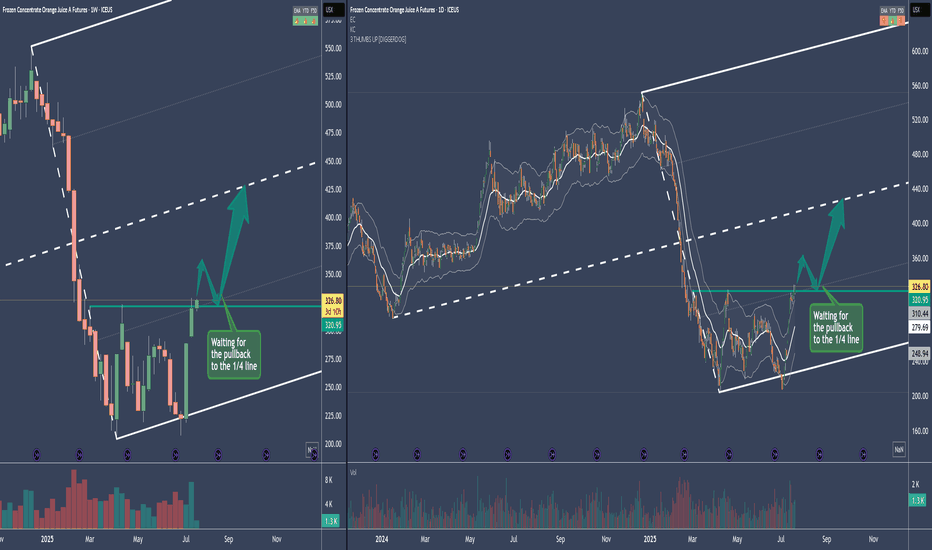

OJ - Frozen Orange Juice Long SetupThe Medianline se aka Fork, is a pullback Fork.

So what we want to see is a reversion to the mean after this drop.

The sideways action from Mar. to Jul. is a "loading" period, where Commercials load their boat.

If we break the resistance, it's usual that there will be a pullback to the prior resistance - now support. Or even into the loading zone.

Entries will be on a intraday basis.

Stalker mode on 88-)

OJ1! trade ideas

Why Your Orange Juice Costs More?The price of orange juice is surging, impacting consumers and the broader economy. This increase stems from a complex interplay of geopolitical tensions, macroeconomic pressures, and severe environmental challenges. Understanding these multifaceted drivers reveals a volatile global commodity market. Investors and consumers must recognize the interconnected factors that now influence everyday staples, such as orange juice.

Geopolitical shifts significantly contribute to the rising prices of orange juice. The United States recently announced a 50% tariff on all Brazilian imports, effective August 1, 2025. This politically charged move targets Brazil's stance on former President Jair Bolsonaro's prosecution and its growing alignment with BRICS nations. Brazil dominates the global orange juice supply, providing over 80% of the world's trade share and 81% of U.S. orange juice imports between October 2023 and January 2024. The new tariff directly increases import costs, squeezing margins for U.S. importers and creating potential supply shortages.

Beyond tariffs, a convergence of macroeconomic forces and adverse weather conditions amplify price pressures. Higher import costs fuel inflation, potentially compelling central banks to maintain tighter monetary policies. This broader inflationary environment impacts consumer purchasing power. Simultaneously, orange production faces severe threats. Citrus greening disease has devastated groves in both Florida and Brazil. Extreme weather events, including hurricanes and droughts, further reduce global orange yields. These environmental setbacks, coupled with geopolitical tariffs, create a robust bullish outlook for orange juice futures, suggesting continued price appreciation in the near term.

OJ BUYBUY OJ at 203.00 to 188.00, riding it back up to 511.00 to 575.00 as Profit Targets, Stop Loss is at 103.00!

If anyone likes long mumbo jumbo garbage analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from the markets, because the markets are NOT a sure thing,

so it is definitely NOT for you.

WARNING: This is just opinions of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a RISKY business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

Orange Juice Long BiasFundamentals:

Valuation:

Undervalued on

10d - 13d - 30d

Seasonality:

Showing rally until end 27/05/25

on 5y - 10y

HOWEVER -- 10y isn't aligned..

COT:

The main thing is Users & Producers,

They turned bullish sharply in the past

few weeks

Non-commercials are not yet bullish

on the pair, however, it is natural, as

they buy into strength and sell into

weakness in all markets.

Technicals:

We have a clear (already mitigated) Demand zone on the weekly. With a great Leg out (empolsive move to the upside)

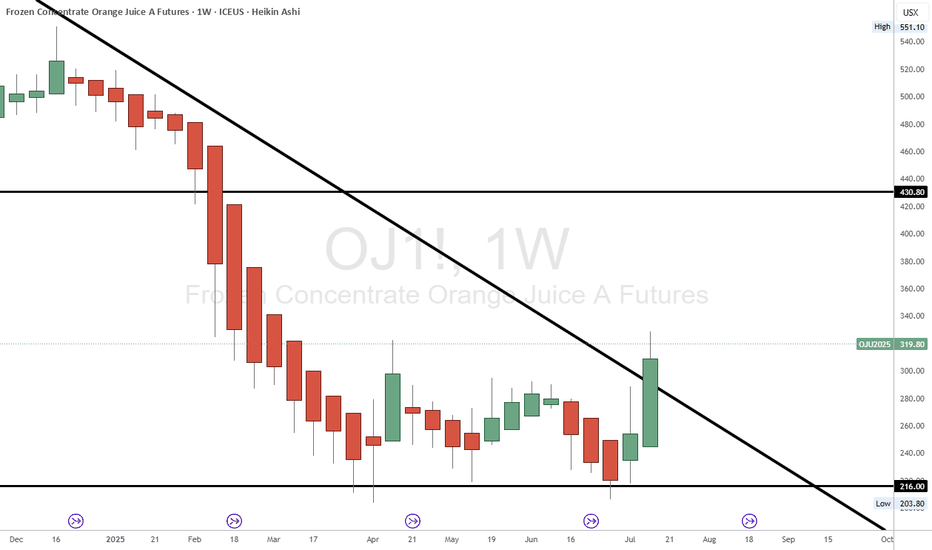

OJ | Orange Juice | SHORT ICEUS:OJ1!

It's time to short orange juice. I expect it to return to its 2022–2023 price range. I have no idea why the price rose 500% in just three years, but this month it has already declined by almost 50% from the all-time high. Here are my targets:

TP1: $260

TP2: $200

TP3: $140

Timeframe: 2025

Orange Juice Futures SHORT OPPPennant Breakout resulting in a Bull Flag w/ a Double Top

Looking for the gap to fill below 402.00 which also confirms the Double Top and the Bearish Breakdown of the Bull Flag Structure, Conservative Measured move (Patterns Measured Move * Percentage Meeting Target) puts it close to the Demand Line from Feb . 23 2023, marking a 5th touch point.

Longer Term lookout

** NOT FINANCIAL ADVICE OR TELLING ANYONE TO MAKE ANY TRADES BASED ON MY OWN ANALYSIS, USE YOUR OWN JUDGEMENT **

The Orange Juice Crisis: A Climate-Induced Market ShiftOrange juice prices have hit record highs due to a confluence of climate-related challenges, including extreme weather events, rising temperatures, and altered rainfall patterns. These factors have decimated citrus crops, particularly in key production areas like Florida, leading to significant supply shortages and driving up prices. This crisis underscores the fragility of our food supply and highlights the urgent need for innovative solutions and international cooperation.

The orange juice industry faces a severe crisis driven by climate change, leading to soaring prices and dwindling supplies. Extreme weather events, rising temperatures, and altered rainfall patterns have devastated citrus crops, particularly in Florida, the heart of U.S. orange production. This has led to a bidding war for orange juice concentrate, exacerbated by inflationary pressures on fertilizers, pesticides, and labor costs.

Globally, major producers like Brazil, Mexico, and Spain also grapple with these climate-induced challenges, resulting in reduced yields and increased vulnerability. The economic toll extends beyond agriculture, affecting jobs and local economies.

Addressing climate change is crucial for the industry's future. Investing in research to combat diseases like citrus greening, improving water management practices, and adopting sustainable farming methods are essential steps. Diversifying crops and exploring alternative citrus products could also offer relief.

This crisis highlights the fragility of our food supply and the urgent need for global cooperation to ensure the long-term viability of the orange juice market. As climate change continues to impact agricultural production, innovative and sustainable solutions are imperative to stabilize prices and secure the future of this beloved beverage.

Orange Juice Crisis Prompts Search for Alternative FruitsThe global orange juice industry faces an unprecedented crisis due to bad weather and disease in Brazil, the world's largest orange exporter. Orange juice futures have surged to record highs, nearly doubling in price over the past year. This situation has led manufacturers to explore alternative fruits like mandarins for juice production.

Key Points:

- Record High Prices: Orange juice futures hit $4.92 a pound, reflecting concerns over supply shortages.

- Natural Disasters: A hurricane and cold snap in Florida, along with citrus greening disease, have devastated US orange groves.

- Brazil's Struggles: Brazil's orange production has fallen by 25% this year due to adverse weather and disease.

- Mandarins as Alternatives: Industry leaders are considering mandarins, which are more resilient to climate change, as a viable alternative for juice production.

- Regulatory Challenges: The International Fruit and Vegetable Juice Association is exploring legislative changes to include other citrus fruits in the definition of orange juice.

The long-term outlook remains uncertain as the industry adapts to these challenges, potentially leading to higher prices and new juice flavors for consumers.

OJ - Frozen Orange Juice Is DoneIn my YT Video Analysis I talked about, how OJ is at the Apex and has a high chance to fall down to the Center-Line.

On the daily chart (see the zoomed Screenshot), you see how price is struggling to get above the U-MLH.

Great signs of weakness.

But beware, OJ is super illiquid. This means that this market can get pushed in any direction, in any magnitude.

However, it's very cool to observe, how even such over-pumped markets react to my super tools, the Andrews Pitchfork aka. Medianlines.

Let's observe how this plays out.

We can learn a lot, and use this knowledge in the future for our own trading.

As for the Medianline-Framework, price falls down to the Center-Line when traded outside the U-MLH, and then comes back into the Fork.

Observation Mode ON!

Peace4TheWorld

Orang Juice (OJ) - Trend Fan Line breaksOrang Juice has been in a Parabolic Uptrend on the larger time frame.

Trend breaks can be highly pronounced when they occur and can provide short-term contra-trend trading opportunities .

It is important to be patient and wait for their occurrence, with targets and stop-loss levels placed at the next and previous resistance levels respectively