GOLD trade ideas

"Gold on Fire! Smart Money Bulls Aiming for Final Target🟡 "Gold on Fire! Smart Money Bulls Aiming for Final Target

Overview:

The XAUUSD chart presents a clear smart money structure, showing a bullish recovery from a strong demand zone and a current move toward a significant supply (resistance) area.

🔍 Key Technical Highlights:

Strong Support Zone

The price reacted powerfully from the well-marked strong support zone (~3,260), aligned with a previous Bullish Fair Value Gap (FVG) and BOS (Break of Structure), confirming bullish intent.

Bullish Market Structure

A clean CHoCH (Change of Character) confirmed the end of the previous bearish leg.

Multiple BOS followed, solidifying the bullish shift in momentum.

Liquidity Grab & Price Expansion

Price swept equal lows (EQL) and mitigated bullish FVG, collecting sell-side liquidity before reversing.

The breakout pushed toward the current level of ~3,380, targeting the Buy-Side Liquidity zone and resistance.

Resistance & Fair Value Gap

The final target is aligned at 3,427.83, situated inside a high-probability bearish FVG and resistance zone.

This area previously rejected price (noted with the red circle), making it a critical supply zone.

Partial Target Hit

Price has already achieved half of the projected move, indicating bullish strength and proper SMC execution.

The current consolidation near the mid-level suggests accumulation or re-accumulation before a final push toward the target.

📈 Educational Notes:

Fair Value Gaps (FVG) highlight inefficiencies in price delivery. These zones often act as magnets for price and reversal points, as seen here.

Break of Structure (BOS) and Change of Character (CHoCH) are crucial for identifying trend shifts. This chart reflects a textbook bullish transition.

Liquidity concepts (EQL, Buy-Side) emphasize institutional behavior. Price often hunts liquidity before moving to new highs or lows.

✅ Conclusion:

XAUUSD is playing out a well-structured bullish smart money setup, with price currently in mid-path toward the final target. Traders should monitor reactions at the 3,427 resistance zone, which will be critical for potential reversal or continuation scenarios.

Gold Breaks Support – Risk of Pullback Toward $3,310📊 Market Summary:

Gold prices initially rose on weaker-than-expected U.S. jobs data, which lowered Treasury yields and weakened the U.S. dollar. However, after breaking the key support at $3,365, gold continued to decline toward $3,354, and briefly touched $3,352, signaling rising technical selling pressure. Despite a 92% market expectation for a Fed rate cut in September, the technical breach increases the risk of a deeper correction.

📉 Technical Analysis:

• Key Resistance: Around $3,365–$3,370 – this zone now acts as short-term resistance; stronger resistance lies at $3,375–$3,380 if prices recover.

• Nearest Support:

The $3,365 level was broken.

New support is seen at $3,352–$3,350; a continued drop may bring prices to $3,335, and possibly toward $3,310–$3,300.

• EMA 09: Price is now below the 9-day EMA, suggesting a short-term bearish trend.

• Momentum / Volume / Candlestick:

RSI is near 50, slightly bearish; volume is tapering on the downside, indicating distribution.

Early signs of a head-and-shoulders (H&S) pattern are developing.

📌 Outlook:

Gold may continue declining in the short term if it stays below the $3,350–$3,352 zone.

A further drop toward the $3,335 – $3,310 region is possible.

If price rebounds and closes above $3,365, the bearish momentum could be neutralized.

💡 Suggested Trade Strategy:

🔻 SELL XAU/USD : $3,355–$3,358

🎯 TP: 40/80/200 pips

❌ SL: ~$3,361

🔺 BUY XAU/USD : $3,305–$3,302 (if price pulls back deeper)

🎯 TP: 40/80/200 pips

❌ SL: ~$3,299

Gold Price ActionHello Traders,

Hope you're all doing well. Here's the current setup I’m observing — and most importantly, remember to wait for the right moment.

As marked, there’s a clear supply zone, and price action is expected to move towards it. For entering a long position, there are a few approaches you can take:

Use the 50% level of the Fair Value Gap (FVG)

Look for breaker blocks

Identify order blocks

The method you choose should depend on current market conditions and price movement.

Once you spot the setup, aim for the top supply zone — that’s where the price is likely headed. Patience is key to catching the right entry. If you need assistance, my indicator can help pinpoint the move — but if you’re confident in your analysis, you may not need it.

Wishing you all the best and happy trading!

BUY XAUUSD 5.8.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the H1 above.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the last bottom (3,370)

Set up entry:

- Entry buy at 3,364

- SL at 3,360

- TP1: 3,370 (~1R)

- TP2: 3,383 (~4R)

- TP3: 3,391 (~6R)

Trading Method: Price action (No indicator, only trend and candles)

Gold Extends Gains as USD Weakens📊 Market Overview:

Gold prices are extending their gains during the Asian and European sessions today, as the US dollar weakens following weaker-than-expected US jobs data. Rising unemployment and a softer Non-Farm Payroll report boosted expectations that the Fed may cut interest rates in September. The US 10-year Treasury yield also dipped slightly, supporting gold's safe-haven appeal.

📉 Technical Analysis:

• Key Resistance: $3,385 – $3,390

• Nearest Support: $3,365 – $3,370

• EMA: Price is trading above the EMA 09, indicating a short-term bullish trend

• Candles / Volume / Momentum: H1 candles show steady buying pressure with stable volume, but we should monitor potential profit-taking if price nears the $3,390–$3,400 zone.

📌 Outlook:

Gold may continue to rise in the short term if USD weakness persists and bond yields stay low. However, failure to break above $3,390 could lead to a pullback toward support levels.

💡 Suggested Trading Strategy:

🔺 BUY XAU/USD: $3,365 – $3,368

🎯 TP: 40/80/200 pips

❌ SL: $3,362

🔻 SELL XAU/USD : $3,392 – $3,395 (if reversal signal appears)

🎯 TP: 40/80/200 pips

❌ SL: $3,398

Gold is fluctuating at a high level. Latest analysis.On Monday, gold surged to around 3370 in the morning before retreating slightly. It fell back to support near $3345 in the European session. The dividing line between bulls and bears lies below 3340, which also marks the support level and the top-bottom reversal before the close of last Friday's non-farm payroll report.

Quaid planned to go long near 3340 on Monday, but the price rebounded to 3345, halting its decline and then fluctuating sideways, preventing an entry opportunity. However, a short opportunity near 3385 was successfully implemented with a slight pullback. Although it did not reach the expected target, a small profit was achieved after the pullback to 3370.

Monday showed an overall upward trend, with the closing price fluctuating at a high level, reaching a high around 3385 before retracing to confirm 3370. The overall market trend remains upward, with a temporary potential for a move to around $3400. Quaid recommends a buy-on-low strategy today. Currently, the 1-hour moving average is trending flat, and the trend of prices continuing to fluctuate at high levels cannot be ruled out.

Support for Tuesday's pullback lies near 3370. The key to a renewed rally lies at 3360, also the level of resistance before Monday's US market opening. As long as this level remains intact, the overall strategy remains unchanged. Alternatively, watch for a re-break of 3385, with upside targets at 3385-3390-3400.

Strategy:

Long at 3360-3365, stop-loss at 3355, profit range at 3380-3400;

Short at 3395-3400, stop-loss at 3410, profit range at 3370-3350;

Key Points:

First Support Level: 3370, Second Support Level: 3360, Third Support Level: 3350

First Resistance Level: 3385, Second Resistance Level: 3395, Third Resistance Level: 3405.

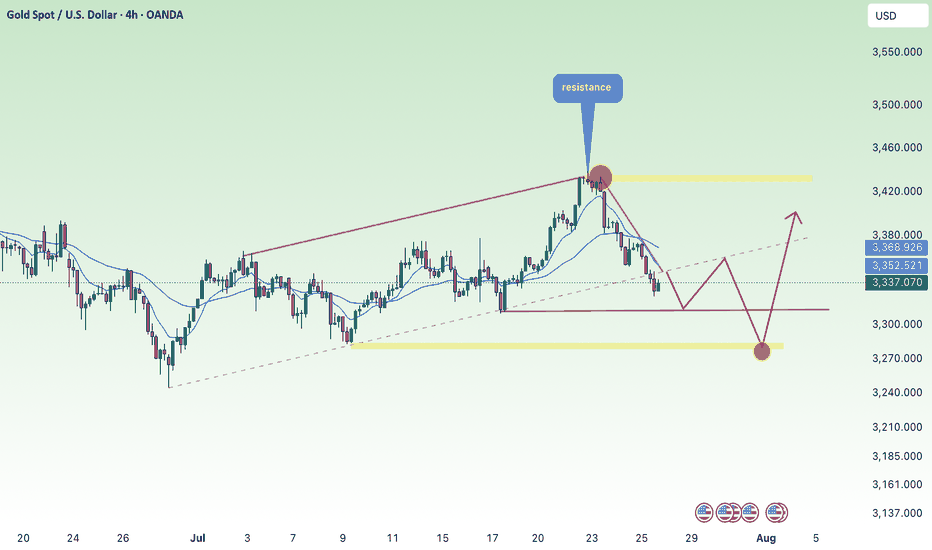

4H Gold/USD - Decoding the liquidity zones 📈 Smart Money Concept: Liquidity Grab & Market Shift

This 4H Gold/USD chart shows a classic liquidity sweep below a key level (Sell-side liquidity) followed by a CHoCH (Change of Character) — signaling a bullish market structure shift. A fair value gap (FVG) is formed as price aggressively breaks previous highs, offering a clean entry point on the retest.

XAUUSD 30M Range Trap Holding, But Will Bulls Break Above $3366Gold is currently trading within a well defined intraday range, with clear resistance around $3,366.36 and support near $3,339.78. After a strong initial move, price action has stalled, reflecting indecision and balanced order flow between buyers and sellers.

The market now approaches a key inflection point:

→ A confirmed 30 minute candle close above $3,366.36 would signal potential bullish continuation, with immediate targets at $3,368.99 and $3,371.11

→ Conversely, a close below $3,339.78 may trigger a downside move toward $3,331.66, followed by $3,328.21

Momentum remains neutral within the range, and any premature entries carry increased risk of whipsaw. Patience is essential, a clean breakout with structure and volume confirmation will offer higher probability trade setups.

This remains a rangebound environment until proven otherwise. Breakout traders should stay alert, but disciplined.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #SupportResistance #BreakoutWatch #MarketStructure #30mChart

GOLD Will Go Higher From Support! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 3,311.57.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,369.04 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Chart Type:* XAUUSD (Gold) – 15 min chart Pattern:AscendingHere’s a simpler breakdown with highlights:

---

*🟡 Chart Type:* XAUUSD (Gold) – 15 min chart

*📊 Pattern:* *Ascending Bullish Triangle*

---

*🔹 Key Highlights:*

- *Orange Line:* Rising *support* (buyers pushing price up)

- *Purple Zone:* Strong *resistance* area (price keeps rejecting)

- *Blue Arrow:* Suggesting a *breakout* to the upside

- *White Path:* Expected *price movement* if breakout happens

---

*🎯 Target Zone (Green Area):*

Where price may go if breakout is successful

*🛑 Stop-Loss Zone (Red Area):*

Where to exit trade if breakout fails

---

📝 Simple Explanation:*

Price is going up slowly and getting squeezed. If it breaks above the purple line, a *strong bullish move* is expected.

Gold (XAU/USD) Technical Analysis – NeoWave Perspective📅 August 2025 | 📈 4H Chart

📍Posted by: @ CryptoPilot

Gold completed a corrective Wave A near $3160 at the bottom of the descending channel. It then rallied to $3440, followed by a decline toward the channel’s midline at $3227, beginning a potential Wave C.

Attempts to break and hold above the channel failed. Price has since broken below the trendline and is now pulling back to retest it from below.

⸻

🔍 Key Insights:

• 📉 No long entries recommended at current levels

• ✅ Bullish confirmation requires a clear breakout and close above the channel top

• 🛒 Safer long setup may emerge near $3120 at the channel bottom and possible Wave C completion zone.

⸻

🔑 Key Levels:

• Resistance: $3380–$3440

• Support: $3120

• Invalidation / Stop-loss: Below $3110

⸻

📌 Follow @ CryptoPilot for more wave structure insights, SMC confluence, and multi-timeframe strategies.

💬 Drop your thoughts and alternate counts in the comments below!

Bullish

Description

Hi traders

I think after the fake break that happened last week at 3280, we should be ready to move higher with a target of 3430-3450 and if the fundamentals are impressive, even a break of the previous high.

Of course, the resistance zone of 3385-3405 is in the way of the price.

I hope that the analysis I am providing is accurate and effective.

Possible positions this week

A:Suitable prices for BUY positions

1)3345-3340

2)3174-3150

B:Suitable prices for SELL positions

1)3385-3405(Of course, with approval from the market and the type of candles)

This is just an analysis and everyone is responsible for their own work.

Hoping for a good and profitable week.

XAUUSD Gold Trading Plan – Monday, 4th August 2025Strategy Type: Intraday / Short-term swing

Bias: Bullish (Buy-the-dip)

Methodology: Price Action + Fibonacci Retracement + Momentum Confirmation

Key Zones: 3366, 3377, 3388

Market Overview

As we head into Monday, 4th August, Gold (XAUUSD) remains in an overall uptrend, supported by bullish macro sentiment driven by weakening USD strength and ongoing uncertainty in global risk assets. Despite last week’s slight pullback, the structure still supports a continuation pattern, especially above the 3350 support region.

The previous week closed with a higher low formation, and current price action shows a healthy retracement rather than a reversal. We anticipate that Gold will respect key Fibonacci retracement levels and rally in phases, allowing for multiple entries and scaling opportunities.

🔍 Trading Plan Summary

✅ Step 1: Buy on Retracement to 3366 (1st Target Area)

Entry Zone: Around 3366

Reasoning: This level is a confluence zone — minor support from Friday’s breakout, aligning with intraday Fibonacci retracement (~38.2% pullback from recent swing low to high).

Confirmation: I’ll look for bullish candle confirmation on 15m/30m chart (e.g., bullish engulfing, pin bar, or strong rejection wick) before entering.

Stop Loss: Below 3356 (previous swing low / invalidation level)

🎯 Target 1: 3377

This will be the first take-profit zone after price reaches the next resistance / previous order block zone.

I will secure partial profits here and trail SL to entry or +5 to lock in risk-free trade.

✅ Step 2: Wait for Retracement Again (Post-3377 Pullback)

If price pulls back after hitting 3377, I’ll wait for the new higher low to form — ideally somewhere between 3370–3373.

I’ll re-enter long with confirmation, targeting the next key level.

🎯 Target 2: 3388

This level is the next visible resistance on 1H/4H structure and may trigger profit-taking or reversal pressure.

I plan to close the majority of my position here unless price shows strong breakout momentum.

⚠️ Risk Management Notes

Maximum total exposure: 1.5% of account (0.5% per trade entry)

All trades will have a defined SL; no averaging down.

Avoid entering if price gaps up directly above 3377 on Monday open — in that case, I’ll reassess structure and wait for new retracement levels.

🛠 Tools to Watch

DXY (Dollar Index): If DXY weakens further below 104.50, this supports the bullish Gold thesis.

US Bond Yields: Any decline in yields also gives bullish pressure on Gold.

Volume & RSI Divergence: For entry and exit confidence.

News Risk: Keep an eye on any surprise geopolitical tensions or Fed commentary, though major data events are limited on Monday.

🔁 Summary of Execution Plan

First Buy Entry: 3366 → TP1: 3377

Second Buy Entry (on retracement): ~3371 → TP2: 3388

SL Discipline: Below swing structure, never moved unless TP1 hits.

Profit Securing: Partial at 3377, majority at 3388

Trade Review: At EOD, whether plan was followed or not

Gold Price Target: 3380-3400+, Set a Trailing StopGold Price Target: 3380-3400+, Set a Trailing Stop

As shown in Figure 4h:

Gold finally rallied this weekend.

Despite recent heavy losses for long positions, the past two days have been encouraging.

We ultimately managed to successfully buy the dip in the 3280-3300 range and recover all our losses.

Gold prices continue to rise, and everyone is asking if it's time to sell.

Now is the critical time to exit.

We must acknowledge one fact:

Gold currently presents a huge opportunity.

Of course, the risks are also increasing.

At times like these, I always emphasize that the best approach is to set a 10-point trailing stop.

Even if gold prices soar, we can move with them.

This non-farm payroll data was a huge disappointment.

It was a truly positive surprise for gold.

The market expected 110,000 new jobs, but the result was a disappointing 73,000, a decrease of half from the previous month.

The market went into a tizzy after the outperformance. But even more shocking news is yet to come: Non-farm payrolls for May and June were revised downward by a combined 258,000.

This means the June gain was revised downward from 140,000 to 14,000.

The May gain was abruptly revised downward from 140,000 to 19,000.

The strong data of the past two months was completely false.

Market followers have become the "clowns" of the Fed and Trump.

Now you understand why everyone praised Powell's hawkish speech two days ago.

Because Powell said: "Only if there is a severe decline in employment will we consider cutting interest rates."

Just this Wednesday, some good non-farm payroll data was released.

This undoubtedly gave the market a false impression.

Everyone believed that a rate cut was impossible, and the probability of a September cut had dropped to 40%.

However, today's poor non-farm payroll data, combined with revisions to May and June data, revealed the truth.

The job market has been dismal over the past quarter.

The market reacted quickly, and gold prices soared on this sentiment.

My advice is to buy gold at a low price and hold on.

For investors who have successfully bought in the 3280-3300 level in recent days, I recommend setting a 10-15 pip trailing stop-loss.

Gold prices are likely to continue their upward trend next Monday.

Our next target is above 3380-3400 points.

XAUUSD Smart Money Technical Analysis – Bullish Potential XAUUSD Smart Money Technical Analysis – Bullish Potential from Strong Support

Gold (XAUUSD) is currently trading around $3,291.780, showing a potential bullish reversal setup from the strong support zone after a clear liquidity sweep and market structure shifts.

🔍 Key Technical Highlights:

✅ Strong Support Zone (Demand)

Price is reacting from a major demand zone (Strong Low) between $3,275 – $3,225, a level that previously triggered bullish rallies.

Multiple Breaks of Structure (BOS) and CHoCH indicate previous bullish control and a possible re-accumulation phase.

✅ CHoCH Near Support

A recent Change of Character (CHoCH) around the support area shows the first signs of smart money accumulation.

Liquidity below recent lows has been swept, triggering possible bullish intent.

✅ Bullish FVG (Fair Value Gap)

A clear Bullish FVG remains unmitigated around the mid-range, offering target confluence at $3,349.560.

Price may aim to rebalance inefficiency and fill the FVG as part of the bullish move.

✅ Resistance Zone Above

The resistance area near $3,325 – $3,350 acts as a short-term target for long positions.

Further resistance lies at the Buy-Side Liquidity & Weak High zone around $3,450 if momentum sustains.

🧠 Smart Money Concept Interpretation:

Liquidity Grab: Price dipped into strong demand to collect sell-side liquidity before potential reversal.

CHoCH + BOS Alignment: Indicates the market may now transition into a bullish phase.

FVG as Magnet: Price is drawn toward unfilled value zones—ideal for bullish target projection.

🎯 Trade Idea (Educational Purposes Only):

Bias: Bullish

Entry: Around current zone ($3,290)

Target: $3,349.560 (FVG zone)

Invalidation/SL: Below strong low (~$3,225)

GOLD: Short Trading Opportunity

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level - 3299.9

Sl - 3304.2

Tp - 3291.3

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold (XAU/USD) Analysis:Gold remains in a downward trend and is currently moving sideways in a consolidation phase in the short term. The bearish outlook still dominates, with a potential move toward levels like $3,245.

1️⃣ A break and close below $3,276 may trigger a drop toward the strong support zone at $3,245.

2️⃣ However, if bullish momentum pushes the price above $3,310, this opens the path toward $3,330, a key level where a bearish rejection might occur.

📈 If the price holds above $3,330, a continuation toward $3,350 becomes likely.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

Gold May Rise Technically after Testing the $3,300 Zone📊 Market Overview:

Spot gold is trading around $3,295–$3,301/oz, influenced by slightly lower U.S. Treasury yields and a softer dollar tone. Analyst consensus from Reuters projects gold likely to stay above $3,220/oz through 2025 and possibly hit $3,400 in 2026 amid continued safe-haven demand

📉 Technical Analysis:

• Key resistance: $3,320 / $3,345

• Closest support: $3,274 – $3,280

• EMA09: Price is currently below the 9 period EMA on H1, indicating a short-term bearish bias.

• Candlestick / volume / momentum: There was a minor bounce from the support zone around $3,274, but volume remains low. RSI isn't oversold, suggesting room for technical pullback.

📌 Outlook:

Gold may experience a technical rebound if it holds above $3,280. A breakout above $3,320 would likely require clear catalyst—such as weak U.S. data or a dovish Fed tone.

💡 Suggested Trading Strategy:

SELL XAU/USD: $3,320 – $3,323

🎯 TP: 40/80/200 pips

❌ SL: $3,326

BUY XAU/USD: $3,279 – $3,282

🎯 TP: 40/80/200 pips

❌ SL: $3376

Gold (XAU/USD) Analysis:Following yesterday's Fed statements regarding the economic impact of tariffs and the decision to keep interest rates unchanged, gold prices dropped to $3,268, before rebounding today to retest the $3,310 zone. The short-term trend remains bearish.

1️⃣ A break and hold below $3,300 may push the price toward $3,280, and potentially $3,260.

🔻 A confirmed break below $3,260 could lead to a deeper decline toward a strong support zone near $3,245.

2️⃣ On the other hand, if bullish momentum appears and the price breaks above $3,310, it may open the path to $3,330 — a key level that could trigger a bearish rejection.

📈 However, if the price holds above $3,330, the next target would be $3,350.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest