GOLD.PRO.OTMS trade ideas

XAUUSD DAILY SNIPER PLAN – APRIL 9, 2025📍 Feed: OANDA | Style: SMC + PA + Macro | Bias: Bearish corrective → bullish potential

🌍 MACRO & FUNDAMENTAL CONTEXT

🏦 Post-NFP volatility fading, but CPI data is around the corner (watch Thursday).

⚔️ Tensions remain: Iran-Israel on edge, U.S. tariffs discourse ramping up again.

📉 DXY showing weakness; risk-on tone brewing quietly.

🕯️ Gold’s structure still bearish short-term after rejection from 3135, but sitting on a higher timeframe discount.

📌 Summary: Market is hunting liquidity — bulls want discount, bears want premium. Let’s follow smart money.

🧭 STRUCTURAL RECAP (D1 → M15)

🔻 D1/H4 Trend: Bearish correction after sweep of 3135; internal structure printing LHs and LLs.

📈 H1: Clean reaction from 2965, struggling to reclaim 3022 flip.

🔂 M15: Price hovering in FVG zone after failing to break 3005.

🔻 SELL ZONE #1 – “Flip Rejection”

📍 3015–3022

🧠 Why: Flipped support → resistance + H1 OB + FVG fill

📉 RSI near overbought + EMA21 rejection

🎯 TP1: 2971 | TP2: 2959 | TP3: 2928

🛑 SL: 3030

📌 NY session sniper if price retraces up with weakness

🔻 SELL ZONE #2 – “Breaker Retest”

📍 3045–3055

🧠 Why: M15–H1 OB + imbalance fill from previous BOS

📉 Liquidity grab probable during London

🎯 TP1: 3015 | TP2: 2971 | TP3: 2943

🛑 SL: 3065

📌 Look for CHoCH on 5M or weak engulfing M15

🔻 SELL ZONE #3 – “Premium Liquidity”

📍 3094–3109

🧠 Why: D1/H4 OB + unmitigated FVG + resting equal highs

📉 Textbook supply raid + swing short

🎯 TP1: 3055 | TP2: 3015 | TP3: 2965

🛑 SL: 3122

📌 Only if CPI or USD weakens too fast and gold overextends

🟢 BUY ZONE #1 – “Discount Tap”

📍 2965–2950

🧠 Why: H1 demand + FVG + trendline bounce

📈 RSI recovery + bullish CHoCH M15

🎯 TP1: 2990 | TP2: 3022 | TP3: 3044

🛑 SL: 2948

📌 Classic LTF confirmation needed, ideal during Asia-London transition

🟢 BUY ZONE #2 – “Last OB Before Break”

📍 2922–2904

🧠 Why: Unmitigated Daily OB + final imbalance

📈 Psychological trap zone if swept

🎯 TP1: 2943 | TP2: 2982 | TP3: 3022

🛑 SL: 2890

📌 Reversal setup if price flushes heavy overnight

🟢 BUY ZONE #3 – “Extreme Discount Play”

📍 2885–2894

🧠 Why: Breaker + extreme OB + fib 0.786

📈 Liquidity grab scenario with high RR

🎯 TP1: 2950 | TP2: 3000 | TP3: 3050

🛑 SL: 2870

📌 Watch for fast reversal candle + LTF CHoCH

⚔ SCALPING ZONE – (For early Asia Play)

📍 2988–2995

🎯 Target: 2965

🛑 SL: 3000

📌 M15 micro OB. If rejected fast, quick drop likely.

🎯 BIAS & SESSION GAMEPLAN

📌 Bearish bias below 3022

📌 NY session → ideal for short from premium zones

📌 London → volatility trap around 3010–3022

📌 Asia → potential grab under 2965 before reversal

📎 FINAL NOTES

All entries require confirmation (CHoCH / engulfing) — don’t front-run price.

Don’t fight the structure — trade with it, not against it.

This isn’t wizardry — just logic, patience, and risk control.

🎯 Structure first. Emotions later.

Gold gave a clean bounce from 2965, but the battlefield isn’t done yet.

Sniper setups mapped for both NY rejection and deeper retracements.

No guessing, no FOMO. Just structure, SMC, and pure execution.

💬 Drop your bias below 👇

❤️ Like if you value structure > noise

🔔 Follow for daily sniper entries

#XAUUSD #SmartMoney #SniperPlan #LiquidityZones #FVG #GoldTraders #GoldFXMinds

Price Reacts to Every Zone I Mark – No Coincidence.Every level you see on this XAU/USD chart is mapped based on institutional moves, order blocks, and real market intent. These aren’t just random zones—each one is backed by experience and a deep understanding of how smart money operates.

Price respects precision. I deliver it every time.

Let the chart speak.

XAUUSD 15M Analysis: A Potential Reversal for Gold Prior to NFPGold (XAUUSD) is approaching a key demand zone, which could offer a potential buying opportunity. Here’s a breakdown of my analysis and trade expectations:

1️⃣ Market Structure & Trend Analysis

• Price is currently in a short-term downtrend, creating lower highs and lower lows.

• However, a Monitor Buy Zone has been identified, where price previously found strong support and liquidity.

• A reaction from this level could trigger a bullish reversal.

2️⃣ Expected Price Movements

• Bullish Scenario: If price reaches the Monitor Buy Zone (3,067 - 3,047) and shows bullish confirmation (e.g., wicks, engulfing candles), we could see a rebound toward 3,095 - 3,100 as the first target.

• Bearish Scenario: If price breaks below the 3,047 support level with strong bearish momentum, it could invalidate the buy setup and push lower toward new demand levels.

3️⃣ Key Levels to Watch

• Resistance Levels:

• 3,095 - 3,100: Initial target zone for a bounce.

• 3,120: Potential extended target if momentum continues.

• Support Levels:

• 3,067: First reaction level in the Monitor Buy Zone.

• 3,047: Last level of defense before a deeper drop.

4️⃣ Trade Plan & Risk Management

• Entry: Looking for bullish confirmations at the Monitor Buy Zone before entering a long position.

• Stop Loss: Below 3,047, ensuring minimal risk if the trade setup fails.

• Take Profit Levels:

• First TP at 3,095 - 3,100 (safe target).

• Extended TP at 3,120 (if bullish momentum continues).

5️⃣ Confluences for a Long Setup

• Liquidity Grab Possibility: Price could sweep below previous lows before reversing.

• Historical Support: Price has bounced from this region before, adding strength to the buy zone.

• Fibonacci Levels: Possible alignment with key retracement zones for added confirmation.

Final Thoughts:

I’ll be closely watching price action at the Monitor Buy Zone before entering a trade. If price respects this area and bullish momentum builds, we could see a strong rebound.

What’s your bias on XAUUSD? Drop your thoughts in the comments!

GOLD is in buy zone!XAUUSD has just drop to daily support with strong price action formation on the lower timeframe with an inverted head & shoulder showing possible bounce off the daily support level. As long term trend is up, we may see a sudden bounce to neck line where daily resistance is.

A possible buy trade is high probability.

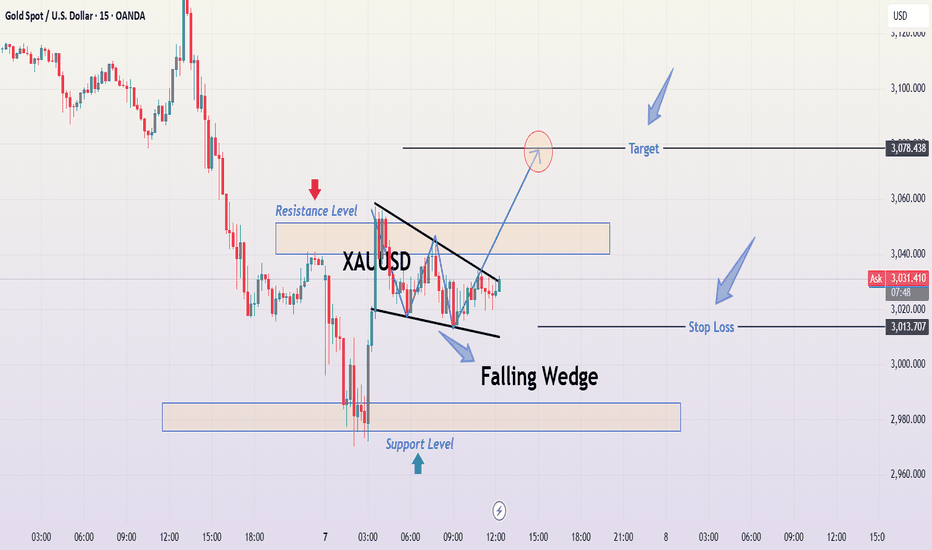

XAUUSD Analysis Falling Wedge breakout Setup to Target🔍 1. Market Context & Structure

Gold has recently experienced a sharp decline, as evident from the aggressive bearish candles leading into the consolidation phase. Following this downward momentum, the market began to consolidate, forming a Falling Wedge pattern—a bullish reversal structure that often signals an impending upside breakout, especially after a strong bearish trend.

📉 2. Falling Wedge Pattern

The wedge is formed by two downward-sloping trendlines that converge, containing price within lower highs and lower lows.

Notice how price is respecting both boundaries, confirming the validity of the pattern.

The pattern also features a series of higher lows, showing a loss of bearish momentum.

🟩 3. Support and Resistance Levels

Resistance Zone: Around $3,035 to $3,045 — This level previously acted as a strong supply zone where price was rejected multiple times.

Support Zone: Around $2,972 to $2,985 — Clearly marked area where buyers stepped in strongly during the sharp pullback.

These levels are critical to observe for any breakout or breakdown confirmation.

📊 4. Trade Plan Based on the Chart

✅ Bullish Bias:

Given the falling wedge setup and slowing bearish pressure, the trade idea favors a breakout to the upside.

🔵 Entry Point:

A confirmed breakout above the wedge’s upper boundary (around $3,030–$3,035), ideally on strong bullish volume.

🎯 Target:

The first take profit level is marked at $3,078.438, aligning with a prior resistance and measured move projection from the wedge’s height.

🔴 Stop Loss:

Positioned just below the most recent swing low and wedge boundary at $3,013.707, offering protection if the breakout fails.

🧠 5. Why This Setup Matters

Wedge patterns are high-probability when they form after a sharp move, as seen here.

Volume confirmation on the breakout would solidify this as a reliable opportunity.

Risk-to-reward ratio appears favorable, with a tight stop and a higher projected upside.

🧭 Conclusion

This is a textbook falling wedge breakout scenario. The consolidation after a bearish leg, narrowing price action, and repeated support reactions indicate that bulls are gearing up. If Gold breaks above the wedge with momentum, there’s potential to ride the move toward $3,078. Always wait for confirmation and manage your risk accordingly.

Go long gold, target: 3030-3040Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to continue its rebound momentum with this strong technical support!

So I think the short-term decline of gold is not a risk for us, but the best gift for us. So I advocate going long on gold from now on. After gold repeatedly tests the support, it will rise to the 3030-3040 area without hesitation.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold's HUGE drop - Where we going next?📉 Gold Market Update: Key Levels & Strategy Ahead

Gold has experienced a significant decline, dropping over 1,000 pips in just the past three trading days. Currently, we’re seeing consolidation just above the $3,000 mark, with the price struggling to hold this psychological level.

While the broader trend appears bullish, we are now in a range-bound phase, which often leads to false breakouts and stop hunts. Given the current conditions:

🔸 Short Bias: The overall setup favors short positions, but patience is key. Look for higher price levels to enter shorts with better risk-to-reward ratios.

🔸 Scalp Opportunities: If you’re considering a long position, it should be strictly short-term (scalping) and only from well-defined support levels.

🔸 Capital Protection: This is not the time to over-leverage or chase moves. Gold is known for volatility in tight ranges—stay protected and use tight risk management.

⚠️ Bottom line: Gold is in a bearish consolidation zone. The safest play is to wait for clearer setups, preferably at resistance for shorts or strong support for scalps. Avoid getting chopped up in the range.

If you found this breakdown helpful, don’t forget to give it a boost! 🚀

XAUUSD: 8/4 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 3055, support below 2950

Four-hour chart resistance 3055, support below 2981

One-hour chart resistance 3015, support below 2981

Gold news analysis: The market is currently in a two-way power game between risk asset selling and rising risk aversion demand. Although gold is a safe-haven asset, it is also facing the pressure of liquidity withdrawal. In the context of the unclear Fed policy and the continued escalation of global trade concerns, gold prices may continue to maintain a volatile pattern.

Gold operation suggestions: Gold rebounded quickly in the Asian session yesterday and was under pressure at 3054, then fluctuated and fell, and continued to fall in the European and US sessions, breaking through the new bottom, and finally accelerated downward to break through the 2960 mark to reach 2956 and stabilize and rise.

From the current trend analysis, today's upper short-term resistance focuses on the one-hour level 3015 and the daily level 3055, and the lower support focuses on the 2981 line support. In terms of operation, the rebound pressure at this position continues to sell bearish. Yesterday's daily line closed below 3015. Today we continue to look for a new bottom, and buying needs to be treated with caution.

Sell: 3055near SL: 3060

Sell: 3015near SL: 3020

Sell: 2981near SL: 2988

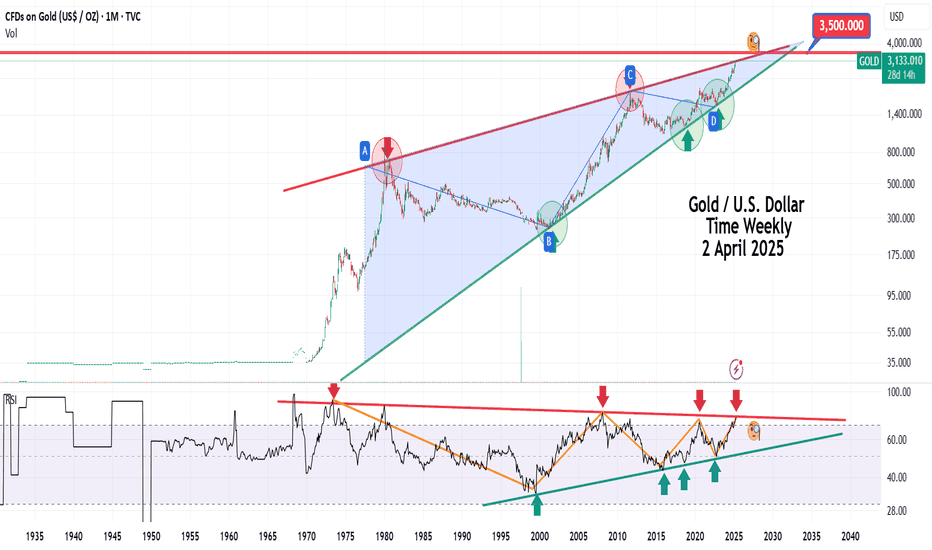

Gold Rebounds Off Key Support — Next Leg to $4,200 = 124,000 PIP

View our previous 120,000 PIPs (target hit) Gold trades at the bottom of this page.

Following our previously fulfilled short trade from the top of the ascending channel (TP2 hit at $2,960), gold has now landed precisely at confluence support — aligning with the psychological $3,000 level, ascending channel support, the quarterly dynamic support, and the prior swing high zone. We are now flipping bias long, with a macro continuation in mind, while still respecting the shorter-term range structure.

Structure & Setup:

Another clean reaction from the ascending channel’s lower boundary reaffirms the structure’s technical validity. Price has now tapped the $3,000 round number support, intersecting with the channel base and our prior short target zone — offering strong risk-defined long opportunities.

Macro Context Holds:

Our long-term thesis targeting $4,270 remains intact, backed by structural breakout on the quarterly chart and fundamental gold demand. This move is potentially the start of the next impulsive leg in a broader macro expansion, though we expect the asset to oscillate within the channel boundaries until at least July.

Entry Logic:

This long setup is based on:

– Channel base bounce

– $3,000 psychological round number

- $2,960 quarterly dynamic support

– Reversal at former Take Profit 2 (TP2) short target

– Tight invalidation just below $2,960

– Favourable 1:11+ R:R targeting macro highs

Invalidation:

A clean break and close below $2,960 would invalidate the long thesis and suggest breakdown risk. Until then, structure holds.

Pip Potential:

From $2,960 to $4,200 = 124,000 pips upside potential — aligning with macro projections and Fib extensions from previous cycles (-1.414 & -1.618 zones).

Outlook:

While $4,200 remains our long-term target, we anticipate ranging between $2,960–$3,200 for the next several months. This accumulation phase may precede a breakout leg that targets historical Fibonacci confluence zones.

Summary:

Short trade complete — bias flipped long. We’ve now transitioned from a completed 1:4 R:R short into a 1:11+ macro long off textbook technical levels. Price action is behaving cleanly within the multi-month channel, and this latest support reaction adds further credibility to the bullish continuation thesis.

Let price consolidate — buy positions accordingly. The macro expansion to $4,200 is likely underway.

Previous Short:

75,000 PIP idea (Target hit):

45,000 PIP idea (Target hit):

Gold fluctuates sharply, with bears dominatingYesterday, the gold market experienced violent fluctuations again. After hitting a high of 3055 during the session, the gold price quickly pulled back to a low of 2956, showing extremely high volatility. Recently, the fluctuation range of gold has been large, with fluctuations of about $100 for three consecutive trading days. Although this volatility is not common, it has become the norm in the current market environment.

Analysis of the causes of fluctuations:

The current violent fluctuations in the gold market are mainly affected by the global economic situation, especially the uncertainty of the international trade situation. In particular, the escalation of Sino-US trade frictions and the extreme volatility of market sentiment have provided strong momentum for gold prices. After China introduced countermeasures to increase tariffs by 34%, the market's expectations of whether the US will further increase tariffs by 50% before the 8th have made market sentiment more tense. Due to the instability of the global economy, the trend of gold will continue to be dominated by market sentiment, and volatility will be difficult to calm down in the short term.

Technical analysis of the gold market:

Daily trend analysis:

Yesterday, gold once again showed a "roller coaster" market, opening low and moving high in the morning, but fell sharply again during the European session and finally closed negative. The 100-point fluctuation range for three consecutive days indicates that market sentiment is highly tense and gold prices are under great pressure.

On the daily chart, after three consecutive negative declines, gold prices formed a large negative line with an upper shadow longer than the lower shadow, which means that they may still face adjustment pressure in the short term. Nevertheless, the market is in an oversold state and there is a need for rebound correction. Therefore, the current lower support of gold prices is around 2955, which constitutes a short-term top and bottom conversion position.

Short-term price range:

As the market still has a need for rebound correction, gold is expected to enter a range oscillation phase. In the short term, the support level of gold prices is in the 2956-2960 range, while the upper resistance is concentrated in the 3025-3030 area. In the context of range oscillation, it will be more effective to maintain a high-altitude and low-multiple operation strategy.

Operation strategy suggestions:

Short layout:

When it rebounds to 3030-3035, you can consider shorting, with a stop loss set above 3040, and a target of 3000-2995.

Long layout:

If the gold price falls back to 2970-2975, it is recommended to consider going long, with a stop loss below 2965 and a target of 2995-3000.

Since the current market sentiment is driven by external economic events and the market has not fully digested the relevant risks in the short term, it is recommended to remain flexible in operation and pay attention to changes in market sentiment and trends driven by news at any time.

Risk warning:

Volatility: The current gold market is extremely volatile. Investors need to pay attention to the impact of breaking news and remain cautious.

Time factor: Even if the gold price fluctuates sharply under the impetus of news, as mentioned earlier, a wave of topping and falling is usually not completed in just three days. Market sentiment may continue to ferment, so the short trend may still need to continue for some time.

Conclusion:

In the current market volatility, it is recommended to adopt a range oscillation strategy and operate flexibly. In the short term, the gold price may fluctuate and consolidate in the range of 2956-3030. In terms of operation, the high-altitude and low-multiple strategy can be appropriately used to arrange near the technical support and resistance levels. At the same time, keep a close eye on external news to avoid being affected by emergencies.

gold sell setup bearish rejection zone 3036🔻 Gold Sell Setup - Bearish Rejection Zone (3026) 🔻

This is a potential short (sell) setup for Gold (XAUUSD) around the 3026 level. The price is showing signs of rejection near a key resistance zone. The setup is based on a clear structure with multiple take profit (TP) levels and a well-defined stop loss (SL), offering a favorable risk-to-reward ratio.

📌 Sell Entry: 3026

🎯 Take Profits:

TP1: 3024

TP2: 3022

TP3: 3020

TP4: 3018

🛑 Stop Loss: 3036

🧠 Analysis Insight:

The price has tested the resistance zone multiple times and failed to break above it, indicating possible exhaustion of bullish momentum. If price holds below 3026, we can expect a bearish push towards the take profit targets. A break above 3036 would invalidate this setup.

📉 Trade with proper risk management and watch for confirmation before entering.

📉 Trade with proper risk management and watch for confirmation before entering.

XAUUSD TECHNICAL & COT ANALYSISOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will fall to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

XAUUSD Strategy Analysis for Next WeekThis week, Trump launched a global "tariff war", causing the international financial market to experience successive "Black Thursdays" and "Black Fridays". The gold, silver, oil, stock, bond and foreign exchange markets all witnessed sharp drops or volatile market conditions, with no market being spared.

From the perspective of the 4-hour market trend, the support level below should be paid attention to around the range of 3010-3020. The short-term resistance above is focused on the range of 3055-3060. Technically, a rebound and correction are needed. It is advisable to mainly go long on the pullback and supplement with shorting on the rebound.

XAUUSD trading strategy

buy @ 3020-3025

sl 3010

tp 3030-3035

Preserve capital, manage risk, generate returns, achieve sustainable long-term profitability, and continuously learn and develop through trading. Access the link below the article to obtain more information.

XAU/USD Bullish Pennant Breakout - Trade Setup Toward Target📊 Overview:

This 4-hour chart of Gold Spot (XAU/USD) presents a clean bullish pennant breakout followed by a corrective pullback to key support, offering a high-probability trading setup for bullish continuation traders.

Gold recently surged above the psychological $3,000 level, but after testing the previous resistance zone / ATH, it retraced back into a critical confluence of support. From a technical perspective, the structure remains bullish, supported by strong trendline dynamics, clean price action, and a well-defined pennant formation.

🔍 Step-by-Step Breakdown:

1. Bullish Pennant Formation

A bullish pennant is a continuation pattern that typically occurs after a strong upside rally (the "flagpole"). In this chart:

The flagpole began around March 13, with gold moving vertically from ~$2,630 to ~$2,950.

This was followed by consolidation between March 19–27, forming a symmetrical triangle pattern with converging trendlines (the pennant body).

Volume (if added) would typically decrease during this consolidation phase.

On March 27–28, price broke above the pennant, confirming the bullish bias.

📌 This breakout signals that buyers are ready to resume control after taking a breather.

2. Rally & Retest Phase

Following the breakout:

Price surged to challenge the resistance zone and all-time high (ATH) area, marked between $3,150 – $3,160.

A natural pullback occurred due to profit-taking and overbought conditions.

This retracement brought price back into the support zone at ~$3,000, intersecting perfectly with:

The rising trendline from the pennant breakout

A horizontal demand zone (former resistance turned support)

A key psychological level ($3,000)

💡 This zone acted as a confluence area, attracting buyers and creating a strong bounce — visible as a bullish engulfing candle.

3. Support & Resistance Analysis

✅ Support Level:

$2,990 – $3,010

Marked by previous highs before the breakout

Validated by the trendline and price reaction

🚫 Resistance / ATH Level:

$3,150 – $3,160

Historic resistance zone that capped the recent rally

Price must break this level for further continuation toward the target

4. Trendline Dynamics

The dotted trendline acts as a rising support structure.

Trendlines in bullish continuations are crucial as they confirm upward momentum.

As seen on the chart, price respected the trendline during the recent dip and bounced with strong momentum — a bullish signal.

5. Trade Setup & Risk Management

A trade based on this structure should follow strict risk-to-reward discipline.

🛒 Entry Zone:

Ideal re-entry lies between $3,030 – $3,040, after confirming the bounce from support.

❌ Stop Loss:

Below $2,976, which is under the support zone and trendline. If price breaches this level, the pattern is invalidated.

🎯 Target:

Measured move (height of the flagpole) projected from breakout zone gives us a target of around $3,221.

The chart also marks this clearly as the "Target" zone.

📈 Risk-to-Reward Ratio: Approximately 1:3, which is attractive for swing trades.

6. Market Psychology & Trader Sentiment

The bullish pennant represents temporary indecision, but ultimately market confidence remains strong.

The pullback to support reflects healthy profit-taking, not bearish reversal.

The bounce from support shows buy-the-dip mentality, a sign that bulls remain in control.

7. Macro & Fundamental Backdrop

While the chart is technical, it's wise to factor in macro catalysts:

🏦 Federal Reserve policy: If the Fed holds or cuts rates, gold typically rallies due to lower opportunity cost.

📉 Inflation Data: Rising inflation or expectations can push gold higher as a hedge.

🌍 Geopolitical tensions: Conflicts or economic instability drive safe-haven flows into gold.

Staying updated on these events can help validate or hedge your technical outlook.

✅ Conclusion:

This chart presents a technically sound bullish continuation setup backed by:

A breakout from a bullish pennant

A retest and bounce from a confluence support zone

A clearly defined risk (stop loss) and reward (target)

Traders looking for medium-term opportunities in XAU/USD can consider this as a high-probability setup with logical structure and strong momentum potential.

🔔 TradingView Tag Suggestions:

#XAUUSD #Gold #TechnicalAnalysis #BullishPennant #PriceAction #SwingTrade #Forex #TradingSetup #Commodities #GoldBreakout