Bearish Projection - XAUUSD📉Bearish Projection - XAUUSD

📌On the 4-hour timeframe, the recent bullish trend appears to have completed its fifth wave, reaching the upper boundary of the structure. Additionally, Fibonacci extensions have surpassed the 2.618% level, indicating a potential retracement or corrective phase. Given the strong rally from $2832 to $3146, we anticipate a pullback toward the $2990 - $2945 zone, aligning with the 50%-61.8% Fibonacci retracement levels.

The recent surge in gold prices, driven by escalating trade tensions and geopolitical uncertainty, has led to significant resistance breakouts across multiple timeframes. With the US Jobs data release** scheduled this week, we could see increased momentum supporting a bearish correction for XAUUSD.

➡️Daily Support - 3010-3000

➡️Key Level - 3056-3044

➡️Expected Price Region - 2990-2945

➖➖➖➖➖➖➖➖➖

GOLD.PRO.OTMS trade ideas

GOLD ROUTE MAP UPDATEHey Everyone,

A Piptastic day on the markets today with the breakout finally taking off, perfectly inline with our plans to buy dips and then into our Bullish targets.

We had 3 tests on our Bullish target at 3032 this week and then finally a cross and lock opening 3050, which was hit perfectly. We will now need a cross and lock above 3050 for a continuation into the next Goldturn or failure to lock will see rejections into the lower Goldturns for the bounces inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3032 - DONE

EMA5 CROSS AND LOCK ABOVE 3032 WILL OPEN THE FOLLOWING BULLISH TARGET

3050 - DONE

EMA5 CROSS AND LOCK ABOVE 3050 WILL OPEN THE FOLLOWING BULLISH TARGET

3065

EMA5 CROSS AND LOCK ABOVE 3065 WILL OPEN THE FOLLOWING BULLISH TARGET

3080

EMA5 CROSS AND LOCK ABOVE 3080 WILL OPEN THE FOLLOWING BULLISH TARGET

3097

BEARISH TARGETS

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2978

EMA5 CROSS AND LOCK BELOW 2978 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2927

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD → Growing economic risks increase interest ↑FX:XAUUSD rallied aggressively due to high interest driven by rapidly rising economic risks, mainly related to Trump's tariffs. For selling, the risk is very high, with the stock and cryptocurrency market declines only adding to the interest in the metal

Markets are taking refuge in defensive assets amid WSJ reports of Trump's possible tariff hike of up to 20% for most US trading partners. This could trigger inflationary pressures and stagflation, weakening the dollar and bond yields, which supports the gold price.

This week all eyes are on Trump's speech on Wednesday, PMI, NonFarm Payrolls and Powell's speech

Technically, it is not worth selling now as it is high risk, and for buying we should wait for a correction to key support levels

Resistance levels: 3127

Support levels: 3103, 3091, 3085

We are not talking about any trend reversal now. It is worth waiting for a local correction or consolidation, the market will mark important levels, liquidity zones or imbalances against which you can build a trading strategy. Gold will continue to grow because of the strongly increasing risks.

Regards R. Linda!

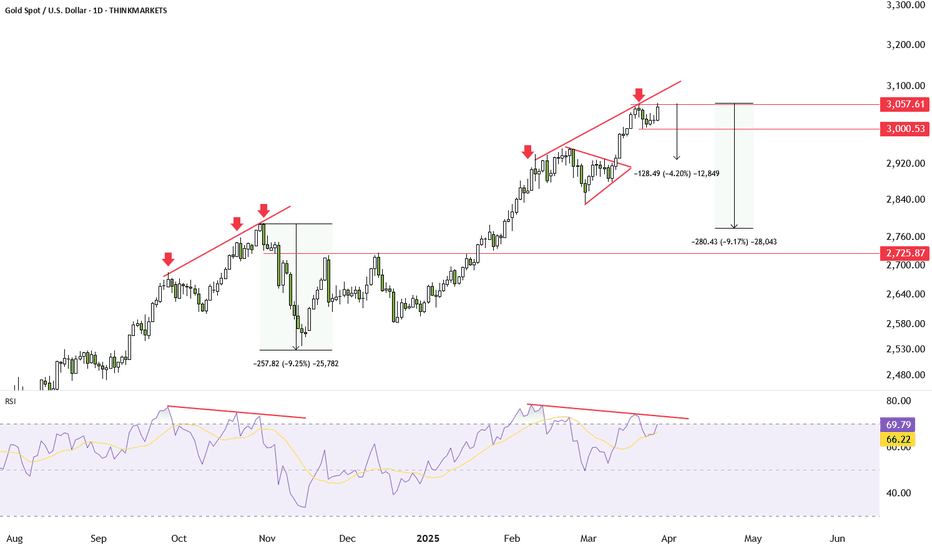

Gold Rally Faces RSI Divergence Near HighsGold remains in a bullish trend, but RSI divergence and a possible double top near all-time highs signal weakening momentum. A breach to $3,000 could send the price lower.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Gold (XAU/USD) Chart AnalysisGold (XAU/USD) Chart Analysis

**Current Price & Trend:**

- Gold is trading around **$3,132.70**, showing continued bullish momentum.

- The price is **above all key EMAs** (7, 21, and 50), confirming an **uptrend**.

**Key Levels:**

- **Resistance (~$3,140-$3,145)** → Price tested this level but struggled to break higher. A successful breakout could push Gold towards new highs.

- **Support (~$3,127-$3,130)** → The price is holding above this zone; if it remains stable, more upside is possible.

- **EMA 50 ($3,110.38)** → This acts as a dynamic support level. A break below it may signal weakness.

**Bullish Scenario:** 📈

- A **break above resistance** at **$3,140-$3,145** could trigger further upside.

- Volume increase would confirm strong buying momentum, with targets towards **$3,160-$3,170**.

**Bearish Scenario:** 📉

- If the price **fails to hold support** at **$3,127**, a pullback to the **EMA 50 ($3,110)** is likely.

- Breaking below **$3,110** could shift momentum bearish, targeting **$3,070-$3,080**.

**Conclusion:**

Gold remains **bullish** but is facing resistance. A breakout could push prices higher, while failure may lead to a correction. Traders should watch key levels for confirmation. 🚀

XAUUSD Time to start selling?Gold (XAUUSD) finally hit our 3 month $3000 target that we've been pursuing since the very first week of this year (January 06, see chart below) and in later stages upgraded to $3100:

Now the price has reached the top of the 1.5-year Channel Up, forming a similar 1D MACD peak formation while completing the +22.50% rise that the previous two major Bullish Legs had. As you can see, the pattern makes its Higher High on the 2nd MACD Bearish Cross and in 2 out of 3 Bearish Legs it retraced all the way to the 0.5 Fibonacci level, while on the remaining it the correction was contained to just above the 0.382 Fib.

On all cases the price came close to the 1D MA100 (green trend-line) before bottoming. As a result, even though some more Trump announcements may cause a momentary push upwards, we technically think that it is a solid level to turn bearish now with a fair 2900 Target on the 0.382 Fibonacci where by the end of April it should come close to the 1D MA100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold has adjusted to the right level and continues to rise!From the closing point of view, the daily line finally closed with a big Yin line with an upper shadow slightly longer than the lower shadow. After such a pattern ended, today's market still has the need for adjustment, but as the market is oversold, the market has the need for rebound correction. Therefore, we treat it as a range shock during the day, maintain high-altitude and low-multiple, and focus on the intraday support of 2956-60. The short-term support is 2978-75. In theory, if you want to wash the market, wash it harder. 3000 can't stop it. Pay attention to the 3020-30 range, and even rush yesterday's high area and then fall. Today, it is mainly bullish and long. There is only more but no short below 2980. The bullish risk area above 3025-30, especially after a rapid rise, refer to the resistance to short! In general, the gold price is still in a long-term bullish trend, and the long-term operation still maintains the idea of buying on dips; the medium-term may maintain high-level shocks, and the medium-term operation needs to be treated with caution; although it is in a downward trend in the short term, beware of technical pullbacks due to oversold, and wait for opportunities to buy on dips in short-term operations.

Today's short-term operation strategy for gold is to focus on long positions on pullbacks and short positions on rebounds. The short-term focus on the upper side is the 3025-3030 line of resistance.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3030-3035, stop loss 6 points, target around 3010-3000, break to see 2990 line;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 2990-2993, stop loss 6 points, target around 3010-3020, break to see 3035 line;

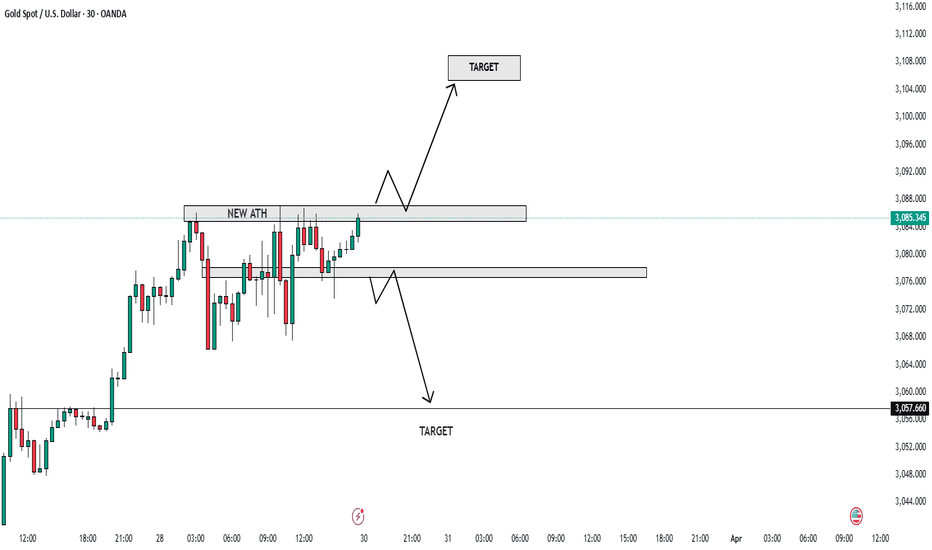

Gold Hits New Highs Amid Rising Uncertainty – 31 March 2025 MarkGold Market Overview – 31 March 2025

Gold ended last week at historic levels, closing near $3,085 per ounce, amid rising economic uncertainty and renewed tariff-related rhetoric from the U.S. President, particularly concerning the automotive sector.

During late trading hours yesterday, fresh developments regarding trade tensions—along with references to potential geopolitical escalation—were noted. These factors appeared to contribute to a gap-up opening for gold, which reached a new all-time high of $3,125 per ounce.

While future price movements remain uncertain, market participants may monitor the following levels:

* The $3,125 high could serve as a key reference point; any revisit to this level may draw attention to the $3,150 area.

* A moderation in momentum near $3,125 might result in a revisit to the $3,112 level.

* Should prices fall below $3,110 , the $3,100 area—commonly observed as a psychological benchmark—may become relevant.

* A continuation below $3,100 might bring the previous high of $3,085 back into focus.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold suppresses the fall and shorts make big profitsYesterday, gold fell under pressure at 3150 and then tested the 3100 mark again in the evening, breaking the previous trend line that had been rising for several days. The market gradually slowed down from strong bullish trend, and the daily line turned negative.

Don’t expect the market to turn to bearish and fall sharply at this point. The long-short conversion needs time to brew, and now it is still a bullish trend, so the probability of forming a volatile trend here is relatively high, with a range of 3138-3100. Only when it breaks below 3100 can we see the market turning to bearish.

If the daily line is just a single negative correction, it will not change the overall upward trend. It depends on whether it can continue to close negative today.

If the European session suppresses the decline and weakens, then the third test of 3100 may break.

If the European session continues to strengthen and break through 3138, it will also hit the high point of 3148-3149

Possibility of correction The price is expected to fluctuate within the current resistance range and then a trend change will occur and we will witness the beginning of a correction. By passing the resistance range, it will be possible to continue the upward trend to the specified resistance levels.

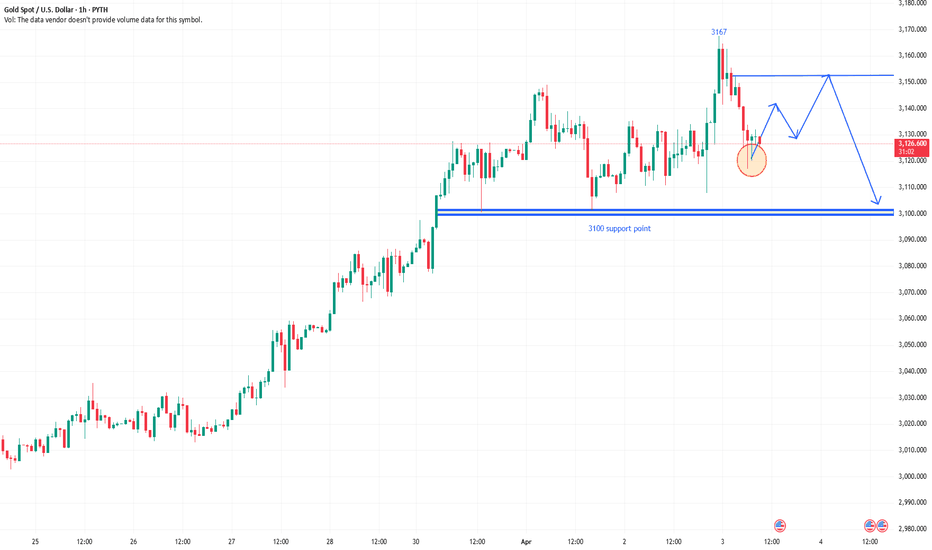

Is the golden large-scale "roller coaster" near miss?Gold took a large "V"-shaped reversal pattern on Thursday, with the highest hitting 3167 in the Asian session, and continued to fluctuate and fall in the European session. It successfully fell to the lowest 3054 before the US session and then rebounded. As of now, gold has deeply bottomed out and rebounded to 3135. It has now started the oscillation mode. Gold continues to fluctuate in the range of 3100-3135, waiting for the release of the initial jobless claims data in the US session. The data is bearish, and the shorts broke through the 3080 line. After all, the technical adjustment is almost done, and everyone can find opportunities to go long. Later, gold hit the 3054 line and rebounded quickly, and the long orders also recovered the losses. This process is full of thrills and excitement. After all, such a large bottoming rebound is relatively rare. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, pay attention to the short-term suppression of 3130-35 on the upper side, and pay attention to the short-term support around 3100-3106 on the lower side. Pay attention to the support of 3083-3087. After stabilizing above this position, continue to follow the low-long rhythm, and stick to the idea of going long after stepping back. I will remind you of the specific operation strategy during the trading session, so pay attention to it in time.

Gold operation strategy: Go long at 3105-3095

XAUUSD Breaking Records: Bull & Bear Setups for the New Month 🔥 Attention all traders!🔥

XAUUSD is on fire, breaking records with power! Here’s the latest update:

🔻 Bearish Outlook: Watch for a potential dip below the 3076-3078 range. If it falls, targets like 3050 and 3030 could be in play. Keep an eye on these support zones! 👀

🔺 Bullish Outlook: A breakout above this range could open up buying opportunities! Look for price action above 3084 with targets at 3097 and 3110. 🚀

New Month Open Candle: As we step into a new month, keep a close watch on the market open candle 📅. This could set the tone for the next move!

💡 Risk Management** is key! Always trade smart and protect your capital! 💰

Join the discussion and share your thoughts! Let's ride this golden wave together! 🌟

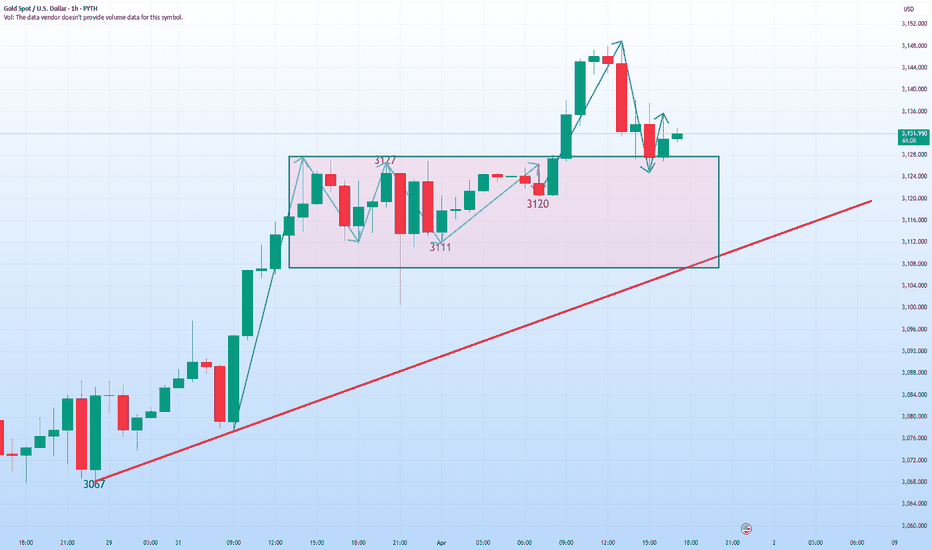

Gold sells off sharply on tariff dayGold, the general trend is as described in the continuous analysis. The price rose from 2614 in a step-by-step manner due to risk aversion, and then consolidated. The tariff policy officially took effect, and the price was blocked at 3168, and fell back after the second confirmation; it is emphasized that the short-term structure is weakening, and the support of the weekly and monthly charts is far away. Combined with the non-agricultural data at the end of the week, we need to be vigilant about the risk of profit-taking and selling; short-term resistance is 3120-3124, and strong resistance is 3135; short-term support is 3104-3100, and strong support is 3095-3085. If it breaks, look back to 3054;

Will the price of gold continue to rise today?At the 4-hour level, the current market is shrinking and oscillating at a high level. The K-line is running above the middle track, and the oscillating and strong trend is maintained above the middle track. Focus on the 3100 support break. Only when it breaks below 3100 will the downward space be opened. There can be more below 3080-3060, and only above 3135 can further hit a new high. Before the data, continue to see range oscillation, small range 3110-3135, large range 3100-3150, short-term can be in the small range of high and low fast in and out. I will give orders online in real time after the data is released.

Gold Continuous High AltitudeGold rebounds or continue to short. Although gold surged after filling the gap in 1 hour, the upper shadow line quickly came down. The overall trend is still weak. It is under pressure near 3050 in the short term. It can continue to short when it rebounds under the resistance of 3012. The market is changing rapidly. Although gold seems to rebound strongly, it eventually surges and falls. Gold is still the home of shorts. However, it is now more volatile. Be patient and wait for a rebound. The volatility should not be underestimated. However, the idea is to continue to keep a high-altitude mindset. On the whole, the short-term operation strategy for gold is to short on rebound and long on pullback. The short-term focus on the upper side is 3012-3015 resistance, and the short-term focus on the lower side is 2950-2956 support.

Gold operation strategy reference:

Short order strategy: Short 20% of the position in batches near 3012-3015 when gold rebounds, stop loss 6 points, target near 2980-2970, break to see 2956;

Long order strategy: Long 20% of the position in batches near 2953-2956 when gold pulls back, stop loss 6 points, target near 2970-2980, break to see 3000;

Tariffs continue to ferment, True or FalseAt present, the tariff shock continues. There were rumors of a 90-day tariff suspension, which stimulated the rapid rise in gold prices, but it was later confirmed to be false news and the price fell back quickly. This shows that the market selling sentiment may continue if the tariff shock remains unchanged. Yesterday's midnight prompt 2963/58 long positions also rose as expected. Technically, gold is currently at 2982, and there are signs of accumulating strength to rush up in the morning. In terms of operation, it is recommended to do more on the pullback and to do more on the rebound. Pay attention to the resistance of 3020-3025 on the top and the support of 2956-2950 on the bottom.

Operation strategy 1: It is recommended to go long on the pullback of 2973-2966, stop loss at 2960, and the target is 2995-3015.

Operation strategy 2: It is recommended to go short on the rebound of 3020-3025, stop loss at 3033, and the target is 2990-2955.

XAUUSD - Uptrend is strong, pullback for buysThe gold market is displaying remarkable strength, with the XAU/USD pair recently breaking above the $3,085 level to establish new historical highs. The upward trajectory has been supported by a robust ascending trendline dating back to late February, indicating persistent bullish momentum. While the immediate trend remains decidedly positive, technical indicators suggest a potential short-term correction may be forthcoming, which would likely present advantageous buying opportunities for traders. The highlighted support zone around $3,030-$3,040 could serve as an ideal entry point for those looking to establish long positions, with the expectation that after this healthy pullback, gold will resume its upward march toward the projected target of $3,100 and potentially beyond.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold has won two consecutive games, continue to short?Gold continued to be in a dead cross downward short position at 1 hour. The strength of gold short positions has not diminished. Gold fell near the resistance of 3017, and the gold moving average resistance has now moved down to near 3021. After gold rebounds, it is still mainly short selling.

Trading ideas: short gold near 3015, stop loss 3025, target 2990

The above is only a sharing of personal opinions and does not constitute investment advice. Investment is risky and you are responsible for your profits and losses.

Gold bullish trend remains unchangedGold surged and then fell back, with the highest price rising to 3167, but then the price fell back and gave up all the gains, falling to 3116. The daily line just touched the 5-day moving average support. As long as the 5-day moving average support is not broken, the short-term will continue to rise strongly. According to this momentum, we can see 3200 points in the non-agricultural data. However, one point worth noting at present is that the hourly MACD indicator has a dead cross signal. Coupled with the surge and fall of gold, the K-line has formed a combination of Yin and Yang, suggesting that the risk of high-level selling pressure is increasing. Once it falls below the key position of 3100 below, the market will be completely controlled by the bears. The current bullish structure of gold has not changed. The key support for the long-short watershed below is still 3100. Above 3100, the strong bullish idea remains unchanged. Short-term operations rely on 3100 for defense, and pay attention to the resistance of the 3140-45 area above.

Will the price of gold fall at night after it surges?Analysis of the latest trend of gold market: Analysis of gold news: Spot gold opened higher and moved higher in the morning trading on Monday (March 31), breaking through $3090/ounce and setting a new record high of $3127.73/ounce, with the largest intraday increase of 0.43%; COMEX gold futures rose to $3122/ounce, an increase of 0.25%. This market is mainly driven by geopolitical risks. Trump's threats against Iran and Russia have aggravated the market's risk aversion and stimulated investors to pour into gold assets.

Analysis of gold technical aspects: From the weekly chart of gold, after three consecutive weeks of steady upward movement, the current structure has formed four consecutive positives, and there is a lack of obvious pressure reference above, so it can only continue to be treated as a large integer range, such as the position of the 3100 mark, which is quite critical. At this stage, the short-term moving average group presents a perfect long arrangement, and the MACD indicator below is also in a golden cross state, so the bulls once again have a clear advantage.

From the daily chart of gold, although the latest inflation index shows the risk of rebound, it is more likely to be caused by the tariff policy. Therefore, risk aversion is undoubtedly the dominant factor, which also caused the gold price to rise to 3127. The current moving average group is an extremely strong upward signal. However, due to the certain distance from the current price, we should beware of the possibility of correction at the beginning of the week. On the whole, today's short-term operation of gold recommends focusing on callbacks and shortings, with the upper short-term focusing on the first-line resistance of 3135-3140 and the lower short-term focusing on the first-line support of 3105-3100.

Gold hits new highs this weekThe 1-hour moving average of gold crosses upward, the bulls diverge significantly, the price fluctuates greatly, and both the rise and fall exceed 20 points. Risk control is very important now, especially avoiding leverage orders and operations without stop loss. The upper resistance is at 3145-3148, and the lower support is at 3120-3117. In terms of operation, it is recommended to mainly do more on callbacks, supplemented by rebound high-altitude strategies.

Operation strategy 1: It is recommended to buy at 3122-3117, stop loss at 3111, and the target is 3147-3145, and the target is 3160.

Operation strategy 2: It is recommended to sell at 3144-3150, stop loss at 3155, and the target is 3130-3120.

The gold bull market continues to hit new highs!In the 1-hour cycle, the gold price consolidated yesterday, and a wave of declines consolidated the support below, which is the 3111 line. This morning, gold once again broke through the upper pressure level of the oscillation range at 3127. The breakthrough is bullish, and we have to go long with the trend. In the one-hour market, gold directly broke through the new high in the early trading and continued to rise, and the 3127 line has turned into a support level during the intraday trading. If it falls back to the 3127 line again in the early trading, we will go long directly!

Overall, the short-term operation strategy for gold today is to focus on callbacks and shorts on rebounds. The short-term focus on the upper side is 3150-3160 resistance, and the short-term focus on the lower side is 3110-3120 support.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3150-3155, stop loss at 3162, target around 3135-3130, and look at the 3125 line if it breaks;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 3125-3127, stop loss at 3115, target around 3140-3150, and look at the 3155 line if it breaks;