GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the markets with our Goldturn levels playing out and respecting in true level to level fashion.

After completing the Bullish target from the retracement range yesterday; we stated that we were now playing in a bigger range and if 2975 fails to lock and open the swing range, the retracement range should give bounces into our Goldturns above. This played out perfectly, as 2999 and 3015 was tested from the bounce. We will now like to see ema5 lock above 3015 for a stronger confirmation for a continuation into 3034 and potentially into 3055 to test the full range again.

However, if we see the break below 2975 retracement level; it will open the swing range, which always gives us a bigger swing action then our usual weighted level bounces. This is the main difference between the weighted level bounces and our swing range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055 - DONE

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148

BEARISH TARGETS

3034 - DONE

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999 - DONE

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975 - DONE

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD.PRO.OTMS trade ideas

Xau/usd..1H Chart Pattren..It looks like you're sharing a trading idea for XAUUSD (gold), analyzing its recent price action and key technical indicators. Here's a summary and clarification of the key points:

Trend Analysis: Gold has risen following Trump's softened stance on tariffs, and is currently approaching a resistance level at 3115.

Technical Indicators:

The 50-period moving average (50-MA) has crossed above the 100-period moving average (100-MA), suggesting a potential bullish signal.

The MACD histogram is below the signal line, which indicates some bearish momentum or a weakening bullish trend.

Trade Setup:

Bullish Scenario: If the price breaks above 3115, gold may continue higher to the next resistance around 3160.

Bearish Scenario: If the price drops below the trendline, it could signal a decline toward 3075.

Seems like you're positioning for a breakout or breakdown scenario. The mixed sentiment (based on the MACD and moving averages) suggests traders should be cautious and wait for confirmation before entering.

If you have any further analysis or need more specific advice, feel free to ask!

GOLD At Interesting Res Area , Should We Sell Now Or Wait ?Here is my GOLD Chart and this si 1H Time Frame , i`m looking to sell it if i have a bearish price action to confirm that the price will go down , i think the price will go up a little to make some wicks and take all stop losses before going down again maybe tomorrow, so i think we will see some stop hunts before the price going going down for 500 pips and then move again to upside very hard .

Analysis of gold market price structure and trends.Layout ideas。On Thursday, the US dollar index broke down sharply, successfully stimulating the market's risk-averse funds to return to the gold market again, and the gold price rose again. Let's briefly sort it out!

First: The tariff issue of the trade war caused the global market to plummet, and gold fell accordingly. The main reason was that it was necessary to sell gold, recover funds, and fill the capital margin in the stock market, foreign exchange market, and bond market; therefore, gold also plummeted downward in the past few days;

Second: The U.S. dollar index plummeted and broke through, driving market funds back into the gold market, and the gold price hit a record high again;

In yesterday's analysis of spot, you can look back at yesterday's analysis of the daily K indicator. There are two situations, restart Golden cross means breaking the top and reaching a new high. You can look back at yesterday's analysis. This is also a common indicator trend.

Spot gold opened yesterday from 3081 and quickly fell to 3071 before rebounding to around 3100. After that, the price fell back to 3078-80 and rose to around 3132. The price fell back to 3103 from around 3132 and then rebounded to around 3136 and bottomed out around 3113-16 and rose to 3175. The price fell from 3175 to around 3152-54 and then rose again to around 3176 and closed. The opening price fluctuated and rose above 3200. From yesterday's trend: 3180 and 3100 are the bottom supports, but the area around 3100 has fallen back and repaired yesterday, so 3132-36 and 3116 are the current support points. Yesterday, it also directly rose and broke through 3134-36 and then rose without stepping back. At the same time, the price rose to 3174-76 and then retreated to 3152-54, so the current support point is around 3176. The opening price directly rose from this position. Currently, 3190 is the nearest support. Comprehensive important support: ①3176 ②3134 ?③3100 ? The small support distribution in the middle is 3190-3167-3154-3115

Spot gold market analysis:

Ⅰ: Spot gold daily MACD golden cross is initially established, and the dynamic indicator STO quickly repairs upward, which represents the bullish trend of prices. At present, there is no resistance point to judge because it is a historical high, so we can only try it based on small cycle indicators. The current support point of the daily line is located near the MA5 and MA10 moving averages, 3096-3088, and it is not necessary to consider it far away from the candlestick chart.

Ⅱ: Spot gold 4-hour current MACD high golden cross oscillates with large volume, and the dynamic indicator STO is overbought, which represents high-level price fluctuations. Because the indicators are at relatively high levels, they may face short-term peak signals at any time. Currently, we focus on the support line of 3176 near the MA5 moving average.

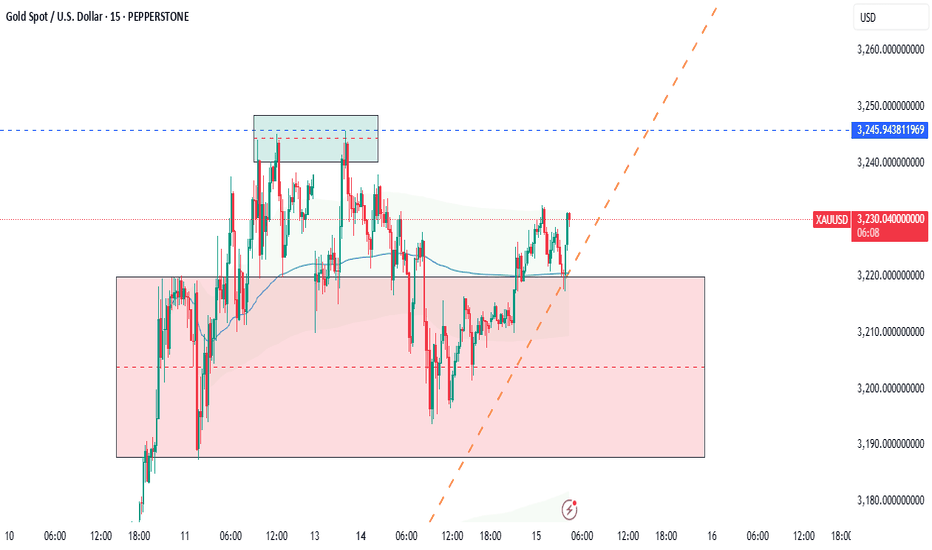

Ⅲ: Spot gold hourly MACD golden cross is currently oscillating with large volume, and the dynamic indicator STO is running overbought, which means that the hourly line is still oscillating and strong. The current focus is on the 3245 line. If it breaks through 3245 this hour, it will continue to look for highs. Otherwise, a small cycle peaking signal will be formed at this position. The current support below the hourly line is located at the MA5 and MA10 moving averages, and the focus is on the MA10 support 3185 line. Comprehensive thinking: The current price is oscillating at a high level, and the short-term focus is on the 3245 line. If it breaks through, the price will continue to move upward. The current focus below is the support near 3190. If it falls below, the price may move to around 3150-3135.

Strategy: Currently, the 3440-50 area is temporarily set to see pressure adjustment

Go long if the key support is stabilized below, and pay attention to 3187-3170 -3153-you can go long

XAUUSD – H1 Key Levels Outlook🧭 XAUUSD – H1 Key Levels Outlook

🔼 Key Resistance – 3,237–3,247 (Premium + Weak High Zone)

Why it matters: This is where price tapped into the premium range and formed a new weak high. Strong imbalance left here.

What to watch:

If price forms a CHoCH or M5 supply inside this zone, expect short-term rejection.

If price consolidates above 3,247 and locks with EMA5, the bullish narrative may extend.

🔄 Mid-Range Zone – 3,183–3,193 (Previous FVG + Breaker Structure)

Why it matters: Zone where price paused before the final impulse — now a reactive area with fair value gap.

What to watch:

First bounce or liquidity sweep here can provide short-term scalp opportunities.

Clean break and EMA lock below 3,183 would open the door for deeper retracement.

🟦 Support Zone – 3,108–3,122 (Prior BOS + Liquidity Pool)

Why it matters: Price broke above this zone strongly — now it may act as key demand.

What to watch:

If price returns and prints bullish CHoCH or rejection from OB on M15, valid sniper buy setup.

A failure to hold here would indicate possible revisit of lower demand.

🧊 Discount + Strong Demand – 2,965–2,980 (HL + Clean OB)

Why it matters: Untouched strong low paired with a clean bullish OB from April 9 reversal.

What to watch:

Ideal swing entry zone if market sells off deeper.

A CHoCH or BOS + engulfing in this zone = sniper long re-entry.

✅ Summary:

H1 confirms bullish flow, but current price is dancing in premium. Let price lead. If we reject the highs, focus on 3,193–3,183 and 3,122–3,108 for possible bounce points. A drop to 2,980 is extreme but worth prepping for.

💛 Trader’s Note:

Don’t chase — observe. Highs can deceive, but key levels always speak. If it doesn’t look clean, it’s not your trade. Keep your plan close, your bias neutral, and your mind calm. Let’s crush the week, one sniper play at a time! 🙌

📣 Join the Conversation!

Got your own levels or sniper zones in mind? Share them below — I love seeing how others view the battlefield! 🧠

If this breakdown helped or inspired you:

❤️ Like it

🔔 Follow and subscribe for daily sniper plays

💬 Comment to grow our trader tribe

Let’s build smarter and trade sharper — together 💥

#XAUUSD #SmartMoney #TradingCommunity #GoldAnalysis #SniperEntry

Gold correction remains bullish The gold 4-hour chart entered a partial correction after a wave of consecutive rises. At present, the support of the broken high point is near 3167. The volatility base is large. It is still in a partial correction in the bullish trend. It has not turned downward, but has slowed down slightly in the short term. The Asian session bottomed out and rebounded to break through the previous high point. The latest support level of gold price in the 4-hour cycle is the moving average support, and this position has been supported for the second time. So today I will continue to be bullish and long based on the moving average. On the whole, the short-term operation strategy for gold today is to go long on pullbacks and short on rebounds. The upper short-term focus is on the 3245-3250 resistance line, and the lower short-term focus is on the 3200-3210 support line.

Short order strategy: short gold in batches near 3245-3248 rebound, stop loss 6 points, target near 3230-3220, break to see 3210 line;

Long order strategy: go long in batches near 3208-3210 when gold pulls back, stop loss 6 points, target near 3230-3240, break to see 3250 line;

Gold's Glory Fades: Bearish Setup in MotionHello,

🟥 XAUUSD – Pro Bearish Playbook

Resistance Breached, But the Rally Looks Exhausted

Gold (XAUUSD) has just smashed through the 1M strong resistance at 3272.314, but let’s not kid ourselves — this move is running on fumes. The rally is heavily overbought, and macro sentiment is shifting fast.

🗞 Macro Trigger: Tariff War Cooling

President Trump has thrown a curveball, suggesting the U.S. may hold off on further tariff hikes, citing concerns about the impact on American consumers.

“At a certain point, people aren’t gonna buy,” he said.

He’s not ruling out new tariffs entirely, but the tone has clearly softened. Even China is stepping back, opting not to match U.S. hikes — and now the TikTok deal is on pause until trade talks settle. This reduces geopolitical risk, and that’s a red flag for gold bulls.

📉 Why We're Bearish:

Overbought Conditions: Gold is bloated. RSI, momentum, and fundamentals all scream “top-heavy.”

Safe-Haven Demand Shrinking: With tariffs cooling and equities catching a bid, gold demand is set to fade.

False Breakout Potential: The push above 3272.314 may be a trap if we don’t get follow-through.

🧭 Bearish Strategy – The Breakdown Plan

We’re not just throwing darts — here’s how we map the fall:

🔻 Level 💰 Price 📌 Role

🟧 1D Pivot Point Use live data Key trigger – watch for bearish confirmation below here.

🟨 1M Resistance (Now Suspect Support) 3272.314 Already breached; likely won’t hold on retest.

🟥 1W Pivot Point 3146.658 Next major target if momentum continues.

🚨 Bear Max Target 2466.313 Full breakdown scenario if risk-off vanishes.

🔥 Execution Plan – What to Do

✅ Wait for confirmation below 1D Pivot.

🔻 Short the rejection at 3272.314 if it acts as resistance on retest.

🎯 Target 3146.658, then trail stops toward 2466.313 on continued weakness.

🚫 Avoid blind entries – confirmation only. This isn’t guesswork.

We’re not chasing gold higher at these levels. We’re waiting for the turn, and when it confirms — we strike.

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1M-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

Risks gradually accumulate, and short gold in batchesAt present, the highest price of gold has reached around 3244, but it soon fell back to below 3240; and the PPI data is obviously bullish for gold, but gold has not shown a significant upward fluctuation, indicating that as gold rises sharply, market sentiment tends to be more cautious, so that liquidity is insufficient. So from this point of view, gold still has a need for a correction!

In the past three trading days, the increase in gold has reached $270. So even if gold remains strong at present, we should not blindly chase more gold. On the contrary, we can still gradually establish short positions in batches. As long as we strictly control the number of transactions in the transaction, we don’t have to worry too much about the transaction risk!

Let us wait patiently for the market to gradually accumulate risk sentiment. Once it accumulates to the critical point, it only takes one opportunity for gold to collapse soon.

It is critical to grasp the entry point when stepping backYesterday, the technical aspect of gold opened in the Asian session and immediately ushered in a strong bullish pull-up. The European session broke through and stood above the 3300 integer mark and entered a strong shock consolidation. The US gold price fluctuated repeatedly and stabilized above the 3300 integer mark and ushered in an accelerated pull-up. Finally, the gold price broke through the 3320 mark in the early morning and continued to rise to around 3350 and closed strongly. The daily K-line closed with a shock break and a long positive, and the daily increase reached 120 US dollars. The overall technical form has completely entered the rhythm of bullish squeeze. At present, all technical aspects are overbought, and short-term technical indicators are distorted. The overall rise logic is greatly affected by the external risk aversion sentiment. The bullish momentum still exists, and the retracement continues to look for opportunities to go long. However, it is worth noting that Friday is Good Friday, and today's weekly close will lead to profit-taking in the market.

From the 4-hour analysis, today's lower support focuses on 3310-3305, and focuses on the important support of 3293-90. This position is also the watershed between the strength and weakness of the bulls and bears during the day. Be cautious about chasing more at high levels. I will prompt you with specific operating strategies during the session, so please pay attention in time.

Gold operation strategy: 1. Go long when gold falls back to 3310-3305, and add to long position when it falls back to 3288-93. The target is 3345-3350.

Gold continues to surge to new highs!Gold technical analysis: Today, the gold price continues to rise strongly. It has risen all the way to more than 80 US dollars. So can it continue to rise? From the long-term chart, the bulls have not changed. Long is definitely the main idea. But you must pay attention to the risks in the short term. Because the increase from 2958 to the present has exceeded more than 340 US dollars. And today's single-day increase is as much as 70 US dollars. So you still need to pay attention to the risks that should be paid attention to in the short term. But don't guess the top too often. Even if you want to guess the top, you must have risk control. You can't trade based on your own sensory thinking.

It has risen sharply from the high point of 3230 yesterday, and has risen nearly 80 points from the low point. It is also trending to hit a new high. Once it breaks the high again, it will continue to hit the 3330-50 line. The next big target of the weekly pattern and segmentation cycle is 3400. It will probably reach it after a few waves of pull-ups. The weekly line rose last week and needs to rise this week. The current focus is still on falling back or breaking through and following the long position.

The current support below can refer to the afternoon low of 3280, which can also be used as an important reference for European trading. The key watershed below may be at the previous top and bottom conversion point of 3245, while the upper pressure is focused on 3330-3350. Overall, today's short-term operation strategy for gold is to focus on long positions on pullbacks and short positions on rebounds. The upper short-term focus is on the 3330-3350 resistance line, and the lower short-term focus is on the 3275-3280 support line.

Short order strategy:

Strategy 1: When gold rebounds around 3330-3333, short (buy short) 20% of the position in batches, stop loss 6 points, target around 3305-3290, break to 3280

Long order strategy:

Strategy 2: When gold falls back to around 3275-3280, buy long positions in batches (buy up) with 20% of the position, stop loss 6 points, target around 3310-3330, break the position and look at 3350

Will gold first fall and then rise today?

The gold 1-hour moving average is still in a bullish arrangement with a golden cross. Now the price is gradually approaching the moving average, but the gold bull trend has not changed for the time being. Patiently wait for the opportunity to adjust. Pay attention to the support near the previous low of 3185. The moving average support has now moved up to the line near 3177. Overall, gold may form a strong support near 3180. For today's gold trend, I personally think it will fall first and then rise.

Gold weakens in the short term, backhand shorts

Gold is still in a strong oscillating trend in the large-scale cycle trend. From the trend, the short-term moving average begins to diverge downward, and the price begins to slowly fall below the previous row support band and gradually weakens in the short-term trend. Pay attention to whether there is a small rebound in the late trading to confirm the secondary decline trend. In the hourly trend, the current small arc top pattern has emerged. The K line begins to slowly stick to the short-term moving average to maintain a good oscillating downward trend. Pay attention to the support band around 3170 in the short term. Pay attention to the adjustment and repair of the short-term trend. For operation, refer to the short-term opportunity near 3215-6, and stop loss at 3221.8.

Hello traders, if you have better ideas and suggestions, welcome to leave a message below, I will be very happy

XAUUSD sell trade setupThis chart outlines a Gold (XAU/USD) sell trade setup, based on a bearish double top pattern. Here’s a breakdown of the idea:

Double Top Pattern:

The chart highlights "TOP 1" and "TOP 2" at the same resistance level, indicating potential price exhaustion.

This is a classic reversal pattern, often leading to bearish momentum after the second top fails to break higher.

Entry Zone 3230

The trade is triggered at the resistance level after the second top, shown with a red arrow.

The price is currently approaching or at this level, suggesting the trader is anticipating a rejection and a move down.

Stop Loss (Red Zone):3247

Placed above the resistance line and recent highs, protecting the trade in case price breaks out upward instead of reversing.

Take Profits:

TP1 (Take Profit 1): 2:1 Reward-to-Risk Ratio — a safer exit, targeting a moderate price decline.

TP2 (Take Profit 2): 3:1 Reward-to-Risk Ratio — targeting a deeper move, likely to a previous support level marked by a blue horizontal line.

Trade Logic:

Price action bias: Repeated failure to break resistance = bearish bias.

Structure: Lower highs and signs of weakening bullish momentum.

Risk management: Well-defined stop loss and clear reward targets, with a risk-to-reward ratio that favors the trade.

Gold on aggressive uptrend extension as expectedTechnical analysis: Gold seems to be recovering last week's Intra-day steep decline towards local Bottom in a rather semi-stable fashion with Hourly 4 chart already stepped in Bullish waters sessions ago. The main reason behind it was the strong decline on the DX (comfortably Trading below the #52-week Low's), which entered an Descending Channel and as I've mentioned these past few weeks on my remarks, has the strongest Short and Medium-term effect (positive) on Gold. Technically, there is only #1 session left before the symmetry of the Hourly 4 chart's cycle catches up as the sequence mimics the previous one. Subsequently, every decline since August #12 resulted as an Short-term relief rally which suddenly reversed in even more steeper decline (check August #22, August #29, September #1 and September #7). If fractal is yet to be repeated, I should expect Price-action to show stagnation and stall the uptrend, then kick-start aggressive takedown towards #3,200.80 benchmark configuration where I will be ready with my piercing Selling orders.

My position: I have announced that Gold is on undisputed Bullish trend and total Bullish domination as I've practically Bought every Bottom lately. My suggestion is to continue Buying the dips / every local Low's.

Let us wait together for gold to break 3200

In terms of operation, short selling is still the main strategy, and short selling is still maintained near 3235. It is expected that gold will continue to adjust in the future, and 3200 will most likely be broken today.

Today's detailed operation strategy

Gold will go long at 3185, defend at 3175, and target 3200-3220

Gold will go short at 3235, defend at 3245, and target 3210-3180

Hello traders, if you have better ideas and suggestions, welcome to leave a message below, I will be very happy

GOLD LIVE TRADE AND EDUCATIONAL BREAKDOWN 18K PROFITGold price retains its positive bias above $3,200 amid US-China trade war, bearish USD

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair.