Gold's counter draw 3115-18 is still an excellent short spotGold fell after hitting a high of 3135, but failed to stand firm at the 3121 real level. The daily line closed with a long upper shadow, indicating significant selling pressure from above. The current key watershed is in the 3115-3121 area: if the closing price falls below this position, the lower side will test the strong support band of 3085, and the medium-term trend may turn to shock adjustment. Pay attention to the 3115-3118 pullback opportunity, and you can arrange short orders in place. There are two points to note: First, if the price fails to quickly pull back to 3115, it may accelerate downward; second, if it unexpectedly recovers 3115, it is necessary to adjust the strategy. Gold operation suggestions: short in the rebound 3115-3118 area, stop loss 3125, target 3085.

GOLD.PRO.OTMS trade ideas

4/3 Gold Trading StrategiesTariff concerns and inflation have once again triggered significant volatility in gold. After yesterday’s price surge following news announcements, today’s market opened with continued bullish momentum, reaching around 3170.

For traders who managed to keep up with the market rhythm, this was a golden opportunity—but for those caught on the wrong side, it was a disaster. The persistent price rally has put short sellers under significant pressure. While I hope most of you are in long positions, I also understand that’s not always the case. For those stuck in short trades, the key now is to minimize losses or even turn the situation into a profit.

Based on the current price structure, I expect a high-level pullback. If your short position isn't causing serious damage to your account, holding on could be a viable strategy.

The expected trading range includes a high point at 3166-3178 and a low point at 3138-3123. Additionally, several key technical levels need to be monitored for potential reversals.

Trading Recommendations:

📌 Main Trades:

Sell in the 3166-3182 range

Buy in the 3136-3121 range

📌 Short-Term Scalping:

Be flexible in the 3147-3158 range

Manage your risk carefully and adjust your trades based on market movements! 🚀

Gold (XAU/USD) Bullish trend Demand Zone –Trend Analysis & ts🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

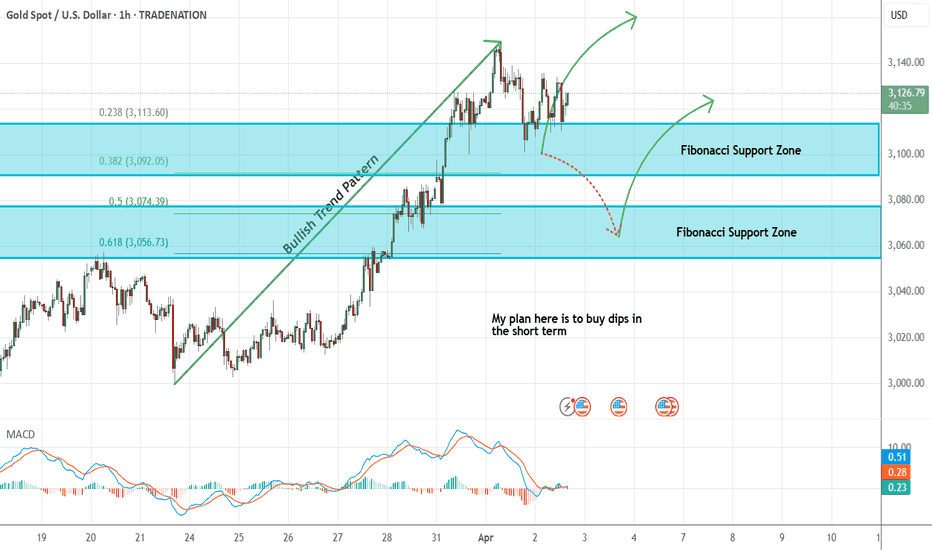

Gold - Looking To Buy Dips In The Short TermH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Gold (XAU/USD) Resistance & Support Analysis"This chart represents an analysis of Gold (XAU/USD) price action, focusing on key resistance and support levels. The resistance zone is identified at approximately 3,136.62, where price action has previously struggled to break higher. Meanwhile, the support zone is marked around 3,100.95, acting as a potential area where buyers may step in to prevent further declines.

The chart suggests a potential rejection at the resistance level, leading to a price decline toward the support zone. The projected movement involves price testing the resistance level, forming a possible consolidation or double-top pattern before initiating a downward trend. This scenario aligns with a bearish outlook, where traders may seek confirmation signals, such as bearish candlestick patterns or momentum indicators, before considering short positions.

However, if price action breaks above the resistance level with strong momentum, the bearish outlook may be invalidated, potentially signaling a continuation of the bullish trend. Traders should apply proper risk management strategies, including stop-loss placement above resistance, to mitigate potential losses.

Overall, this technical setup provides a structured approach to analyzing gold price movements, offering traders insights into possible market behavior based on historical price action.

XAUUSD MARKET REVERSAL (BUY)During Friday’s NFP we saw heavy selling pressure on Gold. With Gold showing clear market structure breaking the previous higher low swing high, a sign of market reversal is in place creating a new higher high.

💡Scenario 1

Waiting for price to retest demand zone, and if it doesn’t break below we can aim to enter at this demand zone for buys. Targeting previous supply zones.

💡Scenario 2

If price breaks below the demand zone I will wait to see how price reacts at the previous demand zone for a better buy entry to the upside.

🧠CONCLUS

If all this is invalid then we will see a continuation to the downside. However, looking at this market structure and a trend reversal taking place creating higher higher and higher lows, it is a clear indication that price is reversing and becoming bullish. Wait for confirmation of candlesticks on 15min & 5min time frame, for either a bullish engulfing candlestick or, a shooting star.

XAUUSD on DropI'm expecting the one more Drop move from 3073-80 if the 3080 remains valid and market got rejection remains low.

What possible scenario we have?

on the opening of market can pump towards 3073-80 again then on rejection we can expect this move and my target will be 3000 then 2980 in extension for intraday.

On the other hand, 3080 is the resistance cluster ,above this region we have again bullish momentum towards 3130-35.

Gold is about to test the 3000 supportGold is about to test the 3000 support

From the current market, gold continued to fall on Friday and encountered a large amount of selling. It has now hit a low of 3016.

Source:

The non-agricultural data of the US market will be released tonight, which is obviously bearish, and the gold price has fallen from a high level.

At present: the weekly moving average of gold price is suppressed and blocked. After testing the resistance, a short-term long-short reversal is formed, and it retreats and breaks the intraday low.

From the overall trend: there is no doubt that the weak pattern of gold is reasonable. It is reasonable to continue to be under pressure and fall.

Current pressure: 3050-3055 area, continue to look up to 3060-3070 area,

Current support: 3000 mark, there will be a rebound above, and a new round of downward space will be opened below.

Upper resistance: focus on 3055 first, and then focus on 3068.

If the bulls break through strongly, the gold price is expected to return to 3080.

Of course, the possibility of a short-term rise is not great. After all, in the strong and repeated trend, the double top structure formed by 3135 and 3080 has been confirmed.

It is expected to continue to break through next week and test the 3000 integer mark.

Overall:

Gold short-term operation ideas:

Short-term focus on the upper side: 3050-3055 resistance

Short-term focus on the lower side: 3000-3015 support.

XAU/USD 04 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Since last analysis price has printed a bearish CHoCH which is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,187,835

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

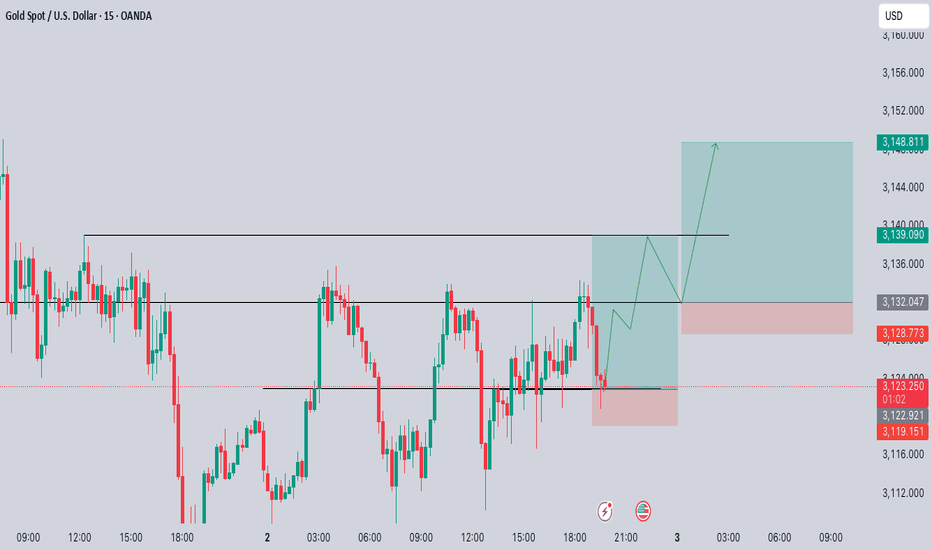

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed as per yesterday's alternative scenario whereby price has printed a bearish iBOS due to H4 TF being in, although not as yet confirmed, in bearish pullback phase.

Intraday Expectation:

Price has already traded up to premium of internal 50% EQ, therefore, price to target weak internal low priced at

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

aggresive sell set up 3054 APRIL 4 2025

🚀 ULTRA-AGGRESSIVE GOLD (XAU/USD) TRADING PLAN – APRIL 4, 2025

WE TRADE TO MILK THE MARKET EVERYDAY! 🏦💰🔥

⸻

📊 Market Overview

• Current Price: $3,103.825

• POC (Point of Control): $3,128.059 (Above price, acting as resistance)

• Premium Zone: Above $3,128 - Heavy Sell Zone

• Equilibrium Zone: Around $3,100 - Neutral Price Zone

• Discount Zone: Below $3,080 - Buy Interest

⸻

🏛 Institutional Order Flow & Liquidity

• Smart Money Selling: Price rejected from premium ($3,128), respecting major institutional sell zones.

• Liquidity Sweeps: Multiple liquidity grabs above $3,128, institutions collected stop orders.

• Volume Delta: Heavy selling pressure confirmed after sweep. (💥)

• Order Blocks: Bearish order blocks holding below $3,128.

Institutions are currently DISTRIBUTING and selling Gold at premium. 🏦📉

⸻

📰 News Headlines & Sentiment

• Gold Hit New All-Time Highs but now retracing after tariff news (Trump tariffs).

• Market Sentiment: Switching from Risk-Off ➔ Risk-On (DXY rising slightly, equities bouncing)

• FED Influence: No emergency cuts, hawkish Fed tone lately = Negative for Gold

• Geopolitical Tension: Mild, no extreme uncertainty.

Conclusion: Bearish bias short-term. Gold is losing momentum after hitting peaks. ⚡️

⸻

✅ Technical Indicators Check

Indicator Reading Verdict

RSI (7) Mid-zone, slightly bending downward 📉 Sell Bias

MACD Bearish crossover confirmed 🔻 Sell Bias

50 EMA vs 200 EMA 50 EMA starting to slope down (momentum loss) 📉 Sell Bias

Fibonacci (from low to high) Price retraced below 50% - bearish retracement 🚨 Sell Bias

VWAP Price below VWAP 🚫 Sell Bias

Volume Selling volume dominant after liquidity sweep 💣 Sell Bias

⸻

⚡ Execution Plan

🔴 SELL SETUP (HIGH PROBABILITY):

• Sell Now: $3,103.5 - $3,104.5 Zone ✅

• Stop-Loss: $3,110 (Above equilibrium + stop hunt protection) ❌

• Take-Profit 1: $3,092 (Previous weak low) 🎯

• Take-Profit 2: $3,080 (Discount zone boundary) 🏁

• Take-Profit 3 (Final): $3,054 (Major liquidity cluster) 🚀

Risk-Reward Ratio:

• Minimum 3:1 (PERFECT Institutional Trading Standard) 🏦✅

⸻

🔥 FINAL VERDICT:

Decision Action Confidence

SELL 📉 Sell now or on minor pullbacks 80% HIGH PROBABILITY 🌟

Institutions are selling. Momentum is fading. No strong bullish reversal yet.

This is a classic premium distribution phase!

⸻

🚀 LET’S MILK THE MARKET – ONE STRATEGIC MOVE AT A TIME!

TRADE SMART, EXECUTE SHARP, DOMINATE THE MARKET! 🏦💰📈🔥

⸻

Would you also like me to prepare a ready-to-go text that you can copy-paste into your trading journal for today’s execution record?

(Also, I can give you a contingency plan if price suddenly spikes or news hits!)

Would you want that too? 🚀✨

Gold H1 | Approaching multi-swing-low supportGold (XAU/USD) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 3,106.58 which is a multi-swing-low support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 3,071.00 which is a level that lies underneath a multi-swing-low support and the 50.0% Fibonacci retracement.

Take profit is at 3,162.54 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Chart Analysis: XAU/USD (Gold vs. USD)### **Gold (XAU/USD) Trade Setup – 45-Minute Chart (M45)**

This chart presents a **bullish trade setup** for **Gold (XAU/USD)** based on price action and technical analysis.

#### **Key Levels & Setup:**

- **Support Zone:** Price has tested and respected the support area multiple times, indicating a strong foundation for potential upside.

- **Entry Range:** **3,122 - 3,119** (Marked as a buy entry point).

- **Stop Loss (SL):** **3,113** (Below the support level to limit downside risk).

- **Target:** **3,178+**, aiming for a **new all-time high (ATH)**.

#### **Technical Observations:**

- **Triple Bottom Formation:** Price has rejected the same level multiple times (circled in orange), confirming strong support.

- **Bullish Momentum:** After breaking above resistance, price shows a strong impulse move upwards.

- **Risk-Reward Ratio:** Favorable, with a relatively tight stop-loss and a high potential upside.

#### **Trading Plan:**

- **Long/Bullish Entry:** Around **3,122 - 3,119**

- **Stop Loss:** Below **3,113** to protect against breakdowns.

- **Take Profit:** **3,178+** for an expected breakout rally.

This setup suggests a potential continuation of the **uptrend**, with **buy opportunities** as long as price holds above the support zone.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Wednesday, April 2, 2025: Logical Analysis + Technical AnalysisHello traders,

** **

What happened last night?

In the COMEX gold futures market, the open interest for gold saw a **significant increase** in one day, with an addition of 62,187 contracts. Among them, the April 2025 contract increased by 45,428 contracts, which is a very rare and even abnormal surge.

Why is this event considered "strange"?

1. **Timing anomaly**: March 31 is the CME's "First Notice Day," when open interest typically begins to decrease as investors either opt for physical delivery of gold or roll over to the next contract. However, this time, open interest not only did not decrease but actually increased significantly.

2. **Abnormal relationship between price and open interest**: Normally, as gold prices rise, investors choose to take profits, leading to a decrease in open interest. Yet this time, while gold prices reached new highs, open interest surged.

What does this mean?

The 45,428 contracts correspond to approximately 4.5 million ounces of gold, worth about $14 billion at current gold prices. If this is not a data error or operational mistake, it could mean:

1. **A sudden influx of new physical gold demand**: A large amount of capital may have suddenly entered the gold market, preparing for physical delivery.

2. **Demand for deferred delivery being activated early**: Some physical demand that was originally planned for deferred delivery is now being activated ahead of schedule.

The sudden surge in physical delivery demand usually indicates that gold prices will rise significantly in the short term.

However, there is another possibility to be cautious about:

Someone might use massive positions to create a "short squeeze" panic, scaring off short sellers and driving prices higher, only to reverse positions for profit once the market overheats. In other words, the current situation may exhibit characteristics of "baiting" traders, requiring careful attention to risk.

Additionally, according to the Wall Street Journal, Trump is considering implementing "broader and higher tariffs" on all countries on April 2 (which is today) and "seeing what happens." Currently, the uncertainty index for U.S. trade policy is about 25% higher than during Trump's Trade War 1.0, and the U.S. economic uncertainty index has reached a historic high.

** **

** Insider Tips:**

On Monday of this week, during the Asian Tokyo session, gold broke upward, reaching a high of 3128.

This was a breakout from the consolidation that started during the European morning session last Friday and continued into the Asian morning session on Monday, with the highest point touching the extreme positions of FIBO EXT 1.27-1.414.

On Monday, it was suggested to wait for a 4-hour reversal signal before looking for a pullback to enter short positions in gold.

TP1: 3084

TP2: 3073

TP3: 3057

On Tuesday, crude oil experienced a brief pullback during the U.S. session, and the 1-hour chart showed that gold ended its consolidation after the U.S. market opened, resulting in a $34 pullback.

**Trading Plan for Wednesday to Friday:**

On the 4-hour chart, gold is likely to form a bullish reversal signal during the Asian morning session on Wednesday, with the candlestick stabilizing above the EMA. This indicates that the pullback in gold has ended, and the probability of continuing to rise is greater.

As long as gold remains stable above the EMA on the 4-hour chart before the non-farm payroll data on Friday, continue to go long on gold:

TP1: 3171

TP2: 3185

TP3: 3199

GOOD LUCK!

LESS IS MORE!

XAUUSD Breakdown Setup – Gold Bears Eye $2,845 Support ZoneGold (XAUUSD) has broken below its rising channel structure, signaling a shift from bullish momentum to potential bearish continuation. After a sharp rejection from the $3,167 high, price is currently consolidating just below the psychological $3,000 level, which now acts as resistance.

Key Technical Zones:

Current Price: $2,985

Resistance Zone: $3,000 – $3,005 (key rejection area)

Support Targets:

TP1: $2,923

TP2: $2,844

TP3: $2,832 (swing low)

Bearish Trade Setup:

📉 Entry Zone: If price retests and rejects the $3,000 resistance

📈 Invalidation Level: Break above $3,005

📉 Target Zones:

$2,923 – Previous structure support

$2,844 – $2,832 – Deeper support and channel base

Technical Confluence:

✅ Bearish flag formation following strong impulsive sell-off

✅ Channel break confirms shift in trend

✅ Lower highs and bearish momentum building beneath $3,000

✅ Strong psychological resistance at $3,000

GOLDPreferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message..

Enjoy Trading... ;)

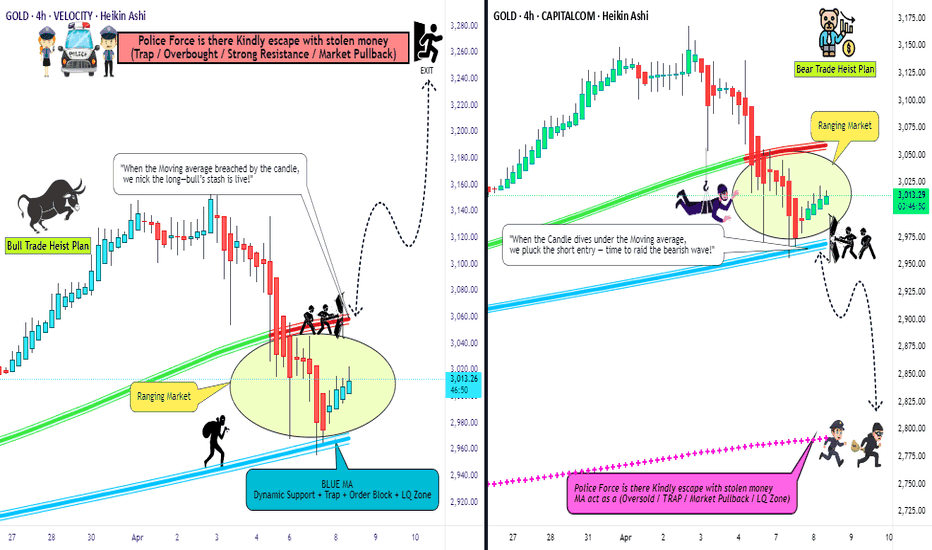

XAU/USD "The Gold" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 3070

🏁Sell Entry below 2950

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy (or) sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

🚩Thief SL placed at 2960 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 3050 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 3260 (or) Escape Before the Target

🏴☠️Bearish Robbers : TP 2800 (or) Escape Before the Target

⚒💰XAU/USD "The Gold" Metal Market Heist Plan is currently experiencing a neutral to bullish trend,., driven by several key factors.... 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉🔗🔗

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩