KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase.

Reinforces BEKE’s leading position in China’s real estate sector.

Expanding Services & Market Reach 🌍

Acquisition of Shengdu Home Decoration (2022) strengthens BEKE’s homeownership services.

Broadens revenue streams beyond real estate transactions.

Strategic Backing & Partnerships 🤝

Tencent’s support enhances financial stability & collaboration opportunities.

Investment Outlook:

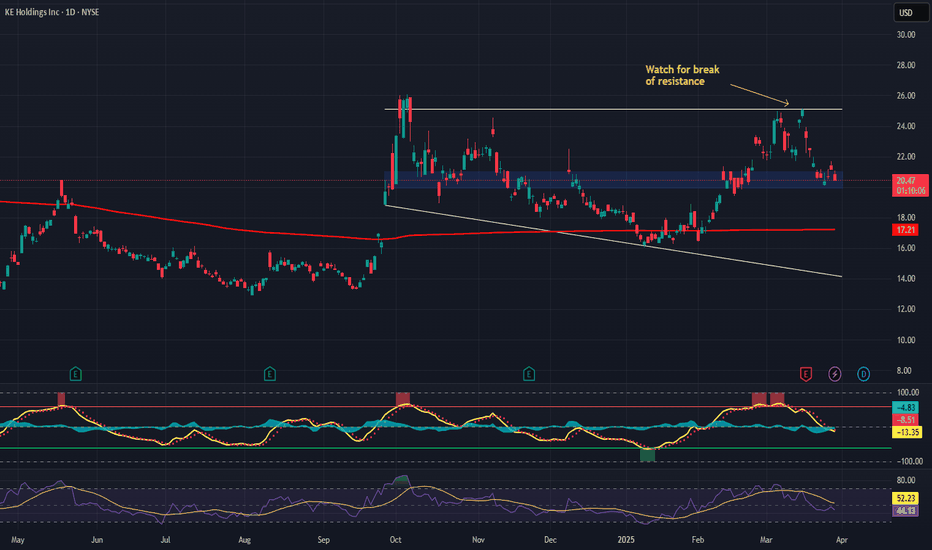

Bullish Case: We remain bullish on BEKE above $20.00-$21.00, supported by rising profitability & business expansion.

Upside Potential: Our price target is $36.00-$37.00, driven by earnings growth, platform expansion, and strategic alliances.

🔥 BEKE – Shaping the Future of Homeownership in China. #BEKE #RealEstateTech #GrowthStock

2423 trade ideas

$BEKE Inverse head and shouldersKE Holdings Inc. is a publicly traded Chinese real estate holding firm that offers a comprehensive online and offline platform for housing transactions and related services through its subsidiaries. It stands as the largest online real estate transaction platform in China.

Investors commonly refer to the entire operation as "Beike."

The company has garnered financial support from major players like Tencent, SoftBank Group, and Hillhouse Investment.

In August 2020, KE made its debut on the New York Stock Exchange (NYSE), successfully raising $2.12 billion during its initial public offering. On its first trading day, the stock soared by 87%, bringing the company's valuation to nearly $40 billion.

By May 2022, KE expanded its reach by becoming a dual-listed entity, adding its shares to the Hong Kong Stock Exchange.

KE operates two primary businesses: Lianjia and Beike. Lianjia functions as a real estate agency, while Beike serves as an online platform that connects customers with estate agents, including Lianjia. Lianjia is often likened to Redfin, whereas Beike is compared to Zillow.

The company is divided into four key business segments:

1. Existing home transaction services

2. New home transaction services

3. Home renovation and furnishing

4. Emerging and other services

My Watchlist: BEKEBEKE: I have a green setup signal (dot Indictor). It has an excellent risk-to-reward ratio(RR:). I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(red line) and a price targets above it(green lines).

Chinese Real Estate looks healthyIn recent years we saw stresses in the Chinese real estate market related to their debt. The Chinese government has been handling it early for years by slowly deflating its real estate bubble. Despite the media narrative, on a financial and technical aspect, the Chinese real estate market is looking promising.

Bullish BEKEI have a bullish outlook on NYSE:BEKE as it recently crossed both the 20 and 50 Moving Averages. Last Friday, it successfully defended these levels and closed near a crucial support level. With the current price around $17, I anticipate that the stock has the potential to reach approximately $18-19. Exciting times are ahead for $BEKE!

BEKE KE Holdings Options Ahead of EarningsIf you haven`t sold BEKE here:

And bought it back here:

Now Analyzing the options chain of BEKE KE Holdings prior to the earnings report this week,

I would consider purchasing the 17.50usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $3.20

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

BEKE reversal momentumBEKE, KE Holdings, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China is bullish after the chinese government pledged to support markets

80.75Bil revenue in 2021.

52 Week Range 7.31 - 61.39

I see a reversal to $20.50 short term.

BEKE Price TargetPrice target for BEKE is $19.

All the Chinese stocks are primed for a strong recovery after China`s top administrative authority said it would work to stabilize the stock market and boost economic growth!

Traders are expecting the Chinese government would support the stock market like the FED did in the US.

$BEKE Descending TriangleAfternoon all, I'm trying to get into trading and would love some opinions.

I have been looking at the daily chart for $BEKE and believe we could be looking at a descending triangle (in Orange) for a potential short position.

Guess I would be looking for a breakout to the downside, either below the pattern support zone (orange) or potentially the LL (in Pink).

Not sure what take profit target would be or the potential effects of earnings, suppose you would use a risk-reward target?

Reservations on the trade would be the lack of correlation/support from other major indicators such as MACD/RSI/EMA.

BEKE Breakout projectionI have a sine wave line on the chart as well as a few EMAs.

BEKE had been using the 50 EMA as resistance for close to 1 yr and now it is waaay below that 50 EMA line. i expect a retest of the 50EMA resistance on a strong volume push and if that breaks, we could see BEKE go as high as $50+.

In the meantime, BEKE should retest $29 and on strong volume, push to $38+

let me know your thoughts on this as well.

:)

Discussion on the coming lost decade in chinaI was meditating on the container ship issue. The root issue is China does not need raw materials for construction, because they overbuilt. Theis is due to the evergrande situation, and the collapse of their real estate sector.

Their alternative to real-estate was tech, specifically the Digital Yuan. The problem was it was bad, really bad. Instead of making DY better,

they decided to break up alipay and make the private sector solution worse. i.e. kill Ali Baba.

In the end they cucked themselves. External trade is dead because on one trusts Chinese investments. Internal trade is dead because of being centralized hobbling.

We should be looking at latin america for growth.

BEKE Double Bottom Weekly TF1. Double bottom on weekly TF

2. Retest with low volume

3. Potential for filling the gap at $33 - $26 at Fib 0.236 retracement 80% increase.

4. Wait for a confirmation of the test of double bottom

5. I will watch closely how China government will deal with China Evergrande Group probable default.

6. SL is below $14.5.

7. RSI 20-30

BEKE KE Holdings. ARK sold all its 9Mil sharesIn a selloff that can predict a new market valuation on Chinese stocks, ARK Invest sold all its 9 139 000 shares of BEKE.

Looking at its financials, BEKE is not a bad stock to own at at price lower than its IPO.

The company had revenue increase year over year in the last 4 years, but only in 2020 went profitable with 2.78Bil Earnings. They also have a decent PE Ratio (TTM) : 39.71

The question is: would you buy now what ARK sold for a loss??

Even Buffett was wrong when he sold Delta Airlines or Icahn about Hertz!

Jim Cramer (Mad Money) on China's tech crackdown: You can't own Chinese stocks!

It seems dangerous to hold Chinese stocks right now.

US-listed Chinese companies have three years to comply with US accounting oversight, to comply with the rules of accounting and transparency that American public companies must follow, if not they will get delisted.

This looks like the beginning of China`s stock market crash.

I`m looking forward to read your opinion about this!