BAIDU 63.6% cash & short term inv., P/E 8.7,possible rotation TABaidu largest search engine in china but way less monopoly in china, there is also bing.

Baidu invests heavily in AI and autonomous driving by apollo go.

China economy is in deleveraging and seems to start growing again.

China devlation problems comapnies sitting on cash.

Baidu advertisment income will come back if the chinese economy improves.

89888 trade ideas

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo levels).

Fundamentally, Car Inc just launched a robo-car rental service powered by Baidu’s Apollo unit. Fully autonomous, bookable for 4 hours to 7 days — this is not future tech, it’s live now. With a $32.6B market cap and low P/E (~12), BIDU looks positioned for revaluation if sentiment shifts.

Tactical setup: entry by market or retest of $90, stop below $82.

When the robot drives customers - you just drive the trade.

Baidu Accelerates Robotaxi Expansion and Opens the European DoorBy Ion Jauregui – Analyst at ActivTrades

Baidu (NASDAQ: BIDU), the Chinese tech giant, is doubling down on autonomous vehicles through Apollo Go, its robotaxi platform. According to industry sources, the company is planning to expand into Europe, with Switzerland and Turkey as its first potential stops. Although Swiss Post has denied any official collaboration, Baidu has made clear its intention to open a Swiss office before the end of the year. This move could trigger a domino effect across Europe’s autonomous mobility ecosystem. Baidu not only leads the robotaxi market in China, but is also developing a globally scalable model. Europe, with its increasingly strict regulations on smart mobility and sustainability, could provide fertile ground to accelerate its deployment.

This is an opportunity that Uber Technologies (NYSE: UBER) has already sensed. The U.S.-based company has signed strategic agreements with Asian firms such as WeRide, Pony.ai, and Momenta, aiming to roll out its own fleet of electric robotaxis in both Europe and the Middle East. At the same time, it is launching a new low-cost service in the U.S. called “Route Share,” a shared ride option that runs along the busiest routes every 20 minutes at half the price of UberX.

The race to control the cities of the future isn’t limited to Uber and Baidu. Tesla (NASDAQ: TSLA) continues refining its Full Self-Driving (FSD) system, while Waymo, Google’s (Alphabet, NASDAQ: GOOGL) autonomous vehicle division, already operates driverless robotaxis in several U.S. cities and also has its eyes on Europe. The message is clear: the autonomous driving war has begun, and the battlefield is global. While distrust toward Chinese suppliers grows in Washington—evidenced by Hesai (NASDAQ: HSAI) being added to the U.S. blacklist—Europe is opening new paths for companies like Uber, Bolt, or Free Now to either collaborate or compete with tech giants such as Baidu, Tesla, or Google in the development of urban autonomous fleets.

Baidu in Numbers

As of now, Baidu has not yet released its Q1 2025 financial results. The company is scheduled to announce them on May 21, 2025. However, according to available estimates, Baidu is expected to report a net income of approximately CNY 206.52 billion for fiscal year 2025, which would mark a significant 791.24% increase compared to the CNY 23.17 billion recorded in 2024. In terms of revenue, Baidu is projected to reach around CNY 139.78 billion in 2025, up from CNY 133.13 billion the previous year. These figures reflect a notable improvement in the company’s profitability, likely driven by its focus on emerging technologies such as artificial intelligence and autonomous vehicles.

For more detailed and updated information, it is recommended to consult Baidu’s official investor relations site after May 21, 2025, when the Q1 results will be published.

Technical Analysis

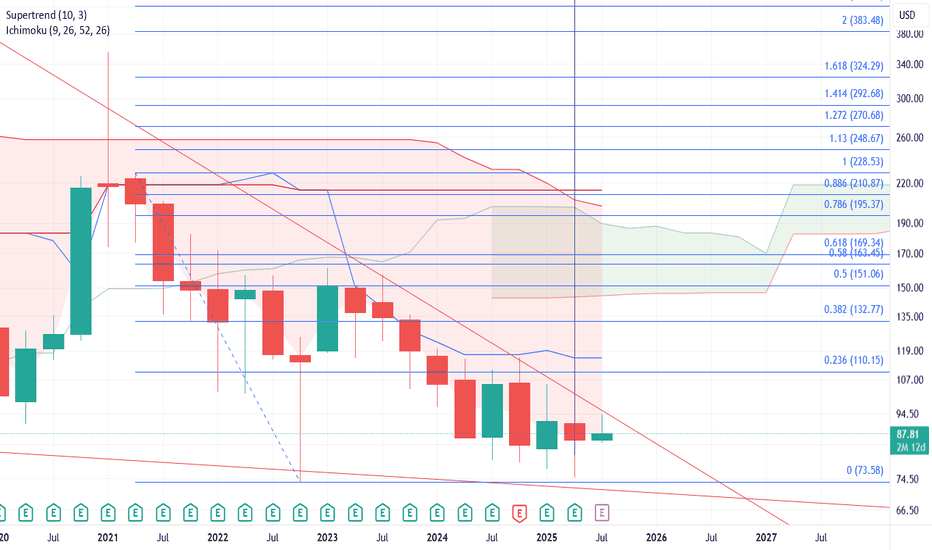

Since reaching its peak of $160.88 in 2023, Baidu’s stock has undergone a correction, dropping to a low of $73.58 in 2022, amid the onset of the U.S. tariff war. Currently, after the suspension of tariffs, the stock has rebounded to the $90 range, which corresponds to its current point of control, as trading volume has been concentrated around this price level. It is likely that, following the upcoming earnings report, the stock may surpass the $92.61 mark, which aligns with the 61.8% Fibonacci retracement level. However, to confirm a solid trend reversal, we would need to see a sustained upward crossover in moving averages—which has not yet occurred. So far, only a bullish crossover of the 50-day and 100-day moving averages was observed in Wednesday’s session. Investors should monitor whether this upward movement continues toward the secondary target of $96 during this summer quarter.

Why Does This Matter to Investors?

Baidu’s expansion into Europe could not only reshape the urban mobility landscape but also spark investment opportunities in software, hardware, LIDAR sensors, cybersecurity, and connected services. For companies like Uber, it also presents a chance to strengthen their leadership while reducing reliance on human drivers.

Europe is looking ahead, and in that future, robotaxis are not science fiction—they’re strategy.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

BIDU close watchAs of the latest update, here’s a snapshot of Baidu Inc. (BIDU) stock:

Current Price: $86.86 (as of May 11, 2025, 10:26 AM EDT)

After-Hours Price: $87.29

Day Range: $86.68 – $87.75

52-Week Range: $74.71 – $116.25

Market Cap: $29.86 billion

P/E Ratio: 9.66

Dividend Yield: 0% 1

Analyst Outlook:

Consensus Rating: Hold

Analyst Breakdown: 12 Hold, 7 Buy, 0 Sell (out of 19 analysts)

Average Price Target: $110.83

Forecasted Upside: ~27.84% from the current price 2

$bidu smash or crashNASDAQ:BIDU continues to get bought up at this demand zone that has held for 12 years between $85-$73. One of the most beautiful charts Ive seen on an individual name in a long time. Not the most exciting name around but $70 cash per share on hand and a PE of 9 with as solid of a defined R/R as you can find. I think Trump's delistment threats are just fluff and could serve as a great buying oppurtunity if you're into Chinese stocks. Let me know your thoughts

Baidu Wave Analysis – 11 April 2025

- Baidu reversed from support zone

- Likely to rise to resistance level 90.00.

Baidu recently reversed from the support zone between the major long-term support level 78.60 (which has been reversing the price from the end of 2022) and the lower weekly Bollinger Band.

The upward reversal from this support level 78.60 is likely to form the weekly Japanese candlesticks reversal pattern Hammer (strong buy signal for Baidu).

Given the strength of the support level 78.60 and the clear bullish divergence on the weekly Stochastic indicator, Baidu can be expected to rise to the next resistance level 90.00.

Baidu | BIDU | Long at $82.50Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments).

P/E = 9x

Debt/Equity = 0.27x

Price/Sales = 1.55x

Price/Book = 0.80x

Price/Cash flow = 7.59x

Thus, at $82.50, NASDAQ:BIDU is in a personal buy zone.

Targets:

$109.00

$125.00

$150.00

Baidu: Possible move as per previous chart patternNASDAQ:BIDU

Hello,

Just a guess work.

I see similar pattern played out few years ago, I guess it can follow the same pattern, may be the magnitude is different.

Please exercise caution while trading these stocks as they can stay flat for years.

Happy trading

Baidu Inc. (BIDU) 1WTechnical Analysis 1W

A breakout from the "falling wedge" could signal potential upside.

Key levels:

-Support: 94.26 | 77.24

-Resistance: 107.61 | 116.99 | 156.75

Fundamental Analysis

-AI Leadership: Baidu continues expanding in AI, cloud computing, and autonomous driving.

-Financials: Solid revenue growth but faces regulatory risks in China.

-Competition: Strong rivalry with Alibaba and Tencent in AI and cloud services.

-Risks: U.S.-China tensions and economic slowdown may impact performance.

A breakout above $116.99 could confirm further upside.

BbThis analysis focuses on a combination of trendlines, RSI, and MACD to identify potential trading opportunities.

• Trendlines: Key support and resistance levels drawn to highlight the market structure and price action.

• RSI (Relative Strength Index): Used to identify overbought and oversold conditions, signaling potential reversals.

• MACD (Moving Average Convergence Divergence): Helps confirm trend strength and possible momentum shifts.

Baidu Heading Up and Up. BIDUTriple Drive/ABCDE B Wave of a zigzag....maybe. This is a bet on a E Wave yet to form. If fractal rules are obeyed, then next move should be a 1.2 of the previous, which aligns in a very nice Fibonacci cluster at 0.786/1.272. Naturally, the indicators below have just turned to bullish as well almost in unison.

BIDU: MAs coiling tightly + Double bottomI really like BIDU stock here, so I entered more than my usual size.

What I like about this setup

- MAs coiling super tightly across all timeframes. 10, 20, 50, 100, 200. Tight MAs represent volatility contraction and this often leads to volatility expansion, i.e. large price movements. All the MAs are now within 5% range. When the MAs crossover, its like this combo nuclear reaction igniting one another, propelling the stock upwards. And its possible you get a sustained one.

- 10 and 20 MA are already above 50MA. short term, we are up. And now I'm waiting for the next nuclear reaction to happen.

- We have attempted to break above this 94.5 key resistance for many times now. If we do, easily 113 as price target.

- Double bottom formation. Yes, its not a double bottom yet since it hasn't break above the neckline. But that false breakdown earlier gave me extra confidence that we have bottomed.

- Fibo retracement at 50% line now. Good support. (did not draw it in, else it becomes cluttered)

- Tailwind from China internet sector.

When will I stop loss

- Break below previous low at 96.8 and stay below 50MA for 5 days.

Others

- I note that Im front-running this a little. If it goes to 92.5 above the flag, and 200sma, it would be better confirmation. But I entered with options, so I wanted a better price before the pump actually happens.

Short BIDU

Taking a small short on BIDU using PUTS

BIDU 250321P90 @ $5.65

The whole Chinese stocks have been on a tear and felt quite overdone.. it's clearer if you see stocks like BABA.. If the broader market falls, I reckon we should see at least a small pullback here?

I was thinking of either shorting JD or BIDU. just choosing the weaker between these two..

BAIDU’S Q4 2024 Earnings drop today Review Q3BAIDU’S Q3 2024 PERFORMANCE—AI GROWTH VS. AD WOES

(1/9)

Good morning, Tradingview Fam! Baidu’s latest financials are 📈🔍. Q3 2024 revenue hit ¥33.6B ($4.7B USD), but the story’s in the details: AI’s soaring, ads are slipping. Let’s dive into BIDU’s numbers and outlook! 🚀

(2/9) – REVENUE & EARNINGS SNAPSHOT

• Total Revenue: ¥33.6B ($4.7B USD)

• Baidu Core: ¥26.5B ($3.7B USD), +4% YoY 💥

• Cloud Revenue: Strong growth (exact figures vary) ☁️

• Q3 EPS: ¥19.2 ($2.67 USD), missed ¥19.62 est.

• Non-GAAP Net Income: ¥7.6B (~$1.06B USD)

Next up: Feb 18 earnings, est. $1.78 EPS, $4.56B revenue (-7.4% YoY).

(3/9) – BIG MOVES IN AI & AUTONOMOUS TECH

• Baidu World 2024: Unveiled iRAG & Miaoda AI tools 🤖

• ERNIE API: 1.5B daily calls, up 30x YoY 📈

• Lidar Deal: $200-300M with Hesai for Yichi 06 robotaxis 🚗

AI and autonomy are stealing the show—growth engines revving up!

(4/9) – SECTOR SHOWDOWN

• Market Cap: $31.36B (Feb 2025) 🌍

• Trailing P/E: 10.56x, Forward P/E: 10.5x—cheap vs. Alphabet or Tencent 📊

• Lags GOOG in search/ad scale but leads Chinese peers (JD, PDD) in AI diversification

At 3x EV/EBITDA, is BIDU undervalued? X posts think so!

(5/9) – RISKS ON THE RADAR

• Ad revenue: Squeezed by Tencent, ByteDance competition 📉

• AI costs: Big R&D spend, profits TBD 🤔

• China regs: Unpredictable hurdles loom 🏛️

• Economy: Slowdown could hit ad & cloud growth

• U.S.-China tension: Weighs on sentiment ⚠️

(6/9) – SWOT: STRENGTHS

• King of China’s search market, mobile ecosystem thriving 🔍

• ERNIE Bot: 430M users, 770k enterprise apps 🌟

• Apollo Go: Leading autonomous driving, $162.6B robotaxi market by 2025 🚦

Baidu’s got serious firepower!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Ad margins shrinking, AI not yet cashing in 💸

• Opportunities: AI cloud expansion, robotaxi scale-up, China stimulus upside 🌍

Can Baidu turn its tech bets into gold? Time will tell!

(8/9) – What’s BIDU’s 2025 vibe?

1️⃣ Bullish—AI and autonomy will drive a breakout.

2️⃣ Neutral—Growth potential, but risks balance it out.

3️⃣ Bearish—Ads and regs will drag it down.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Baidu’s Q3 shows a tale of two trends: AI and autonomy surging, ads under pressure 🌍. With a low valuation and big tech bets, BIDU’s at a crossroads. Will innovation outpace the risks? Earnings drop today—stay tuned for the next chapter! 💪

BIDU - Does history repeat itself? 100% Upside!NASDAQ:BIDU

This is probably the most predictable chart I've seen in a while!

$161 Breakout = 🎯 $248

- Bouncing off Major historical support

- Volume Shelf

- When the Wr% bounces off the green support beam we see the train go all the way from A to B! (See Yellow Dots)

- Double bottom forming and will most likely breakout

Not financial advice

BIDU is testing the border of the rangeDespite the strong driving narrative, BIDU had displayed less prominent growth than BABA, and had reached the upper border of Bollinger bands indicator with a parameter of 50. This usually might indicate an excess, and lead to a mean-reversion move back to the middle of the range.

Conversely, it might be a decent point for a breakout if the positive sentiment for Chinese stocks will prevail, but this is a less dominant scenario.

Don't forget - this is just the idea, always do your own research and never forget to manage your risk!