XAU/USD (Gold) - Triangle Breakout (1.08.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 3249

2nd Support – 3225

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD trade ideas

GOLD → Consolidation after the rally...FX:XAUUSD is not falling back after a strong rally, but is consolidating against resistance at 3362.8. Continued high demand could allow the market to strengthen...

The price of gold halted its two-day rally, trading around $3362.8 on Monday morning after weak US employment data. This heightened concerns about the US economy and increased the likelihood of a Fed rate cut in September to 80%.

Additional pressure on the dollar came from the dismissal of BLS chief Erika McAntfer, which raised suspicions of statistics manipulation. Market attention is also focused on US-Canada trade talks, which could affect investor sentiment. Gold is consolidating for now, but its further growth will depend on the dynamics of the dollar and macroeconomic data.

Resistance levels: 3362.8, 3383, 3433

Support levels: 3345, 3334

As the market has now entered a consolidation phase, MM may form a retest of support before a possible rise in order to accumulate liquidity. However, a breakout of resistance at 3362.8 could trigger further growth.

Best regards, Linda!

GOLD ROUTE MAP UPDATEHey Everyone,

This is a follow-up update on our 1H chart and what can I say, another amazing result!

After hitting our bullish target at 3370 earlier this week, we confirmed the EMA5 cross and lock above 3370 confirming 3392, which I continued to highlight and remind as we bought the dips throughout the week. And today, we finally completed 3392 to perfection.

Next, we’ll be watching for an EMA5 lock above 3392 for a potential continuation. If that fails to lock, we may see some range play between 3392 and 3370.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3370 - DONE

EMA5 CROSS AND LOCK ABOVE 3370 WILL OPEN THE FOLLOWING BULLISH TARGETS

3392 - DONE

EMA5 CROSS AND LOCK ABOVE 3392 WILL OPEN THE FOLLOWING BULLISH TARGET

3416

EMA5 CROSS AND LOCK ABOVE 3416 WILL OPEN THE FOLLOWING BULLISH TARGET

3429

EMA5 CROSS AND LOCK ABOVE 3429 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3348

EMA5 CROSS AND LOCK BELOW 3348 WILL OPEN THE FOLLOWING BEARISH TARGET

3328

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3313

EMA5 CROSS AND LOCK BELOW 3313 WILL OPEN THE SWING RANGE

3296

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Mechanical vs. Anticipation Trades: The Fine LineWhen traders talk about discipline, they often refer to following rules — sticking to a plan, being methodical, and avoiding emotional decisions. But there's a subtle and powerful difference between being rule-based and being blindly mechanical. And even more, there's a moment in every trader’s process where discipline demands adaptation.

Let’s look at a recent trade on Gold to understand this better.

On Thursday, I published an analysis on Gold stating that the recent breakdown of support had turned that zone into resistance. A short entry from that level made sense.

It was mechanical, clean, and aligned with what the chart was showing at the time.

And, at first, it worked. Price rose into the resistance area and dropped. Perfect reaction. Textbook setup. Confirmation. The kind of trade you want to see when following a rule-based system.

But then something changed.

Price came back. Quickly.(I'm talking about initial 3315-3293 drop and the quick recover)

So, the very next rally pushed straight back into the same resistance area, hmmm...too simple, is the market giving us a second chance to sell?

That was the first sign that the market might not respect the previous structure anymore.

It dipped again after, but the second drop was different: slower, weaker, choppier.

That told me one thing: the selling pressure was fading.

So I shifted. From mechanical execution to anticipatory mindset.

This is where many traders struggle — not because they don’t have a system, but because they don’t know when to let go of it. Or worse: they abandon it too quickly without cause.

In this case, the evidence was building. The failed follow-through. The loss of momentum. The compression in structure. All signs that a reversal was brewing.

Rather than continuing to blindly short, referring to a zone that no longer held the same weight, I started looking for the opposite: an upside breakout and momentum acceleration.

That transition wasn’t based on emotion. It was based on market behavior.

________________________________________

Mechanical vs. Anticipation: What’s the Real Difference?

A mechanical trade is rule-based:

• If X happens, and Y confirms, then enter.

• No need for interpretation, no second guessing.

• It can (in theory) be automated.

An anticipatory trade is different:

• It’s about reading intent in price action before confirmation.

• Higher risk usually, but higher reward if you’re right.

• Can’t be automated. It requires presence, experience, and context.

And the tricky part? Often, we lie to ourselves. We say we’re "mechanical" while actually guessing. Or we think we’re being smart and intuitive, when in fact, we’re being impulsive.

The key is awareness.

In my Gold ideas, the initial short was mechanical. But the invalidation came quickly — and I was alert enough to switch gears. That shift is not a betrayal of discipline. It’s an upgrade of it.

________________________________________

Final Thoughts:

Discipline is not doing the same thing no matter what. Discipline is doing what the market requires you to do, without emotional distortion.

And that, often, means walking the fine line between the setup you planned for, and the reality that just showed up.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | GOLD Short-Term Correction From Psychological LevelOANDA:XAUUSD is currently retesting the broken triangle structure from below, having rebounded from the ascending support zone. The price is approaching a confluence near 3,400–3410, where prior breakdown and resistance meet. If this level holds as resistance, the setup favors a bearish continuation toward 3,340 and possibly deeper. The broader structure shows lower highs and increasing rejection pressure below the resistance zone.

📉 Key Levels

Sell trigger: 3,400 rejection

Sell zone: 3,398.660–3,410

Target: 3,340

Invalidation: Break and hold above 3,410

💡 Risks

Momentum from recent rebound could challenge resistance

A higher low formation could tilt sentiment bullish

External factors (Fed, inflation data) may inject volatility beyond the range

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

GOLD ROUTE MAP UPDATEHey Everyone,

Another PIPTASTIC day on the charts!!!

After completing our Bullish target 3370 yesterday, we stated that we are now waiting for ema5 lock to confirm gap to 3392.

We got the ema5 lock above 3370 opening 3392. A nice drop into the lower zone just above our bearish gap allowed us to buy dips inline with our plans. We got the push up all the way into 3390 just short of 3392 gap, so this remains open.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3370 - DONE

EMA5 CROSS AND LOCK ABOVE 3370 WILL OPEN THE FOLLOWING BULLISH TARGETS

3392

EMA5 CROSS AND LOCK ABOVE 3392 WILL OPEN THE FOLLOWING BULLISH TARGET

3416

EMA5 CROSS AND LOCK ABOVE 3416 WILL OPEN THE FOLLOWING BULLISH TARGET

3429

EMA5 CROSS AND LOCK ABOVE 3429 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3348

EMA5 CROSS AND LOCK BELOW 3348 WILL OPEN THE FOLLOWING BEARISH TARGET

3328

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3313

EMA5 CROSS AND LOCK BELOW 3313 WILL OPEN THE SWING RANGE

3296

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD → The market is waiting for NFP. What could happen?FX:XAUUSD is bouncing off resistance at 3310, confirming the upper limit of the new trading range. The dollar continues to rally, but the market as a whole is stagnating ahead of upcoming news—NFP is coming up!

Gold is consolidating at monthly lows around $3268, awaiting key US labor market data (NFP). Trump's new tariffs (10% globally, 35% for Canada, 39% for Switzerland) have boosted demand for the dollar, putting pressure on gold. Markets are waiting for NFP: forecast +110K jobs, unemployment 4.2%. Weak data (<100K) → gold may rise to $3400. Strong (>150K) → the dollar will strengthen, gold will continue to fall. The probability of a Fed rate cut in September is <50%.

Based on yesterday's data, I would cautiously suggest that NFP will be in the range of 125K–145K, slightly above the consensus (110K). This will play into Trump's hands (I think you understand what I mean...).

Resistance levels: 3300, 3310, 3320

Support levels: 3287, 3268, 3255

The news has a negative nuance — unpredictability. Be careful.

Technically, based on the data we have at the moment, I would assume that the market may test resistance at 3300-3310 before a possible pullback to the specified support. BUT! Unpredictable data could turn the game around, and in that case, if the dollar falls, gold could start to rise.

Best regards, R. Linda!

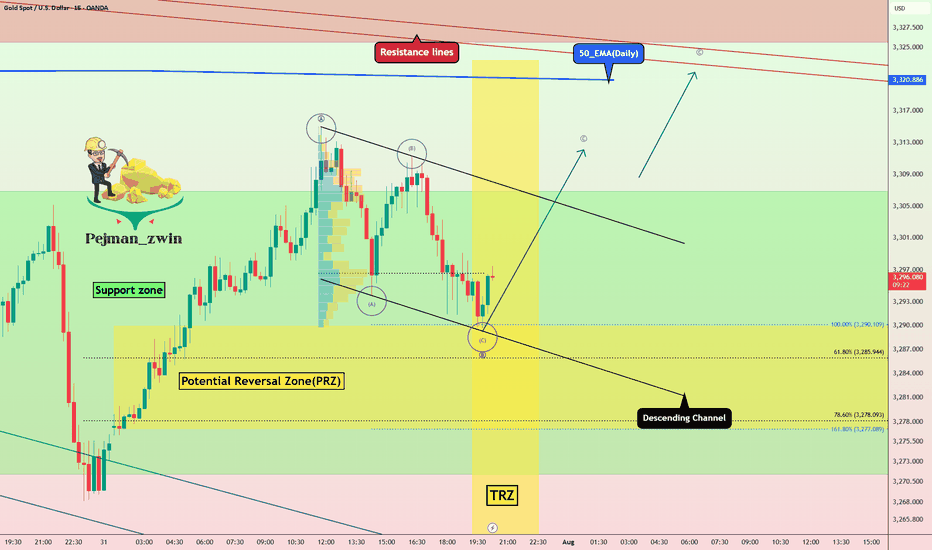

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

As anticipated in the morning review, low volume day which resulted in this range still in play and price just making the sideways up and down move.

That's where we stand at the moment with no break above the red box for higher pricing at the moment. We managed to bag 3 decent set ups of 50pips each but we didn't get the move we wanted.

We have highlighted the key areas now and if you look closely on the hourly, we're in slight triangle formation. The range has also been drawn on the chart so we'll wait for the break out now.

Support here 3365, while resistance stands at the 3385 level.

Not much more to report on gold unless we break above that red box.

As always, trade safe.

KOG

GOLD ROUTE MAP UPDATEHey Everyone,

Great start to the week with our chart idea playing out, as analysed.

We got our Bullish target 3370 hit and now waiting for ema5 lock to confirm gap to 3392. Failure to lock will see lower Goldturns tested for suport and bounce, inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3370 - DONE

EMA5 CROSS AND LOCK ABOVE 3370 WILL OPEN THE FOLLOWING BULLISH TARGETS

3392

EMA5 CROSS AND LOCK ABOVE 3392 WILL OPEN THE FOLLOWING BULLISH TARGET

3416

EMA5 CROSS AND LOCK ABOVE 3416 WILL OPEN THE FOLLOWING BULLISH TARGET

3429

EMA5 CROSS AND LOCK ABOVE 3429 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3348

EMA5 CROSS AND LOCK BELOW 3348 WILL OPEN THE FOLLOWING BEARISH TARGET

3328

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3313

EMA5 CROSS AND LOCK BELOW 3313 WILL OPEN THE SWING RANGE

3296

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3371 and a gap below at 3293. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3371

EMA5 CROSS AND LOCK ABOVE 3371 WILL OPEN THE FOLLOWING BULLISH TARGETS

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3293

EMA5 CROSS AND LOCK BELOW 3293 WILL OPEN THE SWING RANGE

3236

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

THE KOG REPORT - NFP UPDATE 1H 1H:

This is the chart we used last week for the FOMC and NFP KOG Reports. From the chart we can see the low was captured for FOMC and NFP didn’t give us an undercut low. We’ve kept the potential target box from the Report and for now we’ll stick with it. Red box defence is active below at the 3340-5 level and the ideal target stands above in the oval as long as we remain above the 3340 bias level.

KOG’s bias for the week:

Bullish above 3340 with targets above 3370, 3373, 3379 and above that 3384

Bearish on break of 3340 with targets below 3330, 3320 and below that 3310

RED BOXES:

Break above 3365 for 3372, 3375, 3379, 3384 and 3390 in extension of the move

Break below 3350 for 3346, 3340, 3335 and 3330 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GOLD DAILY CHART ROUTE MAPHey Everyone,

Daily Chart Update – Another Clean Rejection: Structure Still Dominates

Following up on the recent price action last week after hitting the 3433 resistance level, we got exactly what the chart warned us about.

There was no confirmed break above 3433, which led to a clean rejection right back into 3272. Interestingly, the move aligned perfectly with the channel half-line, giving us another bounce right off that zone.

We remain in the same structured range, with price still rotating between 3262 and 3433, a 170+ pip zone that continues to deliver high probability trade setups.

Here’s where we are now:

🔹 Range Still Active

Price is respecting the 3272–3433 boundaries with precision. Until we get a decisive break and hold outside this range, range bound strategies remain in play.

🔹 No Breakout = Clean Rejection

The failure to sustain above 3433 confirms resistance is still valid. We're watching EMA5 for potential breakout confirmation, until then, the bias stays neutral within the range.

🔹 Channel Half-line Bounce

That rejection into 3272 also matched the channel half-line and the bounce there further cements this area as critical support.

Updated Key Levels

📉 Support – 3272

Still the major pivot. Buy zones remain valid here unless we see a confirmed breakdown.

📈 Resistance – 3433

Now clearly tested and rejected again. Any clean break and hold above could change the dynamic, but until then, it's solid resistance.

Thanks as always for your support.

Mr Gold

GoldViewFX

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Following on from the FOMC KOG Report which worked quite well, we’ll stick with the same chart and for today suggest caution. It’s the first day of the month and the last day of the weekly candle. The close here for gold is important and will give us further clues to the next few months.

We’ve shared the red boxes and the red box targets are below. There is a key level above 3306-10 which will need to be breached to correct the move back up to the 3330-34 region for the weekly close. However, we now have an undercut low which is potential if there is more aggressive downside to come and that level is sitting around the 3240-50 region which for us may represent an opportunity for a swing low. We’re a bit low and stretched here to short and as we’ve already hit our target for the day so we’ll wait for the extreme levels and if hit and our indicators line up, we may take some scalps. Otherwise, as usual on these events, the ideal trade will come next week.

RED BOXES:

Break above 3290 for 3295, 3306, 3310 and 3320 in extension of the move

Break below 3275 for 3267, 3260, 3255 and 3250 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Weekly Chart Update – Another Clean Rejection + Bounce: Range Still in Play

Just a quick follow up on the ongoing weekly structure. We continue to see incredible respect for levels, with price action playing out exactly as mapped.

After the initial rejection at 3387, we got another test of support at 3281, and once again, the level held perfectly, delivering a clean rejection and bounce. Price is now rotating back upward, currently heading toward 3387, which remains the upside magnet and still open for a retest.

We remain firmly inside the 3281–3387 range, and as long as neither boundary breaks with confirmation, the structure remains our dominant guide.

Updated Structural Notes:

🔹 3281 Rejected Again

Support doing its job to the pip. This latest bounce further reinforces the strength of this level within the weekly channel.

🔹 Back Toward 3387

With 3281 holding once more, price is now tracking toward the 3387 resistance zone, which remains the key level to break for further upside continuation.

🔹 Channel Structure Unchanged

No breakdown below support, no confirmed breakout above resistance. The rising channel remains fully respected, and EMA5 still leans constructive.

Updated Levels to Watch:

📉 Support – 3281

Key weekly pivot tested and held again. Continues to offer solid dip buy opportunities unless decisively broken.

📈 Resistance – 3387

Still our major resistance. It’s been tested and rejected, but remains open for another challenge.

📈 Resistance 2 – 3482

Unfilled gap and broader weekly target. Only comes into focus if we get a proper breakout and hold above 3387.

Plan:

We stay range focused between 3281 and 3387 until proven otherwise. No breakout = no change. Watch for signs of momentum as we approach the top again a confirmed close above could shift the game toward 3482. Until then, structure is king.

Appreciate all the continued support.

Mr Gold

GoldViewFX

GOLD NEXT MOVE (expecting a bearish move)(06-08-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (06-08-2025)

Current price- 3370

"if Price stays below 3380, then next target is 3360, 3345 and 3330 and above that 3400 and 3440 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

Correction in Tokyo, London session. And return go up in NewYork✏️Gold prices saw some selling pressure in the Tokyo session. Yesterday's US session saw strong buying pressure, leading to a psychological profit-taking session early today. The possibility of a correction in the Asian and European sessions today and the buying pressure will return in the London session. The SELL signal is triggered at the moment and the Target is aimed at the reaction of buyers at the support areas for the BUY strategy.

📉 Key Levels

SELL now 3375 (Scalping)

BUY trigger: Price rejection at the support areas 3346-3333-3315

Target 3420

Leave your comments on the idea. I am happy to read your views.

Gold Roadmap — Short termGold ( OANDA:XAUUSD ) rose to $3,383 as I expected in yesterday's idea .

Gold is currently moving in the Resistance zone($3,393-$3,366) .

In terms of Elliott Wave theory , it seems that Gold has completed 5 impulse waves , and we should wait for corrective waves on the 15-minute time frame .

I expect Gold to start declining from one of the Fibonacci levels and fall to at least $3,351 .

Second Target: $3,344

Third Target: Monthly Pivot Point/Support lines

Note: Stop Loss (SL) = $3,392

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

XAU/USD | Next Key Zone: Watch for Rejection at $3334! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that, just as expected, the price dropped from $3310 to $3288 in the first leg, where it hit a demand zone and bounced up to $3305, delivering a 170-pip rally. The main bearish move from $3333 to $3288 yielded 450 pips, bringing the total return on this analysis to over 620 pips!

In the second phase, gold dropped sharply again to $3268, and once more found demand, currently trading around $3307. If the price holds above $3294, we could expect further upside toward the $3322–$3334 zone. Once gold reaches this area, a strong bearish rejection is likely, with a potential return of 250 to 400 pips.

All key supply and demand levels are marked on the chart — make sure to monitor them closely and study the chart in detail. Hope you’ve made the most of this powerful analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Order Block buy setup

XAUUSD H1 — Order Block Buy Setup 📈"

BOS confirmed .Price retracing to order block (3350–3353).

Looking for bullish reaction to target 3390–3400.

Risk small, aim big.

#XAUUSD #GoldAnalysis #OrderBlock #BOS #PriceAction #SmartMoney #TradingSetup #Forex #Gold #SwingTrade #TechnicalAnalysis #RiskReward #TradingPlane

DeGRAM | GOLD reached the resistance level📊 Technical Analysis

● XAUUSD rebounded from the lower channel boundary near 3,294 and reclaimed resistance at 3,357.8, confirming bullish continuation inside the rising structure.

● Breakout above the triangle’s descending resistance line opens upside toward 3,435 and possibly 3,487 on strong momentum continuation.

💡 Fundamental Analysis

● Gold found renewed support as US NFP and ISM data showed softness, weakening the dollar and lowering real yields.

● Rising geopolitical risk and increased central bank gold buying in July continue to support bullish sentiment.

✨ Summary

Long above 3,357. Target 3,435 ➜ 3,487. Setup holds while price stays above 3,294 channel base.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!