DAX WILL GO UP|LONG|

✅DAX is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the index is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 23,200

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DE30 trade ideas

DAX Index: Further Upside Ahead? On the DAX chart, we’re tracking a very large diagonal pattern to the upside, which is likely not yet complete. We are probably in the late stages of circle wave C, within a larger third wave in the yellow scenario.

Upside Targets

Next resistance levels: 24,205 and 25,715 EUR

Support Zone for Wave 4

Support area: 22,512 to 21,610 EUR

This zone would become more relevant if the current rally completes and Wave 4 begins.

On the very small time frame, it’s possible that the internal fourth-wave pullback within circle wave C has already started.

Micro support remains between 22,512 and 21,610 EUR

A break below 22,260 EUR would help confirm that wave 4 is underway

However, one more high is still possible before that pullback begins—this would align with the white scenario, where the current move finishes wave 3 before wave 4 kicks in.

DAX40 The Week Ahead 24th March '25DAX40 bullish & overbought, the key trading level is at 22467

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX Growth Ahead! Buy!

Hello,Traders!

DAX is going down

And will soon retest the

Rising support and after

The retest we will be

Expecting a bullish rebound

Because we are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

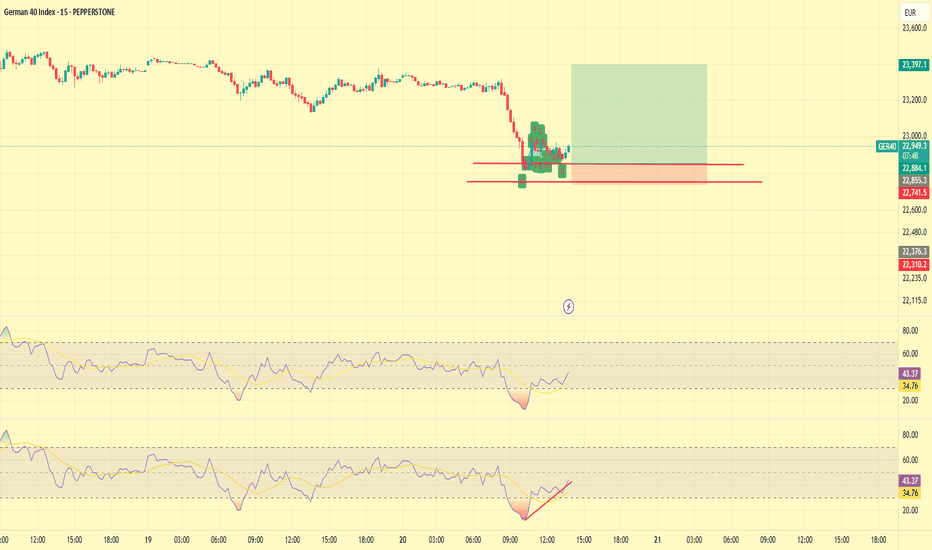

GER40 Breakout Setup! 🔥 GER40 Breakout Setup! 🔥

I'm watching this key resistance level on GER40! 📈 A breakout above could trigger a strong bullish move towards my targets.

🔹 Entry: Waiting for confirmation above trendline

🎯 Targets: TP1 - 23,147.95 | TP2 - 23,341.05 | TP3 - 23,493.75

🛑 Stop-Loss: 22,781.45

Risk management is everything! Let’s see how this trade plays out. Would you take this setup? Drop your thoughts below! 👇

German $DAX ($EWG) Topping Out?Originally posted on 3/12, but blocked b/c I referenced my X account. Looks like a bearish move could be materializing alongside broader risk asset weakness:

Is the XETR:DAX topping out? Monthly RSI @ 80+ w/ weekly nosing over and daily bearish divergences observable. Index high from 3/6 coincided with the 261.8% Fibonacci extension of the 11/2021-10/2022 uptrend correction.

Confirmation short setup could materialize $FDAX closes below pivot low of the 1D uptrend (22226), bounces off of short-term demand (ex: 22142-21691, and trades into supply ≥ 22226. This scenario is speculative - the market needs to show its hand.

Presently, DAX is up > 1.5% alongside US stocks, which dipped into intermediate-term demand and benefited from softer-than-expected CPI prints. However, DAX (and domestic) bulls haven't proven anything yet. Unless buyers manage to push the DAX higher - initially above 22900 and secondarily through 23000-23200 - on accelerating momentum, risk remains to the downside (IMO). German stocks have been global relative strength leaders as of late, so if they do correct, other equity indexes may retreat in tandem.

Long-term charts for US indices ( SP:SPX , NASDAQ:NDX , TVC:RUT ) look more bearish vs. bullish (I still have some shorts on), though a near-term recovery is plausible. If domestic equities do trade lower, selling could materialize in Asian and European markets. Use LTF charts to monitor price action/manage risk and splice into shorts if German stocks AMEX:EWG start to crack.

My $0.02. Feedback welcome.

Jon

DAX40 Bullish sideways consolidation supported at 22467The DAX40 continues to exhibit bullish sentiment, breaking out from a period of sideways consolidation and pushing toward previous resistance and all-time highs (ATH). The prevailing uptrend supports further upside potential, with key resistance levels in focus.

Key Support and Resistance Levels

Resistance Level 1: 23,446

Resistance Level 2: 23,815

Resistance Level 3: 24,000 - 24,420

Support Level 1: 22,467

Support Level 2: 22,204

Support Level 3: 21,870

Conclusion:

The positive reaction to fiscal spending plans and geopolitical developments reinforces the bullish sentiment for DAX40. A sustained move above the nearest resistance at 23,446 could pave the way toward higher targets, while holding above support at 22,467 is crucial to maintaining the uptrend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Potential 30 minute quick scalp on GER30.Price has broken below the previous support after some consolidation. So watch out for retracement to the support (now turned into resistance level) and continuation downwards.

This idea is valid if the 30 minute candle closed below the red resistance level. It is important to wait for a pullback to that zone again to allow price to pick liquidity before moving down.

DAX Trade Log DAX Buy Setup with Ichimoku Confluence

Geopolitical tensions—especially the ongoing conflict in Eastern Europe—continue to influence risk sentiment, while inflation and central bank policy remain in the spotlight. The European Central Bank’s more hawkish stance contrasts with fears of slowing growth in the Eurozone. Despite these headwinds, the DAX could see a near-term bounce, supported by technical signals:

1. Ichimoku Confluence : Price is testing the Kijun and the lower edge of the cloud, aligning with a daily pivot. A close back above the Kijun/cloud area suggests potential upside.

2. Volume Spike : Recent volume surge around this support zone may indicate bullish absorption—watch for follow-through.

3. Macro Backdrop : Although persistent inflation and geopolitical uncertainties loom large, short-term volatility can present trading opportunities. Keep an eye on ECB communications and any unexpected developments in global tensions.

4. Risk Management : A 120-point SL (around 2% account risk) below the key support could help protect against false breaks. Targets include the top of the cloud or previous swing highs.

5. 8-Day Cycle : Day 2 in your cycle analysis suggests a potential upswing—confirmation will come if price holds above this confluence zone.

Stay vigilant, monitor news flow, and maintain discipline in your trading plan. This is not financial advice—always do your own due diligence.

Falling towards 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 22,884.11

1st Support: 22,267.92

1st Resistance: 23,476.03

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DAX strong bullish conditions. Targeting 24200.DAX is trading inside a Channel Up since the October 15th 2024 High.

Since March 11th 2025 it is on a MA200 (4h) rebound and the last time it did so was on January 13th 2025.

It then initiated a +9.12% rebound, which throughout the Channel Up pattern, has been a quite common bullish wave.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 24200 (+9.12% rise from the MA200 low).

Tips:

1. The RSI (4h) has print a Channel Up pattern that is seen on the last three major Lows of the pattern. Strong bullish signal.

Please like, follow and comment!!

Technical Analysis of DAX Index (March 13, 2025, 15-Minute ChartTrend Identification:

The price action is moving within a rising channel (highlighted in purple), indicating a potential short-term bullish trend.

The 200-period moving average (maroon line) is above the price action, suggesting a larger timeframe bearish bias, but price is attempting to reclaim higher levels.

The Point of Control (POC) at 22,658.69 indicates the area of highest traded volume and a key decision zone.

Support & Resistance Levels:

Immediate Resistance: 22,720 (upper boundary of the rising channel).

Major Resistance: 22,800 (previous swing high).

Immediate Support: 22,560 (lower boundary of the channel).

Key Support: 22,440 (recent swing low and potential reversal area).

Chart Patterns & Market Structure:

The price recently bounced from the lower boundary of the channel, suggesting buying pressure at support.

A Volume Profile (VPVR) shows strong volume concentration around 22,658, reinforcing it as a key pivot zone.

The recent sharp rejection from the lows aligns with potential bullish continuation, targeting the upper channel boundary.

Trade Setup & Risk Management:

📈 Bullish Trade Setup (Trend Continuation)

Entry: Buy near 22,600–22,620 on minor pullbacks.

Stop-Loss: Below 22,540 (previous swing low).

Target 1: 22,720 (upper channel boundary).

Target 2: 22,800 (major resistance zone).

Risk-Reward Ratio (RRR): ~1:2.5

📉 Bearish Trade Setup (Reversal Play)

Entry: Sell near 22,720–22,740 if price rejects resistance with strong bearish candles.

Stop-Loss: Above 22,780.

Target 1: 22,600 (POC and key support).

Target 2: 22,440 (lower channel boundary).

RRR: ~1:2

Risk Management & Position Sizing:

Risk 1-2% of capital per trade to maintain disciplined exposure.

Adjust position size based on stop-loss distance to keep risk consistent.

Monitor volume dynamics for confirmation of trade direction.

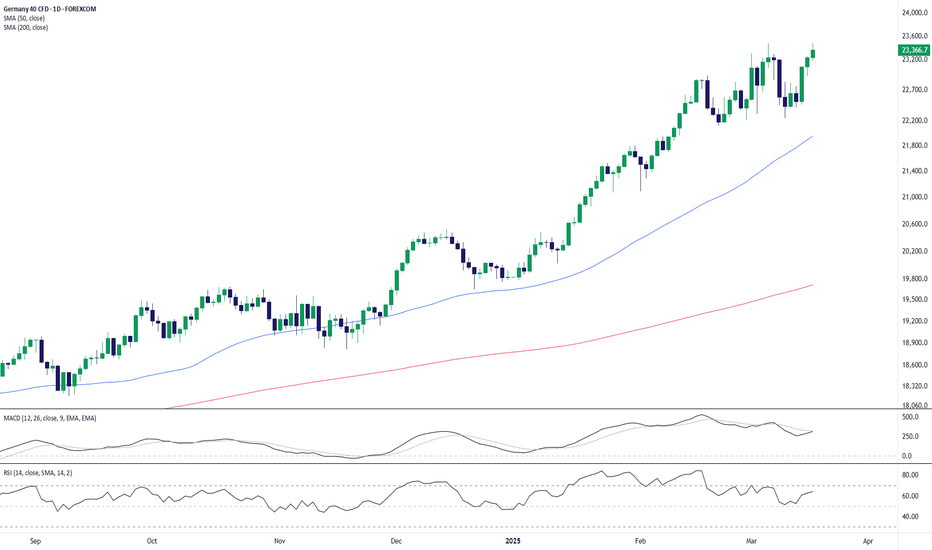

Germany's DAX Hits Fresh Highs as Uptrend StrengthensThe Germany 40 (DAX) continues its impressive rally, climbing to 23,378.7, up 0.60% on the session. The 50-day SMA (21,954.8) remains firmly below price action, signaling sustained bullish momentum, while the 200-day SMA (19,713.1) provides a solid long-term support base.

Momentum indicators support the uptrend:

✅ MACD remains in bullish territory, showing sustained strength.

✅ RSI at 64.04 suggests the index is trending strongly but isn’t overbought yet.

Key Levels to Watch:

📌 Support: 22,800 (recent pullback level), 21,950 (50-day SMA)

📌 Resistance: 23,600 (psychological level), 24,000 (round number target)

As long as 23,000 holds as support, bulls may push for 24,000+ in the near term. A drop below 22,800 could signal a deeper pullback.

-MW

DAX40 Bullish on planned defense and infrastructure spend. The DAX40 index is showing positive momentum this morning, driven by optimism around a debt-financed spending plan targeting defense and infrastructure. The bill is on track for parliamentary approval, with strong backing from both conservative and Social Democrat lawmakers. Meanwhile, the European Union is advancing discussions on seizing frozen Russian assets to increase defense funding, aiming to boost economic pressure on Russia. Additionally, U.S. President Donald Trump and Russian President Vladimir Putin are expected to discuss peace negotiations regarding the ongoing conflict in Ukraine.

Technical Outlook: Bullish Breakout

The DAX40 continues to exhibit bullish sentiment, breaking out from a period of sideways consolidation and pushing toward previous resistance and all-time highs (ATH). The prevailing uptrend supports further upside potential, with key resistance levels in focus.

Key Support and Resistance Levels

Resistance Level 1: 23,446

Resistance Level 2: 23,815

Resistance Level 3: 24,000 - 24,420

Support Level 1: 22,842

Support Level 2: 22,467

Support Level 3: 22,204

Conclusion:

The positive reaction to fiscal spending plans and geopolitical developments reinforces the bullish sentiment for DAX40. A sustained move above the nearest resistance at 23,446 could pave the way toward higher targets, while holding above support at 22,842 is crucial to maintaining the uptrend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.