GOLD.PRO.OTMS trade ideas

Gold Intraday Trading Plan 4/8/2025Gold has respected 3000 support yesterday and went up all the way to 3052 as expected. After that, it dropped all the way to 2957, breaking 3k support. Currently it is trading above 2960 support. In regard of current strong bearish momentum, goldy should continue to fall today, at least in Asia and Euro trading sessions.

I am looking to sell from 3000. 1st target is 2960. If it's broken, 2nd target will be 2930.

4.6 Analysis of current gold trend4.6 Analysis of current gold trend

Trend judgment:

K-line breaks the middle track of Bollinger Bands, short-term bearishness dominates; Bollinger Bands open downward, and the downward wave continues.

Key signals:

3000 mark: If it falls below, it will open up downward space (target 2980-2950); if it stabilizes, it may rebound technically (target 3030-3050).

3030-3050 area: If the K-line fluctuates in this area, it can be regarded as a second bottoming out; if it stands firmly at 3055, be alert to a rebound to 3070.

Strategy

1. Short order (preferred)

Entry: 3050-3055 light position to try short, if it rebounds to 3065-3068, increase the position (stop loss above 3072).

Target: 3030→3015→3000 (step reduction).

2. Long order (caution)

Entry: Long after the 3005-3010 area stabilizes (stop loss 2997).

Target: 3030→3045 (quick in and quick out).

3. Follow up after the break

Lower position breaks 3000: chase short (stop loss 3010), target 2980→2950.

Upper position breaks 3070: wait and see whether it will fall back to 3055 and stabilize, then consider short-term long (target 3080).

Risk warning

Sweep market continues: recent volatility is drastic, avoid chasing ups and downs, and wait for key positions to be confirmed.

Data and events: Pay attention to the Fed's policy expectations and geopolitical situation. If there is a sudden positive news, the rebound may accelerate.

IS THE GLOBAL “BIG SHORT” ON ITS WAY?TRADE WAR WARNING – IS THE GLOBAL “BIG SHORT” ON ITS WAY?

In the last 24 hours, global financial markets were rattled after Donald Trump unveiled a sweeping set of new global tariffs. This wasn’t just a political move — it may well mark the beginning of a new wave of global economic instability.

Markets across the board took a hit:

📉 US, European, and Asian equities

📉 Gold (XAU/USD), the US Dollar Index (DXY), and even crypto — all plunged into the red.

🔍 So, What Actually Happened?

Gold dropped by over 100 points in a single session — and strangely, the US dollar also fell.

Normally, a weaker USD would support gold. So why did gold sell off this time?

➡️ One likely explanation is that institutional investors sold gold positions to cover losses in equity markets, or to free up margin amidst the chaos.

📉 This wasn’t just a correction — it might be the early signal of a global BIG SHORT forming across multiple asset classes.

🧨 The Start of Something Bigger?

Markets aren’t just reacting to tariffs. They’re pricing in the risk of a full-scale trade war, which could disrupt global supply chains and hammer corporate earnings.

Industries like construction, healthcare, logistics, and manufacturing are already showing signs of strain.

If this escalates, we could be looking at something far more serious than a short-term sell-off.

📉 The Data Doesn’t Look Great Either

While inflation in the US continues to cool, other key data points are deteriorating:

ISM Services PMI (March): 50.8 (vs 53.0 expected)

Employment sub-index: 46.2 (down sharply from 53.9)

New orders, export orders and backlogs also fell

👉 These are real signs of economic slowdown, especially considering that services make up over 70% of the US economy.

🧠 Market Sentiment: FOMO, Fear, and Panic

At the moment, it’s hard to ignore how unsettled sentiment has become.

Retail and institutional traders alike are acting on fear. And that’s dangerous.

🔔 Tonight’s Non-Farm Payrolls (NFP) report could either calm things down — or add more fuel to the fire.

🏦 Will the Fed Cut Rates Sooner?

Markets are rapidly shifting their expectations:

A rate cut could come as early as May or June 2025

Traders are now pricing in 2 to 4 cuts this year (previously just 2)

There’s now a strong chance the Fed pivots earlier than expected

If jobs data continues to soften, the Fed may have no choice but to act faster — despite core inflation not yet fully under control.

⚠️ Trading Strategy: Observation Over Action

Right now, your best position might be… no position.

"Sometimes, the most profitable trade is the one you don’t take."

This isn’t the time to chase wild price action.

It’s the time to prepare and plan with logic — not emotion.

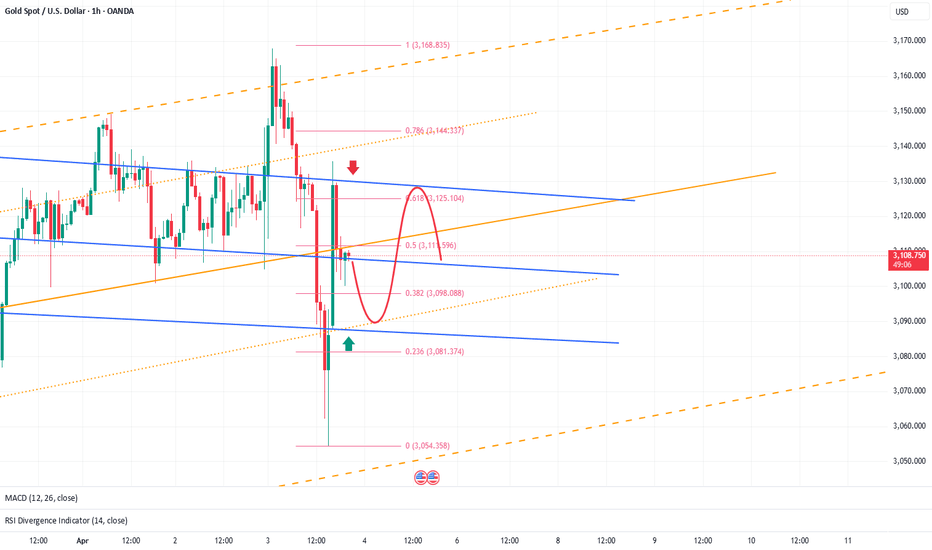

📊 Key Technical Levels on XAU/USD

🔺 Resistance:

3110 – 3119 – 3136 – 3148 – 3167

🔻 Support:

3086 – 3075 – 3055 – 3040 – 3024

🟢 BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

💬 Final Thoughts

The combination of tariffs, recession fears, and rate cut speculation is building into what could become a perfect storm.

Gold is in the eye of that storm.

Now is not the time to panic — but to trade with clarity and control.

📌 Don’t let emotion drive your trades.

Stick to the chart. Stick to your plan. Protect your capital.

🧠 Patience is what separates the lucky from the consistently profitable.

XAUUSD: Buy or Sell?Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious.

However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also needs to recuperate. And there will be NFP tomorrow. It is expected that before NFP, it will be difficult for gold to form a new unilateral market again. So in the process of shock, I think both long and short sides have a certain profit space.

First of all, pay attention to the resistance of 3125-3135 area on the top. If gold touches this area during the shock process, we can still short gold;

And the first focus on the 3095-3085 area on the bottom is that if gold touches this area during the shock process, we can still consider going long on gold.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold-----Buy near 3140, target 3160-3180Gold market analysis:

The international situation is very unstable, the situation in the Middle East, the situation in Russia and Ukraine, plus Trump's trade war, it is difficult for gold to show a weekly decline. The tariffs were released again last night, causing gold to rise strongly. Today's thinking is undoubtedly to continue to be bullish. Today we will first look for structural support to go long. There was a decline in the Asian session, and the daily moving average began to rise. Today, it will be repaired first and then pulled up.

In terms of gold pattern, 3134 is the strong pattern support in the Asian session, and the small support is around 3140. Bulls will play at this position. We estimate that there will be a few pulls in the Asian session today. The range of getting on the train is around 3134-3140. The strong support has reached around 3110. If this position is not broken, it is basically difficult to change the buying trend during the day. In addition, tomorrow is the non-agricultural data, and we estimate that such buying will reach the non-agricultural data.

Support 3134-3140, strong support 3120 and 3110, strong pressure is invisible, small pressure today's high point, the strength and weakness watershed of the market is 3134.

Operation suggestion:

Gold-----Buy near 3140, target 3160-3180

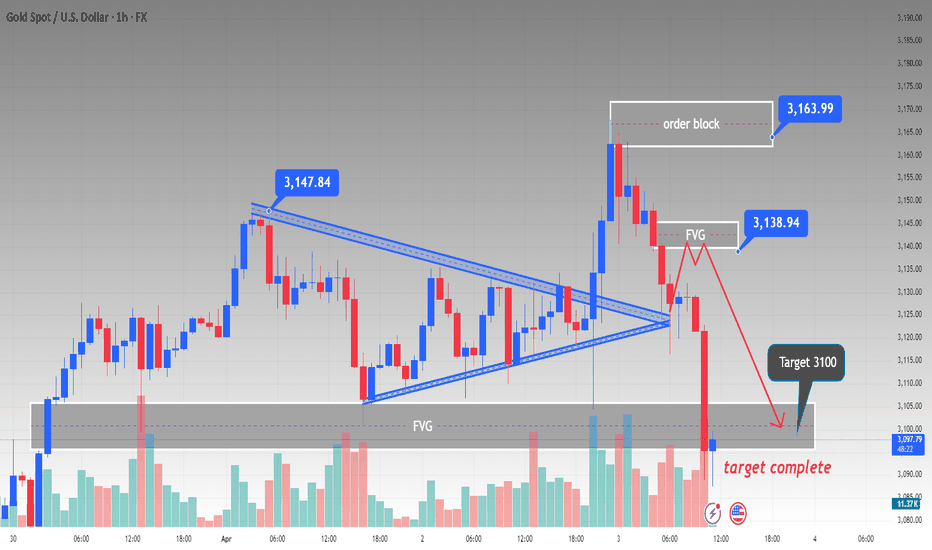

XAUUSD SELL TARGET SUCCESSFUL HITTING READ IN CAPTIONSThis chart shows Gold (XAU/USD) on a 1-hour timeframe, with various key technical levels identified, including order blocks, FVG (Fair Value Gap), and target zones. Here's an analysis based on the chart:

Key Observations:

1. Price Action:

- The price of Gold has been moving in an ascending triangle pattern (denoted by the blue trendlines). Ascending triangles are typically bullish continuation patterns, where the price makes higher lows while encountering resistance at the top. In this case, the price is pushing upwards but facing resistance at around 3,147.84.

- The price recently tested the FVG gap near 3,138.94, suggesting that the market might be filling an imbalance before continuing its movement.

2. FVG (Fair Value Gap):

- The FVG identified between 3,138.94 and 3,147.84 represents an area where the price imbalance exists. In many cases, the market tends to revisit this gap to "fill" it before continuing its direction. The price has already started filling the gap, and traders often look for reversals in these areas.

3. Order Block:- The order block located around 3,163.99 indicates a zone of heavy selling pressure or institutional activity. This is an area where price previously faced rejection, making it a potential resistance zone. It might play a significant role if the price tries to move upward again.

4. Downward Move & Target:

- After filling the FVG, the price has made a sharp downward movement, indicating that the bearish pressure has taken over. The target for this move is set at 3,100, which could be the next area of support. If the price continues its downward trajectory, it may eventually test this target area.

- The target completion at 3,100 was reached, showing a strong bearish reaction after filling the gap.

5. Volume Analysis:

- The volume bars indicate increased selling volume during the downward movement, especially around the time the price hit the FVG gap. This suggests that the market is more willing to sell after filling the gap, signaling strong selling interest.

Potential Scenarios:

1. Bearish Continuation:

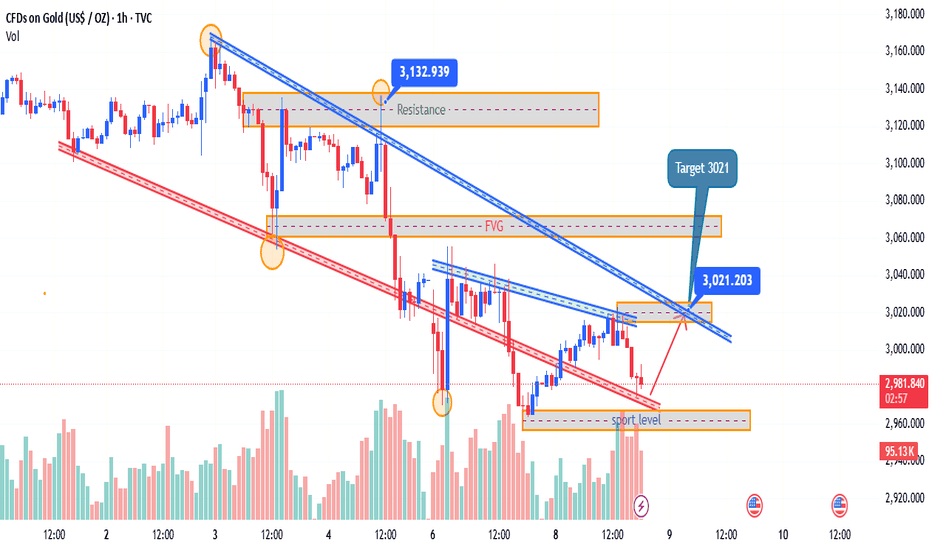

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

Excellent Price-action for Profit opportunitiesTechnical analysis: Choppy Trading sessions so far as the Price-action (Xau-Usd Spot) managed to close above the Daily chart’s Support zone, still giving decent chance to Buyers and so far (throughout today’s session) Gold is Trading above the Support fractal (#2,952.80 - #2,957.80). Hourly 4 chart delivered Double Bottom structure and Technical setting became strongly Oversold as the sequence (#3 out of #3 cycles replicated) recovered the Hourly 4 chart’s #3,012.80 - #3,018.80 belt each time throughout Asian session and as soon as possible in order to revive Buyer’s intent to get back into Bullish phase (Bullish Short-term). However, there is an possibility for aggressive takedown if #3,000.80 benchmark gives away, however that outlook remains less possible as current Bottom is formed and the Price-action is getting rejected twice in a row Hourly 4 chart (both times delivering relief rally). Hourly 4 chart almost delivered strong Bearish formation however current sequence got rejected and now I am ready to pursue values above the current Price-action. Gold is delivering strong Bearish and Bullish formations which brings Lower High's and Higher High's zones in motion for both Sellers and Buyers to pursue both ways. I am consulting my Donchian Channel and Trading it for couple of sessions now and I am interested in both Buying and Selling opportunities.

My position: I have Sold Gold throughout yesterday' session twice from #3,035.80 - #3,042.80 (closed both on #3,015.80) and Bought Gold on #2,065.80 and kept order over-night / closing #3,011.80 few moments ago which is excellent Price-action to Profit on and I am looking forward for today's opportunities. I do expect Gold to remain in #2,952.80 - #3,052.80 range for a while where I will Buy and Sell respectively from my calculated re-Sell and re-Buy zones.

Gold drops sharply amid panic but fundamentals remain strongGlobal markets opened the week under pressure, with major equity indices tumbling once again as volatility swept through the Asian session. The latest wave of selling follows China’s announcement of retaliatory tariffs on the U.S., intensifying the fallout from last week’s ‘Liberation Day’ tariff shock.

Investors had hoped that the worst of the uncertainty would fade following the initial U.S. tariff announcements. Instead, the reality has proven more severe. With tariffs exceeding expectations and no sign of negotiations, markets are now increasingly pricing in the risk of a global recession—beginning with the U.S.

This risk-off mood has triggered broad-based liquidation across asset classes. Even traditional safe havens have not been spared.

Gold Suffers in Unusual Selloff

Gold, typically a beneficiary of risk aversion, has not been immune. XAU/USD has dropped more than 6% since Thursday, a move that seems to defy its status as a hedge during times of market stress. The likely explanation: forced liquidation. As losses pile up elsewhere, investors appear to be selling profitable or liquid assets like gold to meet margin calls or reduce exposure. As a result, this selloff looks more technical and sentiment-driven than fundamental. The key factors that have supported gold remain intact:

- Rising geopolitical tensions

- Ongoing global growth concerns

- Expectations for lower interest rates

- Continued central bank demand for gold

Looking beyond the short-term panic, the medium- to long-term outlook for gold remains bullish. The current environment—marked by volatility, economic uncertainty, and central bank caution—typically favours gold.

Last week, Fed Chair Jerome Powell reaffirmed the Fed’s “wait-and-see” approach in response to the unfolding instability. This week’s March CPI release will be crucial. If inflation data shows further softening, it could strengthen the case for future rate cuts, potentially reigniting demand for gold. On the other hand, a surprise uptick in inflation could limit the Fed’s ability to ease, injecting more uncertainty into the macro picture.

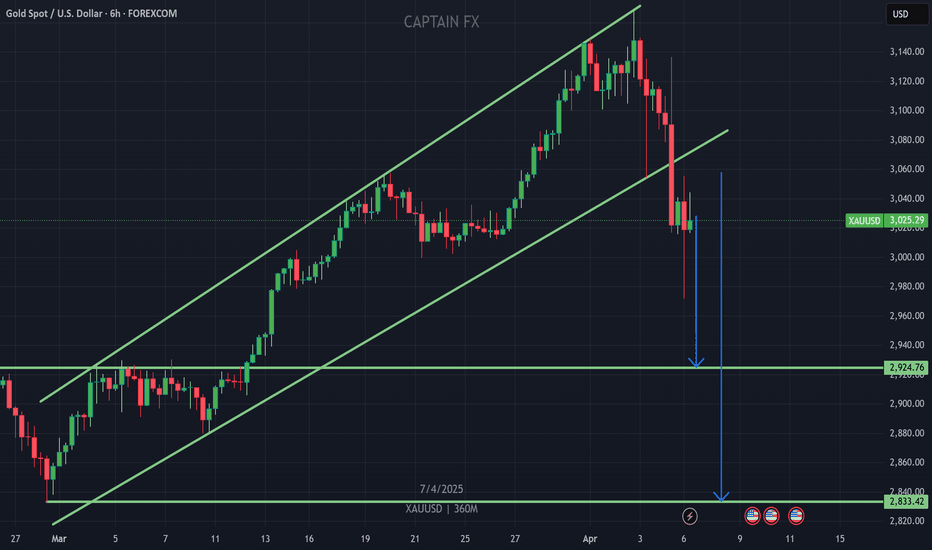

Technical View: Consolidation May Invite Fresh Buyers

On Monday morning, XAU/USD briefly dipped below the 3,000 level, but quickly found support and began stabilizing. While gold has pulled back from recent highs, the daily chart suggests there’s no strong appetite for aggressive selling at current levels.

The RSI (Relative Strength Index) has reset from overbought territory, creating a more favourable technical backdrop for new buying interest—particularly from bargain hunters seeking entry at lower prices.