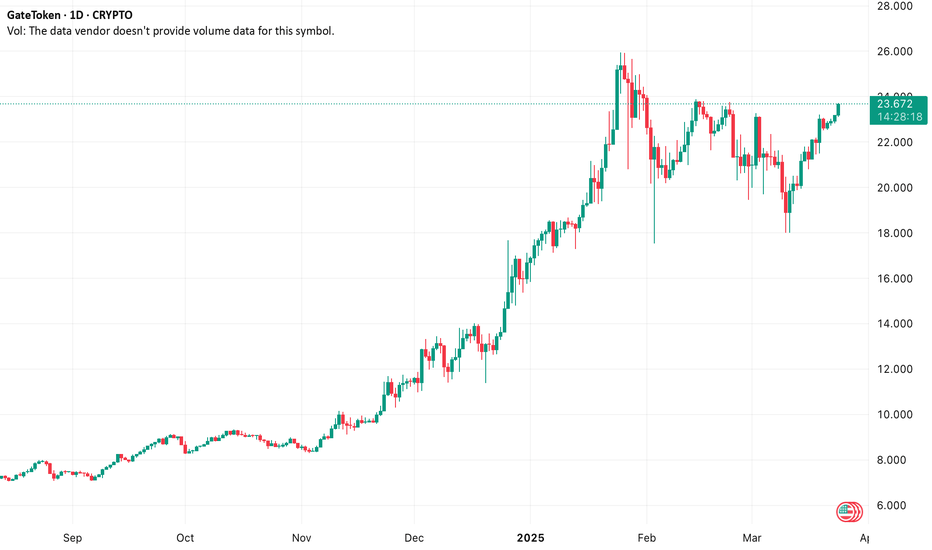

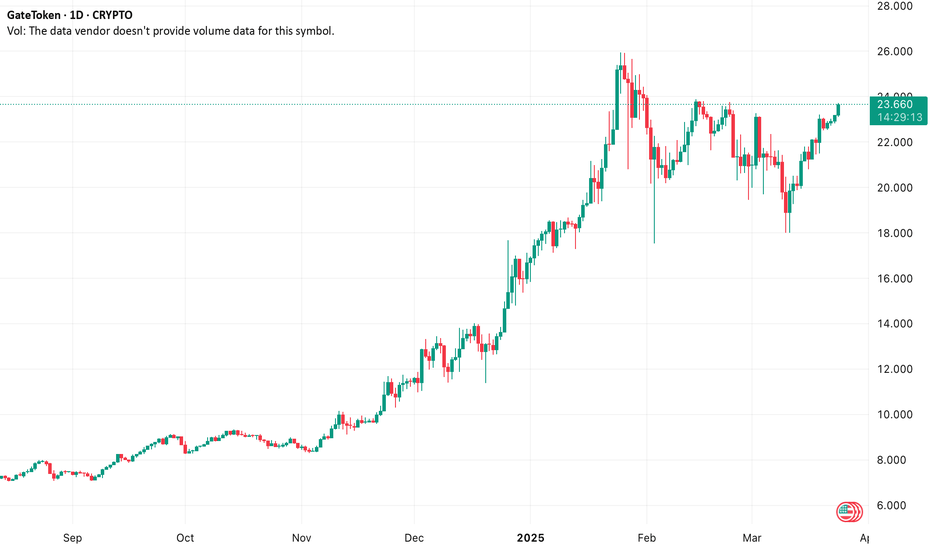

Long Trade Setup – GTUSD!📈

Timeframe: 30-Minute Chart

Pattern: Falling wedge breakout (bullish reversal)

📌 Trade Plan

📍 Entry Zone: Around $21.84 (Breakout confirmation)

🛑 Stop-Loss (SL): Below $21.72 (support + wedge invalidation)

🎯 Take Profit Targets:

TP1: $21.96 – Immediate resistance

TP2: $22.15 – Measured move from wedge pattern

🔍 Technical Highlights

✅ Clean wedge structure breaking upward

✅ Price respecting rising trendline support

✅ Confluence near breakout zone with volume pick-up

🔻 Risk: $21.84 - $21.72 = $0.12

🔺 Reward to TP2: $22.15 - $21.84 = $0.31 → R:R ≈ 1:2.58

🚨 Execution Strategy

🔹 Enter after strong close above wedge

🔹 SL just below white trendline support

🔹 Book partial profits near TP1 and ride rest to TP2

GTUSD trade ideas

GT Technicals Scream Accumulation - Here's Why""Smart money signals:

Whale ratio (top 10 addresses) up 17% monthly

Exchange outflow spikes (+$8.2M past week)

Open Interest rises while price consolidates

Technical confluence:

• Adam & Eve double bottom forming

• Volume surge on up candles

Entry strategy: Scale-in between

4.40

−

4.40−4.60 with 6:1 RR profile"

GT Technical Analysis: Oversold Opportunity or Falling Knife?"After 18% correction:

• RSI at 29 (oversold territory)

• TD Sequential buy signal on 12H chart

• Liquidity pool clusters at

4.25

−

4.25−4.35

Risk-reward ratio 1:3 at current levels. Watch for:

Exchange reserve depletion (down 8% weekly)

BTC dominance reversal"

Why GT Could Be 2024's Dark Horse Exchange Token"3 reasons to watch GT:

GateChain mainnet upgrade (Q3 2024)

15% APY for GT staking - highest among top 10 exchanges

80% circulating supply locked in products

Technical outlook: Cup-and-handle pattern developing on weekly chart. Measured move target $6.80 if pattern completes."

GT: The Exchange Token Outperforming Market - Technical Analysis"While major exchange tokens consolidate, GT shows relative strength:

Golden Cross (50DMA > 200DMA) confirmed

24% TV growth in Gate.io ecosystem Q2 2024

Key Fibonacci levels: $4.80 (38.2%) acting as support

MACD histogram turns positive on weekly chart

Speculative buy zones:

4.60

−

4.60−4.75"

$GT-Sprinting for DaysYou ever had this continuous nagging thought about something that refuse to go away every time you pushed it aside...that is what GT has been doing in my head for months now ...LOL!

I didn't prioritize this coin at $2 and today it is already $7 and still going.. funny i don't even know why..

Looking at Gateio ecosystem and the opportunity they have been giving to budding projects, i think GT should be worth more than tokens like OKB (my personal opinion)... I mean even TV don't capture their price charts like they do for tier 1 exchanges.

It just had some mini PB and consolidating into that bullish pennant.

BUY BUY BUY. $GT Gate.io

Huge highs on the four hour after FTX listing.

Gate.io is currently positioning itself as one of the top AltCoin exchanges in the USA.

Its native token for its exchange and high-throughput blockchain (GateChain) has increased 93% since my last post 30 days ago.

Organic search traffic is up 200% this month alone and with 76 million in circulation its still incredibly undervalued at $8.30 USD.

I see a conservative target between $12 and 14% by end of May

LONG GateChain GTX. Gate.ioA diamond in the rough. Gate.io saw a 76% increase in web traffic to its crypto derivative exchange in March 2021.

It's currently ranked 8th on CoinMarketCap (exchange). It features 1064 markets and 565 coins and has positioned itself

as a large variety exchange for US customers. It's volume will grow exponentially alongside its native chain/token (GT) for yield and fees.

It is ranked #6 for security by cer.live.

It currently has the most markets for us customers.

Time of writing

Binance (BNB) $476.00 +15.11%

GateChain (GTX) $3.18 +21.08%