NATGAS Expected Growth! BUY!

My dear followers,

This is my opinion on the NATGAS next move:

The asset is approaching an important pivot point 3.541

Bias - Bullish

Safe Stop Loss - 3.373

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3.834

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GWM1! trade ideas

NG1!: Will Go Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.540 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 3.507..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Smart Money Trapping RetailThis is a great example of why you trade with the trend and stay away from counter trend moves. I’ve kept the chart basic with only a 50 ema that is pegged to the one hour candle as that is a good short term trend indicator. My question is this. Did smart money pile into this trade to drive the price up to the 50 ema to trap all the retail traders only to create the liquidity they needed to put on large positions and trap retail which is then forced to sell out of their losing positions? I have no idea but this seems to be a repeatable pattern.

NATGAS Local Bearish Pullback Expected! Sell!

Hello,Traders!

NATGAS is about to hit

A strong horizontal resistance

Level of 3.880$ after a sharp

Push upwards by the bulls

So a local correction is needed

From the resistance with the

Expected target being the

Local level below at 3.655$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Bearish Breakout! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Resistance of 3.626$ and the

Breakout is confirmed so we

Are bearish biased and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS formed a head

And shoulders pattern then

Made a bearish breakout of

The neckline which is now

A resistance of 3.850$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

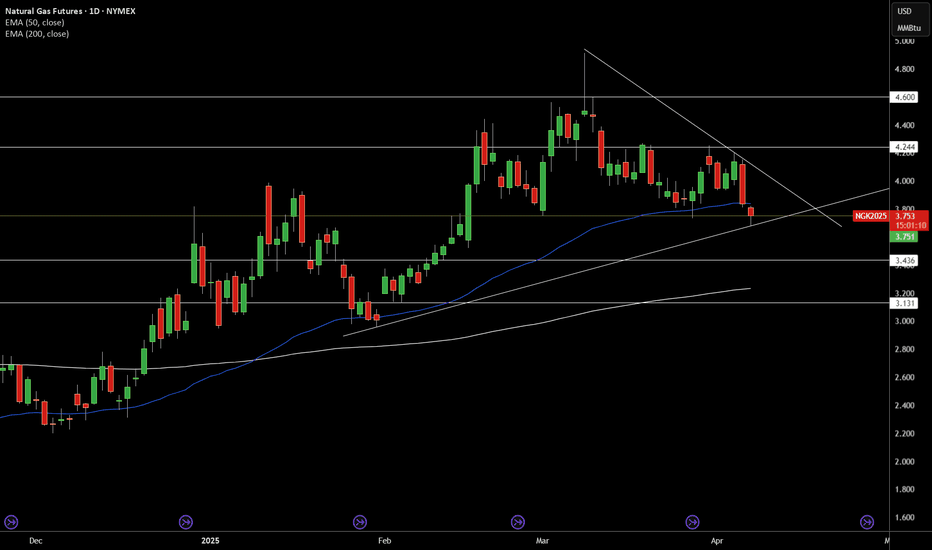

Natural Gas Retests Trendline – Compression BuildingNatural Gas is approaching apex compression, holding above an ascending trendline while capped by a descending trendline from March highs. Price is testing the 50 EMA at $3.83 with a key horizontal level at $3.75 in focus. A break below could trigger downside to $3.43. On the flip side, a breakout above $4.00 could open a run toward $4.24. RSI at 37 supports ongoing consolidation with a bearish lean.

Summary:

⚠️ Neutral bias in play. Watch for breakout above $4.00 for long, or breakdown below $3.75 for short toward $3.43.

NATGAS Technical Analysis! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.819 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.970

Recommended Stop Loss - 3.740

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS will soon retest a key support level of 3.728$

So I think that the pair will make a rebound

And go up to retest the supply level above at 3.887

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS: Bulls Will Push

The price of NATGAS will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Free Signal! Buy!

Hello,Traders!

NATGAS went down again

But will soon hit a horizontal

Support level around 3.784$

So after the retest we can go

Long on Gas with the Take

Profit of 3.907$ and the

Stop Loss of 3.725$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS: Expecting Bearish Movement! Here is Why:

Looking at the chart of NATGAS right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Nat Gas Report 3/29/25: Can you shoulder the shoulder?

Well, after much fanfare it is finally here! No, not the SSW event, not the Liberation Day (Trump’s April Tariffs), but the shoulder season! That important time of the year for energy traders to watch the price of NG drop faster than Trump’s current approval ratings! The cyclical trade in energy warrants a movement of funds this time of the year to Crude oil, then eventually Gasoline. As discussed, a few weeks ago this constant movement in energy trades keeps the asset allocations inline with seasonal trends in energy usage and the funds fat and happy. But this year we have the ultimate monkey in the works, true market dynamics!

Although with the upcoming Liberation Day tariffs starting this coming Wednesday, 4/2/25, the market once again is on edge with the unknown unknowns! As the broad equity market has sold off this quarter, we have seen a movement into commodities, especially NG (sorry Gold bugs!). The underlying weakness in global oil demand, and the inability for oil producing nations and majors to temper supply has led to a glut in worldwide crude stockpiling. Yesterday’s Crude Oil COT report showed commercials with a net short position of -208,888 (an increase in short positions by 3,580 from the previous week) and non-commercials who are net long +197,061. This is not a common seasonal response in the Oil markets. Normally the December to May timeframe is a season of oil accumulation by major traders and the petro industry. This demand is not without purpose; it marks the onset of preparations for the impending summer driving season. Refiners embark on a strategic accumulation of crude oil inventory for gasoline production, laying the groundwork for oil price increases in the months ahead. But with softness in the overall global markets, downward revisions in GDP, Trump tariff uncertainty, and the big electrification to the transportation sector. There is a bearish undertone to the global oil and gasoline market this year. Remember what was discussed. The global nature of institutional energy traders is to trade crude in the spring (as NG sells off), gasoline in the summer (as oil sells off), NG in the fall (as diesel sells off), and diesel/heating oil in the winter (as gasoline sells off). This round robing of trades allows the savvy trader to expect entry and exit points, or to determine the overall direction of seasonal trends. But throw that out this year! The past few months NG and Oil have been trading inversely with each other, almost to the dollar!

So, that leaves us with a tremendous amount of allocated worldwide capital in the one energy trade left. NG! But, not without merit! Natural Gas has a tremendous amount of underlying fundamental support. Lower than normal storage (currently 6.5% below 5-yer average), increasing power generation demand, increasing exports via pipeline to Mexico, increasing LNG export (currently hit a record at 16.7 BCF/d this week and expected to hit 18 BCF/d next month), and stagnant production (NG rig count down 9% y/y, oil down 4.5% y/y). The producers have finally understood that producing too much NG will probably affect the price in a negative way. Last week’s energy conference in Houston, TX had one general theme from all the energy majors. Supply restraint/discipline and an increase in infrastructure. There must have been some concerted effort, because the catch phrase all week was not “Drill baby Drill” but “Build baby Build” The discussion was that Trump’s lowering of barriers for pipeline construction and LNG export facilities is what is going to give them a reason to drill. But, for the time being they need takeaway capacity. They will continue to keep rigs out of the field until that happens. Imports from Canada are at a 2-year low, due to the increase in heating demand in Canada, due to the SSW event taking hold up north. Increasing demand, stagnant production = higher prices!

Weather related demand has decreased with the unusually warm March. But the SSW event is now affecting Canada. If not for the main Pacific Teleconnection, the EPO, this cold bottled up in Canada would have brought seasonal temperature to the US. But!!!!!!! Now the EPO(negative) Teleconnection is aligning with the SSW event and the models over the past week have been printing colder. I expect the month of April to end up below average. Which could possibly lead to one, maybe to more storage withdrawals, outside the withdrawal season. As of earlier this week, April is now projected to end the storage deficit created during the withdrawal season. But if we can head into the month of May with a continued deficit, we can expect elevated prices for the summer strip. The summer forecasts are currently coming out, which is showing dry and hot conditions from the Rockies west to the Mississippi River. The current storage deficit in the South Central region (-10.5%) and the Midwest (-16.2%), will be the main driver for price appreciation due to weather related issues. Years that had a SSW event in the months of March and April, statistically have very hot May and June months that follow. This kick start to the summer cooling season is another reason for the predicted elevated prices this summer. This is not 2024! Do not expect for historic low process to return, bar a pandemic or a worldwide global recession. There will be price volatility, but not a complete dropping of the floor price.

Near term pricing: Ever since moving above the 100D SMA back at the end of December the 50D SMA has held up wonderfully as support during last four months. Since Tuesday the 50D SMA has continued to hold, except for a brief 12 hour period, but the price showed bullish support by retracing, touching and bouncing back off. The weekly low bounced off the lower SD of the BB. This another bullish conformation. The weekly low dropped below the 38.2% fib level and reclaimed upward momentum, another bullish sign, only to move up past the 50% fib level. The psychological 4000 level, another bullish indicator. When technical and fundamentals align, we should pay close attention and listen!

I am watching 4170, 4252, and 4316 for my immediate term resistance levels. If 4316 is broken, the upper BB SD and the 78.6% swing retracement level 4570 is next. For support, 3953, 3854, 3729. If there is a break below the 3729 then the 23.6% swing retracement level at 3560 would be up next. I am of the belief that the market is expected to travel higher. But there are many reasons for continued range bound days. So, I will be setting these levels to range trade until I see an indication for otherwise.

Keep it Burning!

NATGAS: Market of Sellers

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NATGAS pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Growth Ahead! Buy!

Hello,Traders!

NATGAS made a retest

Of the horizontal support

Level of 3.720$ and we are

Seeing a nice strong bullish

Rebound so we are bullish

Biased and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATURAL GAS Channel Up getting ready for the next Leg to 6.600Natural Gas (NG1!) has been trading within a Channel Up since the August 27 2024 Low and right now it is consolidating on its 1D MA50 (blue trend-line).

The last Higher Low was priced on the 1D MA100 (green trend-line), which isn't far of, actually it sits at the bottom of the Channel Up. Given the strong symmetry on the Channel's initial Bullish Legs (+61.23%), we expect the new rally that is about to start to also reach the 1.618 - 1.786 Fibonacci extension Zone as the previous.

As a result, we see NG at a minimum of 6.600 by June - July.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

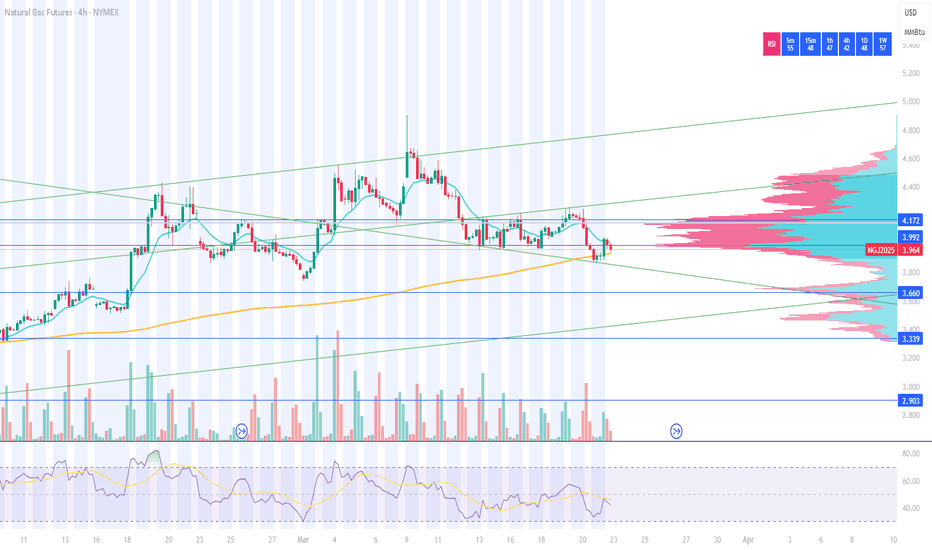

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry - 3.964

Sl - 3.800

Tp - 4.264

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS What Next? BUY!

My dear friends,

Please, find my technical outlook for NATGAS below:

The instrument tests an important psychological level 3.964

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 4.197

Recommended Stop Loss - 3.852

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK