Gold Trading Analysis ReferenceTechnical analysis of gold: Gold continued to fall in the US market, and the price continued to return to the low point in the morning. The rise was not continuous, and the impact of tariffs remained. In the evening, the market reported a 90-day suspension of tariffs. It can be seen that US stocks, crude oil, gold and silver all rose rapidly, and then it was confirmed to be false news, and then fell back quickly. It can be seen that as long as the impact of the tariff news does not change, all assets will continue to sell. However, the current fluctuations are too fast and the amplitude is too large. Short-term operations may not be easy to start, but the direction is still the most important, followed by the position. That is to say, gold will continue to fall sharply. Gold continued to rebound in the morning today. The rebound amplitude actually exceeded our expectations, but the recent market is actually volatile. Because the volatility is relatively large, it is reasonable to have a larger amplitude, but it increases the difficulty of operation. Gold fell back after rising again, and now it is caught in a large range of fluctuations, but it is still short overall. The rebound in the US market is still short.

The 1-hour moving average of gold continues to cross the downward short divergence, and the strength of the short position has not weakened; the rebound continues to be short. Although gold surged after filling the gap in the 1-hour, the upper shadow line came down quickly. The overall situation is still weak. In the short term, it is under pressure near 3050. The US rebound is under pressure at the 3012 resistance, so it can continue to be short. The market is changing rapidly. Although gold seems to have rebounded strongly, it eventually surged and fell back. Gold is still the home ground of the shorts. However, it is now volatile. Be patient and wait for the rebound. The amplitude of volatility should not be underestimated. However, the thinking is still to maintain a high-altitude thinking. On the whole, the short-term operation strategy for gold today is recommended to be mainly short on rebounds, supplemented by long on pullbacks. The short-term focus on the upper side is the 3012-3015 resistance line, and the short-term focus on the lower side is the 2950-2956 support line.

Short order strategy:

Strategy 1: When gold rebounds around 3012-3015, short sell (buy short) in batches, 20% of the position, stop loss 6 points, target around 2980-2970, break to 2956

Strategy 2: When gold falls back to around 2953-2956, buy two-tenths of the position in batches, stop loss 6 points, target around 2970-2980, break through to 3000

GOLD.PRO.OTMS trade ideas

XAUUSD: 7/4 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 3080, support below 2950

Four-hour chart resistance 3050, support below 2970

One-hour chart resistance 3035, support below 3010.

The global stock market crash has triggered a large amount of funds to sell gold to cover stock market positions, but the central bank's demand for gold purchases (such as China's increase in gold holdings in March) provides long-term support. If the panic in the stock market eases and funds flow back to the gold market, it may push the gold price to rebound to $3050-3070. If the DXY index rises or the US stock market is sold more violently, the gold price may fall to the support band of $2950-2970.

Technical short-term bearish but need to guard against rebounds after oversold, pay close attention to US stock market fluctuations and geopolitical events, if panic escalates, it may trigger a simultaneous decline in gold and the stock market

Sell: 3040 SL: 3045

Sell: 2980 SL: 2985

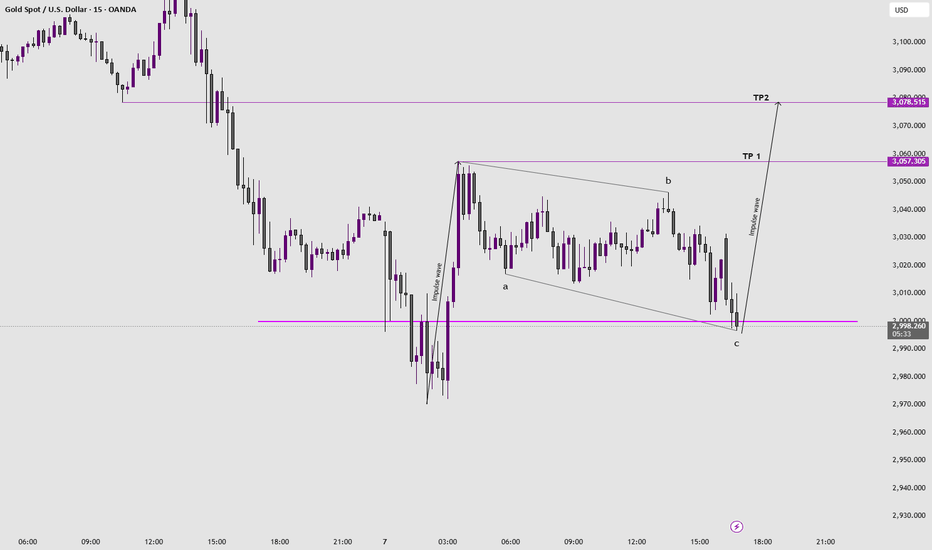

XAU/USD Analysis – Wedge Breakdown & Bearish Trade Setup1. Chart Overview

The 15-minute XAU/USD chart shows a descending wedge pattern forming after a price rally. The wedge is characterized by a series of lower highs and lower lows, signaling a gradual weakening of bullish momentum. After consolidating within this wedge, the price has broken down, suggesting a bearish continuation.

This setup provides a high-probability short trade with clear entry, stop-loss, and multiple take-profit levels.

2. Key Technical Elements

A) Chart Pattern – Descending Wedge Breakdown

A descending wedge is typically a bullish reversal pattern when forming at the bottom of a downtrend. However, in this case, it appears at the end of a corrective move, making it a bearish continuation setup.

The upper trendline (black dashed line) acts as resistance, preventing price from breaking higher.

The lower trendline (solid blue line) represents temporary support.

The wedge narrows as price action contracts, leading to an eventual breakdown.

👉 Breakout Confirmation:

The price has broken below the wedge’s support trendline.

A minor pullback to retest the broken trendline suggests validation of the breakdown.

B) Resistance & Support Levels

1️⃣ Resistance Level (Sell Zone) – $3,100 to $3,135

This area previously acted as a supply zone, rejecting bullish attempts.

Price was unable to sustain above this level, leading to further downside pressure.

Stop-loss should be placed above this level ($3,135.57) to protect against invalidation.

2️⃣ Support Level (Buy Zone) – $3,050 to $3,056

This was a previous reaction zone where price briefly bounced before continuing lower.

Now acting as Take Profit 1 (TP1) at $3,056.58.

3️⃣ Breakout & Retest

After breaking the wedge, price retested the trendline but failed to reclaim it, confirming the bearish trend.

3. Trade Setup & Execution

🔵 Entry Point:

Short trade activation upon the breakdown and retest of the wedge structure.

Price rejection at the trendline confirms seller strength.

🔴 Stop-Loss:

Placed at $3,135.57, slightly above recent swing highs.

This protects against false breakouts or sudden reversals.

🎯 Take Profit Levels:

TP1 ($3,056.58): First target where buyers might step in.

TP2 ($3,022.39): Midway target, acting as another strong support.

TP3 ($2,985.44): Final target where price may stabilize or reverse.

4. Market Context & Confirmation Indicators

📉 Bearish Confirmation:

Strong downward momentum suggests continued selling pressure.

Price action is failing to make new highs, confirming lower highs and lower lows.

📊 Risk-to-Reward Ratio (RRR):

The trade offers a favorable RRR, as the downside potential is significantly larger than the stop-loss range.

⚡ Additional Confirmation:

A strong bearish candle confirmed the breakout, rejecting higher levels.

Potential support breakouts suggest that price could reach TP3 if bearish momentum continues.

5. Conclusion – Trading Strategy Summary

✅ Pattern Identified: Descending Wedge Breakdown (Bearish)

✅ Trade Direction: Short (Sell)

✅ Entry Trigger: Breakout & Retest of the Trendline

✅ Stop-Loss: Above $3,135.57 (Wedge Resistance Zone)

✅ Take Profit Targets:

TP1: $3,056.58

TP2: $3,022.39

TP3: $2,985.44

📌 Final Thoughts:

This setup provides a high-probability trade with a clear breakdown structure and downside potential. If the price continues to respect the bearish trend, reaching all TP levels is likely. However, traders should monitor for reversal signals and manage risk accordingly.

🔔 Risk Warning: Always use proper risk management and adjust positions according to market conditions! 🚀

Gold Attack and Defense GuideAfter the opening of the market on Monday, the three major U.S. stock index futures all fell sharply, with the Nasdaq futures falling by more than 5.5%, the S&P 500 index and the Dow Jones Industrial Average falling by more than 4.7% and 4% respectively, and crude oil prices also falling below $60 per barrel. Although gold and silver have rebounded after a sharp drop, they still cannot escape the selling pressure as a whole. The market panic is quite similar to the outbreak of the new crown epidemic in March 2020. The U.S. tariff policy and the trade war it has triggered have caused the biggest disruption crisis in the global supply chain since the epidemic.

As the new trading week begins, global risk aversion shows a significant sign of rising, and precious metal assets have ushered in a strong performance. U.S. officials announced on Monday that they would launch reciprocal tariff measures against global trading partners the next day, completely shattering the market's previous residual expectations that negotiations might ease at the last minute. As the deadline for policy implementation approaches, the tense atmosphere in the financial market has heated up sharply.

Against this background, mainstream banks continue to hold optimistic expectations for the medium- and long-term trend of precious metals. The current price is driven by two factors: one is the unexpected demand for reserve increases by central banks of various countries, and the other is the continued inflow of funds from gold-linked ETF funds. It is worth noting that the U.S. benchmark Treasury yield fell in a gap on Monday, and the yield curve is rapidly approaching the stage low of 4.172% set in March.

Technical patterns show that gold prices continue to rise strongly after breaking through the psychological barrier of $3,100, indicating that the current main trend is still expanding upward along the line of least resistance. If the price falls back and loses this integer, it may trigger a technical correction, and long position closing operations may push gold prices back to the key support of $3,000. Short-term trading needs to focus on the upward resistance band formed in the $3,148-50 range, which may become a new battlefield for long-short games. I suggest that gold should pay attention to the suppression of the 3080 line above and the 3000 integer mark below. The news has stimulated the recent volatility, and the recent high-altitude is the main focus. Long orders must be cautious.

Operation strategy:

1. Try the 3055-3060 line above the gold short order, and make a stop loss. The target is 15 US dollars.

2. The long order below the gold can be tried at the 3000 line, looking at 10-15 US dollars, and make a stop loss. No long orders can be participated without loss. The 2980 line below can be regarded as a position for replenishment.

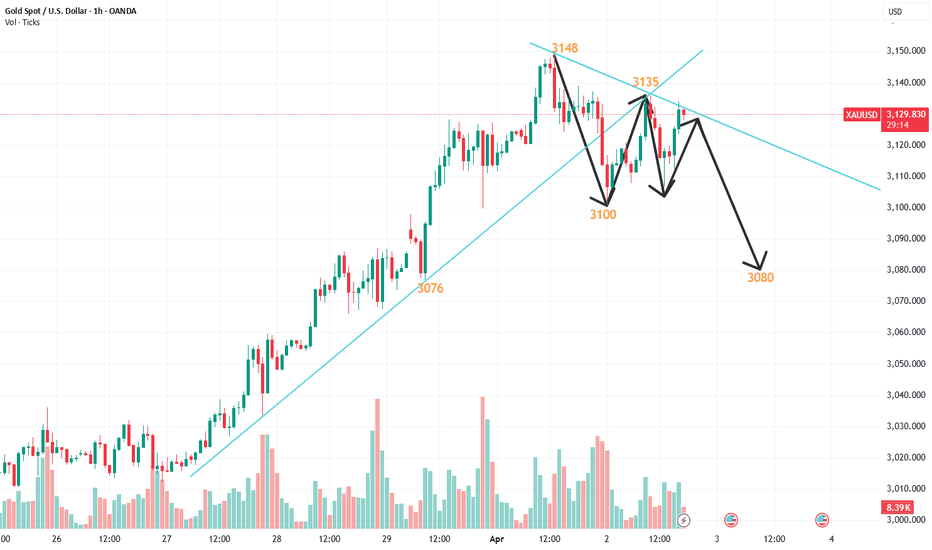

Gold Analysis StrategyTechnical analysis of gold: Gold surged and then fell in the early trading, with the highest price rising to 3167. However, the price subsequently fell and gave up all the gains, falling to 3116 at the lowest. The daily line just touched the 5-day moving average support. As long as the 5-day moving average support is not broken, the short-term trend will continue to rise strongly. According to this momentum, we will see 3200 points in the non-agricultural data tomorrow, Friday. However, one point worth noting is that the 4-hour MACD indicator has a dead cross signal. In addition, the high and fall of gold today, the K-line has formed a combination of Yin and Yang, suggesting that the risk of high-level selling pressure is increasing. Once it falls below the key position of 3100 below, the market will be completely controlled by the bears. So far, there has been a sharp decline, and the impact of the news is more of a roller coaster up and down wide fluctuation. The daily and monthly lines are currently under pressure on the upper track, and bulls should be careful.

The 4H cycle failed to open upward. As a rule, there is a certain probability of a downward kill. The watershed below is still 3100. Only if it falls below this position can it gradually turn to short. At the same time, the current volatility is very large, and any fluctuation starts at ten points. It is recommended to reduce the position to trade; the current long structure of gold has not changed. The key support below is still the long-short watershed of 3100. Above 3100, the strong bullish idea remains unchanged. Short-term operations rely on 3100 for defense, and gradually look up near 3116. Focus on the strength of the European session. If the European session rebounds and does not break the high, then short the US session at highs. Pay attention to the resistance of the 3148-50 area above. On the whole, today's short-term operation strategy for gold is to mainly short on rebounds and supplemented by long on pullbacks. The short-term focus on the upper side is 3148-3150 resistance, and the short-term focus on the lower side is 3100-3110 support.

Short order strategy:

Strategy 1: When gold rebounds around 3148-3150, short sell (buy short) in batches, 20% of the position, stop loss 6 points, target around 3135-3125, break to 3115

Long order strategy:

Strategy 2: When gold falls back to around 3115-3118, buy long positions in batches (buy up) of 20% of the position, stop loss 6 points, target around 3130-3140, break the position and look at 3150

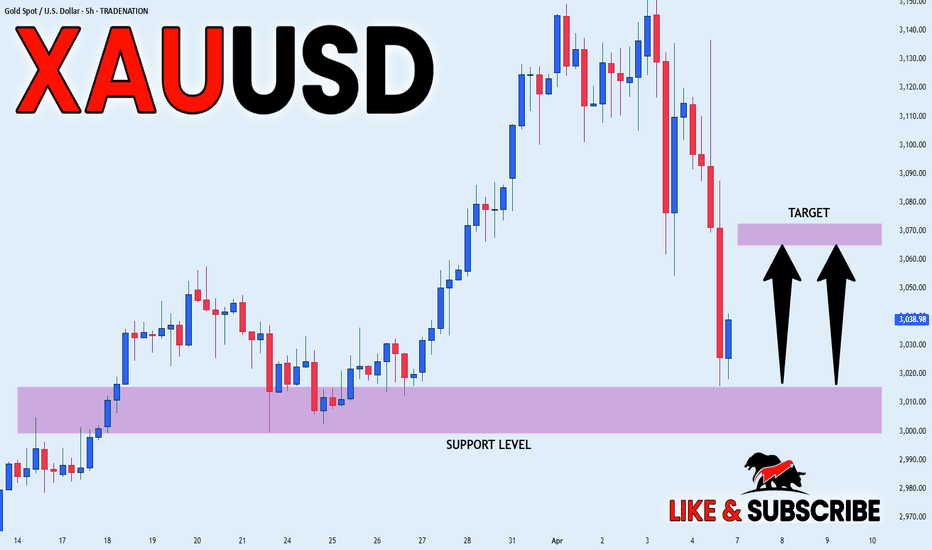

GOLD BULLISH BIAS|LONG|

✅GOLD fell again to retest the support

But it is a strong key level of 3000$

So we are already seeing a rebound

And we will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Closing multiple orders with ProfitAs discussed throughout my Wednesday's session commentary: "Technical analysis: The Price-action was once again seen Trading below the #3,152.80 benchmark extended decline where Sellers should finally prevailed and dragg the Price-action more than #57 points downwards (as was announced on one of my remarks lately that Gold always prints #57 point decline once the local High’s rejects the sequence and delivers the eminent rebound). Gold is dangerously approaching again the Higher High’s trendline of the Daily chart’s wide Ascending Channel, way above the #MA50 (aswell on Daily chart, representing in the same manner the Long-term Support zone) in Overbought waters, however every pullback on Gold is accumulation zone for new Bullish cycle."

First order I have engaged was Wednesday's Sell order (#3,132.80 - #3,111.80) and I have continued Selling every local High's throughout yesterday's session as I announced possible Selling correction ahead on Gold.

Technical analysis: Gold delivered Selling extension as I announced however it would be best for Short-term Sellers to wait for area to be engulfed, as today’s session will most likely represent the crossroads for the next Week, taking in consideration that one can never foresee the sequence until when Fundamentally driven rises and upswing (such as current one) will last and how Gold will digest today's session NFP numbers. Lagging upswing sequence comforted Sellers on it’s Intra-day basis, as Price-action was close to the #2-Month Bottom. The Price-action has altered the downtrend fractal near the Daily chart’s Ascending Channel’s Lower zone, as discussed on my latest commentary, with current mentioned configuration above representing former strong #1-Month Resistance zone. As long as this holds, there are Higher probabilities to reach the Hourly 4 chart’s Higher High’s Lower zone again on Spot prices however touch may be completed Lower depending on the aggression of the current variance. Technically, Gold should ease the Overbought levels, but on such Fundamental landscape (Bull bias), both sides are equally probable unless #3,137.80 gets invalidated to the upside once again. After all, on the Daily timeframe, the pattern is an healthy Ascending Channel which just touched the Higher High’s trendline and has a limit just over current structure, my main point of interests (depending on the impulse of the wave started early last Week). Above the #3,137.80, Short-term Selling pattern is invalidated and the relief attempt may be accelerated towards the Hourly 4 chart’s #3,152.80 benchmark.

My position: After excellent week behind me, I didn't had to Trade the NFP however I will as I do expect downside surprise on NFP which could skyrocket Gold upwards coupled with Powell's talks.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLDThe chart displays Gold (XAU/USD) on a 1-hour timeframe, showcasing a possible reversal and price target. Here’s a detailed analysis of the chart:

Key Observations:

1. FVG (Fair Value Gap):

- The FVG zone is highlighted between 3,130.68 and 3,138.94. This represents a price imbalance that typically acts as a resistance zone. The price has recently tested the upper part of this gap around 3,138.94, showing rejection, indicating that the market may not sustain the upward movement.

2. Order Block:

- An order block is identified at the higher level, around 3,163.99. This area is likely a strong resistance where market participants may have placed selling orders. Price rejection here could push the market downward, as suggested by the current price action.

3. Price Action:

- The price has recently formed an ascending triangle pattern, suggesting bullish continuation. However, it has now reached the FVG zone, where it faced rejection, and the price is now showing signs of moving downward.

- After testing the FVG, the price appears to be in a retracement phase. The pullback could eventually target 3,100 if the price fills the FVG gap.

4. Target:- The target is set at 3,100, just below the FVG zone. This level represents a potential support zone, where the price might stabilize before deciding whether to continue down further or reverse to test higher levels again.

5. Volume:

- The volume bars suggest relatively strong buying in the early part of the trend. However, there is declining volume as the price reaches the FVG zone, indicating that the buying pressure is weakening. This suggests a higher likelihood of a pullback towards the target of 3,100.

Potential Scenarios:

1. Bearish Retracement:

- After reaching the FVG zone around 3,138.94, the price might face resistance and reverse down toward the target of 3,100. If the price breaks below this target level, further downside movement is possible toward the next support levels.

2. Support at 3,100:

- If the price reaches 3,100 and shows signs of reversal (such as a bullish candlestick pattern or an increase in volume), it could find support at this level, leading to a potential recovery toward the FVG zone again. A successful break above the FVG would suggest further upside toward the order block.

3. Break Below Support:

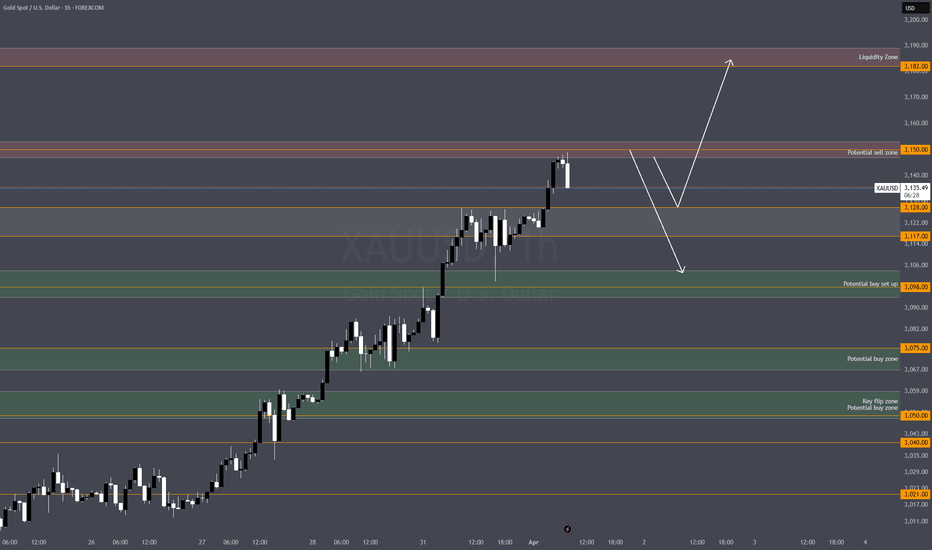

Gold market analysis strategyTechnical analysis of gold: From the market point of view, the trend has not changed. The negative line of the upper shadow of the single K line in the daily chart appears at a high level, which is a turning point. Whether a reversal can occur today will verify the validity of this K line. This wave of rise is caused by fundamentals and the atmosphere of the entire market. However, there is never a market that only rises and never falls. In other words, we do not go to dead short or dead long. Shorts only enter the market at important points. From a structural point of view, the rise has entered a symmetrical space in terms of time and span. It fell below the upper line in four hours, and the early high and fall were the same as expected. The structure has become weak short. The hourly chart is close to the upper line area and is currently running in a divergence, so the overall European market is still high and unchanged. It seems that gold bulls have not been able to go to a higher level with the support of the news, so gold bears may have opportunities at any time; gold is directly short at the current price of 3128 in the afternoon!

Gold fell below yesterday's low of 3124 support as expected, and came all the way to 3100. I have been emphasizing that gold will have a big retracement, but the current decline is far from enough. Gold will continue to fall. The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour moving average of gold has now formed a head and shoulders top structure. Rebounds will continue to be short. The market has weakened. Gold has not yet broken through the 3100 mark for the first time, but the direction of the market has turned short. If it does not break for the first time, I believe there will be a second attempt in the future. Then the bearish situation has been finalized. Long positions must be put aside first, because it is a bearish market now. Gold rebounds and adjustments can continue to be short. Pay attention to the 3128 line of pressure above. You can go short directly when it rebounds! On the whole, today's short-term operation strategy for gold is to focus on rebound shorting and supplemented by callback long positions. The short-term focus on the upper side is the 3138-3130 line of resistance, and the short-term focus on the lower side is the 3100-3083 line of support.

Short order strategy:

Strategy 1: When gold rebounds around 3128-3130, short (buy short) 20% of the position in batches, stop loss 6 points, target around 3110-3100, break to look at 3085

Long order strategy:

Strategy 2: When gold falls back to around 3083-3085, buy (buy up) 20% of the position in batches, stop loss 6 points, target around 3100-3110, break to 3120

GOLD Bounces from Key Demand Zone – Is a Bullish Reversal? Gold has just tapped into a strong demand zone around $2,959 - $2,968, a level that previously acted as a base for a major move up in late March.

This current price action aligns with a potential bullish reversal setup, especially after a sharp sell-off into this demand area. Here's the breakdown:

Key Zones to Watch:

Demand Zone: $2,959 - $2,968 (marked in orange)

Price is reacting here again. A bullish engulfing or strong bullish candle here could signal a reversal.

Mid-Level Resistance: $3,061

A break and close above this level will likely confirm strength in buyers and open the path to the next zone.

Supply Zone/Target: $3,120 - $3,141

Major supply area with heavy seller interest. This is the final upside target if bulls maintain momentum.

Bullish Confluence:

Oversold conditions after a rapid sell-off

Strong historical demand zone tested

Clean risk-to-reward setup for long positions

Bullish divergence forming on lower timeframes (check RSI/MACD)

Fundamentals to Watch:

We’ve got several major USD-impacting news events this week (highlighted at the bottom). Watch closely for any Fed-related statements or CPI data that could trigger volatility in gold.

Trade Idea (Not Financial Advice):

Entry: Around $2,960 - $2,970

SL: Below $2,945

TP1: $3,061

TP2: $3,141

Are you buying the dip or waiting for confirmation? Drop your comment

GOLD BULLS FULL TANK AND READY FOR MOON :))As you can see, gold yesterday came and fill the imbalance and grab liquidity while doing it

Now just waiting for NFP for fireworks, If we get NEGATIVE number will help the spark POSITIVE we might dip a bit and BOOM GALAXY TIME

Im in since yesterday dip

Good luck

XAUUSD Elliott wave opportunityLooking for a buy by leveraging on the reaction of the support trendline.

The aim is to buy on the discounted zones & monitor for TP / Selling opportunities on the roadblock zones ( previous trading range )

This is a MACRO view on XAUUSD combined with elliottwave counting

Summary of This Week’s Gold: a roller-coaster market trendThe price of gold fluctuated sharply this week. It once reached a new record high of $3,167.6 per ounce, and then there was a significant pullback. The cumulative decline was more than $100, and it dropped to a low of $3,015.85 per ounce. The decline in a single week was $152, putting an end to the four consecutive weeks of upward trend.

There were many factors influencing the price of gold this week. Firstly, after Trump introduced the reciprocal tariff measures, it triggered market turbulence. The stock market, crude oil, and other markets all experienced decline. Investors sold off gold to cover losses in other markets. Secondly, after the gold price had continuously risen and accumulated a large increase, some traders chose to take profits, which led to a correction in the gold price. Thirdly, the market's expectations for the prospects of the Federal Reserve's interest rate cuts have changed, affecting the investment demand for gold.

Overall, the gold market this week has been comprehensively influenced by multiple factors, resulting in significant fluctuations. It is expected that next week, the gold market will show a restorative pattern of wide swings. In the long run, the bullish trend of gold has not ended yet. However, short-term investors need to pay attention to market fluctuations, set reasonable sl and tp points, and control investment risks.

Preserve capital, manage risk, generate returns, achieve sustainable long-term profitability, and continuously learn and develop through trading. Access the link below the article to obtain more information.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD - 1H UPDATEGold is still sitting above the previous 'Wave 4 low' which shows not internal structure has been broken to the downside. Until that low is broken, there's nothing indicating a sell off is yet to take place, so it's possible we could see another push up, after SOME CONSOLIDATION. This is known as a 'redistribution phase'.

We also have the Zionist puppet Donald Trump announcing more Tariffs later on more countries, so expect some market volatility across the board.

Gold extended higher, look for signs of exhaustionGold is extending higher, tapping into untested liquidity above. However, signs of exhaustion are creeping in. Watch for potential liquidity sweeps before reversals.

Key Untapped Liquidity Zones

Upside: $3,182 - $3,189

Downside: $3,103 - $3,094

🔴 Sell Setups (Short)

1️⃣ Intraday Reversal Short

Entry Zone: $3,182 - $3,189

Stop Loss (SL): Above $3,193

Take Profit (TP) Levels:

TP1: $3,150 (First reaction)

TP2: $3,128 (Key liquidity)

TP3: $3,103 (Imbalance fill)

📌 Reasoning:

Untested supply at $3,182-$3,189

Price may sweep liquidity above $3,180 before a sharp rejection

2️⃣ Aggressive Short (Scalp)

Entry Zone: $3,150 - $3,153

Stop Loss (SL): Above $3,157

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,117

TP3: $3,103

📌 Reasoning:

Liquidity grab before a possible retrace

Strong momentum-based rejection expected

🟢 Buy Setups (Long)

3️⃣ Safe Long (Key Demand Zone)

Entry Zone: $3,103 - $3,094

Stop Loss (SL): Below $3,089

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,150

TP3: $3,182

📌 Reasoning:

Untested demand at $3,103-$3,094

Imbalance below $3,103 should act as a magnet

Liquidity sitting at $3,094

4️⃣ Deep Liquidity Sweep Buy

Entry Zone: $3,074 - $3,067

Stop Loss (SL): Below $3,060

Take Profit (TP) Levels:

TP1: $3,103

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Liquidity sweep target at $3,074-$3,067

If price taps this zone, a high-probability reversal could follow

Heavy imbalance would need correction

👀 Keep an Eye On:

1️⃣ DXY movements—if the dollar strengthens, gold may struggle to break higher.

2️⃣ News events—major economic data could trigger liquidity grabs before reversals.

3️⃣ Reactions at key levels—watch for wicks, aggressive rejections, and volume spikes.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

XAUUSD - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of XAU-USD (Gold) with you.

Looking at the chart for gold, I've noticed that after every time gold reaches levels like 1,000, 2,000, or 3,000 dollars, and the first weekly candle closes negative, gold typically starts to correct to the 50% Fibonacci level.

Currently, the first weekly negative candle has closed, so I expect a price decline towards the 50% Fibonacci retracement, which brings us to 2,506.27.

📉 Expectation:

Bearish Scenario: A price decline to 2,506.27 after the first weekly negative candle.

💡 Key Levels to Watch:

Support: 2,506.27

Resistance: Previous highs (1,000, 2,000, 3,000 levels)

💬 What do you think about Gold this week? Let me know in the comments!

Trade safe