Daily Outlook – XAUUSD | April 6, 2025📆 Daily Outlook – XAUUSD | April 6, 2025

Structure first. Setups later. Let’s map the battlefield. ⚔️

🚫 No buy/sell zones yet — this outlook is strictly focused on price structure, reaction zones, and the narrative building behind XAUUSD price.

🔹 Structure Context – Daily TF (OANDA feed)

🔹 Market structure:

Strong bullish structure still intact, but showing signs of exhaustion after the sharp impulse and rejection from premium levels. We’re currently in a pullback phase.

🔹 Key Zones & Levels to Watch:

Weekly High Zone (Premium Supply)

📍 3140–3168

▫️ Previous week’s high + extreme premium zone.

▫️ Strong rejection last time price touched it.

▫️ Watch for liquidity or reaction if price returns here.

FVG + FIB 50–61.8 Retracement

📍 3033–3060

▫️ Clear daily imbalance zone.

▫️ FVG overlaps with fib retracement zone of the last bullish impulse.

▫️ Could act as draw or reaction point if the correction deepens.

Trendline (from Jan 2025 lows)

📍 Currently tested and respected.

▫️ A break below might signal deeper retracement toward the next structure block.

Daily OB + Equilibrium Zone

📍 2920–2960

▫️ Strong bullish OB left unmitigated.

▫️ Also in line with daily equilibrium of the macro rally.

▫️ Deepest discount zone in case of larger correction.

🧠 Outlook Logic:

After the aggressive impulse above 3100, price rejected hard, forming a swing high.

We’re currently between 3140 (supply/last high) and 3030 (first imbalance draw zone).

If we hold structure at 3030–3060, price may consolidate and continue the macro uptrend.

If that zone fails, expect the trendline + 2960 OB to come into play as deeper pullback zones.

🎯 This outlook keeps you prepared for both possibilities — strength or weakness — without needing to guess direction.

💬 Let’s stay sharp and adapt as the structure unfolds. If you found this helpful, smash that ❤️, drop a comment and follow to stay updated.

We're building a community of thoughtful traders. Join the journey! 🚀

#XAUUSD #GoldOutlook #DailyPlan #SmartMoneyConcepts #TradingViewIdeas #GoldFXMinds

GOLD.PRO.OTMS trade ideas

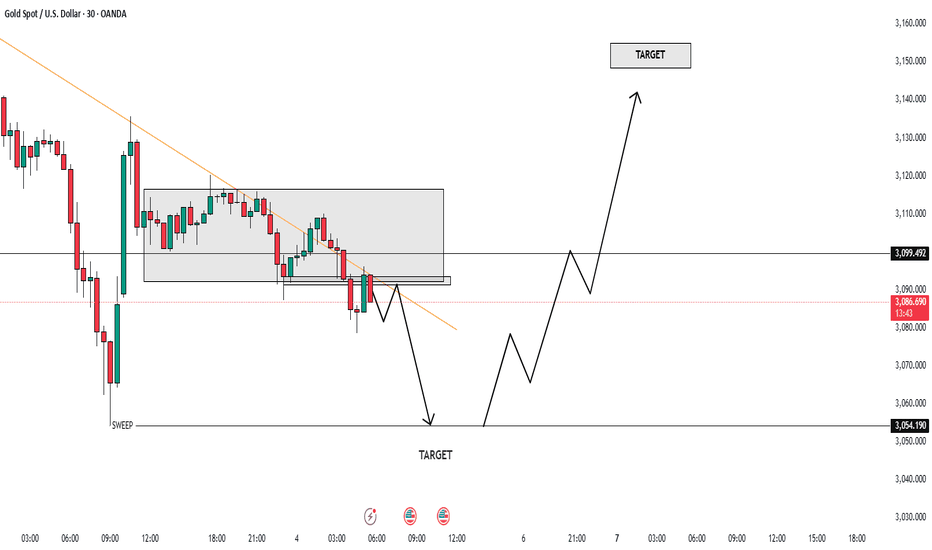

NFP REPORT IMPACT ON XAUUSD ALERT!🚨 XAUUSD Market Alert 🚨

🔥 Current Action: XAUUSD is currently range-bound between 3101 and 3114—will it break out soon? The market’s at a critical point, and a sharp move could be on the horizon!

📉 Bearish Scenario: If price slips below this zone, keep an eye on potential support levels at 3070 and 3054. A downward shift could set up fresh opportunities for sellers.

📈 Bullish Scenario: On the flip side, a solid break above 3114 could trigger buying pressure, with targets at 3140 and 3170. A move like this could spark a new uptrend, especially with NFP data on the way, which could impact the gold market!

💬 Let’s Talk Strategy: What’s your take on the XAUUSD setup? Share your insights, and let’s navigate this golden opportunity together! 💰🚀

Gold and the bearish Breakout Line ...From a cyclical standpoint, a CLOSE below the H1 cyclically derived breakout line may indicate a sharp decline, at least in to the demand zone!

Upcoming news event:

14:15 SWE Time: ADP Non-Farm Employment

The breakout line defines the energy boundaries—once price gathers enough momentum to break through, a strong acceleration is likely to follow.

Gold Market Outlook Post Tariff Response & Pre-NFP VolatilityGold Market Outlook Post Tariff Response & Pre-NFP Volatility

Overview: Last week, gold experienced a major shift as it broke from its recent bullish structure and sold off sharply. This was largely triggered by renewed geopolitical tensions stemming from former U.S. President Donald Trump's tariff remarks and China's reactive stance. These developments rattled risk sentiment and sparked volatility, with gold traditionally a safe-haven asset becoming a battlefield of both fundamental and technical influences.

While long-term fundamentals continue to support gold's bullish case due to global economic uncertainty, short-term volatility has introduced room for corrective movement. Notably, the size of recent price moves (1000+ pips in a single day) indicates high liquidity grabs and institutional rebalancing.

Technical Breakdown:

Weekly Chart:

Gold closed the week with a bearish hammer, signaling potential for deeper retracement after failing to sustain its move above the key 3057 level. The rejection came after briefly breaking resistance at 2955. This structure opens the door for further liquidity grabs and a healthy correction within the macro uptrend.

Daily Chart:

The daily time frame maintains a bullish structure seen by the daily trend line. Price respected the 3018 demand zone, creating a potential short-term base for a retest of the 3057 area of interest. This level also aligns with a 1-hour wickless candle, likely to be filled in future price action.

Intraday & 1-Hour Chart:

A visible trendline rejection capped the upside for now, with the 15-min engulfing candle and the 3128 resistance kicking off Friday’s massive 1000-pip sell-off. That we took in the group.

4-Hour Chart & Fibonacci Analysis:

Measuring the most recent impulse leg, price has retraced to the 0.88 Fibonacci level, suggesting a corrective phase could be nearing completion. A move towards the golden zone (3072–3090) is expected, which also aligns with the 50 EMA.

Key Support for Re-Entry:

Should further downside occur, the 2988 zone stands out as a high-probability area for long re-entries. This level is confluence-rich:

Retest of the daily trendline

1-Hour demand zone

4-Hour trendline retest

Strong support/resistance flip

Key Fundamentals to Watch:

Quarter-End Portfolio Rebalancing & Earnings Season

With stock market participants repositioning, gold may be used for hedging or liquidation depending on sentiment.

Geopolitical Risk (Trump, China, Tariffs)

Ongoing discussions and political headlines could reignite fear-based buying. Be ready for sharp intraday reactions.

Federal Reserve Speeches & FOMC Minutes

Traders will look for clues on potential interest rate cuts or pauses. Hawkish rhetoric could weigh on gold short term.

CPI Data (U.S. Inflation) – Wednesday, April 10th

Critical for rate path expectations. Sticky inflation may keep the Fed hawkish, increasing gold volatility. A surprise miss would benefit gold.

#XAUUSD: Smaller Time Frame With More Accurate Entry Areas! We currently have several active ideas in the Gold analysis section. However, we would like to share a comprehensive chart analysis that clearly demonstrates a market trend and potential entry points. The analysis identifies two entry types: “safe” and “risky.” A “safe” entry is only valid if the “risky” entry is invalidated. You may choose to take either entry if it aligns with your trading bias and chart analysis.

If you find this analysis valuable, please consider liking and commenting on it, as this feedback will help us post more detailed analyses in the future.

As always, we express our sincere gratitude for your unwavering support.

Team Setupsfx_

Has the gold tariff peaked?The current bullish structure of gold has not changed. The key support for the long-short watershed is still the 3100 line. Above 3100, the strong bullish idea remains unchanged. Short-term operations rely on 3100 for defense, and enter the market near 3116 and gradually look up. Focus on the strength of the European session. If the European session rebounds and does not break the high, then short the US session at highs, and pay attention to the resistance of the 3148-50 area above. On the whole, today's short-term operation strategy for gold is recommended to be mainly short on rebounds, supplemented by long on pullbacks. The short-term focus on the upper side is 3148-3150 resistance, and the short-term focus on the lower side is 3100-3110 support. Friends must keep up with the rhythm. It is necessary to control the position and stop loss, set stop loss strictly, and do not resist single operations.

Gold operation strategy: Gold 3100 short, stop loss 3110, target 3080-3070;

XAUUSD Market Recap – “Sniper Entry + NFP Chaos = Full TP Party”📊 XAUUSD Market Recap – “Sniper Entry + NFP Chaos = Full TP Party” 🎯💣

✅ Sniper Sell @ 3135 – Textbook Execution

The daily plan's sell scenario from 3135–3145 played out perfectly:

Premium zone + valid OB

FVG rejection + bearish PA (M5/M15 CHoCH)

Three take-profits hit: 3120 → 3086 → 3054

Structure respected, price never looked back 🔫

🔥 Post-NFP Breakdown – April 5, 2025

📉 NFP (Actual): 228K vs. 140K Expected

📈 Strong surprise to the upside – job creation smashed expectations

📉 Unemployment Rate: 4.2% (vs 4.1%)

📉 Slight increase – softens the impact of strong jobs number

💬 Market Reaction?

Gold dumped hard post-data, as strong NFP spooked the market

Algorithmic move: sweep → push down → bounce on deep FVG

Market front-ran deeper demand (below 3054), tagging 3036 briefly

🔁 What Got Mitigated:

✅ Premium supply zone @ 3135–3145

✅ 3086–3100 OB demand fully tapped

✅ 3054–3040 imbalance filled

✅ Final reaction wick @ 3036–3038 bounced right off deeper imbalance

🧲 Still in Play / Unmitigated:

🟦 3029–2985 = untouched D1 imbalance

🟡 Small rejection gap @ 3081–3085 (may act as intraday retest zone)

🔴 Possible liquidity below 3000 still untouched

🧠 Summary:

✅ Plan respected

✅ NFP added fuel

✅ Gold respected PA structure to the pip

🎯 Sniper sell from 3135 = perfect execution

Gold Trading SignalsTechnical analysis of gold: Today, gold opened low in the morning and then broke through the integer mark of 3,000 US dollars, and fell to 2,972 US dollars. Strong buying pushed gold to rise quickly to 3,055 US dollars. This position is the key pressure point for the top and bottom conversion of gold prices after the decline last Thursday. There will be no big bull market before the breakthrough, but repeated washing and shock. From a technical point of view, the price of gold is currently above the weekly, monthly and daily support, and the medium- and long-term bullish trend has not changed. However, after the gold price fell below the daily support last week, it is necessary to be alert to the continued pressure of the band. The volatility has been very active recently, and it is necessary to identify the trend and find the right point game. The price bottomed out in the early trading and directly arranged more than 2,980 orders during the trading to rise again to 3,055. Next, the European and American markets will continue to intervene in the short market near 3,050-53!

The short-term price is trading at 3030. If there are short positions at the high level of 3050, continue to hold them. Pay attention to the 3000 mark below. If there are no short positions in the European and American markets, continue to go short repeatedly. There will be opportunities for both long and short positions today. It is a good opportunity for short positions to be in the upper track of shocks! After the 4-hour long upper shadow line fluctuates violently, it will fall into calm! After the European and American markets rebound near 3050, arrange high altitude positions! On the whole, today's short-term operation strategy for gold is to focus on rebound shorting and callback longing. The short-term focus on the upper side is 3055-3057 resistance, and the short-term focus on the lower side is 2970-2972 support.

Short order strategy:

Strategy 1: When gold rebounds around 3050-3053, short (buy short) 20% of the position in batches, stop loss 6 points, target around 3020-3000, break the position and look at 2975

Strategy 2: When gold falls back to around 2973-2975, buy two-tenths of the position in batches, stop loss 6 points, target around 3000-3020, break to 3040

Online real-time guidance on gold trendsGold went up in the early trading, but the price fell again after rising to 3135. The fluctuation range of European trading narrowed. ADP employment data exceeded expectations. The market failed to break out of the trend. The current market is in the range of 3135-3109. The market is waiting for the details of the reciprocal tariffs and industry-specific tariffs to be announced at 3 am. The tariff policy announced by Trump is expected to have an adverse impact on the global economy, especially the United States. The current structure of gold is still bullish. After the correction, continue to go long at the key support level.

At the 4-hour level, the current market is shrinking and oscillating at a high level. The K-line is running above the middle track, and the oscillating and strong trend is maintained above the middle track. Focus on the 3100 support break. Only when it breaks below 3100 will the downward space be opened. There can be more at 3080-3060 below, and only when it stands above 3135 can it further hit a new high. Before the data, continue to see range oscillation, the small range is 3110-3135, and the large range is 3100-3150. In the short term, you can quickly enter and exit in the small range with high altitude and low long.

XAUUSD 4H - Lower Timeframes and Plan B Lower Timeframes and Plan B

Based on previous daily analysis , the 3075 and 3000 levels are key levels in the lower timeframe. It is anticipated that a breakout of the 3075 level will lead to an upward trend. However, if the 3000 level is broken, the bearish target at 2960 will become active.

Mathematical Analysis:

3000 level: This level is considered a key support. If the price breaks this level, a bearish move towards 2960 will begin.

2960 level: If this level is also broken, the price could move towards 2890 and 2820.

The targets mentioned in the daily analysis remain valid with a time delay. This analysis is based on mathematical principles and key level analysis in the gold market.

Mathematical Analysis of Gold (XAUUSD)Mathematical Analysis of Gold (XAUUSD)

Following up on my two previous analyses (linked here and here ), gold reached the precise $3135 target, accurately identified based on mathematical calculations. The rally was driven by central bank buying and tariff-related actions by Trump.

What’s next?

The levels mentioned below are mathematically derived and extremely reliable. While several paths are possible, I will present the one with the highest probability:

- After a short consolidation at the current price range, I expect a continuation of the bullish move.

- The next key target is $3270, where many sellers may enter the market.

- A possible correction may follow down to $2960 before the next leg up.

- A final rally could bring gold to around $3485, potentially peaking near $3500, but likely not exactly hitting that number.

As always, updates may follow as new data comes in. However, mathematics offers a clear language for interpreting price behavior — so reactions to these levels will be crucial.

*Let me know your thoughts — do you trust the math behind the market?*

XAUUSD Channel Up holding but be ready to short if broken.Gold (XAUUSD) has been trading within a Channel Up on the 4H time-frame, hitting today its 4H MA200 (orange trend-line). That is the first time the price hits this trend-line since February 28 and the previous Higher Low of the pattern.

As long as it holds, expect a Bullish Leg similar to the previous one, to hit first the 0.786 Fibonacci retracement level at 3130 and then the 1.786 extension for a Higher High at 3280.

On the other hand, if we get a candle closing below the 4H MA200, we will be ready to take the loss and go short instead, targeting Support 1 (Feb 28 Low) at 2840, potentially also making contact with the 1D MA100 (red trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Global panic spreads and sell-offs are expected!Gold price once plunged to $2971.5, then quickly rebounded $84 to a high of $3055, and then fell back to around $3015, which is the expected target of $3035. The rebound was strong after the plunge, but it was still suppressed by two large negative bars on the daily chart. The overall trend was weak, but the European session continued to rise. The current upper resistance is at $3050-3055, and the lower support is at $3020-3015. The operation suggestion is to go long on the callback, supplemented by the rebound.

Operation strategy 1: It is recommended to buy at 3007-3000, stop loss at 2093, and the target is 3030-3050.

Operation strategy 2: It is recommended to sell at 3058-3063, stop loss at 3070, and the target is 3025-3005.

Gold Analysis April 7The D1 candle on Friday clearly identified selling pressure and the amount of fomo pushed the price to 2972.

The H4 structure is still showing that the downward force will continue to be maintained when 3054 was rejected by the buyers.

Back to the trading plan The 3018 and 3035 border areas are considered sideways compression borders. If the price breaks 3018, wait for a retest and sell to 3003. If the US session breaks 3003, then push to 2955.

If the 3018 border remains strong, wait for a break of 3035 to BUY to the exchange price zone of 3054. BUY signals for short-term city and are considered to be against the trend at the moment. When the US session fails to break 3055, you can sell and hold long. If it breaks 3055, waiting for 3080 to sell will be safer than fomo to BUY against the trend.

Gold: Soaring on Tariffs, Testing Technical WatersIn the early trading session of the Asian market on Thursday (April 3rd), spot gold continued its upward trend and once reached a new all - time high of $3,167 per ounce. This was because US President Donald Trump said on Wednesday that he would impose a benchmark tariff of 10% on all goods imported into the United States and impose higher tariffs on some of America's largest trading partners. This move will lead to an intensification of the trade war that he initiated after returning to the White House, causing the market's risk - aversion sentiment to soar sharply.

However, given the rapid increase in the gold price, one should not blindly chase after buying more gold. On the one hand, the rapid rise in the gold price has accumulated a certain amount of pressure for a correction, and there is a high probability that a pullback and subsequent recovery rally will occur. On the other hand, the highly anticipated Nonfarm Payrolls data will be released tomorrow. On the eve of its announcement, the market will not quickly break out of a well - defined trading range and price level.

On the daily chart level, gold entered a downward adjustment mode on Tuesday, breaking the previous consecutive upward trend with positive candles. However, the current moving - average system still maintains a pattern of diverging upwards. Today, the key focus is on whether the downward movement of the market is sustainable. Firstly, we need to pay attention to the support effectiveness of the short - term moving average MA5. Currently, this moving average is roughly located around 3098, which is extremely close to yesterday's low of 3100 when the price dropped. If this support level can hold, then in the short term, gold can still be regarded as being in a strong pattern.

XAUUSD

buy@3105-3115

tp:3140-3160

NFP BIG BULL SETUP BREAKOUT ALERT!🔥 Market Update for Traders! 🔥

Right now, the market is showing BEARISH momentum, and it's looking like we're heading for a dip. We could see the market fall and sweep the area around 3052 👀. Once that happens, expect a *huge* bounce back as the market could be getting ready to **shoot to the moon 🚀🌕!

🛑 KEY BUY LEVEL: 3130 - This is where you want to be ready to go long! 📈

🎯 First Target: Once we hit 3130, eyes on the ATH (All-Time High) for the retest! 🙌 And from there, we're eyeing a target at 3200 🚀🔥.

💥 NFP News Incoming! 💥

After Trump's speech, gold could *fall* around 1000 pips ⬇️, but **NFP could trigger a huge pump 📊💥. Stay sharp and trade with caution.

💡 Risk Management is KEY! Always follow your plan, set stop losses, and protect your capital. Don't let emotions drive your decisions! 📉🔑

Trade smart, stay sharp, and let's get those gains! 💸💥

#BearishMomentum #BullishReversal #RiskManagement #GoldPrice #NFPAlert

Gold's April 2nd Swing: Tariffs Stir MarketsOn the morning of Wednesday, April 2nd, spot gold was trading in a narrow range, currently around $3,114 per ounce. Gold prices rose and then fell on Tuesday. Spot gold once rose to around the $3,150 mark earlier, reaching a new all - time high of $3,148.85 per ounce, but then declined due to profit - taking, closing at $3,114.03 per ounce, with a decline of about 0.3%. US President Trump planned to announce on April 2nd that comprehensive tariffs would be imposed on countries with which the US has a trade imbalance. This led to a large number of safe - haven buying orders, helping gold prices continue to rise. However, near the end, some bulls took profits in advance.

In terms of the 4 - hour - level trend, it is temporarily in a high - level range - bound oscillation, undergoing repair. Currently, the short - cycle moving averages are basically in a state of adhesion and flattening, suggesting that the trend is likely to remain in a high - level oscillation and repair within the day.

The 1 - hour moving averages of gold still show a bullish arrangement with a golden cross pointing upward. Although gold has broken below the moving average support, the strength of the bullish rebound of gold is still relatively strong. Coupled with the support of gold's safe - haven property, the bulls still have the upper hand. As long as the price does not break below $3,100, the bullish view remains unchanged. For intraday operations, it is recommended to focus on buying on dips. Pay attention to whether the support at yesterday's low of $3,100 holds. In the short term, pay attention to the resistance at $3,140 - $3,150 above.

XAUUSD

buy@3100-3110

tp:3130-3140-3150

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Weekly Swing Trade Setup (Targeting New Highs)

Entry 2990

Last week's price action in XAUUSD was dramatic. Initial surges, driven by tariff announcements, propelled the pair to record highs. However, this was followed by a significant correction, leaving the market in a state of uncertainty as we enter the new week.

Considering the current market context (tariff implications, upcoming US economic data, central bank commentary) and the potential for continued volatility, this swing trade idea is indeed ambitious.

The Core Strategy:

We are anticipating a further decline in XAUUSD to a major support level. The key to this trade will be observing a strong rejection at this support, indicating renewed buying pressure. The ultimate goal is to capitalize on this potential rebound and ride the momentum towards making new all-time highs.

Key Considerations for the Coming Week:

Identify the Major Support Level: Pinpointing this level is crucial. It could be a significant previous swing low, a key Fibonacci retracement level, or a strong psychological barrier. Careful technical analysis is required to determine the most probable zone.

Confirmation of Rejection: We will be looking for clear bullish price action at the identified support. This could include bullish candlestick patterns (e.g., engulfing bar, pin bar), positive divergence on momentum indicators, or a break of a short-term downtrend line.

Risk Management: Given the ambition of targeting new all-time highs after a significant correction, robust risk management is paramount. This includes setting a well-defined stop-loss order below the identified support level to protect capital in case the rejection doesn't materialize. Position sizing should also be carefully considered.

Potential Catalysts: Be aware of the upcoming economic data and central bank commentary, as these events could significantly impact price action and either support or invalidate this trade idea.

Patience is Key: This is a swing trade, and the anticipated move may take time to develop. Avoid premature entry and wait for clear confirmation of the rejection at the support level.

In essence, this is a contrarian swing trade based on the expectation that the underlying bullish drivers for gold will reassert themselves after the recent correction. We are aiming to buy low at a significant support level with the high-conviction target of reaching new all-time highs.

Disclaimer: This is a potential trade setup idea and not financial advice. Trading Forex involves significant risk, and you could lose your capital. Conduct thorough research and analysis before making any trading decisions.

Gold (XAUUSD) – Technical Analysis for April 7, 2025 (1H)After a sharp drop, price reached the key demand zone around 3025-3030. This area forms a potential buy zone from which a rebound toward 3080–3100 may occur. The chart suggests a possible W-shaped recovery. A breakout above 3100 could unlock further upside toward 3127 and then resistance at 3167.

However, a breakdown below 3015–3020 could increase bearish pressure and lead to a decline toward 2997 support. Indicators are showing signs of local oversold conditions, hinting at potential technical recovery.

Main scenario – reversal from 3025-3030 with a move toward 3080–3100.

Alternative – breakdown to 2997.

Gold (XAUUSD) Bullish Reversal Setup – FVG Entry to EMA 200 ResiThis chart shows a potential bullish setup for Gold (XAUUSD) on the 15-minute timeframe, with some key technical elements and a projected trade idea. Here's a breakdown of the analysis:

1. Current Market Overview

Price: Trading around $3,038.51.

Trend: Recent downtrend followed by a minor recovery.

Indicators:

EMA 200 (Blue): Currently at $3,090.41, acting as a dynamic resistance.

EMA 30 (Red): Positioned below the EMA 200, indicating a still bearish trend but with potential for a pullback.

2. Key Zones & Labels

Limit Entry Zone: Highlighted around $3,025.72 (bottom purple zone)

Labeled as “LIMIT ENTRY”, indicating a potential buy entry.

This area corresponds with a fair value gap (fvg) — often used in smart money concepts as a sign of institutional interest.

Target Zone: Around $3,082.22 (top purple zone)

Labeled as “target point EA”.

Lies just below the EMA 200 resistance level, which is a likely take-profit area for a bullish move.

3. Projected Price Action

A possible bullish retracement is anticipated:

Dip into the limit entry/fvg zone at ~$3,025.

Then, a rally targeting the $3,082 zone, possibly extending toward the EMA 200 at ~$3,090.

4. Trade Setup (Based on the Chart)

Entry: Around $3,025.72 (limit buy)

Target: Between $3,082.22 - $3,090.41

Risk: Likely below the FVG zone (~$3,015–$3,020), depending on risk appetite.

Conclusion

This is a smart money concept-based setup anticipating a liquidity grab or fair value gap fill before a bullish move. The trade aims for a reversal at a key demand zone, with confirmation from EMA confluence above as a profit target.

Would you like help plotting stop-loss levels or analyzing the risk/reward ratio?

Gold Prices Hover Near Record Highs Ahead of Trump’s TariffGold Prices Hover Near Record Highs Ahead of Trump’s Tariff Announcement

As shown on the XAU/USD chart today, gold prices are fluctuating near their all-time high, set when the price of an ounce surpassed $3,140 for the first time in history.

Gold has risen by approximately 19% in the first three months of 2025.

Why Is Gold Rising?

On 2 April, traders' sentiment is driving gold prices higher in anticipation of US President Trump’s tariff announcements, expected later this evening.

This event enhances gold’s appeal as a safe-haven asset, as concerns grow that Trump’s aggressive trade policies could slow global economic growth and fuel inflation.

Additionally, media reports highlight strong demand for gold from central banks, while exchange-traded funds linked to the precious metal are seeing capital inflows from investors concerned about geopolitical uncertainty.

Technical Analysis of XAU/USD

Gold price movements have formed two ascending channels in 2025: a broader blue channel and a steeper purple channel.

Notably, gold is currently trading near the midpoints of both channels, indicating that supply and demand may have reached equilibrium after buyers broke through resistance around $3,088 (marked by an arrow).

It is likely that XAU/USD will exhibit low volatility until news about Trump’s tariffs emerges. This could trigger sharp price movements, with a potential test of the purple channel’s boundaries in the near future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: Gold Crashes As Trade War EscalatesMarket Analysis: Gold Crashes As Trade War Escalates

Gold price started a fresh decline below $3,050.

Important Takeaways for Gold Price Analysis Today

- Gold price climbed higher toward the $3,150 zone before there was a sharp decline against the US Dollar.

- A key bearish trend line is forming with resistance near $3,068 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price climbed above the $3,050 resistance. The price even spiked above $3,150 before the bears appeared.

A high was formed near $3,167 before there was a fresh decline. There was a move below the $3,100 support level. The bears even pushed the price below the $3,000 support and the 50-hour simple moving average.

It tested the $2,970 zone. A low is formed near $2,970 and the price is now showing bearish signs. There was a minor recovery wave above the 23.6% Fib retracement level of the downward move from the $3,167 swing high to the $2,970 low.

However, the bears are active below $3,050. Immediate resistance is near $3,040. The next major resistance is near the $3,068 zone and a key bearish trend line. It is close to the 50% Fib retracement level of the downward move from the $3,167 swing high to the $2,970 low.

The main resistance could be $3,135, above which the price could test the $3,165 resistance. The next major resistance is $3,200.

An upside break above the $3,200 resistance could send Gold price toward $3,250. Any more gains may perhaps set the pace for an increase toward the $3,320 level. Initial support on the downside is near the $3,000 level.

The first major support is near the $2,970 level. If there is a downside break below the $2,970 support, the price might decline further. In the stated case, the price might drop toward the $2,950 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.