GOLD trade ideas

August 6 Gold Price Analysis: Target $3,400 Trading RecommendatAugust 6 Gold Price Analysis: Target $3,400

Trading Recommendations:

Short-Term Day Trading:

1: Watch for a breakout above $3,380-3,400. A successful breakout could signal a bullish trend with a target price of $3,420.

2: Continue to monitor the $3,350-3,360 support level. Buy on dips as long as the price remains above $3,350.

3: Exercise caution when shorting. Gold prices may converge within the $3,360-3,380 range before rising again.

Buy: $3,350-3,360

Stop-loss: $3,340

Target price: $3,380-3,400+

4: This week's trading strategy focuses on buying at low prices.

Conclusion: The gold market is currently supported by multiple positive factors, and the technical outlook is bullish, but caution is advised regarding a break above key resistance levels. Investors should closely monitor Federal Reserve policy developments and geopolitical developments.

Latest News, Policy, and Technical Analysis

I. News and Policy

The probability of a September Federal Reserve rate cut has soared to 92%.

Weak employment data has weakened the US dollar, bolstering the appeal of gold as an interest-free asset.

Trump's tariff policy has heightened market uncertainty.

US President Trump announced new tariffs on Canada, Brazil, India, and other countries. Escalating trade frictions have heightened risk aversion, supporting gold's status as a safe-haven asset.

Trump also stated that he would "significantly increase tariffs on Indian goods imported into the United States within the next 24 hours" and planned to impose additional tariffs on semiconductors and pharmaceuticals, further exacerbating market volatility.

Federal Reserve personnel changes have raised concerns about policy credibility.

Federal Reserve Board member Kugler has resigned, and Trump will nominate a new member.

The market is concerned that the Fed's independence may be undermined, exacerbating monetary policy uncertainty.

Trump recently announced that he has narrowed the field of candidates for Federal Reserve Chair to four, with Treasury Secretary Bensonant explicitly declining the position.

Geopolitical risks are supporting gold prices.

The ongoing conflict between Russia and Ukraine, tensions in the Middle East, and Trump's "deadline" rhetoric targeting Russia have all contributed to some inflows into the gold market.

Gold ETF Holdings Rebound

Holdings of the world's largest gold-backed ETF (SPDR Gold Trust) increased by 1.72 tons to 954.80 tons from the previous trading day, indicating increased bullish sentiment among institutional investors towards gold.

II. Technical Analysis

Short-Term Trend (4-Hour Chart)

Gold prices found support near $3,325. After breaking through the key resistance level of $3,350, they have stabilized above the 100- and 200-day moving averages.

Key Resistance: $3,380-3,390; a break above this level could challenge the $3,420-3,440 range.

Key Support: $3,365 (short-term trendline); a break below this level could test the $3,350-3,340 range.

Positive factors: Expectations of a Fed rate cut, geopolitical risks, intensified trade frictions, and increased holdings of gold ETFs.

Potential risks: Gold prices could correct if US economic data is unexpectedly strong or the Fed delays a rate cut.

Trading Recommendations:

Short-Term Day Trading:

1: Watch for a breakout above $3,380-3,400. A successful breakout could signal a bullish trend with a target price of $3,420.

2: Continue to monitor the $3,350-3,360 support level. Buy on dips as long as the price remains above $3,350.

3: Exercise caution when shorting. Gold prices may converge within the $3,360-3,380 range before rising again.

Buy: $3,350-3,360

Stop-loss: $3,340

Target price: $3,380-3,400+

4: This week's trading strategy focuses on buying at low prices.

Conclusion: The gold market is currently supported by multiple positive factors, and the technical outlook is bullish, but caution is advised regarding a break above key resistance levels. Investors should closely monitor Federal Reserve policy developments and geopolitical developments.

Latest News, Policy, and Technical Analysis

I. News and Policy

The probability of a September Federal Reserve rate cut has soared to 92%.

Weak employment data has weakened the US dollar, bolstering the appeal of gold as an interest-free asset.

Trump's tariff policy has heightened market uncertainty.

US President Trump announced new tariffs on Canada, Brazil, India, and other countries. Escalating trade frictions have heightened risk aversion, supporting gold's status as a safe-haven asset.

Trump also stated that he would "significantly increase tariffs on Indian goods imported into the United States within the next 24 hours" and planned to impose additional tariffs on semiconductors and pharmaceuticals, further exacerbating market volatility.

Federal Reserve personnel changes have raised concerns about policy credibility.

Federal Reserve Board member Kugler has resigned, and Trump will nominate a new member.

The market is concerned that the Fed's independence may be undermined, exacerbating monetary policy uncertainty.

Trump recently announced that he has narrowed the field of candidates for Federal Reserve Chair to four, with Treasury Secretary Bensonant explicitly declining the position.

Geopolitical risks are supporting gold prices.

The ongoing conflict between Russia and Ukraine, tensions in the Middle East, and Trump's "deadline" rhetoric targeting Russia have all contributed to some inflows into the gold market.

Gold ETF Holdings Rebound

Holdings of the world's largest gold-backed ETF (SPDR Gold Trust) increased by 1.72 tons to 954.80 tons from the previous trading day, indicating increased bullish sentiment among institutional investors towards gold.

II. Technical Analysis

Short-Term Trend (4-Hour Chart)

Gold prices found support near $3,325. After breaking through the key resistance level of $3,350, they have stabilized above the 100- and 200-day moving averages.

Key Resistance: $3,380-3,390; a break above this level could challenge the $3,420-3,440 range.

Key Support: $3,365 (short-term trendline); a break below this level could test the $3,350-3,340 range.

Positive factors: Expectations of a Fed rate cut, geopolitical risks, intensified trade frictions, and increased holdings of gold ETFs.

Potential risks: Gold prices could correct if US economic data is unexpectedly strong or the Fed delays a rate cut.

Gold (XAU/USD) Technical Analysis:Gold began a corrective move with today’s market open and is currently testing the $3,350 support zone, with further downside potential toward $3,310.

🔹 Bearish Scenario:

If the price breaks below $3,350 and holds, a continued correction toward $3,310 is likely.

🔹 Bullish Scenario:

If the price breaks above $3,365 and sustains momentum, it could open the way toward $3,390, and with further bullish pressure, extend to $3,430.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

XAU / USD 4 Hour ChartHello traders. I just figured while I am at the computer to post the 4 hour chart now. We can see that we are coming into an area where we will either reject if support forms, or keep pushing down a bit more. We have ISM news here in the US at 10am est. I will update / post any scalp trade set ups on a lower time frame in a bit. Be well and trade the trend. Shout out to Big G. Happy Tuesday

uptrend for GOLD ?According to the chart, we have an ascending channel and the RSI indicator is also in the ascending channel.

Considering the data on the tension between China and Taiwan and the tariff and oil wars between the United States and China, Russia, India, etc., the possibility of gold growth is not far from imagination.

8/5: Watch for Short Opportunities Near 3400Good morning, everyone!

On Wednesday, gold held above the key support area at 3343–3337, and subsequently broke through the 3372–3378 resistance zone, leading to a strong bullish move and solid long-side gains.

Today, attention should shift to the major resistance around 3400. If bullish momentum continues, price may approach the secondary resistance near 3420. However, from a technical perspective, signs of bearish divergence have begun to emerge. Should price continue rising while momentum weakens, the risk of a short-term correction increases accordingly.

Key levels to monitor:

Primary resistance zone: 3404–3416

Intermediate supply area: around 3398

Crucial support zone: 3372–3363 (a hold here could support further upside)

⚠️ Cautionary Note:

The US PMI data release during the New York session could introduce volatility. Be sure to maintain strict risk management and stop-loss discipline during periods of increased uncertainty.

🔁 Trading Bias for Today:

Prefer selling into strength near resistance, while cautiously considering buying on dips near support.

The 3343–3337 area continues to serve as the primary support zone, and price action around this level will be critical in determining the next directional move

Letting the Pullback Happen – Lining Up for the Next BuyPrice just hit that tough resistance at 3,373–3,380 and started to drop—pretty much what I expected for wave (a) top. Now waiting for a wave (b) pullback. Not chasing here, just being patient.

Game plan:

Waiting for price to drop into the 3,330–3,325 support zone.

If I see a nice bounce or bullish candle in that area, I’ll look to go long.

First target: Back to the 3,373–3,380 resistance. If price smashes through, will hold a small portion for a bigger run.

Stop loss: Just below 3,320 or the latest swing low—keeping it tight.

If price goes lower, next buy zone is 3,298, then 3,278. I’ll repeat the same idea.

If price dumps below 3,262, I’m out. No interest in holding longs if support fails.

XAUUSD Signal Today | Do you think Gold will retest $3400XAUUSD Buy Sell Signal Today | Do you think Gold will retest $3400 resistance? Every gold trader should watch today! In this video, we have the latest XAUUSD technical analysis and provide clear buy and sell levels for scalpers and swing traders. If you want to know if Gold will retest $3400 resistance, stay tuned until the end for exclusive insights, real chart breakdowns, and the best price action strategies. This video will help both new and professional traders make smart trading decisions with live examples and updated gold signals.

#GoldPrice

#XAUUSD

#GoldSignal

#GoldTrading

#TechnicalAnalysis

#GoldForecast

#BuySellSignal

#GoldResistance

#ForexTrading

#livegoldanalysis

Gold XAUUSD Weekly Analysis 4-8 August 2025XAUUSD Weekly Outlook (SWING)

Price is currently approaching a crucial resistance and supply zone between 3363 – 3373. This area has historically acted as a strong rejection point and remains a significant decision level for upcoming market direction.

Bullish Scenario:

If price breaks and closes above the 3363–3373 zone and later retests it successfully—potentially around the 3400 level—this would indicate a bullish market structure shift. A strong reaction from the retest could open the path toward 3438, with a possible extension to 3500.

Bearish Scenario:

Alternatively, a rejection from the 3363–3373 supply zone without a confirmed breakout would likely trigger a downside move, targeting the lower demand area near 3250.

This 3363–3373 zone remains the key pivot. Watch for price action confirmation to validate either scenario.

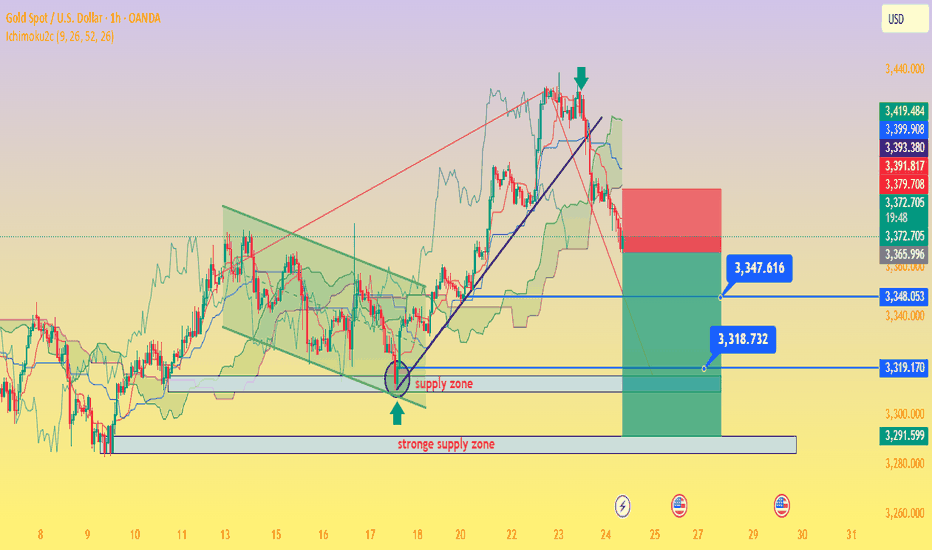

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Trend continuation or reversal?Gold bounced strongly from the bottom of the higher time frame channel, and we should also consider that this bounce was triggered by news that was negative for the dollar on Friday. Now we need to wait and see whether this move is truly strong or if it's going to turn out to be a fake and head back down toward the bottom of the channel.

XAUUSD TRADE UPDATE MISSED TRADE Hey everyone here’s a trade recap of the week at first we were interested to take buys at 3254 zone as first entry and scale in at 3287 zone but price pulled down slightly missed the first entry and I didn’t execute & the second entry didn’t execute that too and market skyrocket if price activated the first entry we would’ve caught a huge trade today,the first one didn’t activated so I didn’t execute the second entry which is the 3287 zone that buyers came in so we move on and I will keep on sharing potential good setups and have a beautiful weekend guys….

GOLD possible ScenarioCurrently gold has broken a major trendline and currently trading in bearish momentum, currently consolidating or pullback from support and may get rejected from 0.5 or 0.618 if bearish ahs to continue 3240-3250, if breaks the fib level along with trendline resistance can easily price can reach 3340 major resistance level. let us see.

Up 16K USD Profit For The Month On XAUUSD Momentum TradingXAUUSD is again making these ranges as it goes up. If you can identify these ranges then you can do a short trade on the resistance levels and a long trade on support levels. XAUUSD is trending up overall but if you are a trend-follower then you will have a hard time timing your entries just because of the ranges XAUUSD is making. It will go up to 3,400 then go back down to 3380 then back again to 3,400 then down again to 3375. Momentum trading is the best approach. You short the tops. Go long on bottoms. Get in, get out. I currently have 16,894 usd realized profit on XAUUSD this month doing momentum trading. I'm trading a live account. FED will probably cut rate soon and there will be a lot of bullish predictions on XAUUSD but I highly suggest to just trade the chart. Do not have any opinion on where the market or the price will go. Let the price move and just react. No one can predict the market. Trade your chart. May you trade well.

GOLD: Long Trading Opportunity

GOLD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry Point - 3372.6

Stop Loss - 3367.3

Take Profit - 3383.4

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Daily Analysis- XAUUSD (Thursday, 6th August 2025)Bias: Bearish

Notes:

- Daily consolidating after Friday spike up

- Looking for price to retrace back down to daily structure

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3390

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

GOLD clear sightDear all my friends wish you bests.

1. We have strong trading range in Daily and 4H this mean market can move up and down anytime and grab liquidity.

2. Analyzing waves going to show there is a downtrend structure as correction but if you look it in weekly its always upward for gold.

3. as market couldnt pass 3452 its going to 3152

if you trade daily careful market moves extremly crazy as we have big trading range in daily.

"IT'S JUST GOOD BUSINESS"