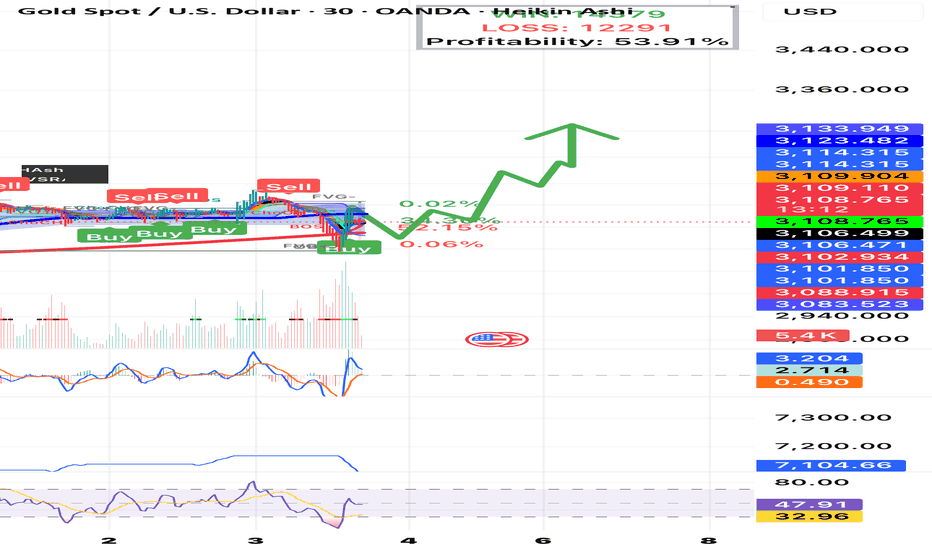

How does tariff gold work?At the 4-hour level, the current market is shrinking and oscillating at a high level. The K-line is running above the middle track, and the oscillating and strong trend is maintained above the middle track. Focus on the 3100 support break. Only when it breaks below 3100 will the downward space be opened. There can be more at 3080-3060 below, and only when it stands above 3135 can it further hit a new high. Before the data, continue to see range oscillation, the small range is 3110-3135, and the large range is 3100-3150. In the short term, you can quickly enter and exit in the small range with high altitude and low long.

GOLD.PRO.OTMS trade ideas

GOLD (XAUUSD): Updated Support & Resistance Analysis

Here is my latest structure analysis for Gold for next week.

Support 1: 2997 - 3015 area

Support 2: 2952 - 2955 area

Support 3: 2916 - 2933 area

Support 4: 2880 - 2890 area

Support 5: 2832 - 2858 area

Resistance 1: 3136 - 3167 area

Consider these structures for pullback/breakout trading next week.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAUUSD): Detailed Support Resistance Analysis

Here is my latest structure analysis for Gold.

Vertical Structures

Vertical Support 1: Rising trend line

Horizontal Structures:

Resistance 1: 3149 - 3151 area

Support 1: 3099 - 3104 area

Support 2: 3048 - 3057 area

Support 3: 3024 - 3036 area

Support 4: 2997 - 3001 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold's decline is difficult to stop under the impact of tariffsGold is currently in the fourth trading day of decline and adjustment. Although there is a rebound, the 1-hour moving average is still in a downward dead cross short arrangement, and the short volume has not decreased, indicating that the short-term short trend is still continuing. Gold prices are also trying to recover lost ground after falling, but the rebound is weak. The bottom signal has not been confirmed yet. At present, given the obvious short trend, Xu Gucheng recommends rebounding shorts as the main, and callback longs as the auxiliary, and pay close attention to the upper 3025-3030 resistance and the lower 2956-2950 support.

Operation strategy 1: It is recommended to go short at 3025-3030 on the rebound, stop loss at 3040, and the target is 3000-2970. If it breaks, it will be 2050.

Operation strategy 2: It is recommended to go long at 3000-2994 on the pullback, stop loss at 2988, and the target is 3020-3030.

XAUUSD breakdown?XAUUSD possibly break below as market opened with gap and the price started to drop from the most important level. Past week with NFP price has rejected with a head & shoulder formation and signaling possible change of trend. In a way price is moving it may respect 3051.00 level and may continue to drop for possible long term change of trend.

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3090 and a gap below at 3074. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3090

EMA5 CROSS AND LOCK ABOVE 3090 WILL OPEN THE FOLLOWING BULLISH TARGET

3103

EMA5 CROSS AND LOCK ABOVE 3103 WILL OPEN THE FOLLOWING BULLISH TARGET

3117

EMA5 CROSS AND LOCK ABOVE 3117 WILL OPEN THE FOLLOWING BULLISH TARGET

3128

BEARISH TARGETS

3074

EMA5 CROSS AND LOCK BELOW 3074 WILL OPEN THE FOLLOWING BEARISH TARGET

3055

EMA5 CROSS AND LOCK BELOW 3055 WILL OPEN THE FOLLOWING BEARISH TARGET

3039

EMA5 CROSS AND LOCK BELOW 3039 WILL OPEN THE FOLLOWING BEARISH TARGET

3020

EMA5 CROSS AND LOCK BELOW 3020 WILL OPEN THE SWING RANGE

SWING RANGE

2999 - 2985

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD continues to fall sharplyHello everyone, it’s great to see you again in our discussion about gold prices today.

Last night, gold prices dropped sharply as investors took profits, U.S. bond yields rose, the USD strengthened, and gold plummeted. At one point, gold even touched the level of 2,955 USD; however, it quickly adjusted to limit the decline, although it has not yet managed to revive the trend.

At the time of writing, XAUUSD is moving around the 3,006 USD mark, achieving a recovery of over 200 pips. Accordingly, technical analysis shows that gold is forming waves according to Dow theory, with the correction target aimed at the 0.618 - 0.5 Fibonacci area before sellers regain control, as the current environment still puts gold at a disadvantage.

Gold market trend analysisGold risk aversion pushed up gold prices, but the bulls failed to continue, and gold prices fell after rising. From a technical perspective, the 4-hour gold price remained above the moving average, and the bullish trend remained unchanged. Structurally, the rise in gold prices was symmetrical in time and space, and the early decline was in line with expectations. The hourly chart showed a weak bearish signal and diverged. The upper resistance is currently at 3137-3141, and the lower support is at 3111-3106. In terms of operation, I suggest that the callback is mainly long, and the rebound is supplemented by high short.

Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3092, and the target is 3130-3150.

Operation strategy 2: It is recommended to sell at 3139-3144, stop loss at 3150, and the target is 3120-3105.

GOLD: Long Trade Explained

GOLD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry Point - 3006.4

Stop Loss - 2998.0

Take Profit - 3024.8

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD Is Bullish! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 3,128.13.

The above observations make me that the market will inevitably achieve 3,167.36 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GOLD My Opinion! SELL!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 3007.7

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2993.1

Recommended Stop Loss - 3015.5

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

THE KOG REPORT THE KOG REPORT:

Last week’s KOG Report worked well with us getting a pip perfect performance on the idea from gold, going up, coming down and although stopping short on the way down, still giving us a fantastic capture. We then went on to complete all of our bias target levels ending the week and potentially the month with a mammoth result not only on the captures, but also the targets completed.

So, what can we expect in the week ahead:

Simple one this week, support stands at the 3075 level which will need to break to go lower, and resistance stands at the 3090-95 region with extension of the move into 3097. We’re only looking for one move to start the week, support holding, if it does, we’ll look higher for resistance to give us a RIP and a potential short.

On the flip, if we break upside, we’ll should see support turn to 3085 with immediate target above 3010. We’ll consider that if it happens, otherwise, too high to consider going long into the psychological level. Please also remember, it’s the last trading day of the month and the quarter tomorrow, so ideally, we want to see how it plays out and the long-term candles close.

We’ll share the bias levels during the course of the week.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Hanzo | Gold 15 min Breaks – Will Confirm the Next Move🆚 Gold

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bullish Setup After Break Out – 3008 Zone

Price must break liquidity with high volume to confirm the move.

☄️ Bullish Setup After Break Out – 3060 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 3059

Key Level / Equal lows Formation - 3014

Strong Rejection from 3014 – The Ultimate Pivot

Strong Rejection from 3060 – The Ultimate Pivot

Strong Rejection from 3082 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 3055 – Liquidity Engineered

Twin Wicks @ 3060 – Liquidity Engineered

Twin Wicks @ 3014 zone – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 3 Apr 2025 – Bullish Retest 3054

💯 27 march 2025 – Bullish Retest / Spike 3054

💯 26 March 2025 – Liquidity Grab Range 3016 : 3010

👌 The Market Has Spoken – Are You Ready to Strike?

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

This is a continuation update from last week, which is playing out perfectly clearing first our Bearish target followed with all our Bullish targets with ema5 lock confirmations.

We are now seeing a gap left open at 3089 and will need ema5 to cross and lock above this level for a continuation into the next level. Failure to lock will see price reject into the lower Goldturns for bounces or further cross and locks below the levels to open the levels below.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3045 - DONE

EMA5 CROSS AND LOCK ABOVE 3045 WILL OPEN THE FOLLOWING BULLISH TARGET

3067 - DONE

EMA5 CROSS AND LOCK ABOVE 3067 WILL OPEN THE FOLLOWING BULLISH TARGET

3089

EMA5 CROSS AND LOCK ABOVE 3089 WILL OPEN THE FOLLOWING BULLISH TARGET

3114

BEARISH TARGETS

3018

EMA5 CROSS AND LOCK BELOW 3018 WILL OPEN THE FOLLOWING BEARISH TARGET

2985

EMA5 CROSS AND LOCK BELOW 2985 WILL OPEN THE SWING RANGE

SWING RANGE

2947 - 2918

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 2772.38 is broken.

OANDA:XAUUSD TVC:GOLD

Technical analysis:

A trough is formed in daily chart at 2832.55 on 02/28/2025, so more gains to resistance(s) 3100.00, 3150.00, 3200.00 and more heights is expected.

Take Profits:

2833.00

2879.11

2955.00

3000.00

3057.40

3100.00

3150.00

3200.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

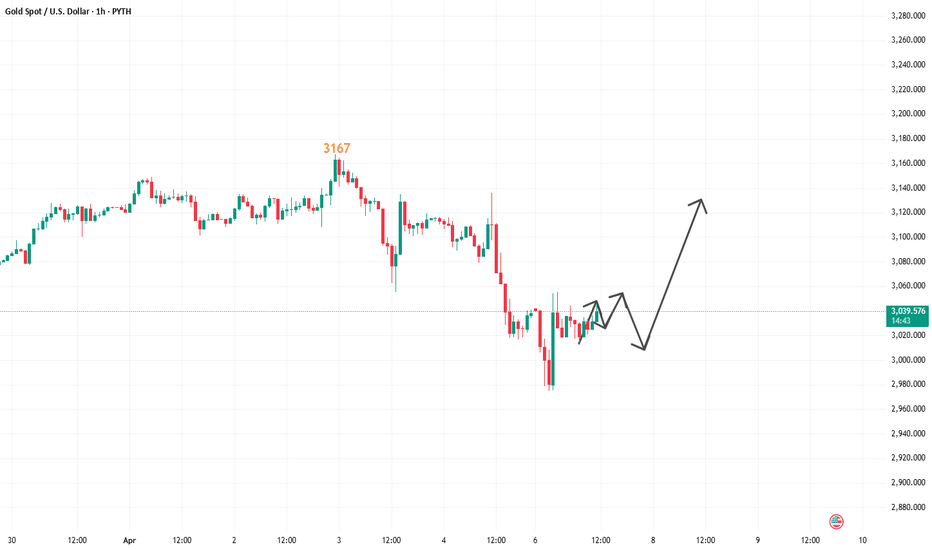

Gold (XAU/USD) Short-Term Bullish Channel with Target at 3030This 15-minute chart of Gold (XAU/USD) shows a bullish breakout from a descending wedge followed by the formation of an ascending channel. The price is currently trading around $3,008.06 and is trending upward within the channel. The analysis projects a potential continuation of the bullish move toward the 3030 resistance level, as indicated by the target label. The overall sentiment appears optimistic in the short term, provided the price holds above the lower channel support.

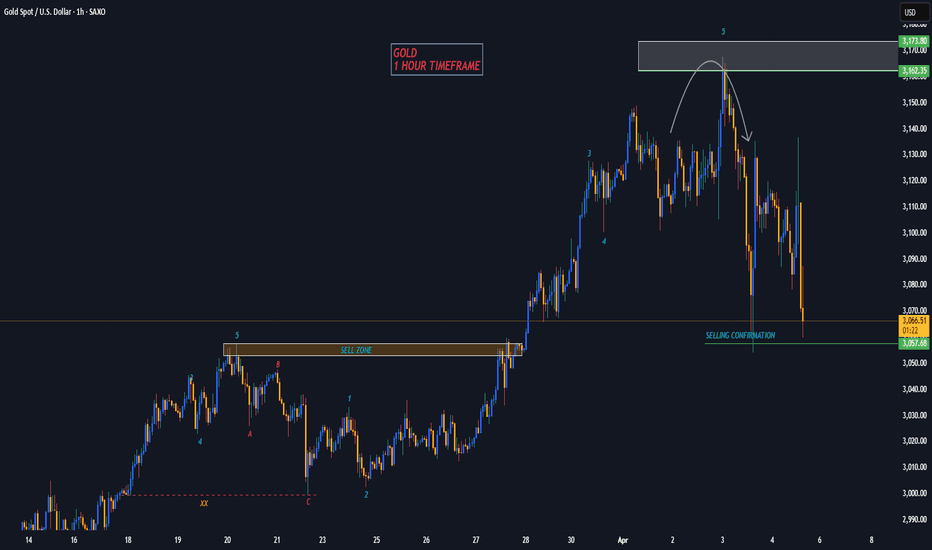

GOLD - 1H UPDATEGold sell running 900+ PIPS in profit, within the Gold Fund for my investors. Price is dropping today again to the downside as we said would happen yesterday.

I'm hoping to get a close below the ‘Selling Confirmation' zone today, so we can get a strong confirmation for a longer term sell off.

XAUUSD 2HDue to the tensions and trade war with the U.S., the price of gold is on the rise. Technically, it is also at a support level, which coincides with a Fibonacci confluence zone.

It is advisable to wait a bit before entering; candlestick confirmations could serve as confirmation for a long trade.

Gold Reclaims Momentum – RSI Enters Overbought TerritoryGold is on fire again, closing at $3,126.45 (+0.38%) and continuing to ride a steep uptrend supported by the 50-day SMA (2,925.58) and a well-respected ascending trendline.

🔹 MACD is trending higher with widening separation – bullish momentum is building again.

🔹 RSI just breached 75.80, putting gold deep into overbought territory.

🔹 No immediate resistance above – price is in discovery mode.

The trend is strong and healthy, but the overbought RSI suggests short-term pullbacks can't be ruled out. Still, buyers remain firmly in control above $3,000.

As long as the trendline holds, gold’s shine won’t fade.

-MW

Gold market trend analysisFrom the perspective of global market performance, after the opening of Monday, the three major U.S. stock index futures all fell sharply, with the Nasdaq futures falling by more than 5.5%, the S&P 500 index and the Dow Jones Industrial Average falling by more than 4.7% and 4% respectively, and crude oil prices also fell below $60 per barrel. Although gold and silver rebounded after a sharp drop, they still could not escape the selling pressure as a whole. The market panic sentiment is quite similar to the outbreak of the new crown epidemic in March 2020. The U.S. tariff policy and the trade war it triggered have caused the biggest disruption crisis in the global supply chain since the epidemic.

In the morning trading today, the gold price once fell sharply to $2971.5, and then quickly rebounded by $84 to a high of $3055, and then fell back to around $3015, which we suggested to go long, and also reached the expected target of $3035. After the early morning plunge, the rebound was strong, but it was still suppressed by two large negative columns on the daily chart, and the overall trend was weak, but the European session continued to rise. The current upper resistance is at $3050-3055, and the lower support is at $3020-3015. The operation suggestion is to go long on the callback, and to go short on the rebound.

Operation strategy 1: It is recommended to go long on the callback of 3007-3000, with a loss of 2093, and the target is 3030-3050.

Operation strategy 2: It is recommended to go short on the rebound of 3058-3063, with a loss of 3070, and the target is 3025-3005.

Gold: covering market lossesFriday's trading session was one of the most painful ones in the recent history of financial markets, surpassing the depression after pandemic lockdown in 2020. The price of gold also pulled back on Friday, around 3%, ending the week at the level of $3.037. Analysts are noting that the sell-off of gold was triggered by investors who were selling this asset in order to cover margin calls from other markets. In addition, there are also fears of trade wars, which started after China imposed a 34% tariffs on all US goods, as a response to US tariffs. Regardless of this short retreat, gold continues to be perceived as a safe-haven asset for investors.

At the start of the week, the price of gold reached a fresh, new all time highest level at $3.160. However, news regarding tariff-war triggered the main sell off on Thursday and Friday, and the price of gold ended the week at $3.037. The RSI reached the clear overbought market side, but ended the week at the level of 54. It still has not entered into the road toward the oversold market side, but there is some probability for this move in the coming period. There has not been much change when MA 50 and MA200 are in question. These lines continue to move as two parallel lines with an uptrend, without any kind of indication over a potential cross.

At this moment, market uncertainty is at its highest level. During the week ahead, any new news regarding tariffs or countermeasures from other countries, will trigger market reaction. Volatility will continue to be high. In case that more investors sell gold in order to respond to margin calls, the price of gold would continue to drop further. However, if markets calm down, there is potential for a modest upside, probably until the level of $3,1K, but this should be taken with a reservation. Market optimism is at its lowest level now, so some significant moves toward the upside should not be expected. At this moment, the price of gold has equal chances for a move toward the up and down side during the week ahead.