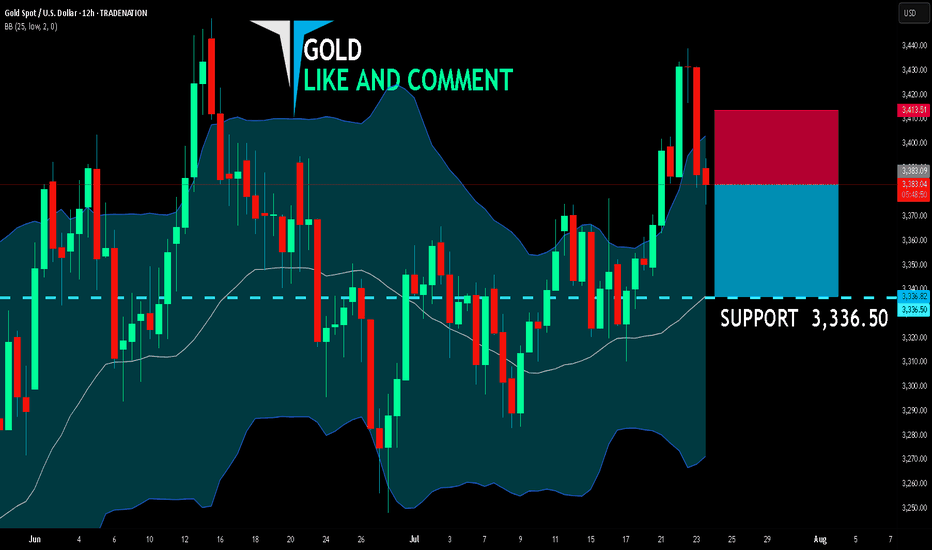

GOLD BEARS ARE STRONG HERE|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,383.09

Target Level: 3,336.50

Stop Loss: 3,413.51

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD trade ideas

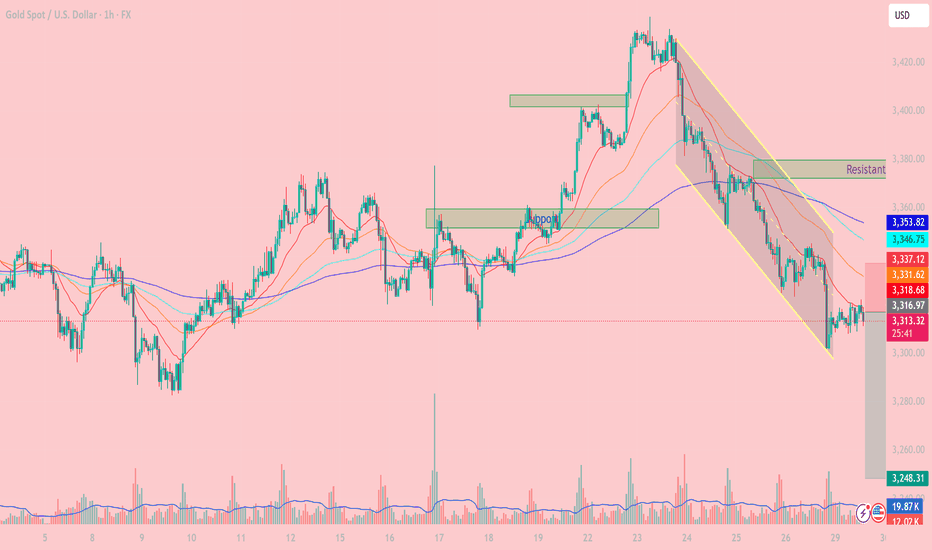

Downward Pressure Resumes After Channel BreakdownXAUUSD OANDA:XAUUSD – Downward Pressure Resumes After Channel Breakdown: Key Levels and Strategy for Today

As of the July 29 session, gold (XAUUSD) remains under short-term bearish pressure, having broken below the descending price channel on the 1H timeframe. The market structure confirms a dominant bearish trend as price continues to trade below the EMAs cluster.

1. Price Action and Market Behavior

XAUUSD is forming a clear sequence of lower highs and lower lows, confirming a short-term downtrend.

Price is currently hovering around $3,316 after breaking below the lower boundary of the channel, signaling potential continuation of the sell-off.

2. Key Resistance and Support Levels

Immediate resistance: 3,337 – 3,346 USD (aligned with EMA20, EMA50 and prior channel resistance).

Major resistance: 3,378 – 3,385 USD (confluence of Fibo and former high).

Near-term support: 3,300 USD (psychological level).

Major support: 3,248 USD (projected target based on measured move from channel height).

3. Technical Indicators

EMA20 and EMA50 are both below EMA200, forming a classic “death cross” – a strong bearish signal.

Volume increased on the breakdown, reinforcing the strength of bearish momentum.

RSI remains below 50, indicating weak bullish retracements and room for further downside.

4. Trading Strategy

Primary Strategy: Sell on Rally

Ideal entry zone: 3,331 – 3,346 USD.

Stop Loss: Above 3,353 USD (above key resistance zone).

TP1: 3,300 USD.

TP2: 3,248 USD (extended target based on breakout structure).

Alternative Strategy: Countertrend Long

Only consider buy setups if strong reversal candles and bullish RSI divergence appear near 3,248 USD.

XAUUSD continues to face downside risk after the channel breakdown. Unless bulls reclaim the 3,337 – 3,346 zone, price is more likely to drift lower toward 3,300 and potentially 3,248. Traders should remain patient and wait for clean setups around these key zones.

Follow for more strategies and remember to save this post if you found it helpful.

Let me know if you'd like a short version for the TradingView caption or hashtags suggestion.

XAUUSD Analysis: Watching 3323.52 as Potential Support-Turn-ResiPrice action on XAUUSD suggests that the 3323.52 level may act as a key area of interest. Following the recent break below a structural low, I am anticipating a possible retracement toward this zone, where it could serve as a support-turned-resistance level.

Should price react to this area and fail to reclaim it, we may see a continuation of bearish momentum driving price lower.

📌 Key Level: 3323.52

📉 Bias: Bearish below this zone

🔍 Confirmation: Watching for rejection or bearish structure on lower timeframes around the level

7.29 Gold 1-hour bottom signal appearsIn the short term, we see the daily line as the range of 3301-3345, and the current price is showing a volatile rebound, so we have to buy on dips. Then 3306-08 is the long point, but the price has risen in the morning, so the long position should be around 3310-12 in advance. If it falls below 3301 during the day, it will continue to test the 3292-3282 line downward. Similarly, if it breaks above 3345 during the day, it will continue to test 3372 upward and show a rebound trend in the next few days.

GOLD BUY In the XAU/USD 2025 Forecast, FXStreet analyst Eren Sengezer suggests Gold’s 2025 outlook depends on Federal Reserve (Fed) policy, Donald Trump’s decisions and geopolitics. A bearish scenario could unfold if geopolitical tensions ease, inflation remains persistent and United States-China trade tensions weaken China’s economy, reducing Gold demand. A hawkish Fed could also pressure prices.

On the bullish side, continued global policy easing, a recovering Chinese economy or escalating geopolitical conflicts could boost safe-haven flows into Gold, supporting its resilience and pushing prices higher.

Gold's technical outlook suggests weakening bullish momentum, with the RSI at its lowest since February and XAU/USD. Key support lies at $2,530-$2,500, with further declines potentially targeting $2,400 and $2,300. On the upside, resistance at $2,900 could limit gains, with additional barriers at $3,000-$3,020 and $3,130 if Gold attempts a new record high.

SUPPORT 3,326

SUPPORT 3,336

SUPPORT 3,350

RESISTANCE 3,306

RESISTANCE 3297

Report - 25 jully, 2025U.S.–EU Tariff Negotiations Stabilizing Markets

Reports confirm the U.S. and EU are nearing a deal for 15% reciprocal tariffs—lower than the initially threatened 30% by President Trump. This easing of tensions led to moderate equity gains in both blocs, with the Stoxx 600 reaching a 6-week high before closing +0.2%. Pharmaceutical and auto stocks outperformed (Volkswagen +2.3%, Bayer +2.3%).

Forecast: If the 15% deal is finalized by the August 1 deadline, it would remove a key overhang on equities and boost cyclical sectors reliant on transatlantic trade. A failure, however, risks escalation, triggering retaliatory tariffs by the EU on $93bn of U.S. goods, dragging risk assets sharply lower.

DXY Outlook: Tariff de-escalation boosts safe-haven flows and investor optimism, supporting USD strength.

S&P 500: Short-term relief rally expected if the 15% tariff framework is signed. However, margin compression risks remain from lingering supply chain disruptions.

Tesla vs Trump: Policy Shock Rattles EV Sector

Elon Musk warned that Trump's anti-EV stance and trade war posture will sharply erode Tesla’s regulatory credit revenue and remove the $7,500 EV tax credit. Tesla's stock has cratered 37% since December, with a sharp 8% drop yesterday. Adjusted Q2 net income was down 22%, revenue -12%.

Risk Forecast: Loss of EV subsidies + political fallout between Musk and Trump could drag Tesla further and dampen broader EV sector growth.

XAUUSD: Rising political uncertainty and risks to the U.S. tech sector may drive safe-haven flows into gold.

Dow Jones: Tesla's underperformance and anti-EV policies could limit industrial sector gains.

ECB Holds Rates Amid Trade Risk Fog

The European Central Bank paused its easing cycle, holding the benchmark rate at 2%. Lagarde emphasized a "wait-and-watch" stance, signaling uncertainty due to unresolved trade talks and tariff volatility.

Market Implication: Eurozone government bond yields rose (10Y Bund at 2.70%), paring rate-cut bets. The euro softened to $1.1760.

EURUSD: Lack of further ECB accommodation and weaker consumer confidence amid trade frictions.

Fed Independence in Jeopardy? Market Confidence Wobbles

Pimco warned that White House pressure on Fed Chair Powell—including potential firing and scrutiny over $2.5bn HQ renovations—could destabilize markets. Trump continues pushing for aggressive 1% rates, diverging from current 4.25–4.5% levels.

Fiscal/Political Implication: Undermining Fed autonomy risks flight from U.S. bonds, undermining monetary policy credibility and capital inflows.

USDJPY: Yen may gain if markets lose faith in U.S. institutional integrity, despite rate differentials.

DXY: Temporary support from yields, but structural downside if Fed credibility erodes.

Deutsche Bank and BNP: Diverging Strengths in Volatile Landscape

Deutsche Bank posted its strongest Q2 in 18 years, driven by litigation charge reversals and stable investment banking performance. BNP Paribas also reported solid FICC trading (+27%), though equity trading lagged due to weak derivatives demand.

Equity Implication: Strong capital returns and stable European banking profitability support DAX resilience amid trade noise.

DAX: Boosted by banking and auto outperformance.

China–EU Trade Strains Escalate

Von der Leyen directly confronted Xi Jinping over trade imbalances and support for Russia. EU exports to China are down 6% YoY while Chinese imports to the EU are up 7%. Xi defended Beijing’s stance, warning against "decoupling" rhetoric.

Geostrategic Implication: EU may escalate anti-dumping and export control measures. Markets may see renewed volatility in European industrials and luxury sectors reliant on China.

XAUUSD: Rebalancing of power and heightened East–West tensions favor gold.

Oil Oversupply Warning from TotalEnergies

Total warned of an oil glut due to OPEC+ production increases and weakening global demand. Q2 profits fell 30% YoY. Brent now likely to stay within $60–70 range barring major geopolitical flare-ups.

Crude Oil: Short- to medium-term downside risk with soft demand and oversupply fears.

Energy Stocks: Dividend maintenance remains but debt levels and margin pressures may weigh.

AI Spending Surges – Alphabet and SK Hynix

Alphabet posted a 19% Q2 profit jump as AI integration boosts search volumes. Google’s cloud revenues rose 32%. Capex raised to $85bn. SK Hynix also posted record revenues from high-bandwidth memory chip sales, extending its lead over Samsung.

S&P 500: AI-driven earnings upside bolsters tech sector. Expect multiple expansion in mega-cap AI-exposed names.

XAUUSD : Robust AI investment supports risk appetite but inflationary fears could lift gold marginally.

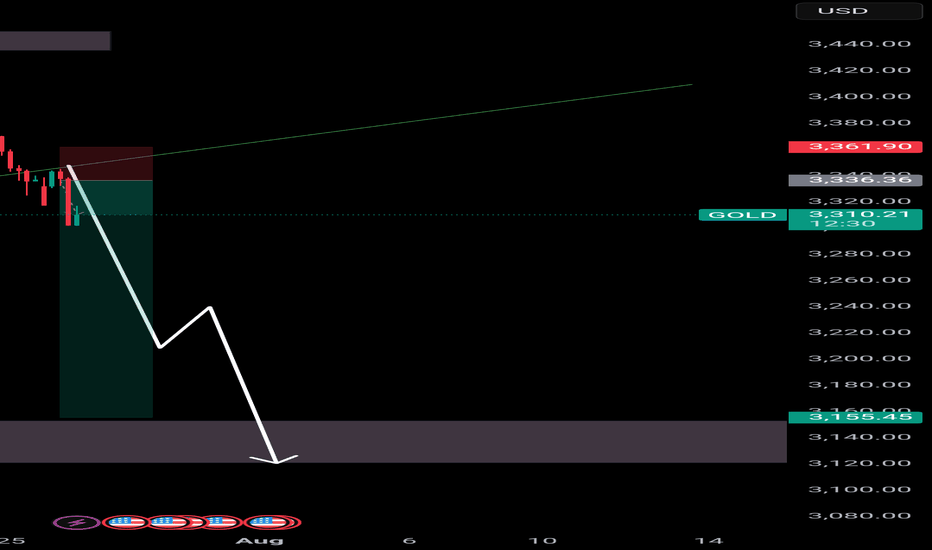

Gold analysis Gold (XAU/USD) Technical Analysis

Date: July 28, 2025

Market Context

Gold (XAU/USD) is currently trading at $3,313.01, showing a modest gain of +0.32% on the day. From a Smart Money Concepts (SMC) perspective, price action is now positioned at a high-probability demand zone, presenting an attractive opportunity for long positions.

Key Technical Observations

Liquidity Grab at $3,308

Price has recently swept the liquidity resting below $3,308, indicating the possible completion of a stop-hunt move orchestrated by institutional players. This move created an ideal setup for a bullish reversal from a zone where weak longs have been shaken out.

Discounted Price Zone (89% Fibonacci)

The market has retraced deeply into a discounted region, reaching the 89% Fibonacci retracement level of the most recent bullish leg. This zone coincides with a previously identified demand block, enhancing the confluence for potential bullish continuation.

Market Structure & Order Blocks

The current structure shows a bullish intent with price revisiting a bullish order block that previously led to a strong rally. The reaction from this block is key—holding above $3,300 would confirm buyers stepping in with conviction.

Internal Liquidity Void (Imbalance)

A visible inefficiency (price imbalance) exists between $3,345 and $3,398, acting as a magnet for price in the short-to-mid term. This inefficiency aligns perfectly with SMC principles that favor price filling these voids.

Bullish Targets

If price holds and confirms bullish intent from the current zone, we expect a move toward the following key levels:

Target 1: $3,345

This is the midpoint of a previous consolidation range and also lies just above the 50% Fibonacci level.

It also aligns with a minor supply area and could serve as a first TP level.

Target 2: $3,398

This is the upper bound of a key supply zone that previously initiated a strong sell-off.

It coincides with the 0.00% Fib retracement, marking the origin of the most recent bearish leg.

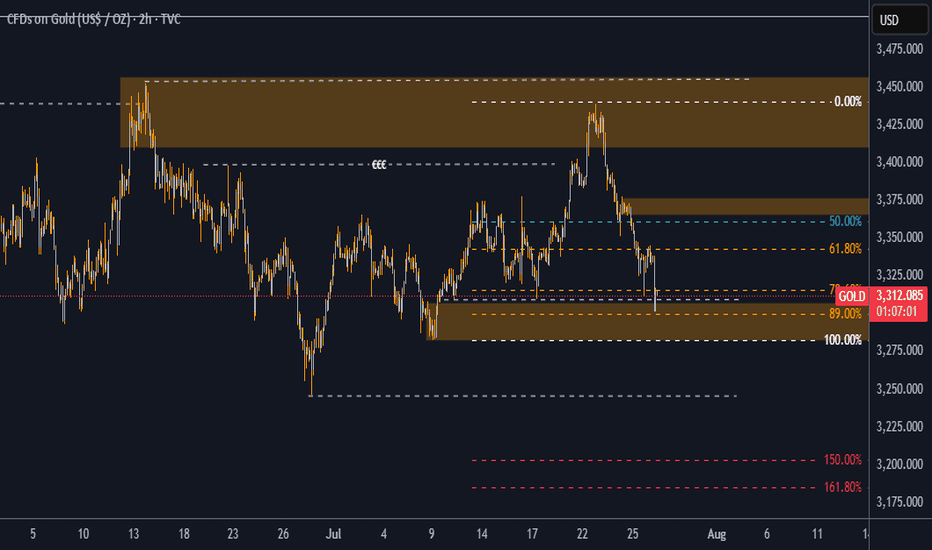

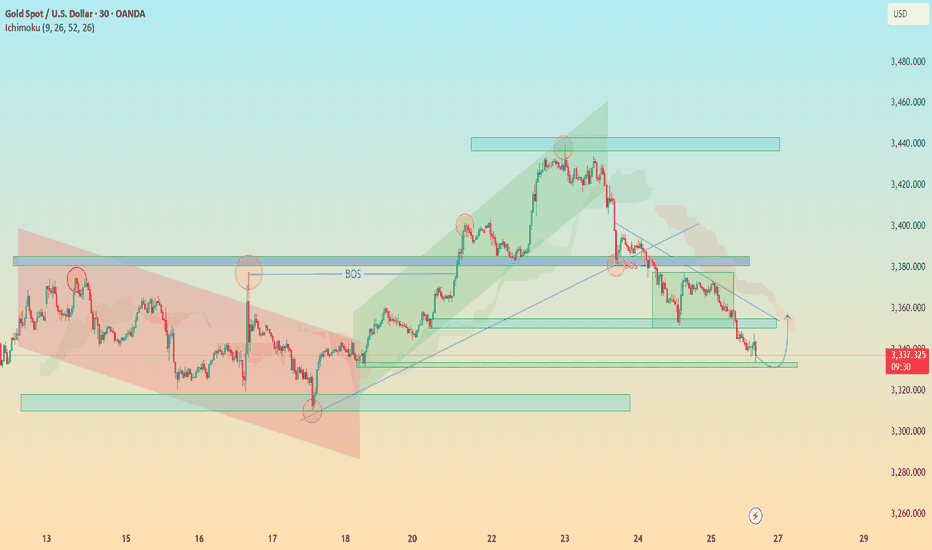

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

Gold (XAUUSD) - Liquidity Sweep Setup and Long Bias PlanPrice is currently respecting my projected structure and moving in line with expectations. I'm anticipating a deeper liquidity sweep into the marked demand zones below, where multiple liquidity pools are likely to be taken out. These areas have historically provided strong reactions.

🟦 Key Zones:

Three stacked liquidity sweep levels are highlighted, where previous lows and stop clusters are expected to be swept.

Watch closely for bullish reaction after liquidity grab in these zones.

🟢 Plan:

Looking for potential Entry Long after confirmation from the sweep and market structure shift.

Expecting price to accumulate, fake out with a final sweep (as sketched), and then launch upwards.

If the sweep completes and the structure confirms, targeting a strong bullish continuation move.

📈 Context:

Higher timeframe bullish structure still intact.

Setup aligns with ICT Smart Money Concepts – targeting liquidity and institutional order flow behavior.

💡 This idea will be updated as the setup develops. Trade safe and wait for confirmation.

XAUUSD Next swing is Ready Gold is currently below rising channel also completion of structural support chart . Eyes on DXY

What's possible scanarios we have?

▪️I will wait next for my buy trades at 3290-3285 area but what we have to watch during that time H4 candle closing.

▪️Secondly if H4 candle closing below 3278-3275 this upside move will be invalid

Additional TIP: let the market comes to you