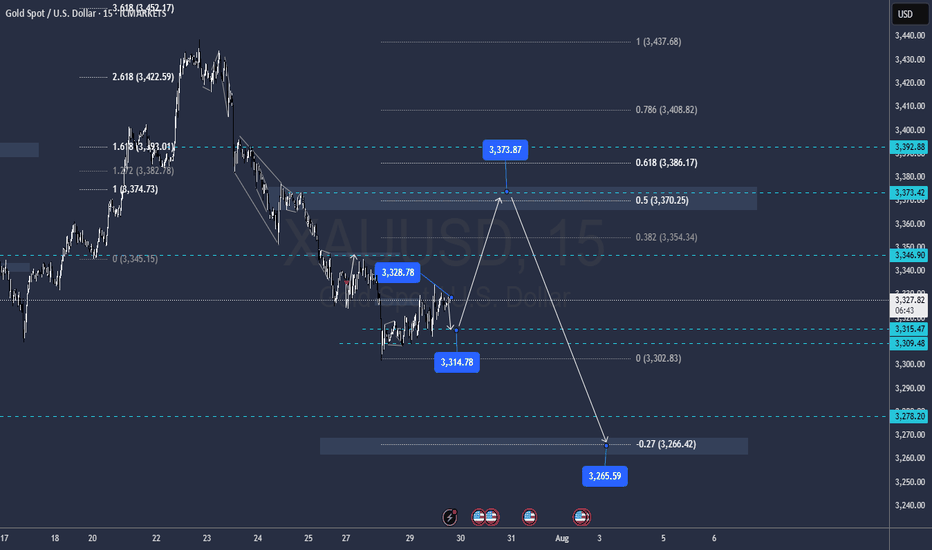

Gold Surges on Weak NFP Hello everyone, what’s your take on XAUUSD?

Gold prices soared at the end of the last session and are now trading around $3,380. This sharp rise followed a weaker-than-expected U.S. Non-Farm Payrolls (NFP) report, which shifted market sentiment toward expectations that the Fed may delay interest rate cuts. As a result, the U.S. dollar weakened and demand for gold as a safe haven surged.

Technically, gold appears to be forming a cup and handle pattern, with the first resistance target at $3,400, followed by $3,435.

What do you think? Could this rally continue? Let us know in the comments!

GOLD trade ideas

10 POWERFUL INVESTING & TRADING QUOTES OF ALL TIME

Here are powerful quotes of professional traders, investors and experts in financial markets.

Let their words inspire you and help you in your trading journey.

"To succeed in the market, you must learn to think like everyone else and do the opposite." - Sir John Templeton 📈💭💡

"The four most dangerous words in investing are: 'This time it's different.'" - Sir John Templeton ⏳📉🛑

"The more you learn, the more you earn." - Warren Buffett 📚💰📈

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money." - Victor Sperandeo. 💪💰🚫🧠

"Investing is not about making predictions, it's about having a plan and sticking to it." - Tony Robbins 📊🔄📌

"The best time to buy a stock is when the blood is running in the streets." - Baron Rothschild 💀🔪💰

"The best investment you can make is in yourself." - Warren Buffett 💼💡💰

"The stock market is not a casino; it's a crooked casino." - Charlie Munger 🎰🎲🏛️

"Losses are part of the game. You can't win every trade." - Martin Schwartz. 📉😔💔

"The fundamental law of investing is the uncertainty of the future." - Peter Bernstein. ⚖️❓🔮

The More I trade, the more I realize how precise and meaningful are these phrases. Take them seriously, and they will help you achieve the financial success.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SMART MONEY CONCEPT (SMC)Bearish Analysis – Market Structure

1: Market Context

• The price was coming from a strong bullish structure that had already mitigated the last remaining interest in the 4H OB.

• A key resistance zone was formed where institutional investors closed buy orders.

• The bullish momentum left a Fair Value Gap in 1H, which has not yet been mitigated.

2: Shift Signals

• A fake out (false breakout) was observed above the resistance, followed by a Change of Character (Choch).

• This indicates liquidity absorption and the possible start of a bearish phase.

• Distribution structure confirmed before the bearish momentum.

3:Entry Plan and Target

• Entry (Sell): In the upper zone after the 4H OB retest/resistance.

• Stop Loss: Above the fake out wick (invalidation zone).

• Take Profit: Around 3305, seeking to mitigate the FVG-1H and reach the previous support zone.

• RR: High (favorable for swing or scalping with partials).

4:Confirmation and Management

• Wait for confirmation on a lower timeframe (5M / 1M) before executing the entry.

• Watch for a possible last liquidity grab before falling.

• Manage with partials and move the SL to BE when the halfway point is exceeded.

GOOD LUCK TRADERS…

GOLD falls sharply, fundamental analysis and technical positionOANDA:XAUUSD fell sharply below the $3,300/oz price level as Chairman Jerome Powell did not signal any rate cuts at his next press conference on September 16-17. He only said that “no decision has been made on September” and that “more data will be evaluated in the coming months.” Economic data undermined the case for a rate cut, while geopolitical play remained a potential support.

The Fed and Interest Rates

The Federal Reserve kept interest rates unchanged for a fifth straight meeting on Wednesday, defying persistent pressure from President Donald Trump and White House officials.

However, two members of the central bank's board dissented, a rare move in three decades that underscored growing divisions within the central bank over the impact of Trump's tariff policies.

At the meeting, the Fed kept its benchmark federal funds rate in a range of 4.25% to 4.5%, in line with policy through 2025. Last fall, the Fed cut rates by a total of 100 basis points.

However, Federal Reserve Board Governors Christopher Waller and Michelle Bowman opposed cutting interest rates by another 25 basis points, marking the first time since Alan Greenspan in 1993 that two board members have opposed a majority resolution at a meeting.

At the press conference, Chairman Jerome Powell did not signal a rate cut at the next interest rate meeting on September 16-17, saying only that “no decision has been made about September” and that “more data will be evaluated in the coming months.” Powell also noted that despite Trump’s call for a sharp 3% rate cut to reduce interest costs on US debt and stimulate the housing market, the Fed will continue to monitor the longer-term impact of tariffs on the path of inflation and economic recovery.

Market expectations for a Fed rate cut in September fell to 47% in Powell's speech.

Economic data

ADP jobs data beats expectations and is bearish

US ADP payrolls jumped 104,000 in July, beating market expectations of 75,000 and marking the biggest gain since March. The data showed continued strength in the labor market, reinforcing the Federal Reserve’s stance on keeping interest rates high. Meanwhile, the preliminary estimate of annual GDP growth in the second quarter came in at 3% (2.4% expected), and the core personal consumption expenditures price index rose 2.5% year-on-year (2.3% expected), indicating both economic resilience and inflation stability, further weakening expectations for a rate cut.

Keep an eye on the ISM manufacturing PMI and non-farm payrolls data on August 1. If the jobs numbers continue to be strong, this could reinforce the Fed’s dovish stance.

Geopolitical and Policy Plays

News of a 90-day extension of the US-China tariff deal has eased some safe-haven demand, but Trump’s August 8 deadline for a new Russia-Ukraine deal, coupled with tensions in the Middle East, continue to provide potential support for gold.

Continued purchases by central banks (such as China and India) are a positive signal in the medium to long term, but are unlikely to offset short-term pressure from the Federal Reserve’s policies.

Technical outlook for OANDA:XAUUSD

On the daily chart, gold has been sold below the $3,300 level and now the $3,300 level has become the nearest resistance at present. For now, gold will be limited by the area of the 0.382% Fibonacci retracement with the original price point of $3,300, along with that it has formed a short-term downtrend with the price channel, the next target will be around $3,246 in the short term followed by the Fibonacci retracement level noted with readers in previous publications.

On the momentum front, the Relative Strength Index is operating below 50 and is far from the oversold zone (20-0), indicating that there is still plenty of room for downside ahead.

In addition, the gold trend will also be pressured by the EMA21, as long as gold remains below the EMA21, the current technical conditions continue to favor the downside.

For the day, the technical outlook for gold is bearish with notable positions listed as follows.

Support: 3,246 – 3,228 USD

Resistance: 3,300 USD

SELL XAUUSD PRICE 3345 - 3343⚡️

↠↠ Stop Loss 3349

→Take Profit 1 3337

↨

→Take Profit 2 3331

BUY XAUUSD PRICE 3240 - 3242⚡️

↠↠ Stop Loss 3236

→Take Profit 1 3248

↨

→Take Profit 2 3254

Crystal Ball Forecast for Gold (XAUUSD)🔮 Crystal Ball Forecast for Gold (XAUUSD)

Current Price: 3372

Medium-Term Direction: 🔻 DOWN

✅ My Forecast: GOLD WILL GO DOWN from 3372

🔍 Why? (Technical Reasons Supporting Bearish Outlook)

1. Gann Price Vibration (From recent high ~3385)

3372 = 45° level – key resistance level

Price rejected at 3375–3385 zone multiple times

If 3375 holds as resistance, next vibration levels:

3335 (Gann 45° down)

3284 (Gann 90° down)

3250 (Gann 120° down)

2. Elliott Wave

Looks like Wave 5 (ending diagonal) completed at 3385

Current price at 3372 = classic "after top" trap zone

Next structure likely forming ABC correction or new bearish impulse

Projection:

Wave A → 3335

Wave C → 3280–3250

3. Price Action + Candle Behavior

Strong upper wicks around 3375–3380

Lower highs forming = distribution pattern

MACD & RSI divergence visible on 4H/1D

📉 Medium-Term Bearish Targets

Target Price Reason

3335 Gann 45° down, Wave A low

3284 Gann 90° down, Wave C

3250 Gann 120°, Cycle

3183 Gann 180°, major support

📌 Summary Forecast

✳️ Gold is topping out.

✳️ Bearish move toward 3280–3250 is highly likely.

✳️ Best entry = on rejection from 3375–3380 zone

✳️ Stop = above 3390

✳️ Hold short for 2–3 weeks or until target reached

XAUUSD (GOLD): Wait For The BOS! FOMC and NFP Looms!In this Weekly Market Forecast, we will analyze the Gold (XAUUSD) for the week of July 28 - June 1st.

Gold is in the middle of a consolidation. Bas time to look for new entries!

FOMC on Wednesday and NFP on Friday. Potential news drivers to move price in a decisive direction!

Wait for a break of structure (BOS) either direction before entering a new trade.

Be mindful that the Monthly is bullish, and the Weekly is neutral.

The Daily is bearish, with 3 days of data indicating so. I am leaning towards this bias, as the draws on liquidity are near and obvious.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Gold (XAU/USD) - Market Structure Analysis Points to Next MoveThe provided 4-hour chart for Gold (XAU/USD) displays a market structure analysis incorporating concepts like Break of Structure (BOS), Change of Character (CHoCH), Fair Value Gaps (FVG), and defined support and target (resistance) levels. The price has shown a recent bullish trend, marked by higher highs and higher lows, confirmed by BOS signals. Currently, the price is consolidating around the 1st support level after reacting to a FVG.

Current Position: Consolidating around the 1st support level (approximately $3,365.028 - $3,353.094).

Support Levels:

1st support: Immediate support zone.

2nd support: Lower support zone ($3,328.619 - $3,320.000).

GL Zone & Support Zone: Confluence of a Golden Level and support ($3,299.096 - $3,290.067).

MAJOR SUP ZONE: Significant historical support area ($3,280.000 - $3,273.685).

Resistance Levels (Targets):

1st TG: Target/resistance zone ($3,392.891 - $3,402.807), containing a FVG.

2nd TG: Higher target/resistance zone ($3,413.659 - $3,423.805), also containing a FVG.

Market Structure: Evident bullish market structure with BOS confirmations, although a recent CHoCH suggests a potential shift or at least a temporary pause in the aggressive uptrend. Multiple FVGs indicate areas where price might find support or resistance.

Potential Trading Scenarios

Bullish Continuation: If the price respects the 1st support level and moves to fill the lower FVG within the 1st TG, a long opportunity could arise targeting the 2nd TG. Confirmation would be a break above the upper boundary of the 1st TG.

Bearish Retracement: If the 1st support fails to hold, the price could retrace towards the 2nd support level. A break below the 1st support and a failure to hold the FVG within the 1st TG would signal this scenario.

Range Trading: The price could consolidate between the 1st support and 1st TG levels, offering short-term trading opportunities within this range.

Explanation of Specific Elements

BOS (Break of Structure): Indicates a continuation of the current trend. A bullish BOS occurs when the price makes a higher high, confirming the uptrend.

CHoCH (Change of Character): Suggests a potential shift in the market's behavior. A bearish CHoCH after a bullish trend might indicate weakening buying pressure and a possibility of a reversal or a significant pullback.

FVG (Fair Value Gap): Represents an inefficiency in the market where there were aggressive price movements with less trading volume on one side. These gaps can act as future support or resistance levels as the market often tries to fill them.

Support Levels: Price levels where buying pressure is expected to outweigh selling pressure, potentially halting a downtrend.

Target/Resistance Levels (TG): Price levels where selling pressure is expected to outweigh buying pressure, potentially halting an uptrend.

GL Zone & Support Zone (Golden Level): This likely refers to a support level coinciding with a Fibonacci Golden Ratio level, often considered a high-probability reversal zone.

MAJOR SUP ZONE: A significant historical support level where strong buying interest has been seen in the past.

TradingView "Publish Idea" Post Based on the Chart

Title: Gold (XAU/USD) - Bullish Structure Consolidating at Support with Breakout Potential

Analysis:

Gold (XAU/USD) on the 4-hour timeframe shows a clear bullish market structure confirmed by multiple Breaks of Structure (BOS). After a strong upward move, the price is currently consolidating around the 1st support level ($3,365.028 - $3,353.094), which also aligns with a Fair Value Gap (FVG).

The presence of a recent Change of Character (CHoCH) suggests that the aggressive bullish momentum might have temporarily subsided, and we could be seeing a period of accumulation before the next move. The price action within the FVG near the 1st TG ($3,392.891 - $3,402.807) will be crucial.

Potential Scenarios & Trading Plan:

Bullish Continuation: If the 1st support holds and the price breaks above the upper boundary of the FVG within the 1st TG, it would signal a likely continuation of the bullish trend.

Long Entry: Upon a confirmed breakout above $3,402.807.

Target 1: The 2nd TG zone ($3,413.659 - $3,423.805), which also contains a FVG.

Stop Loss: Place below the 1st support level (e.g., below $3,353.000) to manage risk.

Bearish Retracement: Failure to hold the 1st support could lead to a deeper retracement.

Short Entry: On a confirmed break below $3,353.000.

Target 1: The 2nd support zone ($3,328.619 - $3,320.000).

Stop Loss: Place above the 1st support level.

Key Levels to Watch:

Support: $3,365.028 - $3,353.094, $3,328.619 - $3,320.000, $3,299.096 - $3,290.067.

Resistance (Targets): $3,392.891 - $3,402.807, $3,413.659 - $3,423.805.

XAUUSD August 2025 Monthly OutlookWelcome to August — and welcome to the top of the macro ladder. Gold is not just rising. It’s rewriting structure.

🔸 Macro & Fundamentals

Gold opens August with a fresh impulsive breakout above $3360, fuelled by a weaker USD, rising global risk sentiment, and continued speculative positioning from institutional buyers. The upcoming Jackson Hole meeting and shifting Federal Reserve expectations create the perfect climate for volatility. All eyes are now on the premium structure top — but will gold expand beyond it or retrace to refill?

🔸 Monthly Trend & Bias (HTF Overview)

🔹 Structure: Clean bullish BOS, continuation leg in progress

🔹 Last CHoCH: April 2023 → Confirmed full trend shift bullish

🔹 Current Monthly Candle: Explosive push into supply with top wick rejection beginning to show

🔹 Bias: Still bullish but in extreme premium — watch for cooling/rebalancing

🔸 EMA Structure

| EMA Type | Status | Signal |

| ----------- | -------------- | ------------------------------------- |

| EMA 5 / 21 | Strong Bullish | Dynamic expansion, steep angle upward

| EMA 50 | Below | Clean breakout from range

| EMA 100/200 | Far below | Long-term uptrend deeply intact

🔸 Key HTF Levels (Wick-to-Wick Mapping)

Zone Type Price Range Confluences

🔴 Premium Supply 3350 – 3439 Monthly FVG + Wick exhaustion + RSI 80+

🔵 Bullish Imbalance 3180 – 3270 Monthly FVG + old BOS + EMA5 baseline

🔵 Mid-Level Support 2920 – 3000 Monthly OB + FVG + structure base

🔵 Deep Demand 2670 – 2780 HTF equilibrium zone + RSI support

✅ The current candle has pierced into the final wick supply, but with clear signs of loss in momentum.

⚠️ If 3439 breaks cleanly, next expansion zone opens toward 3505 → 3610 (Fibonacci projection). Otherwise, expect cooling to 3270–3180 first.

🔸 Fibonacci Context

🔻 Swing Low: 1810

🔺 Swing High: 3439

🎯 Current price ($3363) sits just below the 100% Fibonacci projection, with the 1.272 and 1.618 extensions at 3610 and 3740.

This confirms we are in a macro premium, and any long positions from here forward must be built only on strong LTF confirmation or clean pullbacks into value.

🔸 August Scenarios

🟢 Scenario 1 – Breakout + Price Discovery

If bulls break 3439 with strong volume and close:

New leg toward 3505 → 3610 opens

Watch for LTF continuation on H4–D1 with bullish OB reentry

Only valid if 3350 holds as new support

🔻 Scenario 2 – Rejection + Healthy Pullback

If price holds below 3439 and monthly wick exhausts:

Clean retracement toward 3270 → 3180 expected

EMA5/21 rebalancing will support bullish structure

Deeper rejection could retest 3070 zone if volatility spikes

🔸 Conclusion & Action Plan

We open August fully inside the last monthly supply zone. Trend is still bullish, but RSI, FVGs, and EMA distance warn us: this is not the time to chase — it’s time to wait for structure to speak.

📌 Key pivot = 3439.

Above it → Expansion.

Below it → Retracement.

Let August unfold — but stay sharp. The next big move will be born from this compression.

—

What’s your take — are we just getting started or about to cool off?

Drop your thoughts, chart it out, and stay ready for what August brings. ⚔️

—

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

With clarity, confidence, and control,

GoldFxMinds

Gold trend analysis!From the price level of 3368 and above, gold is expected to pull back at least until the Stochastic on the M30–H1 timeframes reaches oversold levels.

After that, a bullish continuation is likely, pushing the price up to around 3400.

This area will be a critical decision point — determining whether the market will continue its uptrend or reverse into a downtrend.

If the H4 chart prints a reversal candlestick pattern, it would indicate the beginning of a bearish trend, which could potentially lead to a downward movement of up to 20,000 points.

Bullish bounce off?The Gold (XAU/USD) has bounced off the pivot, which acts as a multi-swing low support and could rise to the 1st resistance, which is slightly below the 50% Fibonacci retracement.

Pivot: 3,310.45

1st Support: 3,288.74

1st Resistance: 3,362.86

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential Reversal After Complex CorrectionThe current movement of gold (XAUUSD) is estimated to be forming part of wave ii of wave (c) of wave under the black label scenario. This implies that XAUUSD has the potential to undergo a deeper correction, targeting the 3,073–3,184 range.

However, under the alternative red label, the price action appears to be developing a triangle pattern as part of wave of wave 4. In this scenario, XAUUSD still holds the potential for further upside toward the 3,394–3,438 area, which also coincides with a Fibonacci cluster zone, serving as a critical resistance region.

Gold Next Move (Read description). Hello, Traders.

As you saw we have achieved our target at last ideas.

This week gold is running in down trend, today it has touched the price 3268 and then gold pumped.

As you see guys, gold has breakout the last support area and its support became resistance.

Gold has changed the character according to H1 and there is break of structure (BOS).

The trend is bearish, so gold needs to fall, it can fall till 3351.

Comment positive feedbacks, Thanks.

GOLD awaiting confirmation of a bullish zone formation.Gold has confirmed support at 3310, with the price rebounding and returning to the buying side. We are now awaiting confirmation of a bullish zone formation.

Gold remains under pressure ahead of key market-moving events, including the US GDP data release and the Federal Reserve’s interest rate decision. However, the pause in Dollar strength is offering some support to the gold price. As long as the price holds above this level, the bullish scenario remains valid. A sustained move above this zone may open the path toward the next resistances: 3360 / 3385 we can expect Growth more.

You May find more Details in the Chart.

Trade wisely best of Luck Buddies.

Ps: Support with like and comments for more insights Thanks for Supporting.

GOLD BUY TRADE IDEA🟡 XAU/USD Smart Money Setup – July 31, 2025

🔍 Key Technical Highlights:

• Demand Zone Entry:

• Price has tapped into a clear demand zone (gray box) around 3,274 – 3,290, signaling potential institutional accumulation.

• The previous inducement low has been swept, aligning with Smart Money Concepts (SMC).

• Liquidity Engineering:

• Equal highs (liquidity pool) visible from late June remain uncollected — a prime upside target.

• Price structure shows internal BOS, suggesting a shift in market sentiment.

• Expected Path:

• A potential multi-leg bullish move is mapped out, targeting the 3,440+ premium zone, completing imbalance fill and stop-run above highs.

• Risk-Reward:

• Stop loss sits just below the demand zone (~3,274), maintaining a favorable risk-to-reward ratio.

⸻

🧠 Smart Money Flow Narrative:

1. Sweep of inducement lows triggers institutional entries.

2. Demand zone holds with bullish reaction — confirmation of intent.

3. Expect higher highs and a rally toward uncollected liquidity above 3,440.

4. Low-risk buy opportunity for both swing and intraday traders.

XAUUSD Update 03 Augt 2025 BOUNCINGAs we knew on last weekend, price has bounced from 3267 level. It wont touch 3245-50 as a support.

From this reaction, we will follow on this week, is the price will break 3378 resistance ?

Is the price will retest 3400 level again and again ?

And if it so, it seemlikes a bullish momentum.

Just becarefull, waiting for the price make a correction first.

Have a blessing week ahead !

After data shock, GOLD has bullish conditions againOANDA:XAUUSD rose more than 2% on Friday, hitting a one-week high, as weaker-than-expected U.S. non-farm payrolls data boosted hopes of a Federal Reserve rate cut and the announcement of new tariffs boosted safe-haven demand.

On the economic data front

Gold prices rose more than 2% in U.S. trading on Friday (Aug. 1), hitting a one-week high, as weaker-than-expected U.S. non-farm payrolls data fueled hopes of a Federal Reserve rate cut and safe-haven demand was boosted by the announcement of new tariffs.

The U.S. Department of Labor's Bureau of Labor Statistics reported that nonfarm payrolls increased by just 73,000 jobs in July, well below market expectations of 110,000. June's data was revised down to just 14,000, indicating a significant slowdown in job growth. The unemployment rate rose to 4.2%, indicating a cooling labor market.

The jobs data was weaker than expected, but slightly higher than the market's lowest forecast. This increases the likelihood of a rate cut by the Fed later this year. As a non-yielding asset, gold typically performs better in a low-interest-rate environment.

According to CME Group's FedWatch tool, market participants now expect the Federal Reserve to cut rates twice before the end of the year, starting in September. Earlier this week, the Fed held rates steady at 4.25%-4.50%. Chairman Powell said it was too early to determine whether a rate cut would be forthcoming in September, citing inflation and employment data.

On the trade front

Trump has imposed a new round of tariffs on exports from dozens of trading partners, including Canada, Brazil, India and Taiwan, causing a global market crash.

Countries are scrambling to negotiate a better deal. In times of economic and geopolitical uncertainty, safe-haven gold is in high demand.

So far in 2025, gold prices have risen more than $400, hitting a record high of $3,167.57/oz on April 3, driven by safe-haven demand and central bank buying.

Weak jobs data also sent the dollar lower against major currencies, further supporting gold prices as a weaker greenback makes gold more attractive to investors holding other currencies.

Investors' Attention Turns to September FOMC Meeting

Markets are now focused on the September Federal Open Market Committee (FOMC) meeting. Facing the dual pressures of volatile inflation, slowing employment and escalating global trade tensions, the Fed will have to balance its inflation target with economic growth.

Markets are betting on the Fed to begin a new round of easing, and gold, as a hedge against currency devaluation and economic uncertainty, is expected to continue to benefit.

Gold prices have risen more than 30% year-to-date, reflecting the market’s preference for safe-haven assets. If weak U.S. economic data continues in the coming weeks, or if new geopolitical conflicts emerge, gold prices are expected to continue their upward trend, challenging new highs for the year.

Summary, Commentary

Weak employment, new tariffs and a slumping stock market have all contributed to a strong recovery in gold prices. With the possibility of the US Federal Reserve cutting interest rates in September increasing significantly, gold market sentiment has warmed and risk aversion has returned.

Investors will need to keep a close eye on inflation data, Fed officials’ speeches, and whether Trump continues to stoke trade tensions, which could lead to greater volatility in the gold market.

Against the backdrop of the unexpected non-farm payrolls report and moderate inflation, the market has essentially “locked in” the possibility of a rate cut in September, but whether the cut will be 25 or 50 basis points, and whether there will be further rate cuts in the future, will depend on the interaction between the Fed members’ verbal guidance and market expectations.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, affected by the sudden weak data that shocked the market, gold broke most of the technical structure that was leaning towards the downside. Price action was pushed above the EMA21, while the short-term downtrend channel was also broken above and the Relative Strength Index crossed above 50.

These are the initial conditions for a short-term uptrend. But to confirm an uptrend and a new uptrend in the near term, gold needs to continue to break above the 0.236% Fibonacci retracement level (3,371 USD) first, then the target will be around 3,400 USD in the short term.

If gold breaks above $3,400 again, traders should set a new target of $3,430 in the short term, rather than $3,450 which is the all-time high.

Motivationally, the RSI has not reached oversold territory to provide pure reversal support, but it has been pushed by the market shock after the NFP data release, so this rally may not be sustainable in a purely motivational way either.

Overall, gold is now more bullish after a rally on Friday, opening up initial conditions for expectations of a new uptrend. And the notable points will be listed as follows.

Support: 3,323 – 3,310 – 3,300 USD

Resistance: 3,371 – 3,400 – 3,430 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3327 - 3329⚡️

↠↠ Stop Loss 3323

→Take Profit 1 3335

↨

→Take Profit 2 3341