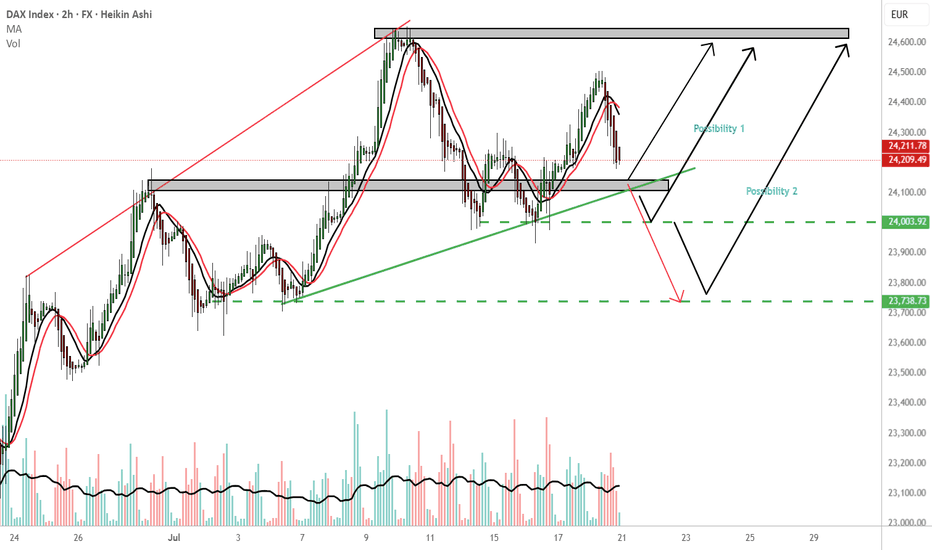

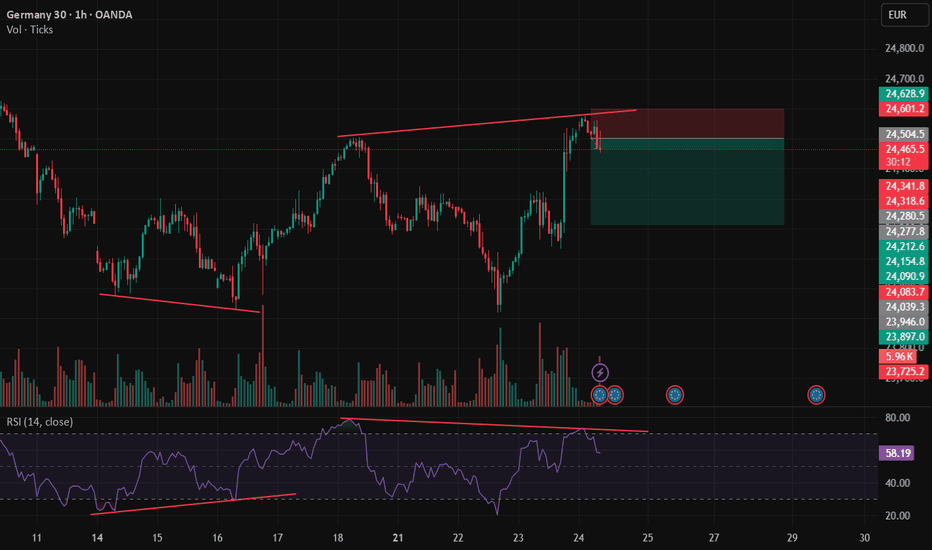

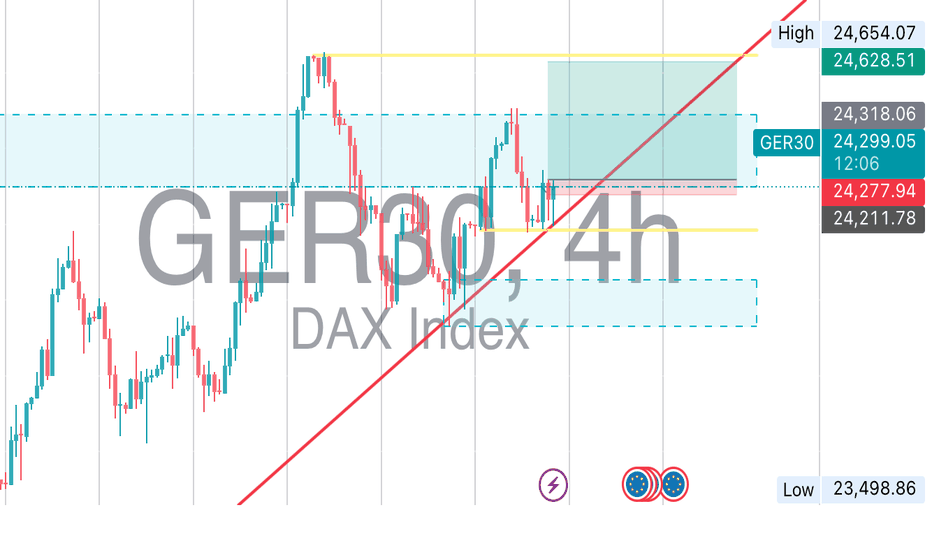

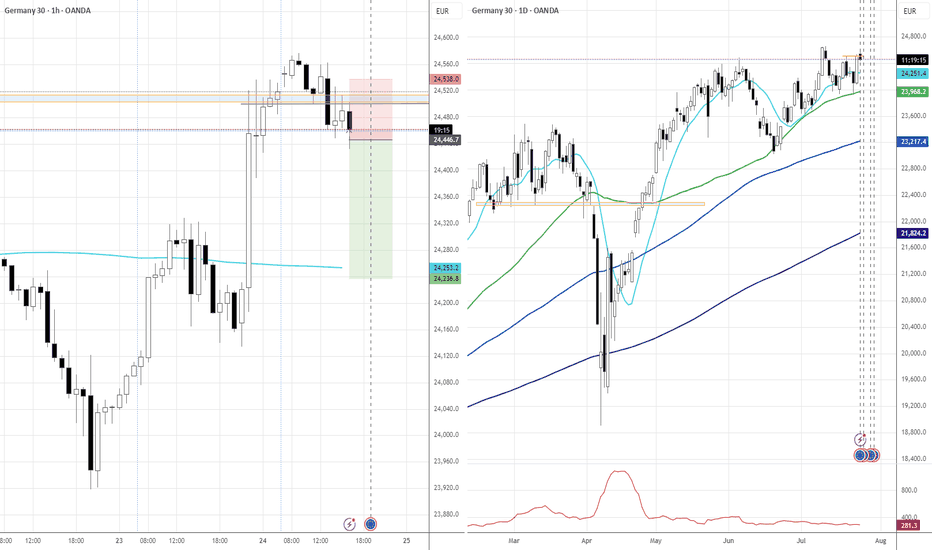

GER 30 endless possibilitiesMy most immediate outcome is reversal 24,140 price area. TP:24,600

Possibility 1: If Ger 30 holds the 24,000 price area i would consider a buy to 24,600.

Possibility 2: If Ger30 holds the 23,730 price area that would be another possibility for a buy. TP 24,600.

WCS: Worst case scenario, continuation downwards from the 24140 PL. Consider the red arrow. The 24,140 is a important price area please wait for confirmation

Please follow your trading plan.

THOUGHTS????

DE30 trade ideas

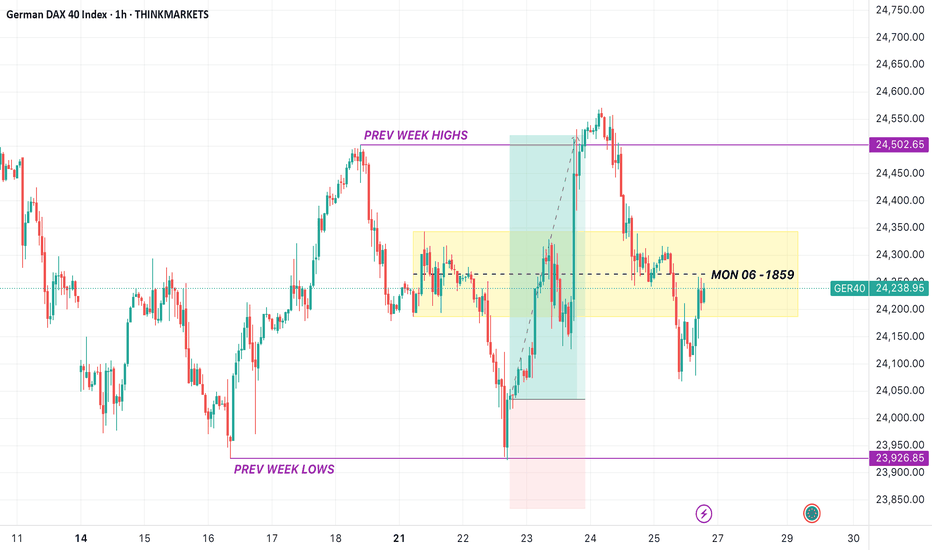

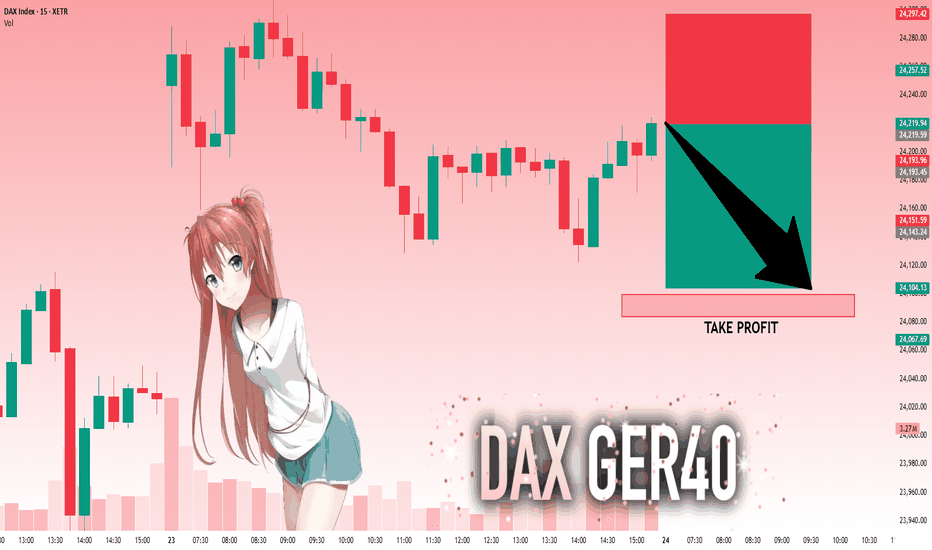

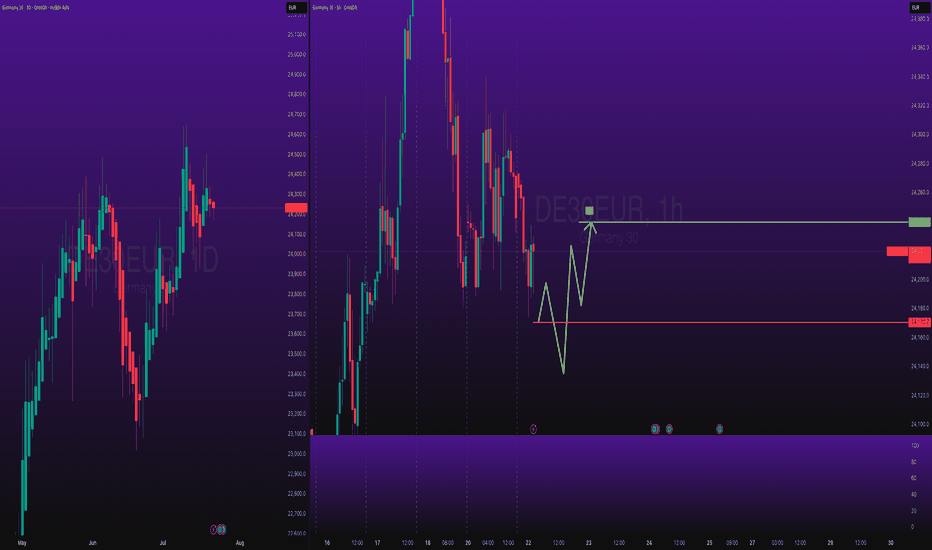

DAX: Target Is Down! Short!

My dear friends,

Today we will analyse DAX together☺️

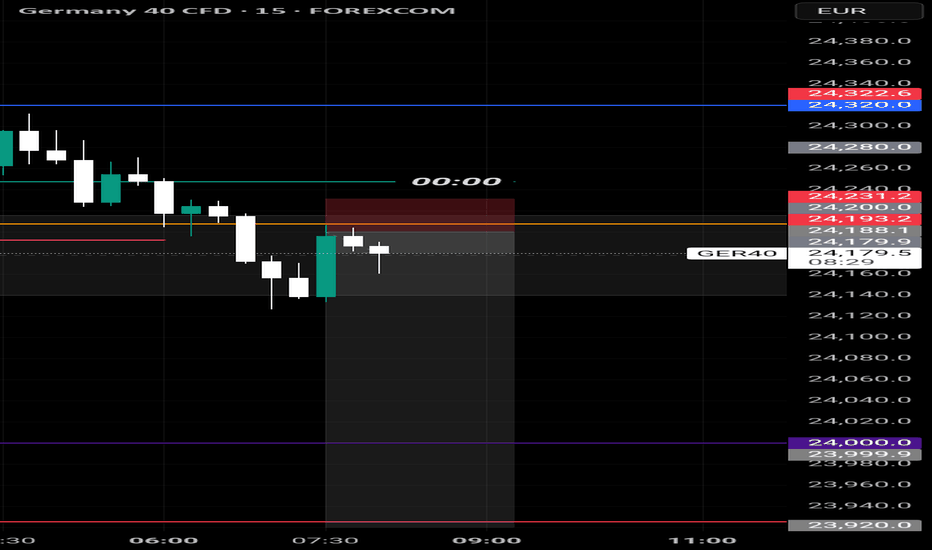

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 24,219.59 will confirm the new direction downwards with the target being the next key level of 24,099.27.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

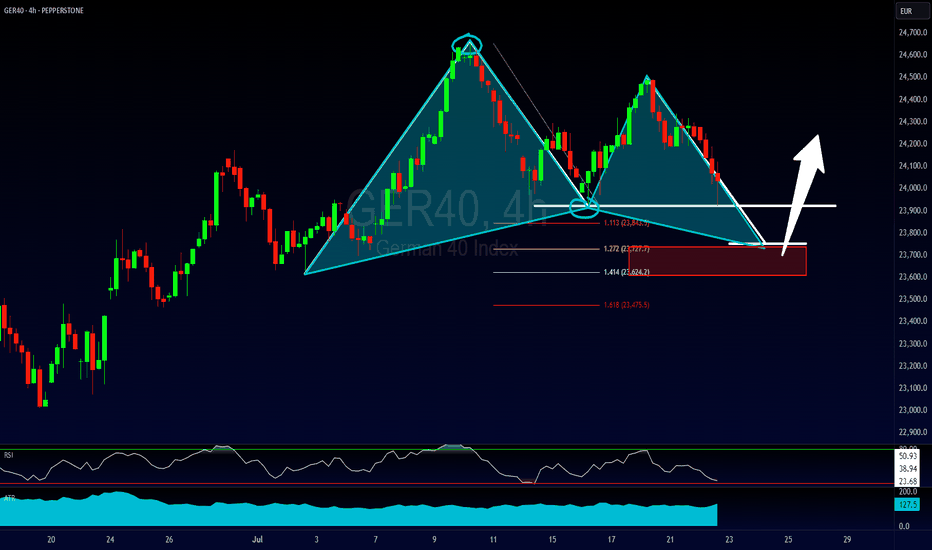

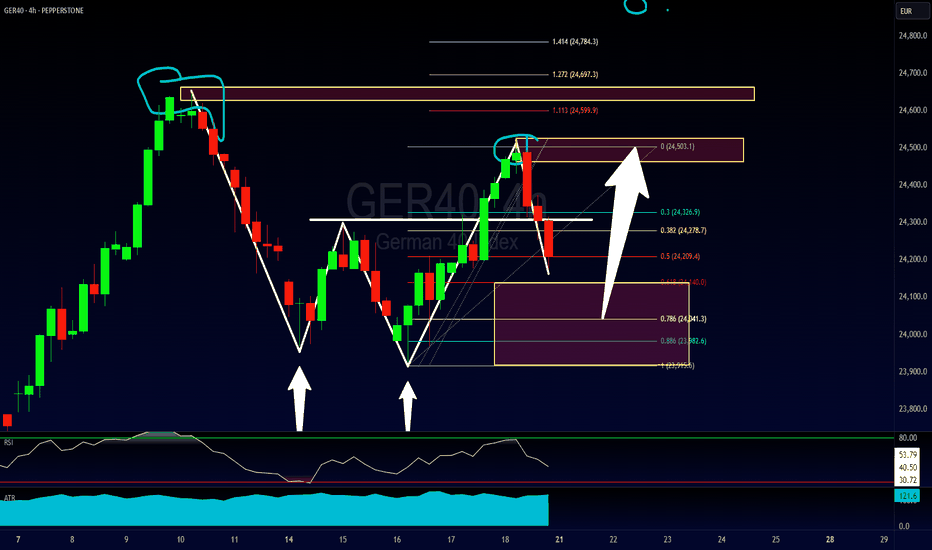

The Kiss of Death Trade & Other Reasons for EntryFollowing up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved.

1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom.

2) A potential Kiss of Death trading opportunity

3) A bigger potential bullish gartley pattern IF the current 2618 opportunity is violated.

Please leave any questions or comments below & feel free to share your opinion on the setup.

Akil

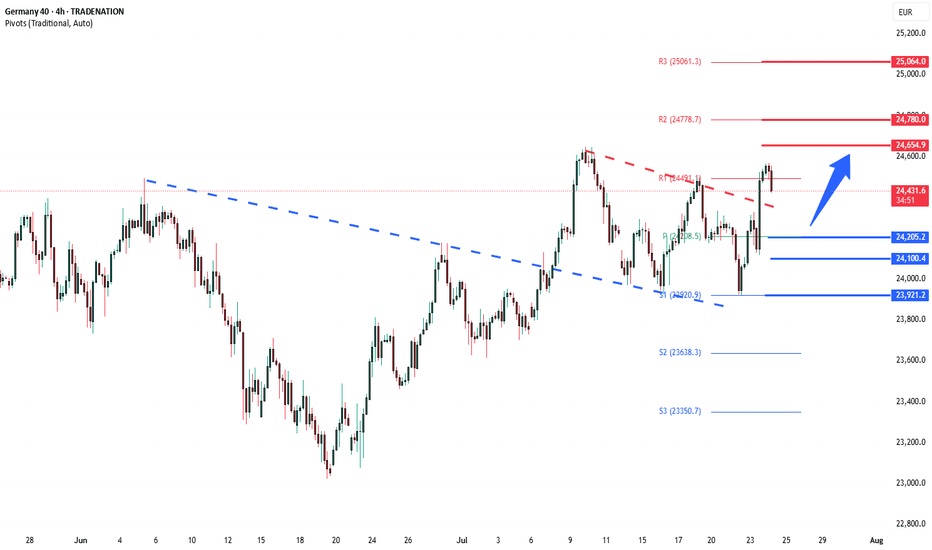

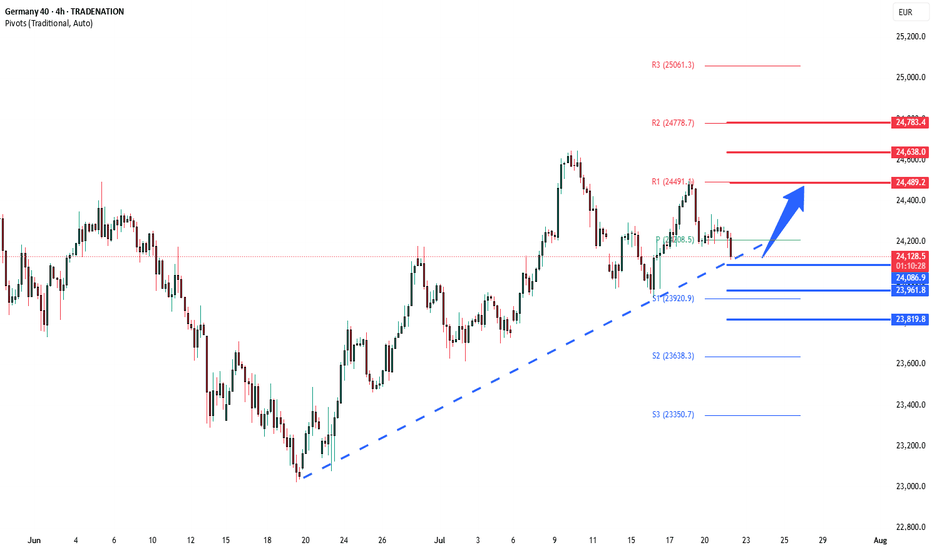

DAX40 Bullish breakout retest support at 24205The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24205 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24205 would confirm ongoing upside momentum, with potential targets at:

24655 – initial resistance

24780 – psychological and structural level

25064 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24205 would weaken the bullish outlook and suggest deeper downside risk toward:

24100 – minor support

23921 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX40 holds above 24205. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX40 Support retest at 24085The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend.

Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at:

24490 – initial resistance

24640 – psychological and structural level

24780 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24085 would weaken the bullish outlook and suggest deeper downside risk toward:

23970 – minor support

23800 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 24085. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

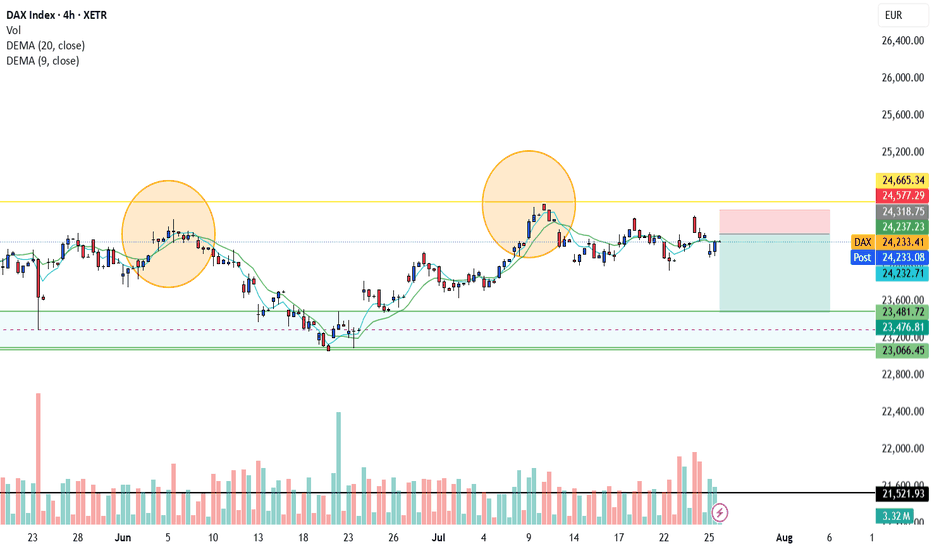

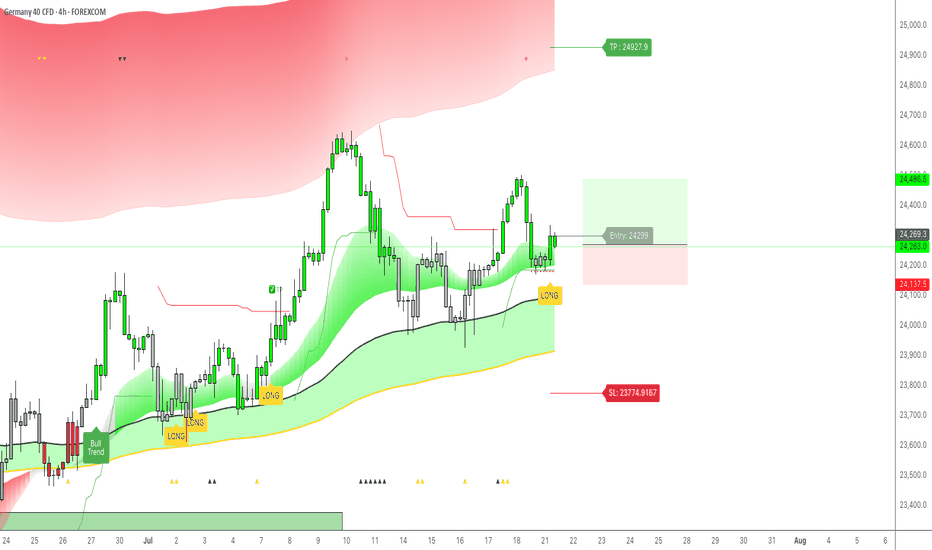

DAX / GER40: Double Long tradeGood morning traders,

I just received an alert from my LuBot Ultimate indicator of a Long signal on a good uptrend structure.

From the weekly chart I see that we are surfing on the wave of the second swing after the last bearish retracement, however on the daily the first swing has just begun after a slight minimum made in the last few days.

On the 4H this opportunity presents itself which I take advantage of in a doubly way, that is:

-I insert a trade on correction with stop at the level suggested by the indicator and TP to be defined based on the trend.

-I insert a second trade, again on correction, but with stop below the latest lows and take profit on the latest highs, the invested capital is much lower in this case in order to contain the loss but optimize any profit.

👍 If you want to see other similar posts, like/boost

🙋♂️ Remember to follow me so you don't miss my future analyses

⚠️ Disclaimer: This post is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.

AMEX:EWG BMFBOVESPA:DAX1! FPMARKETS:GER40 PEPPERSTONE:GER40 ACTIVTRADES:GER40 XETR:DAX

How To Trade A Bullish 2618 Setup on the GER40A walkthrough of the 2618 Trading Strategy which is a secondary or more conservative way to enter a double top/bottom. In this case, due to the overall directional analysis of the Dax, this also might be a good opportunity to hop on a pullback for a larger bullish trend continuation trade.

2618 RULES

Step 1 - Look for double top or double bottom.

Step 2 - Wait for violation of peak.

Step 3 - Look for pullback into a minimum 61.8 Fibonacci retracement.

Hope you guys have a great week of trading and remember to let me know which profit target method you think you would go with.

Akil

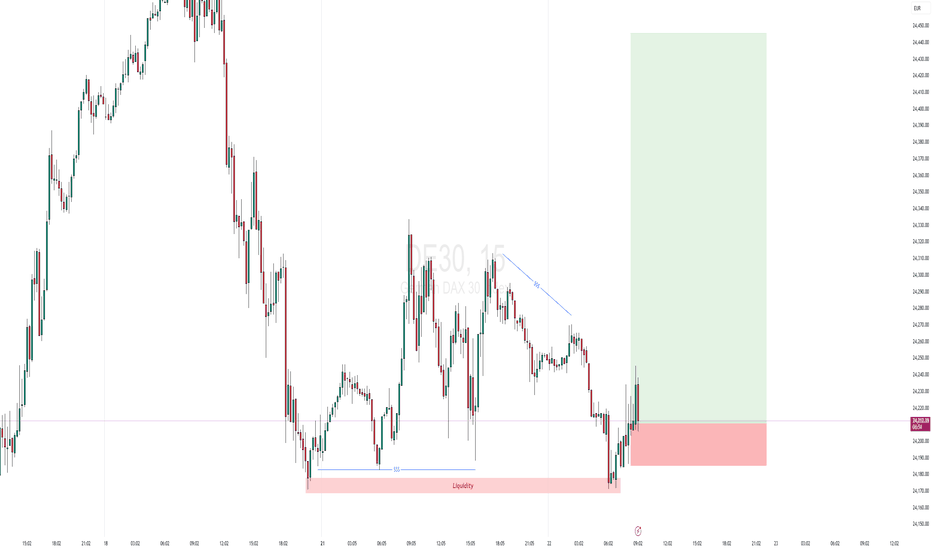

DAX - potential buyPotential buy on the German index as we are coming out of the 30min correction that followed a first small impulse to the upside. Conservative target is a move equivalent to the first 30 min setup. Optimal target are the break of the top and even better the 24.85 area. Levels on the chart. Trade with care.

#DAXDate: 01-08-2025

#DAX Current Price: 23680

Pivot Point: 24193.295 Support: 23822.409 Resistance:24566.692

Upside Targets:

🎯 Target 1: 24882.344

🎯 Target 2: 25197.995

🎯 Target 3: 25574.758

🎯 Target 4: 25951.520

Downside Targets:

🎯 Target 1: 23505.502

🎯 Target 2: 23188.595

🎯 Target 3: 22811.833

🎯 Target 4: 22435.070

#TradingView #Nifty #BankNifty #DJI #NDQ #SENSEX #DAX #USOIL #GOLD #SILVER

#BHEL #HUDCO #LT #LTF #ABB #DIXON #SIEMENS #BALKRISIND #MRF #DIVISLAB

#MARUTI #HAL #SHREECEM #JSWSTEEL #MPHASIS #NATIONALUM #BALRAMCHIN #TRIVENI

#USDINR #EURUSD #USDJPY

#SOLANA #ETHEREUM #BTCUSD #MATICUSDT #XRPUSDT

#Crypto #Bitcoin #BTC #CryptoTA #TradingView #PivotPoints #SupportResistance

Technical Analysis WeeklyGermany 40 remains in a bullish trend and is currently in a pullback phase. It trades at 24,308, almost identical to its VWAP of 24,307.5. The RSI at 54 suggests a pause in momentum. Support is found at 23,786 and resistance at 24,650.

UK 100 is in an impulsive bullish phase, breaking above previous highs with price at 9,145 well above the VWAP at 8,970. The RSI is at 73, indicating strong buying pressure. Support is at 8,748 and resistance is at 9,101.

Wall Street continues its bullish trend, pausing near recent highs. The price is at 44,880, above its VWAP of 44,445. RSI at 63 confirms steady bullish momentum. Support sits at 43,921 and resistance at 44,880.

Brent Crude remains in a broad neutral trend with short-term range-bound action. Price is at 6,768, just under VWAP of 6,866. RSI at 45 reflects a lack of directional conviction. Support is at 6,717 and resistance at 7,015.

Gold continues to trade sideways within a broad range. It trades at 3,337, nearly equal to its VWAP. The RSI at 47 suggests balance. Support is found at 3,290 and resistance at 3,407.

EUR/USD holds a bullish trend while undergoing a correction. It trades at 1.1740, close to its VWAP at 1.1699. The RSI at 59 shows mild positive momentum. Support is at 1.1585 and resistance at 1.1814.

GBP/USD is in a bullish trend but under corrective pressure and seemingly turning rangebound. The price is 1.3433, slightly below the VWAP of 1.3511. RSI is at 42, hinting at waning momentum. Support is 1.3336, resistance at 1.3687.

USD/JPY continues in a neutral trend but could be about to break higher, currently ranging around 147.66 and VWAP at 147.00. RSI at 57 shows a modest bullish bias after having pulled back from overbought territory. Support is at 144.54 and resistance at 149.46.

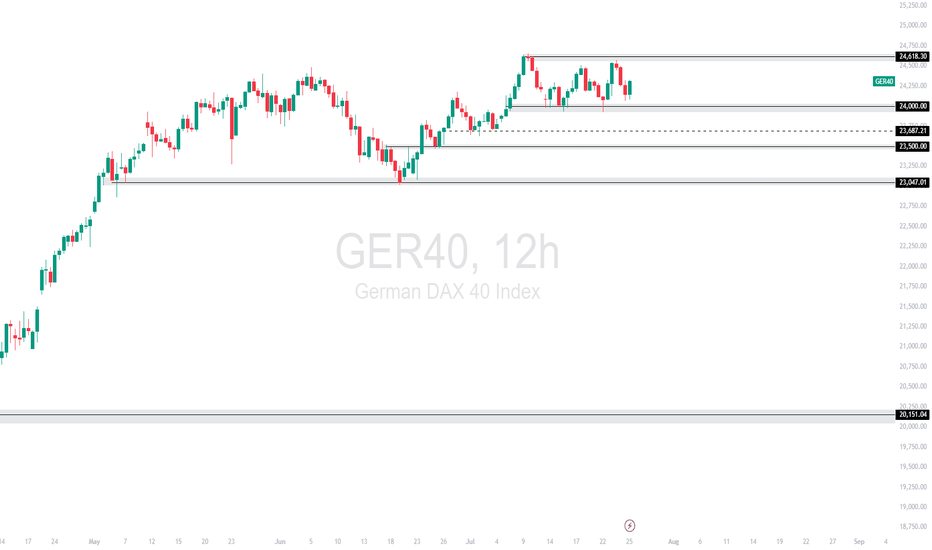

GER40 | Cools Below ResistanceThe DAX rallied aggressively into 24,618.3, but price action has since turned sideways. The index is now ranging just below resistance, as bulls and bears battle for direction in this consolidation phase.

Support at: 24,000.00 / 23,687.21 / 23,500.00 / 23,047.01 🔽

Resistance at: 24,618.30 🔼

🔎 Bias:

🔼 Bullish: Clean break and close above 24,618.30 targets fresh highs.

🔽 Bearish: Break below 24,000 may confirm short-term distribution toward 23,687 and 23,500.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

Long or short?📉 Everyone Bought the Dip… You Could’ve Sold the Top.

While most traders chased short-term bounces,

the ELFIEDT RSI + Reversion script called SHORT on the 4H — right at the peak.

🔻 Double confirmation:

1. Reversion SELL trigger

2. Bearish RSI divergence

Result? A massive unwind.

⸻

Why Swing Traders Win:

⚠️ Lower timeframes were printing BUYs inside this structure…

But smart money knows:

🧠 4H structure > 15m noise

This is the power of top-down confluence:

Trust the higher timeframe → avoid false longs → ride the move with confidence.

⸻

📍 ENTRY STRATEGY:

1. Watch 4H RSI diverge from price

2. Wait for ELFIEDT “DOWN” tag confirmation

3. Enter short on next candle break

4. SL = above signal high

5. Let the cascade unfold

This is how you avoid the trap — and catch the trend early.

⸻

💬 DM “DAX 4H SHORT” for the full system

📈 Follow for high-timeframe precision setups

🔒 No noise. No hype. Just structure + signals that deliver