BYD Co. (CN:002594) has announced the launch of its Super e-Platform, which can charge a vehicle with a 400-kilometre range in just five minutes.

This sentiment is reflected in analysts’ decisions, as they continue to lower their target prices for TSLA shares, further fuelling negative sentiment.

TSLA Price Forecast

According to MarketWatch, RBC Capital Markets has cut Tesla’s target price from $440 to $320 due to a worsening outlook for the company’s robotaxi programme and autonomous driving software.

However, RBC analyst Tom Narayan maintained a “Buy” rating on Tesla (TSLA) shares, stating that concerns over a sharp sales drop in Europe and China are “overblown.”

Technical Analysis of Tesla (TSLA) Chart

The previously identified downward channel (marked in red) remains relevant. However, price action suggests that selling pressure may be easing:

→ The decline on 10 March (marked by arrow One) was much more aggressive, but the downward momentum has since slowed (also marked by arrow One).

→ During yesterday’s session, the price closed only slightly below the opening level, suggesting that bears are hesitating near the yearly low.

This could potentially lead to a bullish Double Bottom pattern, increasing the likelihood of an attempt to break above the current resistance around the psychological level of $250.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla What Next? TSLA Buy Bargain OR Bust?✅️Now you guys know my thoughts on this and although TESLA has been beaten ⚫️black⚫️ and 🔵blue🔵 recently somehow there may be an opportunity on the horizon.🚀

ℹ️ The way I look at it is unless you think TSLA is dead forever and to be cast to the dustbin 🟢SeekingPips🟢 would be looking for a buying opportunity.

👌I don't know who coined the phrase first however it's one that 🟢SeekingPips🟢 loves and uses often it's

⭐️"BUY WHEN THERES BLOOD IN THE STREETS"⭐️

⚠️Now don't get me wrong it doesn't mean I will be loading up gun ho RIGHT AT THIS MOMENT but it certainly DOES MEAN I'M NOT A SELLER AND STALKING BUYING OPPORTUNITIES✅️

❓️What's you thoughts on Tesla❓️

Share your thoughts with 🟢SeekingPips🟢

TSLA Downside targetK.I.S.S. Easy technical target below. Fundamentally overvalued and HATED by the public this brand is going down. I'd be surprised if it doesn't hit the target. Into 2026, I'd not be surprised to see it sink further as people swear off of anything Elon in Europe and Chinese automakers eat its lunch in Asia. Good luck. NASDAQ:TSLA

TSLA dragging the market and vice versa.The decline

The headlines and the chart shows a 50% decline in the value of Tesla shares. Several factors have contributed to this.

According to the company's reports the sales have declined in several regions, on one side, the hype of the electrical brand has diminished and the involvement of Elon Musk in politics has people left wandering who is in charge of Tesla right now? The man who forced people to "work at the office or get fired" is the first one not showing up at the office and taking care of a different business, called politics. His controversial comments, behavior, being under the spot light and the cameras that amplify everything he says and does hasn't created a good image associated with the brand which has sparked the boycotts. The recent show room improvised at the white house didn't help much either. The brand is already associated with politics, and politics by nature are divisive and have contrasting emotions associated. So Tesla became a far right luxurious item, no longer the "Electric Auto for the Masses".

Tariffs and World Politics

The Tariffs and geopolitical instability have taken a toll in the overall market, the investors are nervous and they started taking the exit. Once the index goes down and the Magnificent 7 goes down, they drag the index down. So it's both, Tesla dragged the index and the index is dragging Tesla. NVDA didn't took well tariffs and the main contributors of the Mag7 are dragging everyone down.

Analyst Ratings

Several analysts have reduced the price target for Tesla, so we're not thinking about a new all time highs soon. This is what Trump called "A little disturbance".

The Mag7 Performance

We can see from the chart the performance of the mag7. The main contributors in a hypothetical portfolio have been NVDA, MSFT and TSLA. Tesla started a relative decline compared with the SP:SPX at the end of 2024. Once Elon started getting more involved in politics and less involved with the brand. Afterwards it's been all down hill.

What's next?

We have a systemic risk here, the secular bull market is currently in correction, and if the current politics plus the performance of the main components of the Index aren't strong enough to hold the correction, then we'll see a recession and a sharp decline in the market. Elon Musk is damaging the brand, he's the main shareholder, and he should take accountability of his actions and how they are hurting the company. He should step down and let someone else take care of Tesla. His public image is no longer what sparked the interest in Tesla. His multitasking CEO commitments and now his "Head of DOGE" position, aren't helping Tesla at all.

Removing Elon won't create a reversal in the trend, but at least this will give Tesla better credibility in the market and dissociate it with the political world.

Grafic TSLA ComparativThis TradingView chart illustrates the relative performance of several major assets—TSLA (Tesla), AAPL (Apple), GOOG (Alphabet), BTCUSD (Bitcoin), GM (General Motors), DELL, and others—over a 4-hour timeframe on the daily chart, spanning late 2024 to March 17, 2025. The period captures the market's reaction to Donald Trump’s re-election and early policy implementations, including tariffs and a push for a weaker dollar. Tesla (yellow line) and Bitcoin (purple line) saw significant gains in late 2024, reflecting optimism in innovative sectors, but both experienced downturns in 2025, with Tesla down 5.41% and Bitcoin up 22.18%. Traditional players like Apple (red line, -4.19%), Alphabet (blue line, -2.00%), GM (green line, -8.76%), and Dell (orange line, -26.36%) have generally trended downward, highlighting the broader impact of macroeconomic pressures such as rising inflation, global trade tensions, and policy-driven market volatility. The chart underscores how macro conditions and political decisions can overshadow individual company performance, driving relative stock movements in a turbulent economic landscape.

TESLA stock Chart Fibonacci Analysis 031725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 241/161.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

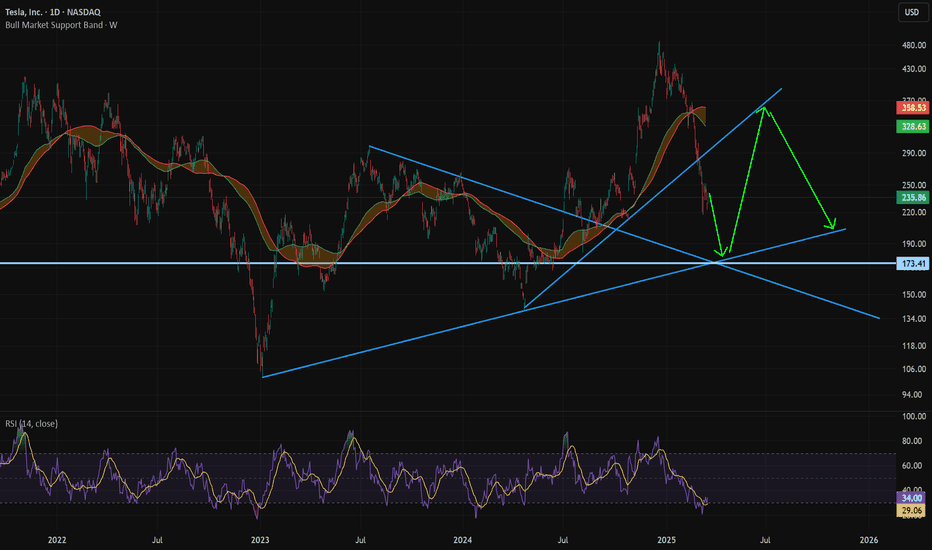

TSLA, a break coming. But not over yet… Tesla looks like it’s about to take a break from its vicious pounding in the market, potentially returning to $270. But it looks inevitable that NASDAQ:TSLA is going to come across some very serious trend lines soon, joining at approx $170 end of April, right at the earnings date….

TSLA in Buy ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channels

Stochastic Momentum Index (SMI) near oversold level

Money flow momentum is spiked negative and under at bottom of Bollinger Band

Price at or near Fibonacci level

Entry at $100

Target is upper channel around $340

the last time this condition was met, NASDAQ:TSLA went up 10%, so let's see what happens.