Intel Golden TimeFundamental and Technical Analysis of Intel (INTC) Stock

Fundamental Analysis

1. Financial Performance: Intel is one of the largest semiconductor manufacturers in the world. However, in recent years, it has faced challenges, including a loss of market share to competitors like AMD and NVIDIA.

2. Industry Outlook: The semiconductor industry continues to grow, but Intel has lagged behind in advanced chip manufacturing, particularly in comparison to TSMC and Samsung in the 3nm segment.

3. Profitability & Revenue: Intel’s revenues have been volatile, and profit margins have been under pressure. Its large investments in manufacturing plants may lead to long-term profitability.

4. Macroeconomic Factors: A slowdown in the tech industry, reduced global demand for personal computers, and rising interest rates could impact Intel’s performance.

Technical Analysis

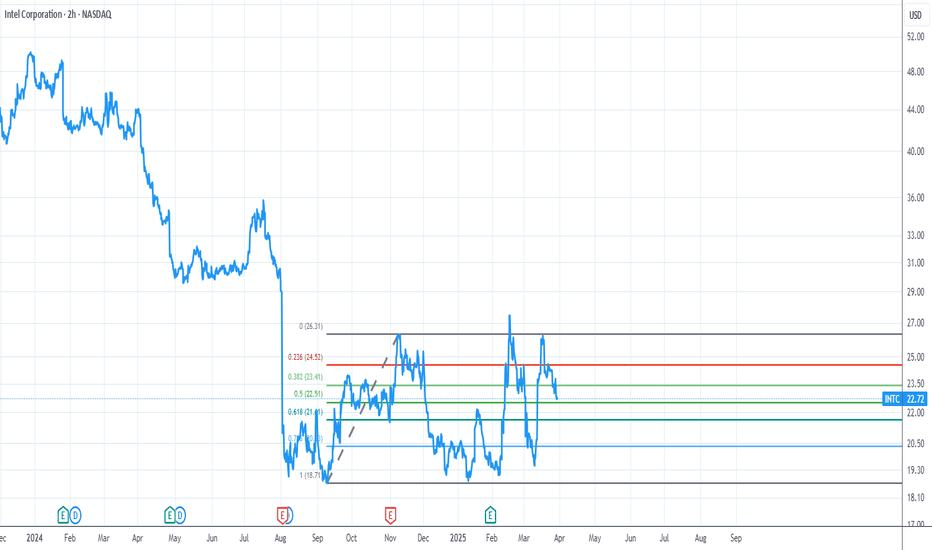

1. Support and Resistance Levels:

Key Support: Around $22, which is close to the current price level.

Key Resistance: In the $30-$35 range if the price starts to recover.

2. Overall Trend:

The stock has been in a downtrend, having dropped significantly from its all-time high of around $70.

The $22 level appears to be a strong historical support.

3. Indicators:

The RSI is likely in the oversold zone, indicating a possible reversal.

Moving averages probably confirm a bearish trend.

Conclusion

Fundamentally, Intel is in a rebuilding phase, but it still faces stiff competition from AMD and NVIDIA.

Technically, the stock is near a critical support level, meaning a rebound is possible, though the overall trend remains bearish.

For long-term investors, further analysis of Intel’s fundamentals is necessary. For short-term traders, confirmation of a price reversal at this support level is crucial before entering a trade.

4335 trade ideas

Great Uncertainty with a Dramatic Twist: Intel’s Recent ShakeupIn a surprising move last December, Intel CEO Pat Gelsinger abruptly stepped down following a tense board meeting that revealed growing dissatisfaction with his turnaround strategy. The sudden exit—on a quiet Sunday—left the tech world stunned and set off a chain of dramatic leadership changes.

To stabilize the company, Intel temporarily appointed CFO David Zinsner and Executive VP Michelle Johnston Holthaus as interim co-CEOs. But the real twist came in March 2025, when the company announced the return of Lip-Bu Tan as the new CEO—a figure whose reappearance adds serious dramatic flair to the story.

Tan had previously resigned from Intel’s board in August 2024, seemingly stepping away from the company for good. His unexpected return just months later, this time as CEO, feels like a corporate plotline worthy of an Emmy—or even an Oscar—nomination. Adding intrigue, Tan had reportedly clashed with Gelsinger on Intel’s direction, making his comeback a powerful statement about the board’s new vision.

Meanwhile, both Gelsinger and Zinsner were named in a shareholder lawsuit filed in August 2024, alleging securities fraud tied to concealed operational setbacks. The case, however, was dismissed in March 2025 after a judge ruled there wasn’t enough evidence to prove the company misled investors.

But beyond the boardroom drama lies a more sobering concern: Intel’s financial health. To me, the situation increasingly mirrors that of Lehman Brothers before its collapse—over-leveraged, burdened by mounting obligations, and heading straight into intensifying macroeconomic and sector-specific headwinds. The semiconductor industry is cyclical, and as the winds shift, Intel may simply not be financially equipped to weather the storm.

Unless it secures a major loan or receives a government bailout, I believe Intel’s stock is significantly overvalued at its current price of $22. Based on its deteriorating fundamentals, market sentiment, and leverage risk, a fairer valuation could be as low as $2 per share. Ironically, that $2 level roughly aligns with a 30x price-to-earnings ratio—where many mature tech companies are trading—if one accounts for where Intel’s true earnings power might settle after the dust clears.

My Fibonacci levels also suggest a sharp dip toward $12 in the near term. And even if Intel does hit that level, I suspect it may only be a dead cat bounce—temporary relief before a deeper plunge.

With leadership drama, legal clouds, and financial fragility all colliding, Intel isn’t just facing a tough quarter—it’s staring down a full-blown existential crisis.

INTC Intel Price Target by Year-EndIntel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers.

Intel’s turnaround strategy, focused on rebuilding its foundry business and strengthening its position in the AI and data center markets, is starting to show signs of progress. The company’s push into advanced chip manufacturing and strategic partnerships with major tech firms have positioned it for improved revenue growth in the coming quarters.

Technically, the triple bottom pattern indicates strong buying interest at current levels, reinforcing the case for a potential breakout. Combined with the improving outlook for chip demand and Intel’s strategic shift toward AI, a price target of $28 by the end of the year appears achievable. This would represent approximately 15% upside from current levels.

Investors should monitor Intel’s progress in its foundry business and AI initiatives, as any positive developments in these areas could accelerate momentum toward the $28 target.

my favorite setup for next week!INTC looks ready for a explosive move higher in my opinion, nice consolidation after trend resistance from 2023 broke.. building support for its next move higher, push into 28-31 targets is possible short term in my opinion, if it can break that pivot level then 37-41 targets should follow 🎯

this may be my last chart of the week, if it is I hope you all had a profitable week 🤑 and i hope you have a great weekend. see you soon ✌️

INTEL CORPHI GUYS the pic above illustrates weekly path, continuation weekly sells to a false break.

The second pic illustrates daily structure to sells to clear tripple bottom weekly then we will see bulls again next month.

we are currently looking for sells on daily chart to h4,h2,h1 entries on candle close

INTC 20 Mar 2025 Analysis

INTC remains in a 158-day trading range (yellow box).

Attempt to breakout above the trading range on 18-Feb lacked follow-through buying and failed.

The recent strong move up to the March 18 high looks like a Buy Vacuum and bull leg within a trading range.

To see the definition of a Buy Vacuum, see the comment section on the tagged related post on the 20 Mar SPX analysis.

For now, because the market remains in a trading range, traders will BLSH (Buy Low, Sell High).

That means buying from around the lower third and selling in the upper third of the trading range.

Traders will continue to do this until there is a breakout from either direction with follow-through buying/selling.

Is INTC in a Wyckoff Distrubution?Serious question. Asking traders in the community that are more students of the methodology than myself.

I keep a casual eye on NASDAQ:INTC and have since the big drop last August that took it to juicy decadal lows. That alone had me interested in picking it up. Smarter minds than myself that follow chipmakers more closely have educated me to the fact that chipmakers operate in multi-year cycles of Research and Development to Market. The stock was never "dead" and likely a bargain. I have just been searching for a price action thesis to give me a risk framework for taking and holding the trade.

INTEL Bullish Reversal and Continuation NASDAQ:INTC is showing a strong rebound from a well-established support zone, as indicated by multiple price bounces.

Currently, the stock is testing a downward trendline resistance and is attempting to stay above the 200-day SMA, signaling a bullish trend shift. It might be time for Intel to fill that gap!

In my eyes, there are two options: A confirmed close above $26.2 could indicate further upside potential, with buyers gaining control. Volume has increased, suggesting growing bullish momentum. However, failure to break resistance could lead to another pullback first towards the 200 SMA and, if failed again, back to the lower demand zone.

Watch closely for this breakout confirmation in order for us to continue higher with a target of $30.

Intel seems to be a rudderless ship

30% uplift for a CEO change... that says quite a lot. What I think most people are missing is that for changing course of a semiconductor design, it takes at a minimum of 4-5 years. To catch up with someone that's already ahead (AMD), it takes around 6 to 10 years. AMD was playing catch-up with Intel for about 10 years (remember AMD Bulldozer?)

Ever since the Core/Core 2 architecture was launched, back in 2006, Intel has dominated the market - that was up until around 2018, when AMD further improved on their Ryzen architecture. It took ~12 years for AMD to get "back in the game". Lisa Su worked wonders with AMD since 2012, became CEO in 2014, and finally managed to usurp intel through an innovative new design, chiplets.

You want to know the biggest reason why Lisa Su has been so successful? Firstly, she is an Engineer, she designs solutions to problems. I have the utmost respect for her, and I thank her tremendously for bringing back competition to the industry. But one major contributor was the fact that Intel was resting on its laurels, they did not truly innovate. Ever since about ~2013, when they launched the ~i7-2600k (which powered my PC for almost 8 good years), all their future CPU's were very marginal iterations, ~5% uplift in performance from a generation to the next is a joke, especially considering the increased power consumption. I remember there were two generations where Intel intentionally sabotaged their own CPU's by replacing the soldered thermal interface with thermal pads, just to decrease heat transfer, and create a fictitious worse product, so they could have a better one released next year (having again soldered thermal interface). Yep, people were "delidding" their CPU, getting 20-30 degrees lower temperatures, because the "engineers" at intel wanted to either save a few cents, or most likely they wanted to release the next generation of CPU's without putting in any real work for improvement. Why do I think this is the case? Because intel was lead by bean-counters.

2005 to 2012, Intel was led by Paul Otellini, a person who had over 30 years of experience at the company. The development of the Pentium can be attributed to him (prior to becoming CEO), and during his tenure, Intel market share went from ~50% to 75% (as per cpubenchmark, though I really doubt it was below 90% at that time).

2012 to 2018, Brian Krzanich, the sunset starts, practically no innovation, one generation to the next are just incremental improvements.

2018 to 2021, Bob Swan, the then CFO took over as CEO, no comment.

2021 to 2025, Pat Gelsinger, an engineer, the lead architect of the 486 CPU took over. He had very good ideas, but in my opinion not enough time to implement them.

Now Intel has a new CEO, mainly knowledgeable in software, not in hardware. I guess only time will tell, but honestly, I think if Pat had a few more years, he could have pointed the ship in the right direction. As it stands, I do not have high hopes for Intel. My prediction is a drop to 15 by the end of the year. AMD doesn't rest on its laurels, Intel needs some innovation, and innovation takes time.

Anyway, all the above are my own thoughts, and I wrote them down for entertainment purposes only. Please perform your own research before opening any positions.

Intel (INTC) Shares Surge by Approximately 14%Intel (INTC) Shares Surge by Approximately 14%

As shown in the Intel (INTC) stock chart:

→ Trading opened yesterday with a strong bullish gap.

→ By the end of the session, shares had risen by approximately 14% compared to the previous day's closing price.

According to Dow Jones Market Data, INTC shares recorded their largest percentage gain since 13 March 2020, making them the top-performing stock in the S&P 500 index (US SPX 500 mini on FXOpen) on Thursday.

Why Did Intel (INTC) Shares Rise?

The surge followed the company's announcement of a new CEO appointment. Lip-Bu Tan, a former board member, has been named the new Chief Executive Officer, set to assume the role on 18 March. Investors reacted positively to the decision, as Tan previously achieved significant success as CEO of Cadence Design Systems.

As the Wall Street Journal put it:

"Lip-Bu Tan is Intel’s best hope for a turnaround—if Intel can be fixed at all."

Technical Analysis of Intel (INTC) Stock

In our previous analysis of INTC price movements, we identified an upward channel (marked in blue), which remains relevant.

The current bullish momentum may lead to a breakout above the long-term downward trendline (marked in red). If this happens, it could pave the way for a move towards the psychological level of $30, which served as support last year.

Intel (INTC) Stock Price Forecasts

"We really like the new CEO appointment," wrote BofA Securities analyst Vivek Arya in a note, upgrading Intel’s rating from "Underperform" to "Neutral" and raising the target price from $19 to $25.

According to TipRanks:

→ Only 1 out of 23 analysts surveyed recommends buying INTC shares.

→ The average 12-month target price for INTC is $23.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

INTC LONGIt seems to me that we are in a nice accumulation area for INTC with more positive news coming out from the company and large volumes around $20 level. The biggest scare seems to be current market volatility but so far the stock was unfazed. I'd say this is a good spot to buy for anyone interested in this company.

INTC | If Keeps This up it will get Past it's Technical IssuesINTC makes CNBC news as top mover today 3-12-25, it needs the attention, why... if Intel keeps this up it will get past it's technical issues which I think it will; buyout rumors are very real and possible and it's getting the attention it DOES deserve, I think it surprises the market with moves higher. Apple or Samsung could use all the patents and history on this mega-company, at this price I feel it's a steal absolutely. Someone must be eying taking it out outright IMO.

Strong technicals are forming right here and now.

INTC - Basing out for LEAP'sI have liked this chart for "too" long.

Long term basing out, almost gave up the bag near that $18 area, but doubled up on a few leaps and some shares.

Seems to be breaking out of the downtrend, and now retesting the trend line...

Would rather go with price levels here vs over shooting a trend line...

$18 - $20 this week?

I'm only accumulating shares, and swing trading option positions several months out for safety.

I'm not sure on day trading the stock on short term options.

Intel chart looks good to go up in a month. New announcements Intel Corporation's (INTC) stock has recently shown promising technical indicators suggesting potential upward momentum.

Intel's stock exhibits positive technical signals, supported by recent developments in AI chip manufacturing and strategic interest from industry leaders. Investors should monitor the RSI for potential overbought conditions and watch the identified support and resistance levels to gauge future price movements.

Please note that investing involves risks, and past performance is not indicative of future results.

Intel: "So the last shall be first..."As the Holy Bilble says in Matthew 20:16, "So the last shall be first, and the first last: for many be called, but few chosen."

We agree. After our analysis, one stock comes into focus: INTEL - a long-term buy candidate. Investment horizon: 5-10 years, the right time to get in could be now.

This is not a buy recommendation, just an exchange of ideas. You have to use your own analysis and your own head and make your own decisions.

Intel (INTC): Bullish Signs Emerging, Eyes on $75 ATHIntel (INTC) has started to show strong bullish signals, confirming a reversal after refusing to drop below $18. The stock has since climbed to $27, signaling renewed investor confidence and a potential breakout in the coming months.

Key Resistance Levels: The Path to $75

$30: The first critical resistance level that Intel must break to continue its bullish momentum.

$37: A key milestone that, if surpassed, would strengthen the uptrend.

$75 (All-Time High): The ultimate long-term target.

If Intel successfully breaks above $37, it could trigger a sustained rally toward its ATH of $75, potentially supported by industry advancements and stronger financial performance.

Risk Scenario: Consolidation and Potential Drop to $12

If Intel fails to break $30, it could enter a multi-year consolidation phase.

A prolonged range between $12 and $30 could play out if bullish momentum fades.

In a worst-case scenario, Intel could hunt the $12 level, creating a long-term accumulation zone before attempting another breakout.

Summary: Bullish Structure with Key Levels to Watch

Intel’s refusal to drop below $18 and its climb to $27 signal growing bullish momentum.

Break Above $30: Signals continuation to $37, then a long-term push toward $75.

Failure at $30: Could lead to a multi-year consolidation, ranging between $12 and $30.

The next few months will be crucial in determining whether Intel resumes a strong uptrend or enters a long accumulation phase before the next major breakout.