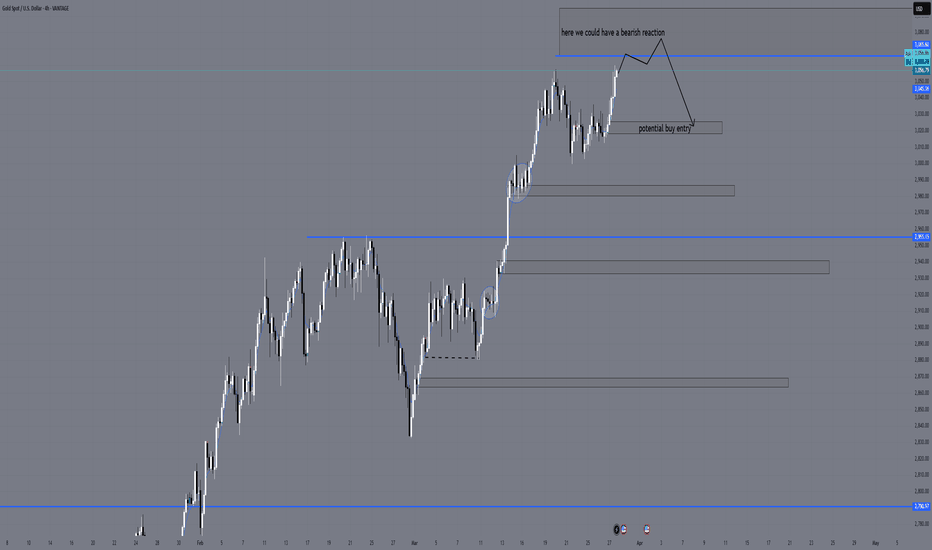

Gold breaks through historical highs again, trend and analysis.From the perspective of future trends, combined with various signals from fundamentals and technical aspects, spot gold is still in an upward cycle dominated by bulls in the short term. From a technical perspective, the weekly, daily and H4 cycle performances are all extremely strong, with no signs of decline or desire to fall. Therefore, cyclical bullishness needs to wait for the daily line to peak or to break out of a continuous decline before looking at the effective space for decline.

The upper resistance of gold is currently connected by the recent high point line and the extension line. The upper pressure can be seen in the 3128-3132 area, and the lower support can be seen in 3100 or even 3086. After getting support, enter the market to buy more. If it breaks through, the upper side will further look to around 3152-3177

GOLD.PRO.OTMS trade ideas

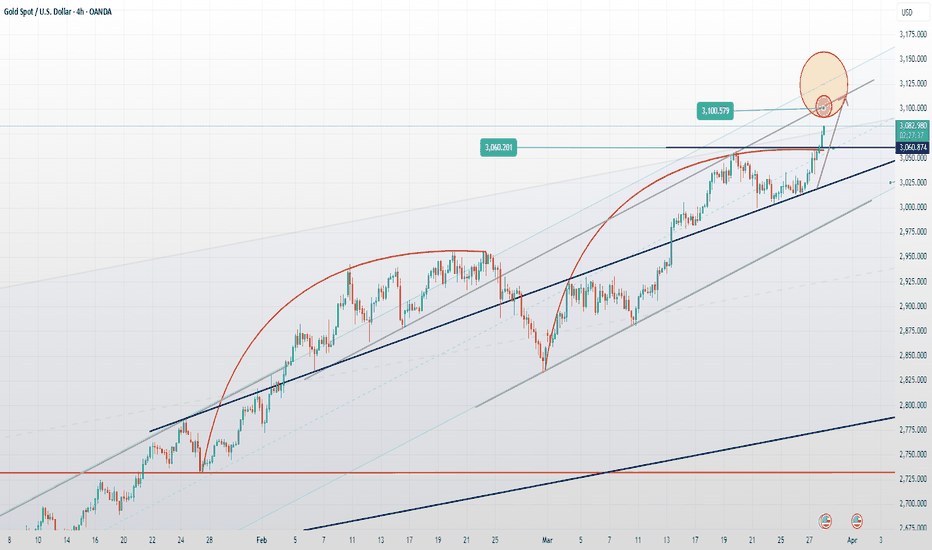

Gold Recovers After Dip – Is a New ATH Next?After reaching its recent all-time high exactly one week ago, Gold began a correction, dropping to $3,000, where buyers stepped in. This led to a recovery, pushing the price above a key resistance zone at $3,025–$3,030.

At the time of writing, the price is sitting at the upper boundary of this support zone. If it stabilizes above this level, a new ATH could be on the horizon.

I remain bullish as long as the daily close stays above this zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Is gold accelerating towards its peak?Today, the European and American markets focus on the breakout of 3127-30. If the European market fails to break higher, then this point may become a short-term high point. It is best to go long when it falls back to around 3100-02. It is still possible to go short if it falls back to 3102 and then rebounds to 3125-27. Finally, I would like to advise retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, then going short may be the best choice. It is better not to do it than to make a mistake! Watching more and doing less is also a suitable strategy.

In today's short-term operation of gold, it is recommended to focus on longs on callbacks, supplemented by shorts on rebounds. The top short-term focus is on the first-line resistance of 3128-3130, and the bottom short-term focus is on the first-line support of 3100-3097.

Continue to short gold, there is still huge downside potentialGold fell below the short-term key support of 3120 and extended to around 3100. The short-term raid caught most long traders off guard. Today, I evaluated from both market factors and risk factors, and made a plan to short gold in the 3135-3145 zone, with the goal of a pullback to 3100. The potential profit space is $50. I believe that as long as you pay attention to and follow my trading strategy, you will definitely make a lot of money today!

At present, gold has rebounded slightly after touching around 3100, but I do not recommend going long on gold in this position area; because a sharp drop in gold can easily hit the confidence of long traders, stimulate profit-taking and panic selling, so I think the decline is not over.

Even from a technical perspective, although gold has a certain degree of technical repair after a rapid decline, it is obvious that the 4-hour level has not started to make up for the decline, indicating that there is still a lot of room for correction below. In this round of decline, I think gold is likely to continue to fall to the area around 3085, or even the 3075-3065 zone.

Therefore, for short-term trading, we can still consider shorting gold in batches after it rebounds to the 3115-3125 zone, with the target pointing to the 3095-3085 zone.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold continues to hit new highsFundamentally, although the tension between Russia and Ukraine has eased, it has not ended peacefully. There is still a certain degree of uncertainty and temporary stability. In addition, the situation in the Middle East is also intensifying. Trump also threatened to bomb Iran this week, which has increased the risk aversion of the market's geopolitical situation. In terms of US tariffs, Trump's tariff policy is still continuing. The reciprocal tariffs to be announced in the Rose Garden of the White House on April 2 will also put global economic trade at risk. Its uncertainty has made the market wait and see, and more inclined to safe-haven gold. Although Fed officials said that there is no stagflation in the economy and the expectation of interest rate cuts has weakened, as long as it does not turn to interest rate hikes, even if inflation strengthens, it will boost the commodity attributes of gold and support the strengthening of gold prices. In addition, major banks around the world have raised their gold price forecasts, and strong capital inflows from gold-backed ETFs, etc., will become the main factors supporting gold prices.

On the whole, today's short-term operation of gold recommends focusing on callbacks and shortings, with the upper short-term focus on the first-line resistance of 3138-3143, and the lower short-term focus on the first-line support of 3110-3105.

GOLD MARKET ANALYSIS AND COMMENTARY - [March 31 - April 04]This week, the international OANDA:XAUUSD increased sharply from 3,003 USD/oz to 3,087 USD/oz and closed this week at 3,085 USD/oz.

The reason for the sharp increase in gold prices is that US President Donald Trump decided to impose a 25% tax on imported cars into the US. This seems to go against Mr. Trump's previous statement about "easing" tariffs, causing investors to worry that US partner countries will retaliate, making the global trade war more intense.

Some countries, such as the UK and Japan, have taken some steps to appease and actively negotiate to avoid US tariffs, while many other countries have announced their readiness to retaliate against US tariffs. Therefore, many experts believe that the tariff policy announced by Mr. Trump on April 2 will be very unpredictable.

If Mr. Trump still decides to impose tariffs on many countries, the gold price next week may continue to increase sharply, far exceeding 3,100 USD/oz. However, if Mr. Trump narrows the scale of tariffs as announced and does not impose additional industry-specific tariffs on lumber, semiconductors, and pharmaceuticals, the gold price next week is at risk of facing strong profit-taking pressure, especially when the gold price is already deep in the overbought zone.

In addition to the Trump administration's tax policy, investors also need to pay close attention to the US non-farm payrolls (NFP) report to be released next weekend, because this index will directly impact the Fed's interest rate policy.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

The most notable economic news in the coming week will be the US implementation of global trade tariffs on Wednesday, along with the March non-farm payrolls report due Friday morning. Experts warn that both events could increase the appeal of gold as a safe-haven asset. In addition, a number of other important US economic data will be released, including the ISM manufacturing PMI and JOLTS job vacancies on Tuesday, the ADP employment report on Wednesday, along with the ISM services PMI and weekly jobless claims on Thursday.

📌Technically, short-term perspective on the H1 chart, gold price next week may continue to surpass the 3100 round resistance level, approaching the Fibonacci 261.8 level around the price of 3,123 USD/oz. The current support level is established around the 3057 level, if next week gold price trades below this level, gold price is at risk of falling to around the 3,000 USD/oz round resistance level.

Notable technical levels are listed below.

Support: 3,057 – 3,051USD

Resistance: 3,100 – 3,113USD

SELL XAUUSD PRICE 3133 - 3131⚡️

↠↠ Stoploss 3137

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

XAUUSD – Refined Daily Plan w/ Sniper Entries🔹 HTF Bias (D1 + H4)

🔼 Overall trend: Bullish

Price is inside a Premium HTF zone (3065–3090)

Daily and H4 structure are bullish, but price is testing a major liquidity zone

Reaction expected either:

✅ Bullish continuation on breakout

🔁 Short-term rejection for retracement ➤ sniper setups engage

🧠 Current Setup Situation (M15–H4 Context)

📍 Price is consolidating below 3065, forming equal highs ➤ liquidity sitting above

M15 + M30 show clear FVG + OB confluence zones

H4 has no CHoCH yet — structure intact

Strategy: reactive entries based on smart money reaction

🔻 SNIPER SELL SETUP (Scalp to Retrace)

🎯 Sell Plan:

Entry Zone: 3064.5 – 3066

SL: Above 3070 (above wick + LQ)

TP1: 3041 → M30 FVG

TP2: 3020 → H1 bullish OB

TP3: 3008 → large imbalance (LTF)

⚠️ Entry Conditions:

Price must:

Sweep liquidity above equal highs

Show M15 or M5 bearish BOS / engulfing

Ideally with shift in order flow (CHoCH)

✅ Confluences:

D1 & H4 Premium zone

M15 OB + FVG

Liquidity resting above 3065

🔺 SNIPER BUY SETUP (Continuation)

🎯 Buy Plan:

Entry Zone: 3016–3020

SL: Below 3010

TP1: 3035

TP2: 3055

TP3: 3065 (liquidity revisit)

⚠️ Entry Conditions:

Clean rejection from OB zone

Bullish candle (M15/M30) or LTF BOS

No full break below 3008 – that invalidates buy

✅ Confluences:

Clean OB + FVG (M30 / H1)

Sits in discount zone after potential rejection

H4 demand & D1 continuation zone

🧭 Decision Tree

→ If price breaks 3065 + holds → wait for retest → long continuation

→ If price sweeps 3065 + shows rejection → sniper sell

→ If price drops to 3020 → look for long

→ If price breaks 3008 → wait for structure to reset

🧼 Summary:

HTF = Bullish

Active zone = 3065 (reaction zone)

Trade reaction, not prediction

Let price come to your zone. Then strike like a sniper 🧠⚔️

Sniper setups only execute after LTF confirmation

🧠 Structure > Emotion

🎯 Setup > Impulse

💬 If this breakdown helped you, support the post:

🔁 Boost / Like to help more traders see it

✅ Follow for clean daily plans, sniper setups & SMC flow

Let’s grow together, one smart trade at a time 📈

XAU/USD Analysis–Bearish Continuation Within Descending Channel📉 Gold (XAU/USD) H1 Analysis – March 26, 2025

🔻 Descending Channel Formation:

The price remains confined within a downward-sloping channel, signaling continued bearish pressure.

Lower highs and lower lows confirm the short-term downtrend.

📍 Key Levels & Structure:

Current Price: $3,019

Resistance Zone: Around $3,025 - $3,030 (upper boundary of the channel)

Support Zone: $3,000 psychological level and potential lower boundary near $2,985

📌 Market Imbalance (MB) Not Filled:

A minor liquidity gap remains unfilled above, indicating a possible short-term retest before continuation.

📉 Bearish Expectation:

If price fails to break above the resistance trendline, we could see a drop toward $3,000 or even lower.

Watch for rejection signals at the upper boundary for short opportunities.

🔎 Trade Considerations:

Bearish Bias: Short entries from resistance with targets at $3,010 - $3,000.

Invalidation: A breakout above $3,030 could signal bullish strength.

XAUUSD – Daily (D1) Analysis🧱 Market Structure

The D1 structure is clearly bullish – price is printing HHs and HLs consistently.

Current push is a continuation from previous consolidation, breaking structure upwards.

No CHoCH or BOS bearish yet – buyers still in control.

🔵 Key Zones (marked on your chart)

1. Near-term Liquidity / Resistance

Price is approaching a marked supply zone / premium area at the top (same one from W1).

This is likely to act as a reaction point – either:

Sweep liquidity and reverse

Break through and continue higher

2. Imbalances / Mitigation Zones Below Price

These zones are clean mitigation targets if price rejects from the top:

Zone Level Description

2955 Fair value gap / inefficiency (imbalance)

2790–2800 Strong structure zone + FVG + OB

2740–2750 Potential OB + previous consolidation

2495 Deep retracement level – less likely short-term

🧩 Order Flow Observation

Very little sign of exhaustion in candles right now.

The only reason to expect reversal is if:

Price hits the extreme premium zone

We see a strong daily rejection or

Lower timeframes shift (CHoCH / BOS)

📉 EMA Perspective (implied)

Assuming EMA 21/50/200:

Price is well above EMA 21 & 50, indicating strong short-term bullish trend.

A return to EMA 21 (probably around ~2950–2970) would be a healthy pullback.

📌 Bias – Daily

Term Bias Reason Daily

✅ Bullish Clean bullish structure, no shift Short-term

⚠️ Watchful

If price hits supply zone with reaction

Ideal setup

Rejection from premium + CHoCH on H4/H1

🧠 Trade Ideas (based on D1)

🔼 Bullish Scenario

Price holds above 3060 and breaks 3090+

Entry on breakout + retest of minor OB on H1

Target: ATH sweep and continuation

SL: Below minor HL / reaction low

🔽 Bearish Scenario

Price enters supply zone → forms bearish D1 candle (engulfing / pinbar)

Look for CHoCH on H4/H1 to enter short

Target levels: 2950 ➝ 2800 ➝ 2750

SL: Above daily high or OB

XAUUSD – Weekly (W1) Trading Plan🧱 Market Structure

Clear bullish structure with sustained Higher Highs (HH) and Higher Lows (HL).

Strong impulsive candles show aggressive bullish momentum, no signs of exhaustion yet.

Order flow remains bullish until proven otherwise.

🔍 Key Zones (S&D, FVGs, Gaps)

🔝 Premium Zone

Current price is within this premium area, which contains a weekly FVG / imbalance.

Price is reacting inside this inefficiency (3064–3094) → draw on liquidity.

This is not a demand zone, but rather a sell-side trap area for late buyers.

Possibilities:

Price fully fills the gap to ~3094 → then reverses (bearish reaction).

Or, price continues pushing up for ATH sweep (liquidity above all-time-high).

🧩 Below Current Price – Mitigation Zones

🔵 2900–2950: Minor imbalance, could be used as short-term retracement target.

🔵 2750–2800: OB + structural retest zone → high-interest mitigation area.

🔵 ~2480–2550: Deep retracement zone – valid only if major structure breaks.

📈 EMA Overview

(Assuming standard 5/21/50/200 EMA stack)

Price is far above all EMAs → strong bullish sentiment.

A revisit to the 21 or 50 EMA (weekly) would represent healthy retracement.

⚖️ Bias

Term Direction Reason

Long-term ✅ Bullish Strong structure, unmitigated imbalances above

Medium-term ⚠️ Neutral-to-bullish Depends on reaction from 3064–3094

Short-term 🔄 Await reaction LTF confirmation needed for short setups

🎯 Trade Scenarios

🟩 Bullish Continuation

If price uses 3064–3094 as support (mitigation → continuation)

Targets: New ATH above 3100+

Strategy: Wait for bullish PA confirmation (engulfing / BOS on D1/H4)

🟥 Bearish Rejection

If price shows strong bearish reaction from 3064–3094 zone

Ideal confirmation: bearish engulfing / CHoCH on H4/H1

Targets:

TP1: 2950

TP2: 2800

SL above the high (once structure confirms)

⏳ What to Watch Next

Weekly close relative to the 3064–3094 zone

Daily/H4 candlestick behavior: rejection vs continuation

Look for divergence between price and momentum, or exhaustion candles

XAUUSD SHORTING CONCEPTMorning ladies & gents.

Ok... Gold has been playing games & hard to get for a while. I don't know bout you guys.

As per today and the picture you're currently looking at, the market has cleared so many buy-side liquidities without proper retracements.

Being a Thursday, we could possibly have a TGIF setup, or maybe have it on a good old fashioned Friday.

So, even if we're in an uptrend or a downtrend, I want to see the market either clear Asian highs & or up to the 4 hr end of fvg, and give a sell model or just reverse where it currently is.

My targets: 1 hr Inversion fvg/ 4 hr end of fvg / other discount arrays.

I'ma update frequently on this trade idea so stay tuned.

& If you like my content, ideas and more, just hit the follow button & boost for a thumbs up

breakout - gold price rebounds 3045⭐️GOLDEN INFORMATION:

Gold prices remained stagnant late in the North American session, constrained by a rebound in the US Dollar Index (DXY), which initially dipped to 104.18 before recovering. The turnaround came after the White House confirmed that President Donald Trump would unveil new automobile tariffs around 22:00 GMT. As of writing, XAU/USD is trading at $3,019, showing little change.

Despite reports from The Wall Street Journal suggesting that Trump may introduce limited tariff measures, including on automobiles, bullion traders struggled to find momentum. Meanwhile, the DXY, which measures the Greenback against a basket of six major currencies, climbed 0.32% to 104.55, further weighing on gold’s appeal.

⭐️Personal comments NOVA:

Gold price recovers, breakout of H1 frame. With the latest 25% car tax policy, gold price reacts strongly and increases again.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3045 - $3047 SL $3052

TP1: $3038

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3023 - $3021 SL $3016

TP1: $3030

TP2: $3040

TP3: $3057

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

We will continue to hold a bearish viewToday, the XAUUSD market is mired in extraordinary volatility. The uptrend in prices has continued unabated, with values rocketing to $3086. This powerful rally has inflicted heavy losses on bearish traders, leading to a mass liquidation of their positions.

Currently, the market is in a “double - whammy” situation, where both bulls and bears are feeling the pinch. This is the result of large - scale capital inflows. Savvy institutional investors and market players are deploying capital strategically, aiming to maximize profits.

Despite this current upward surge, we remain unwaveringly bearish. Our comprehensive analysis, which encompasses long - term economic trends, geopolitical developments, and technical indicators, further validates this stance. Many fundamental indicators suggest that the ongoing rally is merely a short - lived market anomaly. As the market digests various macroeconomic data, we anticipate increasing downward pressure that will eventually reverse the current uptrend.

We must not let these large - scale capital operators achieve their objectives. By staying true to our bearish view, maintaining strict risk management, and making well - informed trading decisions, we can counteract their market - manipulating tactics.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3085 - 3080

🎁 TP 3040 3030 3020 3010 3000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Gold Breaks Resistances_ Is a New All-Time High(ATH) on the Way?Gold ( OANDA:XAUUSD ) is moving in the Resistance zone($3,032-$3,021) and has managed to break the Resistance lines .

In terms of Elliott Wave theory , it seems that Gold has completed the main wave 4 . The structure of the main wave 4 is Double Three Correction(WXY) . One of the signs of the completion of the main wave 4 can be the breakdown of the resistance lines and the Resistance zone($3,032-$3,021) .

I expect Gold to trend upwards in the coming hours and can even create a New All-Time High(ATH) .

Do you think Gold can create a new All-Time High(ATH)?

Note: If Gold goes below $3,013, we should expect more dumps.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD: The rally is getting stronger. Growth after a false crashOANDA:XAUUSD breaking upward and attempting to consolidate above the previous high of 3127 as part of the adjustment process. This will serve as an ideal support level for buyers. The price increase, against the backdrop of political and geopolitical issues, only intensifies.

Tariff increases are driving gold demand higher. Trump has rejected the idea of lowering tariffs and the Treasury Secretary has named 15 countries on the list for new measures. This has weakened the dollar and increased concerns about stagflation, boosting demand for gold as a protective asset.

Additionally, tariff tensions are unlikely to end after April 2, especially with auto tariffs taking effect on April 3, and this combined with growth uncertainty will keep buyers interested in gold if prices decline.

Technically, we have a strong upward trend, selling carries risk, and we are looking for strong areas or levels to buy. For example, if prices consolidate above 3127 or after breaking through the false 3119/3111 levels.

Before continuing growth, there may be adjustments to key support areas to normalize market imbalances and capture liquidity. Consolidation above levels after false breakouts will be a positive signal for growth.

But! There is upcoming news and high volatility potential!

GOLD H1 Market Update: Bear Trap / liquidity sweep BUY DIPS📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸3050 USD Resistance Heavy

🔸3000/3040 Trading Range

🔸2990 potential Bear Trap

🔸Price Target BULLS: 3100 USD - 3150 USD

🔸Recommended Strategy: BUY DIPS 2990

📊 Gold Market Summary – This Week

💰Gold Price Surge: Gold prices soared above $3,000, prompting Bank of America to raise its price target.

💸Profit-Taking Pressure: After the surge, mild profit-taking caused a slight price correction.

🛡️Safe-Haven Demand: Gold continues to show strength, supported by safe-haven flows amid economic uncertainty.

📅 Economic Data Impact: U.S. economic data (e.g., 0.9% rise in durable goods orders) is influencing gold prices, pushing them to session highs.

🔄Consolidation with Bullish Outlook: Gold is consolidating but remains bullish due to favorable U.S. dollar performance and Federal Reserve policies.

🌍Geopolitical Tensions: Ongoing Russia-Ukraine conflict and U.S.-Russia tensions continue to support gold’s status as a safe-haven asset.

💎 Summary:

Gold remains resilient with strong demand, positive economic indicators, and geopolitical tensions supporting its value, despite minor price corrections.

GOLD knocking on heaven's door againAnd once again we are at the spot, where MARKETSCOM:GOLD is trying to go for another all-time high. Will we see another strong push, or is it time for the commodity to slow down and retrace? Let's dig in!

TVC:GOLD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Gold Potential Bullish ContinuationWith widespread panic about tariffs, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity.

Trade Plan:

Entry : 3131

Stop Loss : 3095

TP 1 : 3167

XAUUSD - Daily, Gold’s Next Big Move: Be Ready!XAUUSD - Daily Update 📈

With most analysts focusing on Gold’s bullish momentum, let’s step back and analyze where we are in the bigger picture and where we should secure profits before a potential correction.

Gold has been in a strong uptrend since the $2,000 zone, forming three major bullish legs as highlighted in the chart:

🔹 First leg correction: ~$150 drop

🔹 Second leg correction: ~$250 drop

🔹 Third correction may be deeper, so caution is needed in the target zone.

Key Levels to Watch:

📌 Potential Target Zone: $3,050 - $3,150

✔️ Measured Move: Previous legs suggest an extension into this zone.

✔️ Liquidity Grab: Gold tends to hunt liquidity over round numbers—just as it did at $2,000 → $2,060, it may break $3,050 before reversing.

✔️ Ascending Channel: The price is approaching the top of the channel, where market makers may trigger a fake breakout before a significant pullback.

🚨 Trading Strategy:

Swing traders: Secure profits near $3,050 - $3,150.

Daily traders: Use pullbacks as short-term profit opportunities.

💸 If you missed this rally, stay ahead for reversal signs & upcoming moves! Follow for more insights! 🚀

Gold’s Surge: New Highs, Key Resistance, and the Path to 2720Hello,

XAU/USD has been on a strong upward trajectory, repeatedly reaching new all-time highs. Gold has just recorded its best quarter since 1986, solidifying its status as the ultimate safe haven amid economic uncertainty. Factors such as Trump’s trade war and the weakening U.S. dollar—on track for its worst year since the 2008 financial crisis—have further reinforced gold’s appeal as a reliable hedge.

Currently, gold is testing a significant resistance zone. If this level holds, the price could move toward 2720, provided key conditions are met along the way. A strong early signal would be whether the price remains comfortably below the 1W PP, which could pave the way for movement toward the 1M PP. Should this level act as resistance, the path to 2720 becomes more likely.

While such a scenario may seem unlikely under current market conditions, history has shown that when things appear strongest, declines often follow. Stay prepared, and good luck!

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1D-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

Gold is expected to peak faster on FridayGold is expected to peak faster on Friday

Gold continued to rise sharply, breaking through the 3000 support, and then the bulls directly rose, forcing the bears to rush to 3080-90. Yesterday, the European session pulled up and broke through the high point, and the US market bottomed out and rebounded and continued to break through the high point, showing that it is still strong.

So will there be a short squeeze after 3080 points? Will there be a turning point?

At present, it is a typical short squeeze trend.

Of course, don’t think that it has reached the top after rising for two days. When it retreats, it is a big waterfall. It’s not that you can’t see it, but you have to be careful every time.

Then with the accelerated rise, the space behind becomes smaller, and the bulls continue to be bullish, but pay attention to prevent waterfall risks

According to the hourly chart below the big positive line:

The current support level is 3060-3065.

The watershed is 3054.

Above 3060, all operations are bullish

In addition, the market that breaks high and accelerates will generally last for 2-3 days. Today is Friday. It should be understood that even if the market does not fall on Friday, it is equivalent to rising, so the probability of oscillating upward next Monday is very high.

Therefore, next, pay attention to the support near 3060.

Go long when the callback is above 3060