Trump Tariffs: Gold's Wild Ride & What's NextToday, Trump's policy of reciprocal tariffs has been officially implemented. The gold market, which has been overly hyped, has witnessed the fulfillment of a risk event, and the concentrated closing of long positions has triggered a deep correction. Spot gold prices plummeted from the high of $3,167.71 per ounce in the early Asian trading session. It touched a low of $3,054 per ounce, with an intraday amplitude of over $110, completing the technical action of building a top.

The leading institutional investors have precisely taken advantage of the market psychology of "buying on the news and selling on the fact" and completed the long position layout before the tariff policy was implemented. Their operation method is quite typical: first, they attract retail investors to take over the shares through a pulsed upward pull. Subsequently, they adopt a three-stage washing method of "plunge - consolidation - second plunge", completely breaking the recent upward oscillation pattern in the Asian and European trading sessions. This method is identical to the top formations in history on many occasions, and its purpose is precisely to create panic selling and trap the chips that chased the high prices.

Technically, a clear top signal has emerged in the daily chart of gold. Currently, the decline has exceeded the 38.2% Fibonacci retracement level, and the price has fallen below the middle band of the Bollinger Bands, indicating that the medium - term trend may reverse. However, it should be noted that this round of adjustment has not yet completed the complete five - wave structure. In the future, we need to focus on the guidance of tomorrow's non - farm payrolls data on the market's expectations of the Federal Reserve's policies, as well as whether the weekly closing price can confirm the head pattern. John suggests that it's advisable to mainly adopt a wait - and - see approach. One should get involved only after the trend stabilizes. Pay attention to the resistance levels above at 3118 and 3130, and the support levels below at 3100 and 3085.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

GOLD.PRO.OTMS trade ideas

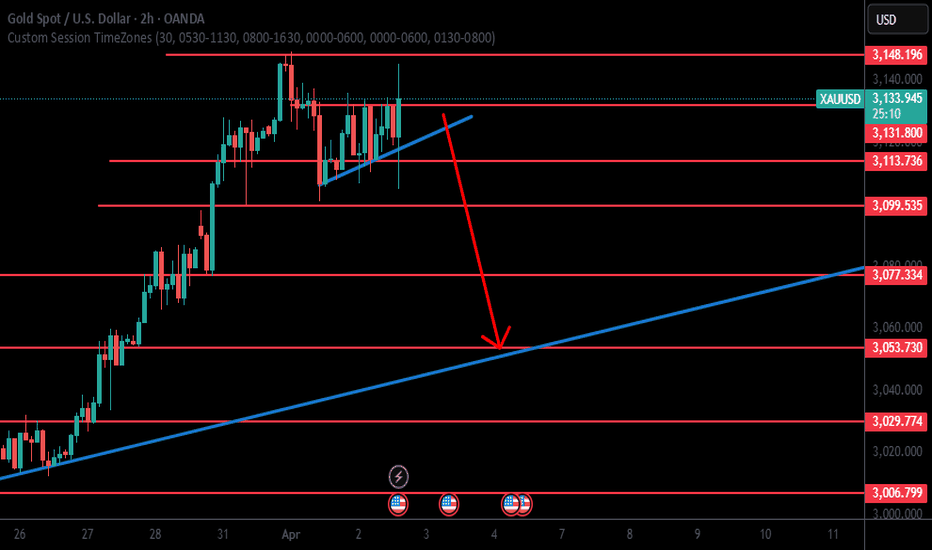

Restesting Resistance - GOLDGood Morning,

Gold broke down of its high at 3160$. It tried with good momentum to get back into trend but was rejected.

Overall Gold is still in a bullish long term trend however for the purpose of swing trading we are always looking to take advantage of those highs and lows.

I am still holding a short against Gold since its drop and have not looked to exit yet.

Currently we are showing another attempt to retest and break out of its short term bearish trend.

Enjoy!

“Gold’s Resilience: Sustaining the Long-Term Uptrend”XAUUSD remains in an uptrend and is estimated to be in wave (v) of wave ; more specifically, it is currently within wave iv of wave (v).

In the short term, XAUUSD is expected to undergo a correction toward the 2,948–2,989 area. However, in the broader outlook, I anticipate further upside movement toward the 3,091–3,161 level.

Gold (XAUUSD) based on the chart analysis Trade Plan: XAUUSD (4H/1H Sell Setup)

🟠 Entry Zone (Sell Limit)

🎯 $3063 – $3088

(This aligns with the 0.5 – 0.618 Fibonacci retracement zone + Smart Money order block + resistance)

🔴 Stop Loss (SL)

🔺 $3095

(Slightly above the order block and minor swing high to avoid fakeouts or wicks)

✅ Take Profit (TP)

TP1: $2985 → current support structure

TP2: $2955 → 1.618 Fibonacci extension level

TP3: $2900 → optional swing TP if bearish momentum is strong

📊 Risk to Reward (RR) Calculation

Estimated Entry: $3075

SL: $3095 → 200 pips risk

TP1: $2985 → 900 pips = RR ~ 1:4.5

TP2: $2955 → 1200 pips = RR ~ 1:6

💰 Risk Management – Example Lot Size

Account size: $1,000

Risk 2% per trade = $20

SL = 200 pips

🧠 Additional Confirmation Tools (Optional but Recommended)

Bearish divergence (RSI/MACD) around entry zone

Bearish candlestick pattern or M-pattern near $3063–3088

Minor break of structure (BOS) on 15m or 1H after rejection

Trump is controlling the world marketFear gripped global markets earlier this week as major economies clashed over tariffs that threatened to push the United States and the world into recession.

Donald Trump said on Sunday that the United States was taking “medicine” to cure its trade “disease.” But the pressure on the Trump administration is growing as Americans’ investment and retirement accounts have plummeted. Even Trump’s staunchest supporters, including Sen. Ted Cruz, Rep. Mitch McConnell and Elon Musk, have begun to voice concerns.

JP Morgan CEO Jamie Dimon warned that the tariffs would push up commodity prices and slow economic growth, potentially leading to “stagflation.”

The market is currently pricing in five rate cuts by the Federal Reserve this year, totaling 1.25%. Many investors believe the Fed could make an emergency rate cut before its next policy meeting.

Technically, despite the weakness in gold prices, buyers still have the technical advantage in the short term. The overnight rebound suggests that sellers may be exhausted. The buyers’ target is to close above the resistance level of $3,201.60/ounce (the contract high). On the other hand, sellers want to push prices below the support level of $2,950/ounce.

XAU / USD Hourly ChartHello traders. I just wanted to follow up from my last post a few hours ago. As I had said, I was of bearish mindset and sure enough it played out perfectly. I took no trades today. Now I am watching the current area to see if we keep pushing down, or move up a bit to take out the short positions being held. Big G gets my thanks. Let's see how the next 4 hour and 1 hour candle play out. Be well and trade the trend. Happy Tuesday.

XAUUSD under selling pressure: Will Gold’s downtrend continue?At the end of the last trading session, XAUUSD continued its downward trend, currently quoted at 3037 USD, corresponding to a 2.46% decline on the day.

The main reason for this decline is the escalating trade war, which has raised concerns about a global economic recession, leading to panic and a sell-off in gold to cover losses from other assets. Additionally, the recovery of the USD during the day also put pressure on gold.

Meanwhile, Federal Reserve Chairman Jerome Powell stated that President Donald Trump's new tariffs are "larger than expected" and that the new tax policies could have stronger-than-anticipated effects on the U.S. economy, increasing inflation and slowing economic growth.

Therefore, the current environment remains risky for XAUUSD, and as long as the resistance levels within the downward trend channel are protected by the sellers, our target price will be limited to the lower boundary of the descending channel.

What about you? Do you think gold will continue to fall?

I told you !Hello Traders 🐺

In the last couple of weeks, my only bearish idea was about the GOLD price, and I mentioned that somewhere around $3100 would be the top — at least from a mid-term perspective.

Now, as I told you before, price created a fakeout from the rising wedge pattern, which is inherently a bearish pattern!

But we had a bullish breakout with a bearish divergence on the RSI, so what came next was so obvious!

Now I’ve mentioned two price targets for GOLD in the immediate short term on the chart — make sure to act accordingly.

And what about the mid-term? You can check my last idea about GOLD in the related link below this idea.

But about the total financial market, I have to admit that there is a chance for recession,

but honestly, I can’t feel it, because the danger of recession is much higher than inflation.

And also, with the recent tariffs, I can say Donald Trump wants to grow the US economy, and that’s not going to happen through recession.

However, let me explain all of this in detail in the next idea...

I hope you enjoyed this idea — and always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

Potential bearish drop?XAU/USD is rising towards the resistance level which is a pullback resistance that aligns with the 23.6% Fibonacci retracement and could drop from this level to our take profit.

Entry: 3,007.14

Why we like it:

There is a pullback resistance level that line sup with the 23.6% Fibonacci retracement.

Stop loss: 3,059.25

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Take profit: 2,951.70

Why we like it:

There is a pullback support level that is slightly below the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

XAUUSD H4 | Bearish FallBased on the H4 chart analysis, we can see that the price has just reacted off our sell entry at 3049.32, a pullback resistance.

Our take profit will be at 2956.84, a pullback support that aligns close to the 61.8% Fibonacci retracement.

The stop loss will be placed at 3114.63, an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Gold's upper resistance appears, trend analysisGold has recently shown a strong upward offensive, and the daily line has been rising continuously, showing an upward trend. What gold needs to pay attention to is that the end of the rising market is not determined by the high point, but by the breaking of the key support level. The current upper resistance is at 3148-3152, and the lower support is at 3122-3117. It is recommended to rebound high and short as the main, and low and long as the auxiliary.

Gold strategy:

long at 3127/28, stop loss at 3120, target 3140-3145; if 3145 is not broken, short on rallies and then look back to around 3130-28.

XAUUSD Daily Plan – April 7 | Sniper EntriesNo guessing. No chasing. Just structure, logic, and precision entries. Based on current structure from H4 down to M15, price is hovering above a major reaction zone, and both bulls and bears have valid reasons to get involved — only if the zone speaks. Let’s map the battlefield 👇

🔹 Market Snapshot:

After the perfect sniper short from 3135, price printed a series of LHs and lower closes.

Now reacting from the 3015–3020 demand/FVG zone, respecting both internal structure and a long-term trendline.

RSI recovering from oversold on M15/H1. Volatility likely as we approach NFP aftermath flow.

🟩 BUY SCENARIO 1 – “The Bounce from the Base”

📍 Entry: 3020–3015

🧠 Why: Bullish M15 FVG, trendline support, RSI reversal

🎯 TP1: 3086

🎯 TP2: 3130

🛑 SL: 3008 (below swing low + OB invalidation)

💬 Classic sniper entry on bullish reaction + CHoCH on M5

🟩 BUY SCENARIO 2 – “Deeper Tap, Higher Reward”

📍 Entry: 2975–2965

🧠 Why: Untouched M30 OB + imbalance zone + D1 demand

🎯 TP1: 3050

🎯 TP2: 3086

🛑 SL: 2958 (below OB + psychological 2960)

⚠️ Only take if 3010 breaks clean and flushes into this area

🔻 SELL SCENARIO 1 – “Short the Retest”

📍 Entry: 3107–3115

🧠 Why: M15 OB + unmitigated FVG + CHoCH after LH

🎯 TP1: 3030

🎯 TP2: 3010

🛑 SL: 3119 (above OB + intraday wick space)

💬 Look for M1–M5 confirmation & bearish PA

🔻 SELL SCENARIO 2 – “The Premium Re-Entry”

📍 Entry: 3135–3142

🧠 Why: Strong OB zone, premium liquidity grab, equal highs

🎯 TP1: 3086

🎯 TP2: 3020

🛑 SL: 3148 (above liquidity + invalidation of OB)

🧠 Still valid if price rallies fast — best with RSI divergence

🧭 Key Levels Recap

3142 – Upper premium OB

3115 – Intraday LH rejection

3020 – Bullish FVG + trendline

2965 – Deeper demand zone

2958 / 3148 – Final SL protection areas

💬 Let’s Grow together

If this sniper plan helps refine your view: ✅ Like if it aligns with your bias

🔔 Follow for clean, daily smart money plans

💬 Drop a comment with your scenario or questions

We're here to build consistency — one precise setup at a time. 🎯

Stay sharp, stay kind! 💛

#XAUUSD:$3200 Next Big Move, Bulls Are Like to DominatePrice has been bullish since many months as US Dollars continue to decline, the fear of further decline in dollar value is triggering the gold market to go all time high. There is a big possibility that price is likely to go upwards of region of 3200$. We will have to monitor the market next week since we have big news week coming up.

Like and Comment to Show us the support 🚀❤️

Team Setupsfx_

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Quiet day on the markets today, while we wanted gold to reject the resistance level it breached giving the move upside completing the bias levels. It's a move we ideally wanted to take from below, but nothing ventured nothing gained as they say.

Now we have support below at the 3115 region with resistance in a potential order region 3130-35, which could be the potential level they target for the close or during the Asian session.

It's the last day of the month and the first day of a new month tomorrow. For that reason we're taking it lightly trading the red boxes only for scalps up here. 3135 is the level to watch we feel.

As always, trade safe.

KOG

GOLD, preppin tarmac for the next FLIGHT season from here 2980GOLD has been breaking expectations the last few weeks with constant ATH breaks and parabolic surges since last year -- overtaking most risk-on assets in the field and for good reason. I can't say enough fundamental reasons because they are too far many -- which all favors GOLD's ultra ascend.

After tapping its ATH peak at 3167, gold finally retreated for a healthy trim down following the markets RED pressure. It tapped 61.8 fib levels to touch 2979 zone -- an almost a 2000 pip drop.

This area is where most buyers converge. And based on our latest metrics from the diagram -- we are now starting a new transitional phase, and prep work for the next BIG SHIFT. It is currently commencing as we speak.

This transition shifts only comes once every 6 months -- so this occasion is very rare specially to those who seek to get the best seasonal price (post correction).

*Disclaimer, we may see some bargain overextension moves from here -- but those are good opportunities to stack up if it gives more discount ranges.

Ideal seed at the current range. A retap of the ATH peak -- and go beyond further is expected from the higher basing zone.

Last chance to grab this rare discount season.

Spotted at 2980.

Interim at 3167 (current) ATH

Mid 3300

Long term 4000.

TAYOR. Trade safely.

Gold pulls back from its all-time high! Can more be done?Trump's tax increase strategy is intended to increase revenue, but it is easy to trigger a reverse polarization in international trade. It may be effective in the short term, but it may aggravate inflation in the long term, posing a hidden worry to the economy. Against the backdrop of a weaker dollar, the value of gold stands out, not only because of the rising geopolitical risks, but also because the credit of the dollar is questioned. Time has become the best boost for gold prices to rise.

Operation strategy 1: It is recommended to buy at 3115-3110, stop loss at 3100, and the target is 3130-3150.

Operation strategy 2: It is recommended to sell at 3139-3144, stop loss at 3150, and the target is 3120-3105.

Gold Price Analysis March 31Fundamental Analysis

Gold price attracts safe-haven flows for the third straight day amid rising trade tensions.

Fed rate cut bets weigh on the USD and also lend support to the non-yielding yellow metal.

Overbought conditions on the daily chart now warrant some caution for bullish traders.

Technical Analysis

Gold continues to hit ATH levels and is very difficult to trade with a large amount of Fomo BUY. The important point to retest the BUY signal today is at 3100-3098. And 3145 is the target level for the ATH peak of Gold today.

What do you think of the above analysis? Please leave your comments.