Gold’s Bearish Trend vs. Fundamentals –What’s Driving the MarketGold’s Bearish Trend vs. Fundamentals –What’s Driving the Market?

Gold has hit our first target, just as we predicted. Some doubted this move, but it happened. The current geopolitical situation is messy, making it hard to judge what’s good or bad right now. One thing is clear—gold seems heavily manipulated. Since Trump’s controversial decisions, other countries have grown wary, and gold’s price has been hesitant to rise.

There’s a lot of talk about a U.S. and global recession, partly due to Trump’s tariffs and unpredictable policies. Yet, despite this, gold prices are moving downward.

Interestingly, when inflation was at 10% in many countries, gold stayed around $2,000. But as inflation dropped to 5% or lower, gold prices climbed. This feels like manipulation at play.

Russia recently announced plans to sell gold between April 5 and May 12. This could flood the market with liquidity and push prices down. However, other Central Banks or Hedge Funds may be also involved in these transactions. Russia might not be acting alone.

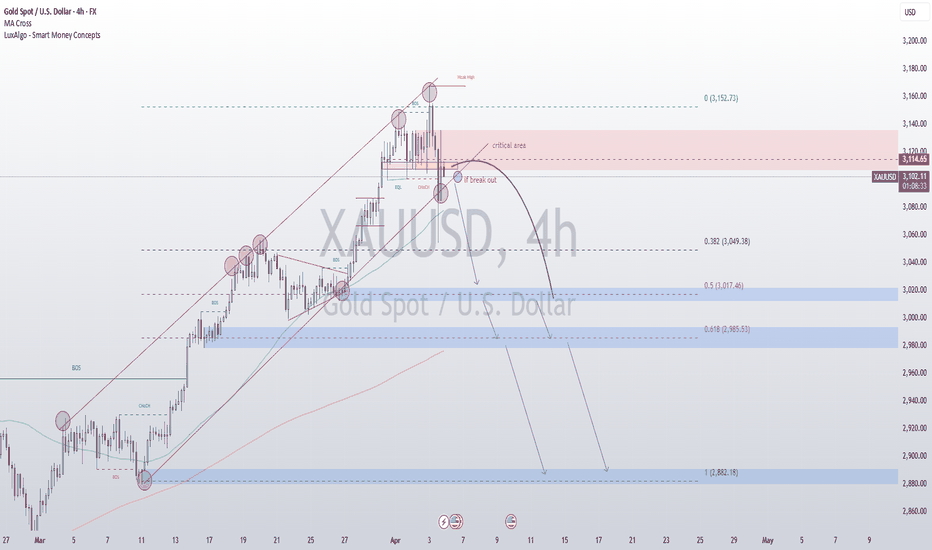

From a technical perspective, the analysis remains unchanged.

After any significant correction, gold could continue to drop further, as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

GOLD.PRO.OTMS trade ideas

XAUUSD price Forecast Consolidation XAUUSD DownSite entry 3004 ---

*GOLD (XAUUSD) TRADE ALERT!*

*Price Forecast & Market Insight*

*Current Trend:* Consolidation phase completed – Selling pressure building up!

*Action:* Time to SELL GOLD!

*Entry Level:* *3004*

*Stop Loss (SL):* *3035*

*Target Levels (TP):*

1️⃣ First Target – *2975*

2️⃣ Second Target – *2940*

3️⃣ Final Target – *2910*

**Why Sell No

After a strong consolidation, the market shows signs of downward momentum. Sellers are stepping in – it's time to ride the wave!

*Risk Management:*

Always stick to your *Stop Loss*! Manage your position size carefully – this market is moving big!

*Safe Trade = Smart Trade*

*Reminder:* Set your TP & SL *now* – Don't miss out!

*Let's catch the move together!*

Stay sharp, follow the signal, and let's win this trade!

**#XAUUSD #GoldSell #ForexSignal #PriceAction #GoldForecast #TradeSetup #RiskManagemen

DeGRAM | GOLD reached the lower boundary of the channelGOLD is in an ascending channel between the trend lines.

The price has already reached the lower boundary of the channel.

The chart is forming a descending structure and is holding under the 50% retracement level.

We expect the decline to continue.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold: Potential Bullish Surge or Bearish Correction?Gold: Potential Bullish Surge or Bearish Correction?

On the 60-minute chart, GOLD is forming a bullish pattern between 3067.50 and 3086.80.

If the price breaks above 3086.80, bullish momentum could strengthen significantly, with GOLD potentially raising to the 3100–3110 range in the short term.

On the other hand, if the price falls below the support level of 3067.50, there’s an increased possibility of a short-term bearish correction, pushing GOLD towards 3057, 3045, or even lower.

While the pattern looks bullish, the overall market picture remains complex.

It's essential to stay flexible and watch how the price develops further.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Snipper plan ideeas before NFP and Powell Speech - April 4th📌 Macro & Market Context

Gold remains in a strong HTF bullish market structure, with recent highs around $3,160 acting as a key resistance.

NFP data, Unemployment Rate and Powell's speech will add increased volatility later today.

The market is currently correcting after liquidity grab above $3,160, showing signs of distribution.

📊 Market Structure Overview (4H & 1H)

Bullish/Sell bias remains neutral, but a temporary retracement is underway.

Premium supply zones are positioned above $3,140–$3,160.

Discount demand zones are around $3,080–$3,050.

📍 Setup 1 SELL

Scenario: Bearish retest to this zone

Entry: $3,135 - $3,145 (if price returns to this zone).

Confirmation: Rejection wick + Bearish Engulfing on 15M or 5M.

Stop Loss: Above $3,153

TP1: $3,125

TP2: $3,110

TP3: $3,090

📍 Setup 2 SELL

Scenario: Wait for price to push back into 3,091–3,095 zone (M5 imbalance retest).

Entry: 3091-3095

Confirmation: Entry on rejection + BOS or CHoCH M1/M5.

Stop Loss: Above 3,096

TP1: 3066

TP2: 3054

TP3: 3040

📍 Setup 2 BUY

Scenario: If price retraces to key demand zones $3,080–$3,070, look for a long entry.

Entry: Buy at $3,080–$3,075.

Confirmation: Liquidity grab + Bullish engulfing on LTF (1M, 5M).

Stop Loss: Below $3,070.

TP1: $3,100

TP2: $3,120

TP3: $3,135

📍 Setup 3 BUY

Scenario: Bounce/reversal confirmation near 3,054 (last demand block + imbalance edge).

Entry: Buy at 3048-3055

Confirmation: Entry only if M1/M5 shows CHoCH + volume.

Stop Loss: Below 3048

TP1: 3085

TP2: 3115

TP3: 3128

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

If you find the ideas contribute to your views on the market be kind to press boost🚀/like button. Your support is appreciated.

Gold – Key Buying Zone at 3,090 for a Target of 3,157Why is $3,090 a Great Buying Area?

Support within the Channel – The price has been respecting the lower boundary of the channel, and 3,090 aligns with this trend structure.

Volume Profile Confirmation – Visible volume accumulation around this level suggests it has strong support. Buyers previously stepped in here, making it a logical point for re-entry.

Trend Continuation Setup – The overall bullish structure remains intact, making pullbacks like 3,090 a low-risk buying area for continuation toward the target of 3,157.

Why Not Short Here?

The trend is clearly bullish, and there are no reversal signals.

Even if a pullback occurs, it should be seen as an opportunity to buy rather than an indication to short.

The price is approaching the upper boundary of the channel, but until clear bearish signals appear, betting against the trend is risky.

Conclusion

A pullback to 3,090 should be considered a buying opportunity for a move toward 3,157. As long as the price remains within the channel, the primary focus should be on buying dips rather than looking for short entries.

XAU/USD 30 MIN pairMy trading gold (XAU/USD) on the 30-minute chart with a bearish Head & Shoulders pattern and an active sell entry at 3030. Here's your setup:

Resistance: 3138

Sell Entry: 3030 (confirmed active)

Targets:

Target 1: 3080

Target 2: 3050

Observations:

1. Bearish Confirmation: A Head & Shoulders pattern suggests a downside move if the neckline is broken.

2. Stop-Loss Consideration: You might want to place a stop-loss above resistance (3138) or just above the right shoulder for risk management.

3. Risk-Reward Ratio: Ensure your risk-to-reward ratio is favorable before committing fully to the trade.

Let me know if you need further refinements or chart analysis!

It's brothers who let him get to 3100After the sharp drop to the 2,968 zone, gold bounced back like a fighter who got knocked down but still has the strength to stand up. Currently, gold prices are "swaying" in the 2,998 - 3,057 range, with the EMA 34 and 89 acting like a cushion, preventing prices from falling freely once again.

The H4 chart shows prices struggling to find momentum within the accumulation zone, still undecided whether to move up or down. Keep an eye on the 3,116 resistance zone. If the price breaks through, it’s likely to continue climbing, but beware, this zone could easily become a “trap” for buyers.

And don’t forget the upcoming CPI news! If CPI data comes out higher than expected, the USD may strengthen, pushing gold down a bit. On the other hand, if the data is softer, gold might have the excuse to bounce back up.

Gold's Rollercoaster: From 3167 ATH to 2950 Support–What's Next?Since the beginning of the year, Gold has been on an impressive uptrend, gaining over 5000 pips, culminating with last week's ATH at 3167.

As I highlighted throughout last week's analyses, even though we're in a strong uptrend, the price was too far deviated from the mean, making a correction inevitable.

✅ Friday Recap:

After testing the resistance zone formed at 3135-3140, Gold dropped hard, closing the week 1000 pips lower from its peak during Friday's session.

📉 Recent Developments:

The correction continued yesterday, with Gold recently touching an important confluence support around 2950.

📈 What's Next?

I expect an upward movement and resumption of the uptrend, with targets at:

• 3050 zone 📌

• 3080 zone 📌

🎯 Plan:

Buy dips near support, aiming for the mentioned targets. The analysis would be negated if we see a clear break below 2950. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

A rebound is a good opportunity to short goldGold rebounds from 3100, but is the bullish momentum truly revived?

I don’t see it that way. Yesterday’s retracement to 3100 has already weakened the strong bullish structure to some extent, with 3150 likely acting as a key resistance level. I believe the current rebound is merely a technical retest of the 3150 zone, reinforcing it as a potential cycle high and paving the way for a double-top formation, which could provide a bearish technical setup for further downside.

Following the initial 3100 test, a second retest of this support level is likely. If gold fails to hold 3100 on the second attempt, a break lower towards 3095-3085 would become increasingly probable.

I will continue to scale into short positions within the 3132-3142 zone, with an initial target of 3120-3110. If gold approaches 3100, I will closely monitor the price action to assess the likelihood of a further breakdown.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

GOLD - where is current support ? What's next??#GOLD... perfect move as per our discussion and now market again at his current support (that was our resistance )

Keep close the supporting region and if market holds then we can expect a further rise towarss next resistance areas.

Good luck

Trade wisely

DeGRAM | GOLD retest of the channel boundaryGOLD is in a descending channel between trend lines.

The price is moving from the dynamic support, which has already acted as a rebound point.

The chart has already consolidated above the support level and returned to the channel.

We expect a rebound after consolidation above the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

#XAUSUD: Small Time Bearish Correction With Three Take Profit! After reaching a record high of $3,150, the XAUUSD currency pair has experienced a decline. Analysis conducted over the past few hours has led us to anticipate that the price may experience minor corrections within a short time frame.

Upon analysing the data and price movements, we have identified three distinct zones or targets that could serve as potential price levels for the XAUUSD pair.

For further insights into chart analysis, please consider liking and commenting on our content. We appreciate your continuous support.

Sincerely,

Team Setupsfx_

GOLD (XAUUSD): Classic Pullback Trade From ATHGold is currently experiencing a strong bullish trend and has recently reached a new all-time high.

The market is now consolidating within a horizontal range on an hourly timeframe.

If the support of this range is broken, it could signal a significant bearish reversal, potentially leading to a drop in prices to the 3090 level.

XAUUSD: A Strong Bearish Presence in the market!A strong bearish impulse propelled the price to its lowest point in the past two months, reaching 2972. This suggests that sellers continue to dominate the market trend. Our entry point at 2992 has been rendered invalid, and the market currently lacks any substantial bullish momentum. There is a possibility that the price may decline further, potentially reaching the liquidity point where sellers may become exhausted.

Best of luck,

Team Setupsfx_

4.5 Gold falls off a cliff and waits to stabilize! ! !Gold 4-hour level: The last wave of pull-up started from the low point of 2999 to 3167. Yesterday, it fell back and tested the 618 split position 3063. The current support is still valid, which is also the MA66 day position; From the perspective of macd, it is still short-selling and has not been fully repaired. Wait until it crosses below the zero axis, and then slowly stabilizes and tends to golden cross in the future market, then a wave of trend pull-up will gradually form, and it will take time; if 3063 cannot be maintained, the two split positions below are 3035 and 3018, and attention should be paid to stabilization.

Intraday support: 3035 3018 3005

Resistance: 3045 3070 3100

Gold Trade plan 04/04/2025 ( Ascending Channel)Dear Traders,

yesterday, price Hit my Target around 3060

for Today i expect price will continue Uptrend (Ascending Channel)

"If it remains in the upward channel, my initial target is 3140."

If you enjoyed this forecast, please show your support with a like and comment. Your feedback is what drives me to keep creating valuable content."

Regards,

Alireza!

Golden Horizons on the PrecipiceGold on the Brink of a Downturn: A Shift in Market Sentiment

Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.

The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.

As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.

Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.

If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.

The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.

The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.

For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.

As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.

Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!