GOLD trade ideas

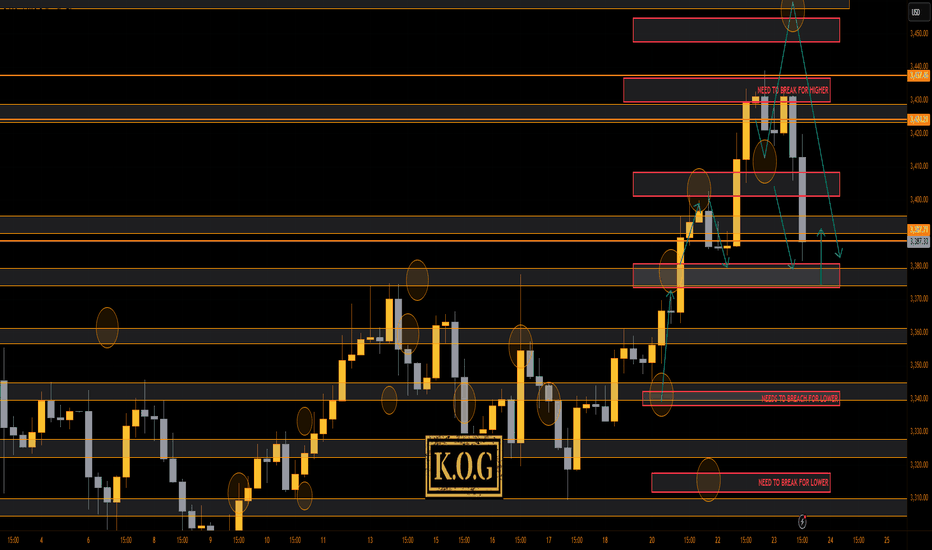

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

That was worth waiting for! We were expecting higher to then short this into the level we wanted, but as you can see, we had no red box break and our bias level was 3335. That resistance gave us an opportunity early session to get in and then the break of the 3320 level confirmed the move completing a majority of our targets.

Now we have support here and resistance at the 3395 level and above that 3406. We have a lower level here of 3375 which we feel if targeted and rejected, could give the opportunity for a RIP into the higher levels.

KOG’s Bias of the day:

Bearish below 3450 with targets below 3420✅, 3410✅, 3406✅, 3397✅ and 3390✅

Bullish on break of 3450 with targets above 3455, 3458, 3464 and 3478

RED BOXES:

Break above 3435 for 3440, 3446, 3449 and 3461 in extension of the move

Break below 3420 for 3410✅, 3406✅, 3397✅ and 3379 in extension of the move

As always, trade safe.

KOG

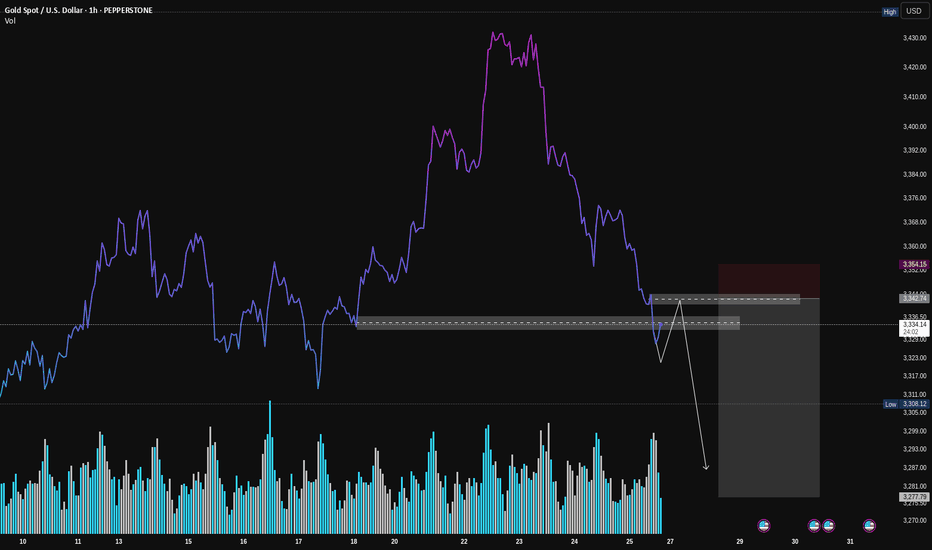

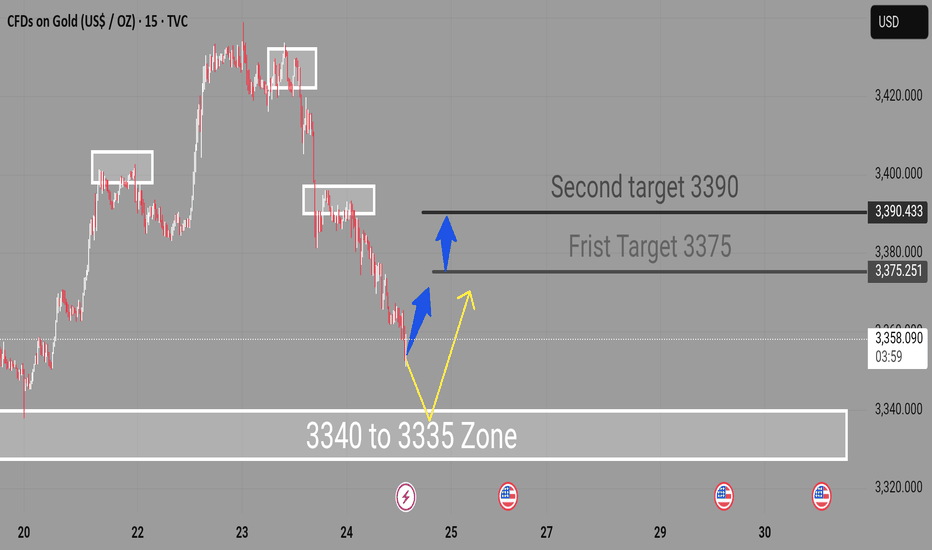

Gold (XAU/USD): A Classic VSA Short Setup in PlayHey Traders,

Following up on the general weakness we discussed in Gold, here's a closer look at a specific trade setup that's unfolding right now. This is a textbook example of a high-probability short setup according to Volume Spread Analysis (VSA).

Let's break down the story the volume is telling us.

1. The Breakdown: Sellers Show Their Hand

First, look at how the price broke down hard through that support level (the grey box). Notice the volume on that sharp drop? It was high. This is our clue that sellers are strong and in control. They had enough power to smash right through a level that was previously holding the price up.

2. The Retest: Buyers Don't Show Up

Now, the price is creeping back up to that same exact level. But here's the most important clue: look at the volume on this rally. It's much lower than the volume on the breakdown.

This is what VSA calls a "No Demand" rally. It’s like the market is trying to push a car uphill without any gas. It tells us that strong buyers (the "smart money") have no interest in buying at these prices.

3. The Setup: Selling into Weakness

This combination creates a classic short setup:

Logic: We are looking to sell at a level where old support has flipped into new resistance.

Confirmation: The low volume on the retest confirms the rally is weak and likely to fail.

How to Potentially Trade It

The grey box represents a high-probability entry zone. To time an entry, you could watch for a clear rejection signal right inside this zone. For example:

A "rejection candle" (like a pin bar) that pushes into the zone but gets slammed back down.

An up-bar with a tiny body and very low volume, showing buyers are completely exhausted.

Seeing one of these signs would be the final confirmation that sellers are about to take back control.

Conclusion:

This is a powerful setup because all the pieces line up: the background is weak, sellers have shown their strength, and buyers are now showing no interest at a key resistance level.

Disclaimer: This is my personal analysis using VSA and is for educational purposes only. It is not financial advice. Always do your own research and manage your risk. Good luck, traders!

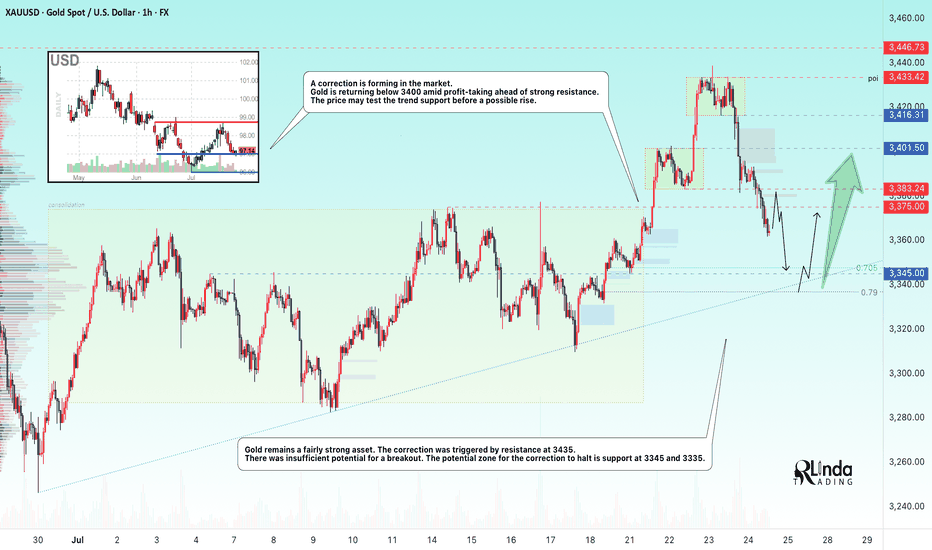

GOLD → Countertrend correction. Where will growth begin?FX:XAUUSD faced pressure in the 3430 zone, traders moved into profit-taking mode, triggering a correction. The price entered the sell-off zone...

On Thursday, gold is trading below $3400 as traders assess progress in US-EU trade talks and await preliminary PMI data from the US and the EU. These indicators could influence expectations for Fed and ECB rates. Optimism is being bolstered by reports of trade agreements between the US and Japan and other countries. The ECB is expected to keep rates unchanged, while the probability of a Fed rate cut in September is estimated at 60%. Investors are also watching Trump's conflict with Powell amid his visit to the Fed. Technically, the daily market structure is not broken, and a correction is forming within acceptable limits.

Based on the current direction, the market may test the intermediate bottom: trend support, the 3345-3320 area.

Resistance levels: 3375, 3383, 3400.

Support levels: 3345, 3320

A retest of resistance at 3375-3383 is possible. If the bears keep the price below this zone, the metal may continue its correction phase towards the zone of interest indicated on the chart. Local sell-offs have not yet broken the bullish daily structure.

However, the absence of a downward impulse and consolidation in 3375 - 3383 with a subsequent breakout of local resistance could increase demand again, which would generally lead to premature growth to 3400 - 3435.

Best regards, R. Linda!

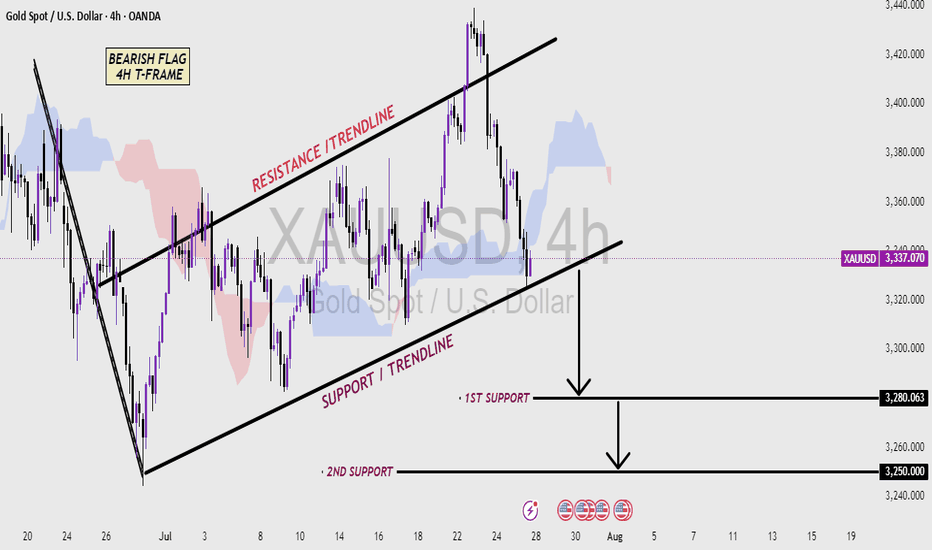

XAUUSD 4H CHART - Bearish pattern Analysis (read the caption)📉 XAUUSD 4H Chart – Bearish Flag Pattern Analysis

This 4-hour chart of Gold (XAUUSD) shows a classic Bearish Flag pattern, which is typically a continuation signal in a downtrend. After a strong bearish move, price entered a consolidation phase inside a rising channel, forming higher highs and higher lows—this creates the flag structure.

The price is currently trading within the Resistance and Support Trendlines of the flag. A break below the Support Trendline would confirm the bearish flag breakout, suggesting a continuation of the downtrend.

Key support levels to watch:

🔻 First Support: 3280.063 – Initial target after breakout

🔻 Second Support: 3250.000 – Extended target if bearish momentum continues

Traders should monitor for a confirmed breakdown with volume and bearish candlestick confirmation to validate short entries. This setup favors sellers if the support breaks decisively.

GOLD Range-Bound Before Fed – Breakout Above 3349 Unlocks 3374GOLD | Bullish Momentum Builds Ahead of Fed Decision – Key Range Between 3349 and 3312

Fundamental Insight:

Gold is slightly higher as the U.S. dollar weakens ahead of the Fed’s rate decision. Markets await signals on future policy, which could drive sharp moves in gold.

Technical Outlook:

Gold remains bullish while above 3320, with upside potential toward 3349.

A 1H close above 3349 confirms breakout momentum, opening the path toward 3374, and potentially 3401.

A break below 3320, especially below 3312, would invalidate the bullish setup and trigger downside toward 3285, then 3256.

Currently range-bound between 3349 and 3312 — watch for breakout confirmation to determine the next trend direction.

Key Levels:

• Support: 3320 – 3285 – 3256

• Resistance: 3349, 3374 – 3401

Bias: Bullish above 3320

📍 Watch Fed volatility – breakout expected soon

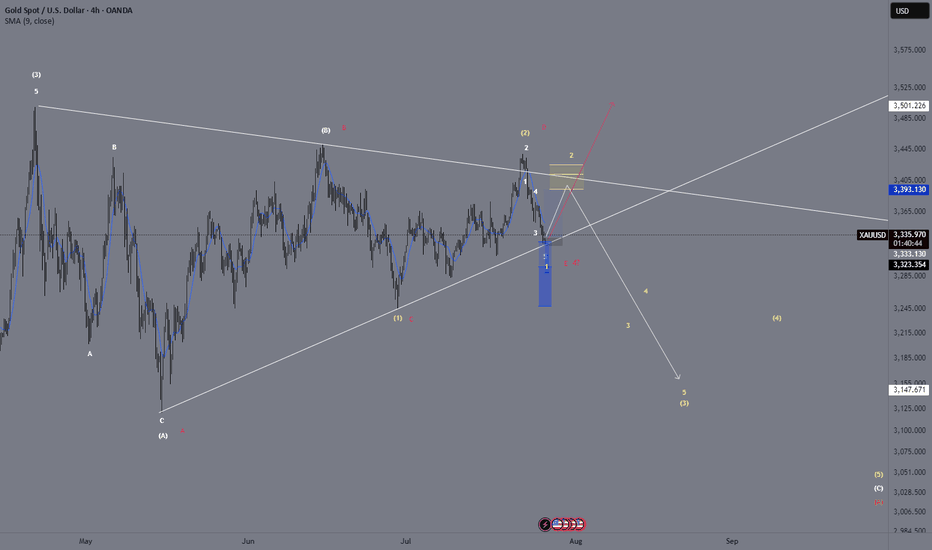

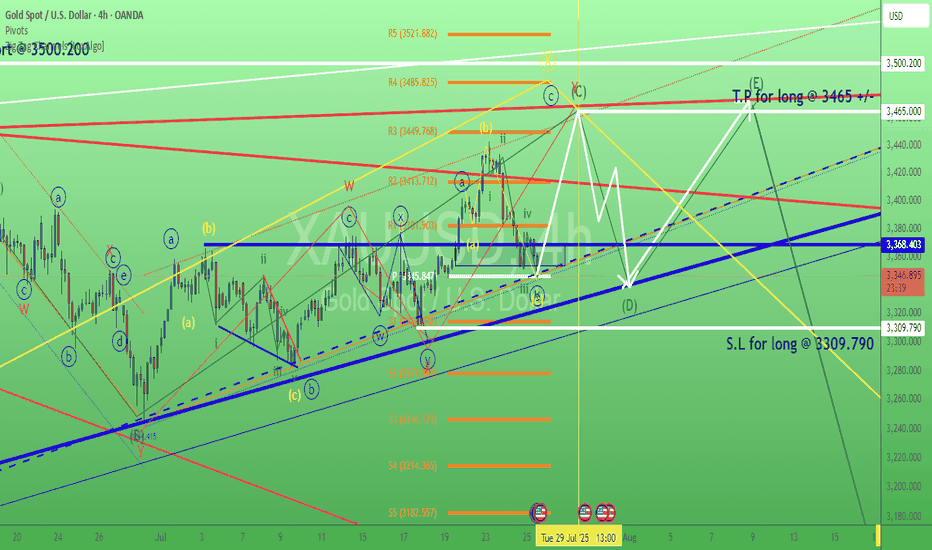

XAU/USD – Current Wave Count & Potential ScenariosOANDA:XAUUSD

We are currently moving from (white) wave 3 to (white) wave 4.

So far, I am leaning towards the white count where the waves labeled (A), (B), (C) form a larger corrective wave A, which leads to wave B, and then to (white) wave 4.

Up to now, we have only completed (A) and (B).

Now, in the yellow bracket, we can interpret a 1-2-3-4-5 structure leading to (white) wave C 🟡.

Alternatively, one could interpret a triangle pattern (pink count):

Waves A, B, C, D, E, which would then form our wave 4.

In that case, we would expect bullish targets afterwards 🚀.

We need to watch closely if the price reverses or breaks through our yellow Fibonacci zone 🟡.

For now, we are primarily looking for upside potential 🔼.

From our yellow wave 2, we saw a downward push, which could theoretically be our yellow wave 1 leading into yellow wave 2 and the yellow Fibonacci zone — essentially a five-wave move from wave 2 to wave 3.

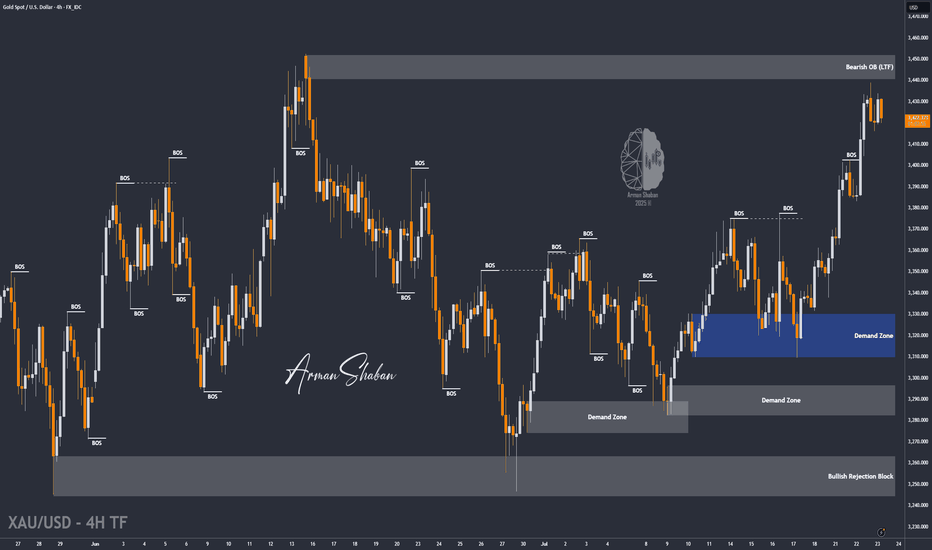

XAU/USD | Watching for Potential Drop Toward $3391! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that gold continued its bullish move after holding above $3409, successfully hitting the $3440 target and delivering over 200 pips in returns! After reaching this key supply zone, gold corrected down to $3415 and is now trading around $3421. If the price stabilizes below $3431, we can expect further downside movement, with the next bearish targets at $3415, $3404, and $3391. If this scenario fails, an alternative setup will be shared.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

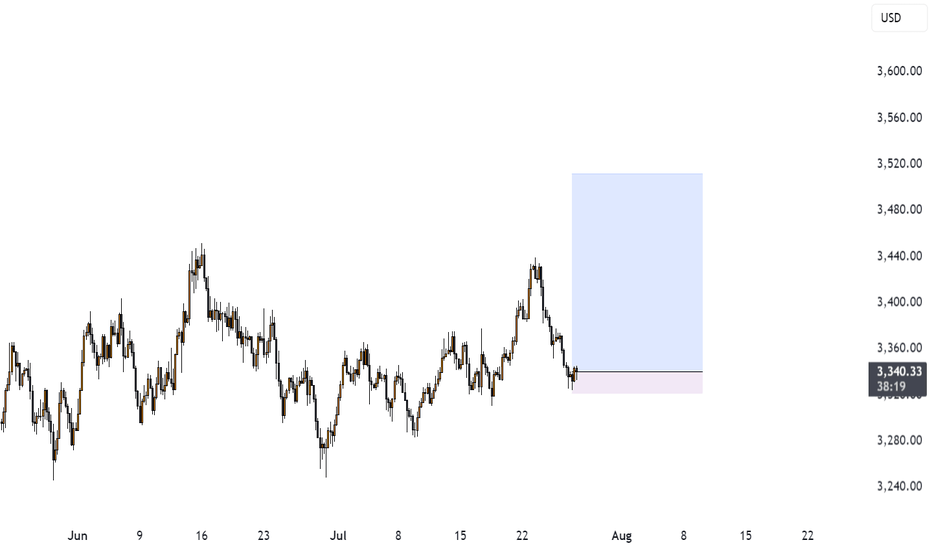

XAUUSD Expecting bullish Movement Gold is currently testing a strong demand zone between 3340 to 3335, which previously acted as a support area. The price action indicates potential for a bullish reversal from this zone, supported by oversold conditions and historical reaction levels.

Entry Zone: 3340 to 3335

First Target: 3375

Second Target: 3390

Two potential scenarios are highlighted:

A direct bullish reversal from the 3340–3335 zone

A slight consolidation before continuation to the upside

This setup offers a favorable risk-to-reward opportunity for intraday or short-term swing traders. Monitor price action confirmation signals before entering

Gold 30Min Engaged ( Bearish Break Out Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish From now price - 3306

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

GOLD -Key Levels-Wait for Confirmation!Gold (XAUUSD) is now testing a critical Rejection Area 📍 (around 3,328–3,333), right beneath a minor CHOCH zone. This is a key decision level, and I'm just waiting for price to show its intrest – no early entries here. ⚠️

🔼 Bullish Scenario:

Price fails to hold above minor CHOCH ✅

Comes back to retest the Rejection Area as support 🧱

If we get a clean bounce + confirmation, I’ll look for buys toward 3,346 → 3,360 🎯

🔽 Bearish Scenario:

Price rejects from minor CHOCH ❌

Gives strong bearish confirmation 🔻

Then retests the Rejection Area as resistance 🚫

That’s my cue to short toward 3,310 → 3,295 📉

NOTE: possibility is that market take all liquidity from sell side. Avoid Taking any trade untill setup is clean.

Being patient here. Confirmation is everything! Let’s see🔍💡

Avoid Mid-Zone Entries!

XAUUSD is still bearish Gold is currently below rising channel and holding the Range of 3320-3335,although yesterday implusive drop is incompleted without testing 3290-3280

What's possible scanarios we have?

▪️I'm still on bearish side till 3345 is invalidated and candle flips above. I open sell trades at 3332 again and holds it .

if H4 & H1 candle close above 3345 I will not hold or renter sell.

▪️Secondly if H4 candle closing above 3345 this down move will be invalid and Price-action will reached 3370.

Gold VS US 10- year yield Gold pared most of its gains on a strong US dollar. It hits an intraday low of $3307 and is currently trading around $3311.

Any breach below $3305 (365- 4H EMA) confirms trend weakness and a dip to $3245/$3200 is possible. The strong US dollar and surge in US 10-year yield after strong US jobless claims and GDP data.

It is good ot sell below $3305 with an SL around $3330 for a TP of $3245/$3200.

Bullish Sentiment Returns to Gold?Hello everyone, what are your thoughts on XAUUSD?

From a technical perspective, XAUUSD has just retested its long-term ascending trendline and formed a bullish reaction candle, suggesting that buying pressure may be returning.

Recently, a survey of 206 investors revealed that market sentiment remains optimistic, with 66% expecting gold prices to continue rising, 19% predicting a decline, and 15% anticipating a sideways market.

What do you think? Share your opinion in the comments!