NG1!: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 3.653 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

GWM1! trade ideas

NATGAS Resistance Ahead! Sell!

Hello,Traders!

NATGAS is growing sharply

But the price is nearing a

Strong horizontal resistance

Around 3.80$ so after the

Retest on Monday we will be

Expecting a local bearish

Correction as Gas is already

Locally overbought

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Long Term H&S Pattern with a Completed Intermediate H&S PatternHead and Shoulder pattern are one of the most reliable patterns. And when you think about the psychology behind them it makes sense why. Essentially natural gas pricing in the long run is driven by fundamentals but speculators who trade solely on technical analysis add gasoline to the fire to cause massive price dislocations. The H&S pattern is an example of this. Fundamentals drive the price up. Speculators participate forming the left shoulder. Profit taking ensues completing the left shoulder. Speculators then tap the well again to form the head. At this point fundamental traders(hedgers like large commercials) can’t pass up the massive price dislocations and lock in large profits for future deliveries. Speculators panic and close longs once they lose control. Right shoulder is forming. Speculators will try to tap the well again thinking they can control the large commercials. Large commercials allow them to be right for a short period so they can sell even more future deliveries. In the end the commercials win out and price goes lower. Neckline complete. Speculators panic and massive selling ensues. The expected move to complete the pattern would be the distance from the head to the neckline in terms of percentage. So a $5 head and $3 neckline means a 40% target lower from the $3 neckline. $1.80 seems like a lofty price target. Price targets are suggestions in patterns. They are not absolutes.

These patterns fail as well so while this pattern is forming technically, it is not complete. In my experience, anticipating patterns has a 100% failure rate.

Natural Gas Technical Convergence Signals a Major Trend ReversalNatural Gas is showing early signs of completing a multi-year bottom and entering a potential new bullish impulse cycle.

🔹 Key Technical Highlights:

✅ A-B-C correction ended at $1.50 (Feb 2024); impulse to $4.90 may be Wave 1.

🔁 Current pullback looks like Wave 2, potentially bottoming near $2.85–3.00.

🔼 Golden Cross (50 > 200 DMA) occurred in Oct 2024 — rare long-term bullish signal.

🔃 RSI & MACD momentum are rebounding from deeply oversold zones.

📊 Volume shows signs of capitulation and early accumulation near $3.00.

📐 Chart patterns: Triangle + falling wedge breakout (on 4 hr charts) = bottoming structure.

🌀 Seasonal cycles suggest spring weakness may be ending — summer upside risk rising.

💼 COT positioning: Specs remain extremely short, while commercials are net long — a classic contrarian buy setup.

⚖️ Gold/NG Ratio has peaked and is declining — historically a bullish signal for NG heading into 2026.

🔍 Directional Bias:

Cautiously Bullish

Majority of signals are now aligned or turning bullish. A sustained breakout above $3.75–4.00 would confirm a broader trend shift.

🧭 Trade Setups:

📍 Short-Term (1–2 weeks)

Entry: $3.00–3.20 | Target: $3.75 | Stop: <$2.85

Play the bounce from oversold zone and 200DMA test

📍 Medium-Term (2–8 weeks)

Accumulate: $3.00–3.30 | Target: $4.90–5.80

Possible Wave 3 breakout pending above $4.90

📍 Long-Term (3–12+ months)

Position: $2.90–3.50 | Target: $6.20 → $9+

Post-correction rally underway; risk/reward is favorable on dips

🗓️ April 28 Candle Recap:

Bullish engulfing candle on rising volume. If bulls hold this breakout into May, the $2.85–3.00 floor may be confirmed.

🔚 Bottom Line:

NG appears to be transitioning from a long bear market into a new upcycle. The stars are aligning — just be ready for near-term chop.

Natural Gas Ready to Explode?In recent months, Natural Gas (NG1!) has shown significant volatility, but now there are clear signals suggesting a major directional move could be imminent.

On the weekly technical chart, price has bounced from a strong demand zone between 2.50 and 2.70 USD/MMBtu, an area historically defended by institutional players. Currently, it is trading above 3.30 USD, consolidating in preparation for the next move. Key resistance zones to watch are between 3.90 and 4.20 USD, a region of high volume confluence and institutional supply.

Retail sentiment is extremely interesting: over 75% of retail traders are currently long. Historically, an excess of retail longs often leads to either corrections or accumulation/distribution phases, as large players tend to act against the majority.

Looking at the COT Report, the data supports the bullish thesis: non-commercials (speculative funds) remain net short, while commercials (physical operators) are increasing their long positions, indicating expectations of higher real demand in the medium term. This is a historically bullish signal, although it may not materialize immediately: commercials often start accumulating well before price movements occur.

Finally, seasonality favors the bulls: historically, from late April through mid-June, Natural Gas tends to perform positively, fueled by storage accumulation ahead of summer and the following winter season.

Strategically, a consolidation phase above 2.90–3.00 USD could serve as a base for larger moves towards 3.90 and eventually 4.90 USD, with the bullish scenario invalidated only below the 2.80 USD area.

Potential Decline of Natural Gas Prices to $2.43–$2.74Brief Overview of Events and News Explaining the Potential Decline of Natural Gas Prices to $2.43–$2.74.

➖ Weather Forecast and Reduced Demand

On April 23, 2025, the U.S. National Weather Service forecasted milder-than-average weather across the U.S. for late spring and early summer 2025, particularly in key gas-consuming regions like the Northeast and Midwest.

Warmer weather reduces the demand for heating, a primary driver of natural gas consumption. This led to a 2.5% decline in Henry Hub natural gas futures, settling at $3.05 per MMBtu on April 24, 2025.

Source: Reuters

➖ High U.S. Natural Gas Inventories

The U.S. Energy Information Administration (EIA) reported on April 17, 2025, that natural gas inventories increased by 75 billion cubic feet (Bcf) for the week ending April 11, 2025, significantly exceeding the five-year average build of 50 Bcf. Total U.S. inventories are now 20% above the five-year average, indicating an oversupply that pressures prices downward.

Source: EIA, "Weekly Natural Gas Storage Report," April 17, 2025

➖ Weak Global LNG Demand

On April 22, 2025, Bloomberg reported a decline in demand for liquefied natural gas (LNG) in Asia, particularly in China, due to an economic slowdown and a shift to cheaper coal alternatives. China’s LNG imports in Q1 2025 dropped 10% year-over-year, reducing export opportunities for U.S. gas producers and adding pressure on domestic prices.

Source: Bloomberg, "China’s LNG Imports Fall as Coal Use Rises," April 22, 2025

Technical Analysis

Natural gas futures (NYMEX) are currently around $3.15 per MMBtu as of April 28, 2025, following a recent decline from a peak of approximately $4.90 in 2025.

Fibonacci retracement levels indicate correction targets at 38.2% ($2.74) and 50% ($2.43).

Fundamental factors, such as oversupply and reduced demand, support a bearish scenario that could drive prices to these levels in the near term.

Nearest Entry Point Target:

• $2.74

Growth Potential:

Long-term:

• $10

Screenshot:

NATGAS Set To Fall! SELL!

My dear friends,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 2.964 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 2.929

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NG1!: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse NG1! together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 2.951 will confirm the new direction upwards with the target being the next key level of 3.042 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NATGAS: Expecting Bearish Continuation! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current NATGAS chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NG1! BUYERS WILL DOMINATE THE MARKET|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.247

Target Level: 3.717

Stop Loss: 2.932

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1!: Next Move Is Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3.241 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS went down after

The support cluster breakout

Just as we predicted in my previous

Analysis but price will soon hit a

Horizontal support level of 3.00$

From where we will be expecting

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS is set to retest a

Strong support level below around 3.00$

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above 3.40$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Will there be a 50 percent increase in the price of natural gas?Will there be a 50 percent increase in the price of natural gas?

The imposition of tariffs also has an effect on the price of natural gas, which has fallen dramatically since Trump announced his policy of reciprocal tariffs and the trade war has intensified.

In general, there have been significant declines in natural gas futures, with a drop of about 10 percent in value.

The magnitude of this drop is due to fears that the ongoing global trade war could lead to a reduction in industrial activity and gas demand.

The Trump administration has created many waves of concern and economic instability around the world. The trade tariffs imposed by the president have affected not only finished goods, but also the raw materials used to create them. With the addition of Chinese taxes on U.S. products, the situation has become even more uncertain, with the risk of a global recession increasingly imminent.

The trade war has had a significant impact on the global economy, with increased tariffs leading to higher prices for goods. This in turn has reduced demand and produced a decrease in industrial production and overall growth. Experts also predict a possible reduction in production in energy-intensive sectors, as market uncertainties may lead to lower energy needs in the future.

There are several factors that could affect gas supply and related prices in the coming years. One of these is the increase in oil production starting in May. In addition, changes to storage targets in Europe are expected, which could further increase gas supply. At the same time, more liquefied natural gas shipments to Europe are expected due to lower demand from China. All this could keep gas prices low in both Europe and the United States.

Since the announcement of the duties, many companies have already begun publicly discussing possible shutdowns and production reductions. With the ongoing trade war, these decisions could become a reality.

But it could also be good news for prices. As we all know, the tariff war is likely to end soon. This means that with the closure of the fields-which take at least 3 years to reopen-we could see limited gas supply during the summer, when peak demand is expected and unusual heat is expected, this will be very good for natural gas prices.

From a technical point of view, this asset is one of the few to keep prices above the 200-period moving average. In addition, the rises of the past few months are supported by above-average volumes.

Natural gas supply is currently below average, which is a positive sign for strengthening prices. In such an unstable market, I have decided to invest in natural gas and expect prices to reach $5 in the summer, with a possible 50% growth.

It is important to emphasize the gas futures curve, which is currently backwardation in the long run. When there is strong demand, markets tend to reduce contango and even invert the curve to backwardation. The backwardation curve can be theoretically unlimited, that is, the price differential between near and far maturities can continue to grow indefinitely.

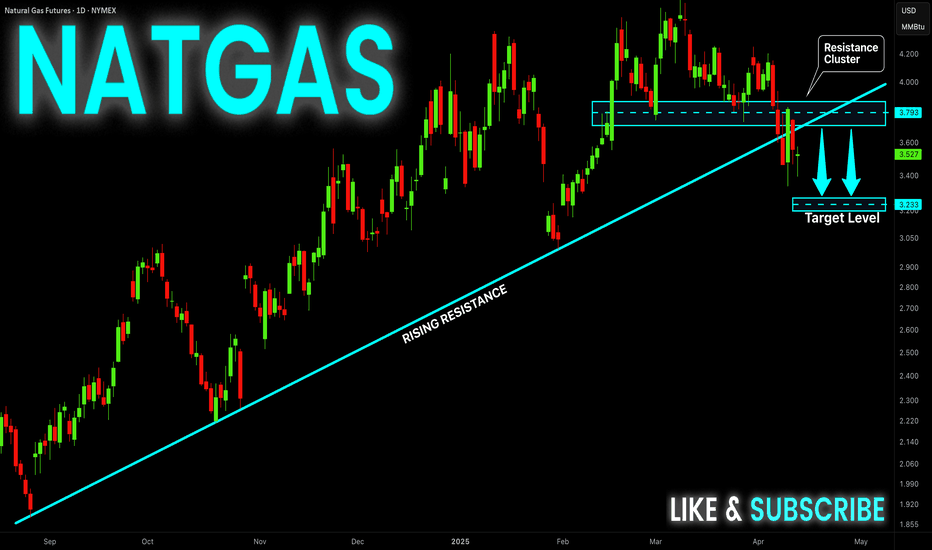

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.