GOLD Bullish Continuation - Will Buyers Push Toward 3,084$?OANDA:XAUUSD is currently trading within an ascending channel, maintaining a bullish structure. The price has broken above a key resistance zone which has now flipped to support, aligning with a potential bullish continuation.

With momentum favoring the upside, the price could move toward the 3,084$ level, which aligns with the midline of the channel. However, a failure to hold this level could indicate a potential shift in momentum.

Traders should monitor for bullish confirmation signals, such as bullish engulfing candles, strong wicks rejecting the support zone, or increased buying volume, before considering long positions.

Let me know your thoughts or any additional insights you might have! 🚀

GOLD.PRO.OTMS trade ideas

GOLD --> Reducing "shock" makes many people bewilderedHello, dear friends, it's great to see you again to discuss gold today.

Yesterday, gold just experienced a "shocking" price drop. The precious metal plummeted vertically from 3136 to 3015 USD, equivalent to more than 800 pips in just a few hours when the market announced the news.

The recent continuous decline in gold is believed to be due to the release of the U.S. Nonfarm Payrolls (NFP) report. Specifically, the positive Nonfarm Payrolls (NFP) report with 228,000 jobs (forecast of 135,000) created optimism about the U.S. economy, strengthening the USD and pushing gold prices down. Escalating trade tensions due to Trump's announcement of new tariffs also made traders worry about a global economic recession, leading to panic and gold sell-offs to cover losses from other assets.

From a technical perspective, the decline in gold is marked by the formation of a price channel and signs of a reversal from the EMA 34, 89. The recent bottom formation is considered a short-term correction, and the current price adjustment is expected to continue until it reaches the Fibonacci retracement level of 0.5 - 0.618. We can expect gold to continue declining after this consolidation phase. Selling is the preferred option, my friends!

What about you? Do you think gold will continue to fall?

Gold rebounds sharplyGold's decline slowed down, focusing on the 2980 support for rebound, and the 3050-3060 area pressure area.The intraday rebound was under pressure at 3054 and it was consolidating sideways. Be careful of a high rise and fall in the evening as it accumulates momentum for volatility. Focus on the break of the 3054 first-line pressure. If it breaks above, we will see further pressure at 3073. If it falls below the intraday low of 3013 in the evening, then we will see a second test of the lows of 2980-2972. Pay attention to whether a double bottom support structure can be formed here.

Tax hikes put the dollar's credibility in doubtThe risk aversion in the early trading pushed up the gold price, but the bulls failed to continue and the gold price fell back after rising. From a technical perspective, the 4-hour gold price is above the moving average and the bullish trend remains unchanged. Structurally, the rise of gold prices is symmetrical in time and space, and the early decline is in line with expectations. The current upper resistance is at 3137-3141, and the lower support is at 3111-3106. In terms of operation, it is recommended to focus on long positions on callbacks and auxiliary on rebounds from high altitudes.

Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3092, and the target is 3130-3150.

Operation strategy 2: It is recommended to sell at 3139-3144, stop loss at 3150, and the target is 3120-3105.

Gold fluctuates sideways at a high level and seesaws!The 1-hour moving average of gold has gradually begun to show signs of turning around. The 1-hour moving average of gold is also a head and shoulders top pattern. Even if it pulls back and forth again, gold will continue to fluctuate in a large range. There will be more data in the second half of this week, and there will also be important event news. Therefore, gold still needs to wait for news or data to let gold go out in a new round of direction. Gold did not break through the intraday high, so our US market will continue to be high and empty.

Today's gold short-term operation ideas suggest that rebounding is the main focus, and callbacks are supplemented by longs. The upper short-term focus is on the first-line resistance of 3138-3140, and the lower short-term focus is on the 3100-3110 first-line support.

Short position strategy:

Strategy 1: Short 20% of the position in batches when gold rebounds to around 3138-3140, stop loss 6 points, target around 3120-3110, break to see 3100 line;

Long position strategy:

Strategy 2: Long 20% of the position in batches when gold pulls back to around 3100-3103, stop loss 6 points, target around 3110-3120, break to see 3130 line;

The more you rise, the harder you fall, or what?The month of March has been a strong month for the TVC:GOLD bugs. The commodity has been hitting new highs every week. Let's see where the next target could be.

MARKETSCOM:GOLD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Gold has been moving big recently, don’t hold it blindly!What is coming has come, more than 100 US dollars a day, the decline is always faster than the rise, and more fierce, after breaking the 3100 watershed, it accelerated downward, the current minimum is 3054, the key position below is 3000/3040, pay attention to the plunge and the card position can also participate in the long, but must be patient to wait for the position.

After the big drop, the stage high point appears, and the follow-up is that both long and short can participate. The first plunge only establishes the high point position, and it is not so fast to turn short. It will fluctuate for a period of time. Generally, major news is an opportunity. The evening news detonates the market, and the main force often uses the news to pull up shipments. If the rebound touches 3110-3120, short it.

GOLD - Day Trading with RSI 04/03/2025FX:XAUUSD

Daily Timeframe (D1): Still in a strong uptrend, with RSI and both moving averages are pointing upwards. The WMA45 is above 60.

4-Hour Timeframe (H4): RSI is positioned between the resistance created by WMA45 (current price around 3152) and the RSI 60 support level (current price around 3121).

1-Hour Timeframe (H1): The WMA45 is trending upward, supporting the bullish trend.

Trading Plan: BUY

Entry Zone:

When the RSI on the M15 timeframe is supported at the 50 or 60 levels.

Entry Confirmation:

When M5 completes a wave, or a divergence appears.

Or even when M1 shows divergence.

Stop Loss:

20–30 pips below the M5 low.

Take Profit:

100 pips or R:R ≥ 1:1.

Or when M5 completes its own uptrend.

But be careful when RSI on H4 reaches its own WMA45.

You can check out the indicators I use here: tradingview.com/u/dangtunglam14/

Gold is expected to strengthen further before non-farm payrollsIn today's short-term operation of gold, it is recommended to focus on longs on callbacks, supplemented by shorts on rebounds. The top short-term focus is on the first-line resistance of 3150-3160, and the bottom short-term focus is on the first-line support of 3110-3120. All friends must keep up with the rhythm.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3150-3155, stop loss at 3162, target around 3135-3130, and look at the 3125 line if it breaks;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 3125-3128, stop loss at 3090, target around 3140-3150, and look at the 3155 line if it breaks;

GOLD XAUUSD – SNIPER PLAN 2 APRIL 2025👇

🦁 GOLD XAUUSD – SNIPER PLAN 2 APRIL 2025 📆

📍 Macro & Political Context

🗞️ Geopolitical Tension: Ongoing war in Ukraine + fresh tariff threats from Trump are sparking investor fear. Safe-haven flows into gold continue.

💰 Fundamentals: Inflationary fears remain strong. Market eyes the US NFP later this week. Fed is silent... too silent. 👀

🌍 Central banks are still buying gold – clear sign of institutional appetite.

🔍 Market Structure Overview

Trend: Bullish HTF ✅

Current Price: $3,113

All-Time High: $3,148 (Reached recently – likely liquidity swept!)

Last Valid BOS: H1 and H4 both show bullish structure, but a correction is brewing. 🍃

📊 Key Technical Zones & Confluences

🔻 Sell-Side Liquidity Below

📌 $3,100 – Clear liquidity pool (equal lows + psychological level)

🔥 Below $3,100 to $3,085 – Strong imbalance zone + unmitigated FVG

🧲 Expectation: Price may grab liquidity here before next leg up

🔷 Imbalance + Discount Zone

📉 $3,085–$3,095 – Massive H1/H4 imbalance. Could be a POI if price breaks $3,100

🧱 Valid Demand OB (H1) inside this zone + FIBO 61.8% retracement from last impulse

🔺 Premium Rejection

🧱 H1/H4 OB near $3,135–$3,145 = Price sharply rejected = probable redistribution zone

✂️ This was also the weekly high, which got swept = liquidity taken

🎯 Plan of Action

🟢 Scenario 1: Long Entry from Discount Zone

"Let them take the liquidity, we take the reversal!" 💸

Entry Zone: $3,085 – $3,095

Confluence:

Valid H1 OB (confirmed with PA)

Imbalance zone

FIBO 61.8% + structure break

Sell-side liquidity sweep from $3,100

Confirmation: M15 CHoCH + Bullish engulfing or low volume sweep

SL: Below $3,078

TP1: $3,130

TP2: $3,145

TP3: $3,150 (liquidity magnet again)

🔴 Scenario 2: Short if Price Pushes Back to $3,140+

Catch the premium short 🧨

Entry Zone: $3,140 – $3,148

Confluence:

All-time high sweep (liquidity trap)

HTF OB rejection

Weakness shown on M15

Confirmation: M5-M15 CHoCH + engulfing

SL: Above $3,155

TP1: $3,125

TP2: $3,100

TP3: $3,085

🧠 Final Notes

📌 Be reactive, not predictive – wait for PA confirmation at POIs

📰 Watch news – especially unexpected geopolitical catalysts or Fed surprise

🧘♂️ Stick to risk management. At ATHs, volatility is high and manipulation common.

👉 If this breakdown helped you, don’t forget to FOLLOW for more sniper setups and smash that ❤️ LIKE button to show some love!

Your support keeps this 🔥 content coming!

Waiting for a healthy pullback or FOMO push to 3150+?🔸 News Update: Geopolitical Turmoil Boosts Gold’s Appeal 🔸

The Russian Ministry of Defense reported missile strikes on Ukrainian SBU and special operations units, further escalating tensions in Eastern Europe. This, combined with China’s continued gold hoarding and a weaker USD, has kept gold’s bullish momentum intact.

🟥 Sell Setup (Liquidity Trap Short)

Entry Zone: $3,121 – $3,125 (Liquidity Grab + HTF Supply)

Trigger: M5/M15 Bearish CHoCH + Weak Bullish Reaction

SL: Above $3,130 (Invalidation Level)

TP1: $3,100 (First Target)

TP2: $3,085 (Deep Profit Zone)

TP3: $3,074 (Full Breakdown)

📌 Why?

Liquidity Hunt Potential → Market may fake out longs before reversal

Bearish Order Flow Zone → Major supply area where sellers are active

HTF Expansion Exhaustion → Price needs to cool off before further gains

🟥 Sell Setup 2 (Momentum Reversal – Only If Confirmed)

Entry Zone: 3,150 – 3,155 (Extreme Supply Zone)

Trigger: Bearish CHoCH + FVG reaction

SL: Above 3,160

TP1: 3,120

TP2: 3,100

TP3: 3,073

📌 Reasoning:

Extreme premium level where HTF supply could react

Only valid if price extends to this level without pullback

Ideal for a larger reversal if bullish momentum fades

🟢 Buy Setup 3 (Intraday Continuation Play – If $3,100 Rejects)

Entry: $3,092 – $3,094 (LQ sweep + minor demand zone)

Trigger: M1/M5 CHoCH + bullish rejection wick

SL: Below $3,090

TP1: $3,100

TP2: $3,108

TP3: $3,117

📌 Why This Zone?

If NY sweeps $3,100 liquidity and retraces, $3,092 – $3,094 could be a quick buy-the-dip area.

Only valid if the previous demand structure remains intact.

Ideal for short-term scalps rather than a deep retrace buy.

⚠ If price drops aggressively below $3,090, don’t force the buy—$3,083 – $3,087 is the next stronger zone.

🟢 Next Fresh Buy Setup (If Price Dips Again)

Entry Zone: $3,067 – $3,070 (Untapped demand + imbalance fill)

Trigger: M1/M5 CHoCH + bullish confirmation

SL: Below $3,064 (Liquidity protection)

TP1: $3,090 (Reaction level)

TP2: $3,108 (Liquidity grab target)

TP3: $3,120+ (Continuation move)

📌 Why This Zone?

Previous NY session left unmitigated demand here.

If price pulls back, smart money will likely buy from this area.

Gold still bullish – this is the next potential buy-the-dip zone.

⚠️ If $3,067 fails, deeper support at $3,055 – watch for a strong reaction there!!

✅ Key Takeaways

✔ Gold remains bullish above $3,074 – buy dips, but avoid FOMO.

✔ A liquidity grab below $3,080 could be the next major long opportunity.

✔ Sells are scalps only – favor longs unless $3,067 breaks.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

Gold’s rebound correction falls into shock?The market has been volatile recently, which is consistent with the properties of gold. When all assets are sold, the safe-haven property of the currency is highlighted. The sharp drop is accompanied by a fierce rebound, and the amplitude is not small. This was the case last Thursday, Friday and today. The current market is defined as a volatile market, which means operating at a certain position. The short-term resistance is 3025/3030 for shorts, and the support for pullback is 2980/2977 for longs. The limit is 2970, and trading is maintained at these positions. I think it is mainly a wash. The long-term price of gold has not changed, and what is more concerned on that day is the current long-short conversion. Today, the resistance of gold focuses on the pressure area of 3025-30. Remember, this adjustment is over after the break of $3055.

Today's short-term gold operation ideas suggest that callbacks should be the main focus, rebounds should be shorts, and the top short-term focus should be on the first-line resistance of 3025-3030.

Short order strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3025-3030, stop loss 6 points, target around 3000-2990, and look at the 2980 line if it breaks;

Long order strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 2978-2980, stop loss 6 points, target around 3005-3015, and look at the 3025 line if it breaks;

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

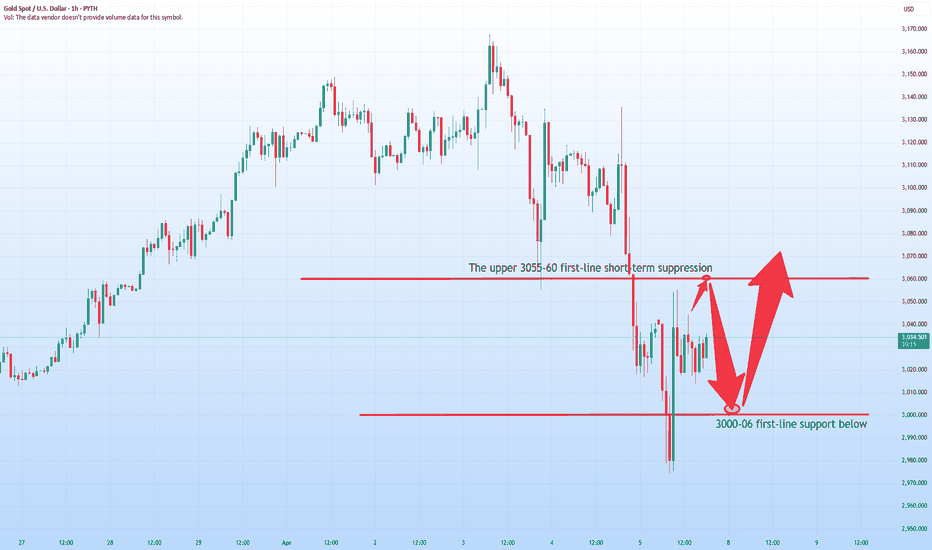

The battle between long and short will be decided in the US markFrom the 4-hour analysis, today's upper short-term resistance is at 3055, and the lower line is at 3000-3008 support. In terms of operation, if the rebound is under pressure at this position, continue to short and look for a decline. You should short once based on the rebound relying on 3055-60, and continue to look to break the bottom for the lower target. Be cautious with long orders at high levels.

Gold operation strategy:

1. Gold rebounds at 3055-3058, stop loss at 3066, target 3015-3020, continue to hold if the position is broken;

2. If gold returns to the 3000-3006 line, you can buy more if it does not break, stop loss 2993, target 3045-53 line, and continue to hold if the position is broken;

Gold: supported by uncertaintyThe price of gold reached the new all time highest level on Friday, at the level of $3.084. As uncertainty regarding trade tariffs and other geopolitical risks strongly holds on financial markets, the investors continue to invest into a safe-haven asset. But it also means that as long as this uncertainty is high, the price of gold might reach even higher levels in the future period. During the previous week the PCE data for March were posted as well as increased inflation expectations of US consumers, through Michigan Consumer Sentiment Index. The US equities sharply dropped on the news, while the price of gold continued its strong uptrend.

The RSI tried to start a path toward the downside, however, the indicator turned for one more time toward a clear overbought market side, by reaching the level of 73 on Friday. The MA50 continues to diverge from MA200, without any indication that the cross might come anytime soon.

The long term trend line, started from highs in April and October 2024 is on the test now. The price of gold perfectly collides with the historical highs, and now is at the level which will either be broken, or the price of gold will continue to follow this long term trend line. In case that the price continues with the higher grounds, then it will enter into uncharted territory. If the price reverts, then the first short term stop might be around $3.010. The week ahead will show which direction the price of gold has chosen.

Gold Will be Bullish from a Historic Support LevelHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

SHORT TERM SELL - 3000As illustrated in a lower timeframe, I'm trying to visualize what the potential sell opportunity could look like.

It's possible to see a correction of Friday's drop at least to the 50% retracement level.

Anywhere between the 50% and the 61.8% retracements is an initial sell area.

Extended sell area would be between the 70.5% and the 79% retracement.

Targets are shown based on the extension levels.

100% = Target 1

127% = Target 2

161.8% = Target 3

-

IMPORTANT :

There's a 1H and 4H imbalance just before FEB's High in which price might show rejection. That's a good sign for a potential rebound and reversal to the upside to continue the uptrend.

I've shown in a previous analysis that potential buy opportunity with mid-term targets toward $3.2k - $3.5k ; go check it out!.

--

Join my trading team.

Ig: @ persaxu

GOOD LUCK!

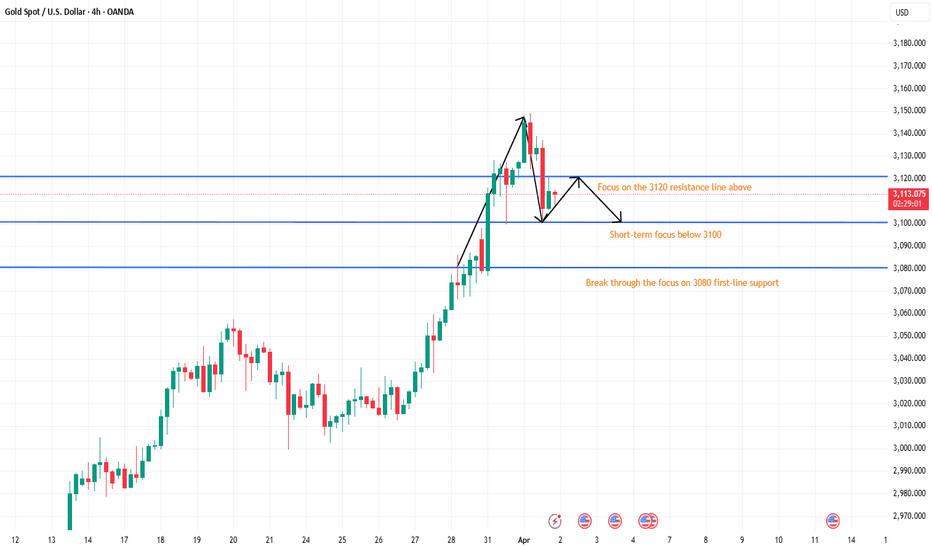

The gold 3100 mark is in danger!In addition to Trump's announcement of tariffs this week, there will also be non-agricultural data, so this week is destined to be extraordinary. This is also the risk that has been repeatedly reminded. Don't be blindly overwhelmed by bulls. You need to respect the market at all times. After falling below 3120, there is room for a retracement, but it is still unclear whether the overall trend will turn. This week is very critical. There is important fundamental news. It is necessary to confirm whether it will change the fundamentals. Only when there is a change will the trend turn. Pay attention to the 3120 first-line resistance on the top of the 4-hour chart, and pay attention to the 3100 support on the bottom in the short term. It is recommended to operate in the range in a short term.

Gold operation suggestion: short near rebound 3112-3115, stop loss 3120, target 3100

XAU/USD Analysis Update – Bullish MomentumXAU/USD Analysis Update – Bullish Momentum in Play

Gold has shown strong bullish momentum, currently trading at $3037 after a powerful rejection from the supply zone at $3017. It has successfully broken the previously long-standing resistance at $3033, confirming a potential shift in market sentiment.

With this breakout, I expect gold to continue its upward movement toward the following targets:

TP1: $3065 – where a major trendline resistance is in play.

TP2: $3100 – upon a successful break and close above $3065.

Note: A short-term retracement toward $3026 is possible before the bullish rally resumes.

Stay alert and manage risk accordingly. Price action and structure are favoring the bulls for now.

Has gold peaked and gone short?So has gold peaked and turned bearish? Yesterday, it rebounded after a sharp drop. Although it fell back, it still closed above 3100, indicating that the market is not weak and has not completely turned bearish. Although the daily line turned negative yesterday, it closed with a long lower shadow and did not fall below the short-term moving average. We can only see long adjustments or corrections. There are generally two types of corrections: time correction and price correction. Time correction is to exchange time for space, and the price does not change much; while price correction is to complete the correction with rapid price fluctuations, mostly in the form of a high-rise fall or a bottom-out rebound. Yesterday's trend was a price correction.

Is Gold about to enter resistance? !XAU/USD is rising towards the resistance level which is an overlap resistance that lie sup with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 3,124.63

Why we like it:

There is an overlap resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 3,146.29

Why we like it:

There is a pullback resistance level.

Take profit: 3,097.69

Why we like it:

There is a pullback support level that lines up with the 38.2% Fibonacci retracement.

Gold has adjusted in place and continues to be bullish!Today is the fourth day of gold's decline, and the price stopped falling at 2956, which is the previous high point. At present, the first round of gold's decline in the short term has been completed. After three days of sharp decline, many people panicked. Those who bought the bottom dared not to buy the bottom, and those who did not short should not chase the short position, as the main force will continue to wash the market! Today, the correction rebound is the main resistance, and the upper resistance is 3015, then 3030-25 and yesterday's high point 3045-55. There are many risks and many opportunities, which gives us too many opportunities, so I have been emphasizing risk control first recently.