GOLDCFD trade ideas

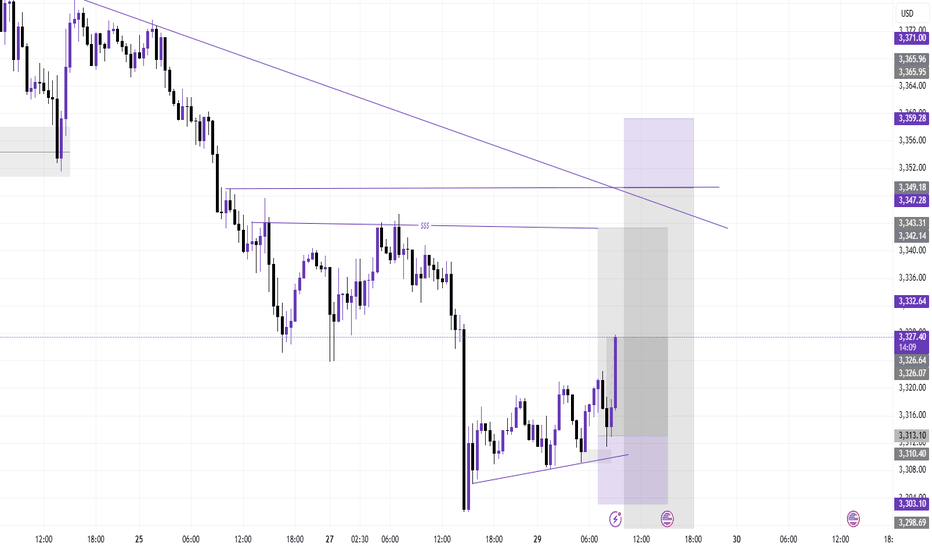

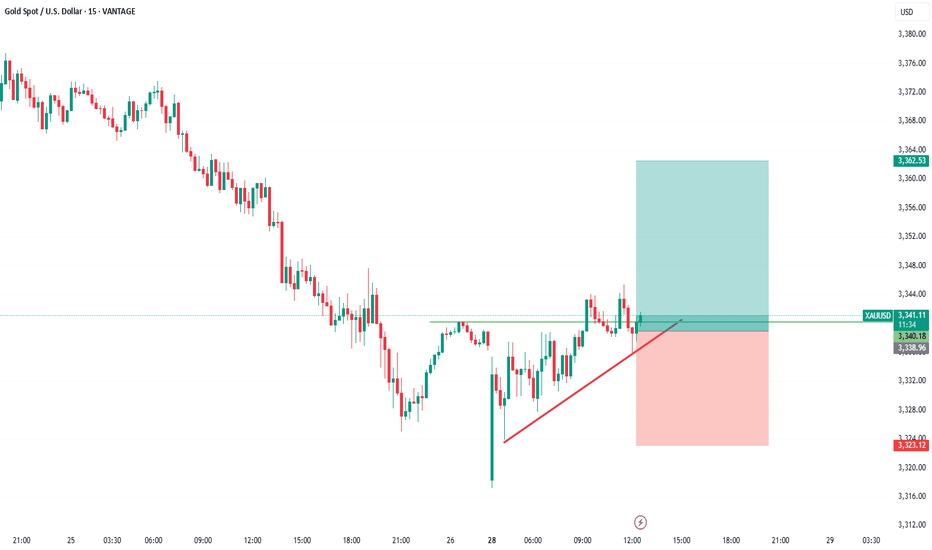

GOLD: Next Move Is Down! Short!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,328.24 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 3,318.05..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

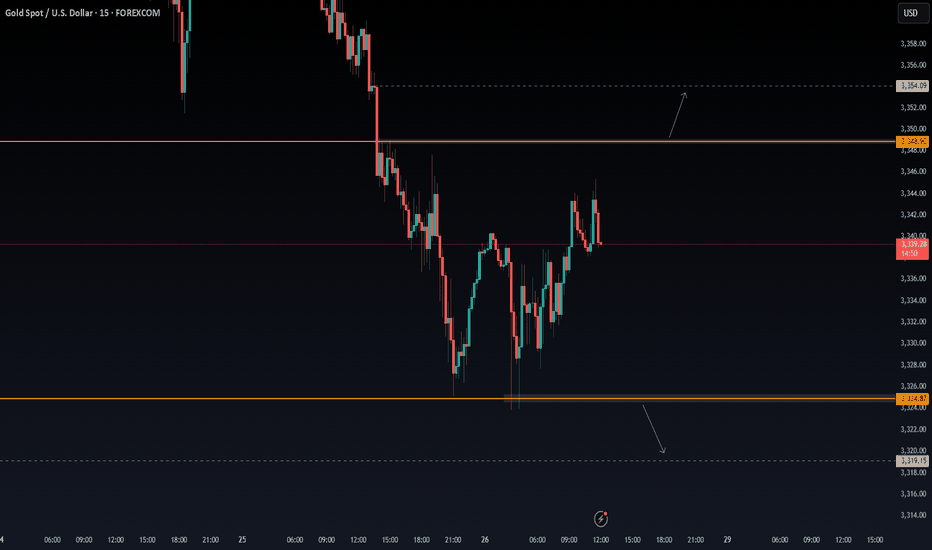

Gold prices under pressure: $3,330-3,350Gold prices under pressure: $3,330-3,350

Upward momentum: Gold could break through $3,330 if the Federal Reserve hints at a September rate cut or the EU economy deteriorates.

Downside risks: Gold could fall below $3,300 if strong US economic data (such as GDP and PCE figures) are released.

Optimistic scenario: If the Fed cuts rates in September and global stagflation risks increase, gold could reach $3,400.

Pessimistic scenario: If the US economy experiences a soft landing, rising real interest rates could push gold prices down to $3,200.

Key Technical Levels:

Support: $3,300

Resistance: $3,330/$3,350

Aggressive Strategy:

Sell Price: $3,325-$3,330

Stop Loss: $3,335

Target Price: $3,310

Conservative Strategy:

Sell Price: $3,340-$3,350

Stop Loss: $3,355

Target Price: $3,330-$3,310

Bottom Picking Strategy:

Buy Price: $3,300-$3,310

Stop Loss: $3,290

Target Price: Above $3,350/$3,400

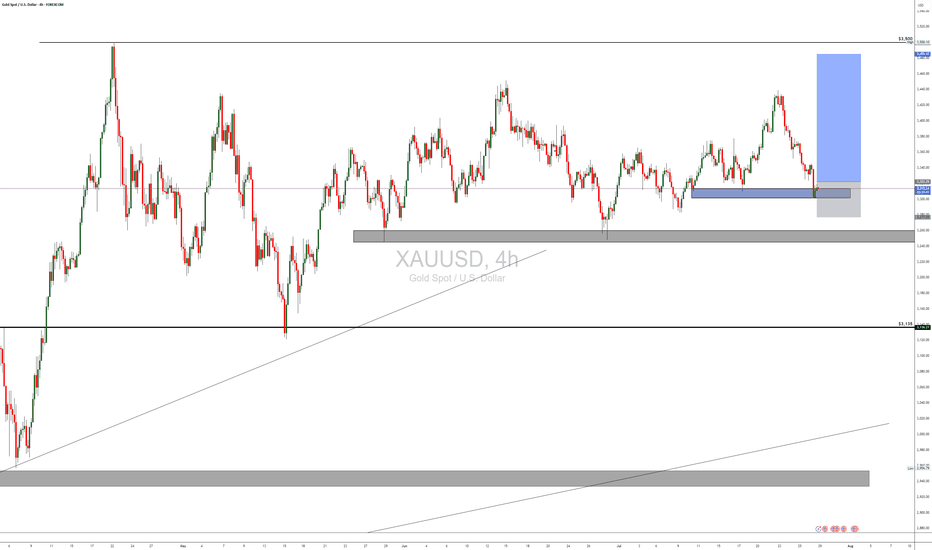

Gold setupGold us just broken to the downside from the previous uptrend and now we expect the prices to continue pushing towards the downside. the prices are likely to reject from the the current order block but if not, they will probably do on the smaller upper order block as you can see via the analysis

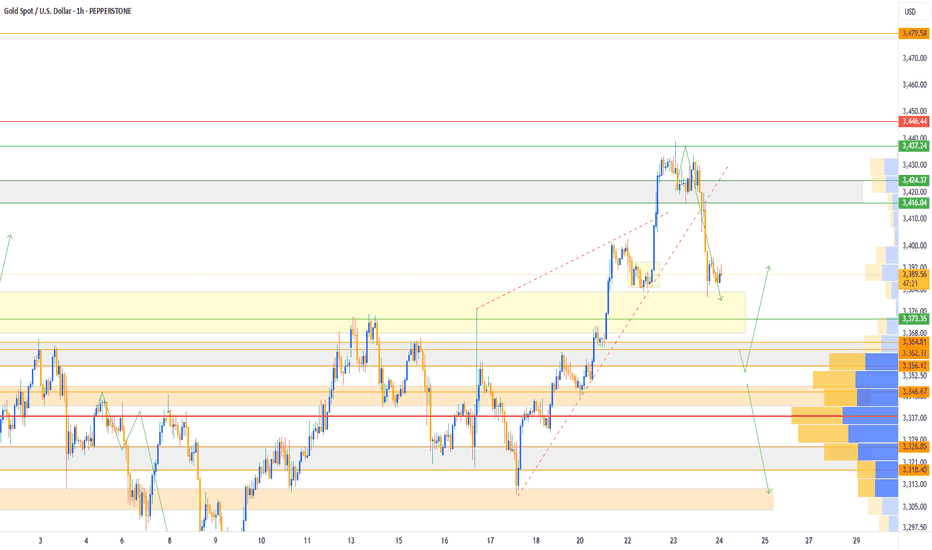

Gold Analysis and Trading Strategy | July 28

✅ Fundamental Analysis:

🔹 The United States and the European Union have reached a significant trade agreement, setting a unified tariff rate at 15% (previously threatened at 30%). The EU has also pledged to invest an additional $600 billion in the U.S. and to purchase $750 billion worth of American energy and military equipment.

🔹 This agreement has significantly eased trade tensions between the U.S. and EU, boosting market risk appetite and sending U.S. stock markets to new record highs. As a result, capital has shifted away from safe-haven assets like gold, causing gold prices to drop to the $3320 level during the Asian session.

✅ Technical Analysis:

🔸 4-Hour Chart:

Since retreating from the 3438.77 high, gold has formed a clear descending channel. While the current candlestick shows some signs of stabilization near the lower Bollinger Band, the rebound has been weak and has yet to touch the middle band, suggesting the downtrend remains intact.

Moving averages are in a bearish alignment, with the MA5 crossing below the MA10, and price continues to trade below both—indicating ongoing bearish control.

If the price fails to reclaim the MA10 level around 3347, the structure will likely remain bearish, with further downside potential targeting the 3316 and 3309 support levels.

On the upside, the 3365–3380 zone represents key resistance. For the bulls to gain meaningful control, the price must break and hold above this area.

🔸 1-Hour Chart:

The overall trend remains bearish within a weak consolidation phase, with price hovering near the lower Bollinger Band.

Despite several attempts to rebound, gold has repeatedly failed to break above the 3350 level, which now acts as a key resistance line.

The Bollinger Bands have begun to flatten slightly, and if the price cannot hold above the 3345–3350 area, the risk of a renewed drop remains. Focus on the 3320–3317 support zone in the near term.

Overall, recent rebounds appear to be corrective in nature, and the 1-hour bearish structure remains unchanged.

🔴 Resistance Levels: 3345–3350 / 3365–3370

🟢 Support Levels: 3330–3325 / 3316–3309

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3350-3355 area. Target: 3330-3310;If support breaks, the move may extend to 3280.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3333-3338 area. Target: 3345-3355;If resistance breaks, the move may extend to 3365.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

GOLD (XAUUSD)GOLD Market Outlook........

📍 Price broke daily trendline and is now retesting it.

📍 You marked a Break of Structure (BOS) — suggesting a shift in direction.

📍 Price is in a consolidation zone (range) with possible accumulation.

What to Expect:

- If price breaks above the range, expect a bullish push upward to the next supply level.

- If it rejects the upper box, it may return to fill imbalance or test previous lows again.

What You Should Do:

1. Wait for breakout confirmation from the consolidation zone.

2. For buys: Enter on a clear break and retest of the upper range box.

3. For sells: If price rejects the top and breaks back below, look for short entries toward support.

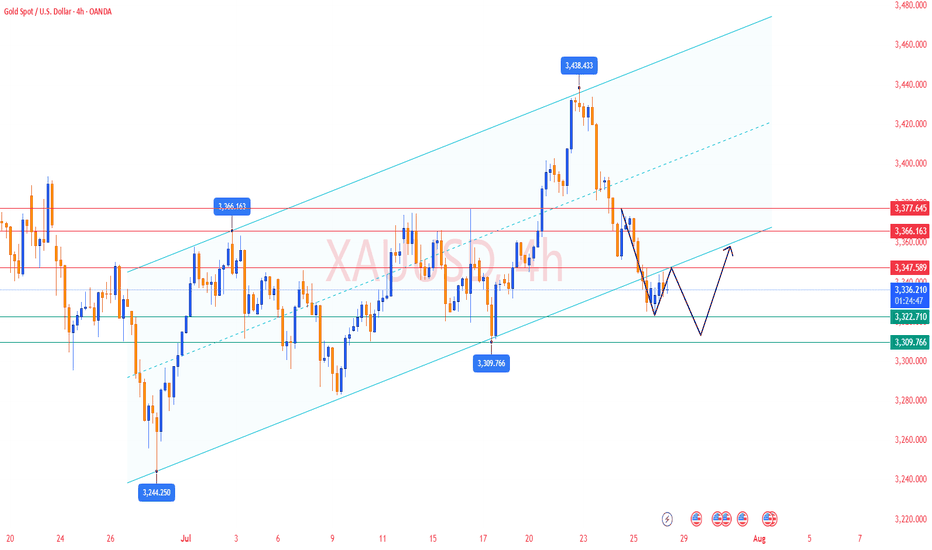

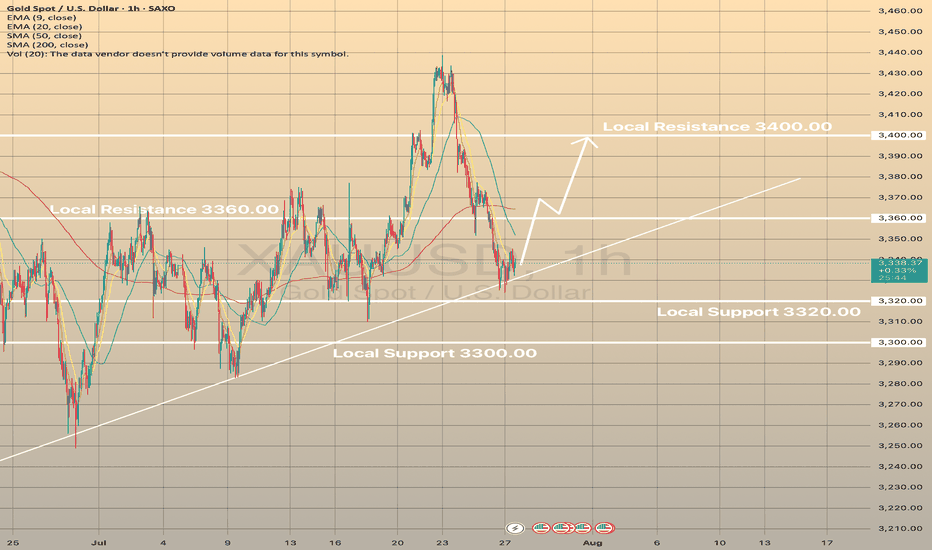

XAUUSD REBOUNDED FROM CURRENT TRENDLINE. WHAT'S NEXT?XAUUSD REBOUNDED FROM CURRENT TRENDLINE. WHAT'S NEXT?

Gold had successfully rebounded from the trendline, still showing mid-term bullish trend despite recent news on U.S. - E.U. and U.S. - Japan trade deals. Currently price is attempting to hold above the EMA20 on 1-h chart timeframe.

If this occurs and the asset develops another short-term bullish impulse, we may expect the price to reach 3,360.00 resistance level with further possible impulse towards 3,400.00 level.

XAUUSDPrice action trading is a methodology where traders make decisions based on the interpretation of actual price movements on a chart, rather than relying primarily on lagging indicators. It involves observing and analyzing candlestick patterns, trend lines, support and resistance levels, and volume to identify potential trading opportunities and manage risk. The focus is on understanding the story the market is telling through its price behavior.

XAUUSD - Scalping ideaPrice is stuck in a range between 3348.90 and 3324.87.

📌 Looking for a clean breakout to take action:

Buy above 3348.90 → Targeting 3354.09

Sell below 3324.87 → Targeting 3319.15

Not interested in any trades inside the range only jumping in once we break out and close outside either level. Waiting for confirmation to avoid getting chopped up.

Let’s see where it goes. 📉📈

No rush, just reacting.

Daily Analysis- XAUUSD (Monday, 28th July 2025)Bias: Bullish

USD News(Red Folder):

-None

Notes:

- Price gap down and filled up the gap

- Looking for price to tap 0.618 fib level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3300

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

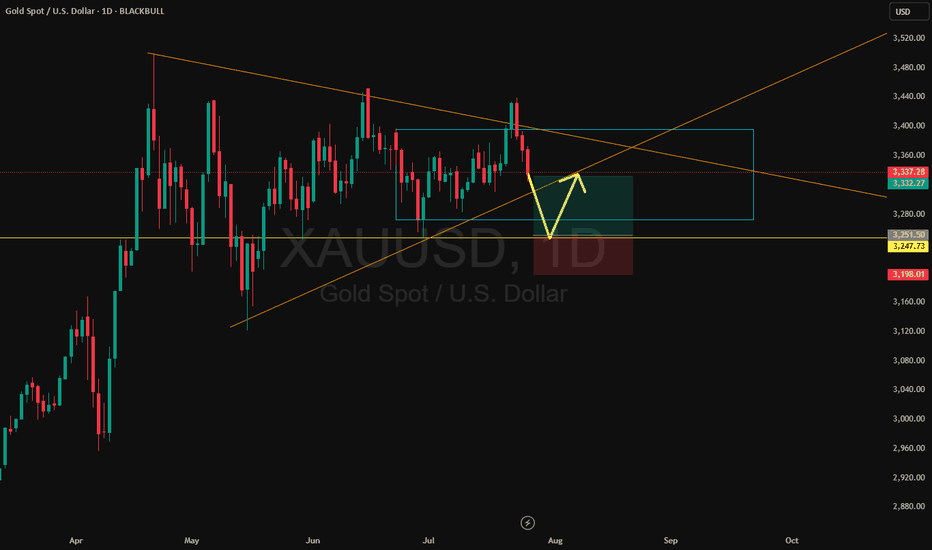

KEMANA GOLD KEDEPAN NYA ?📊 Technical Analysis – XAUUSD (July 28, 2025)

Elliott Wave Structure – Triangle (ABCDE):

The chart clearly shows a contracting triangle pattern (ABCDE), which commonly appears during corrective waves (usually Wave 4 or Wave B in a larger degree).

Currently, price seems to have just completed Wave E, and it's showing early signs of a bounce from the triangle's lower support.

If this wave count is valid, we could expect a bullish breakout soon, continuing the previous trend (most likely upward if this is part of Wave (5)).

🧭 Key Support and Resistance Levels:

Triangle Support (Wave E area):

Around $3,325 – $3,336 (price is currently testing this zone)

Potential Bullish Targets (if breakout occurs):

🎯 $3,374

🎯 $3,414

🎯 $3,498 – $3,500 (major resistance zone / Wave 5 target)

🧠 Fundamental Outlook Supporting Gold (Forward-Looking)

✅ Bullish Drivers:

Fed Rate Cut Expectations (Late 2025):

Slowing inflation → Rate cuts expected → Positive for gold.

Weaker US Dollar:

A weaker dollar makes gold cheaper for international buyers → Bullish.

Global Geopolitical Tensions:

Rising uncertainty supports gold as a safe haven asset.

⚠️ Bearish Risks:

Strong US economic data (e.g., NFP beats or rising inflation) could lead to the Fed staying hawkish → Negative for gold.

If price breaks below triangle support ($3,325), the triangle structure would be invalidated and a larger correction could unfold.

📝 Summary & Trading Strategy:

Direction Entry Area Stop Loss TP 1 TP 2 TP 3

✅ Buy (preferred) $3,330 – $3,336 Below $3,310 $3,374 $3,414 $3,498–$3,500

❌ Sell (if breakdown) Below $3,320 Above $3,340 $3,265 $3,245 $3,118

XAUUSD about to trade downwardsToo many tries on the higher high created by Gold that have failed , now the price has broken a treblndline from months back signalling a bearish move down to 3000 with few breaks to lead it there if the dollar doent slip, which the decline might take up to November according to how I see the pattern formations