Dow Jones Wave Analysis – 1 August 2025

- Dow Jones broke the support zone

- Likely to fall to support level 43000.00

The Dow Jones index broke the support zone between the support level 44000.00 and the 38.2% Fibonacci correction of the upward impulse from June.

The breakout of this support zone accelerated the active short-term correction iv.

Dow Jones index can be expected to fall to the next support level at 43000.00 (target for the completion of the active correction iv and the former resistance from May and June).

US30 trade ideas

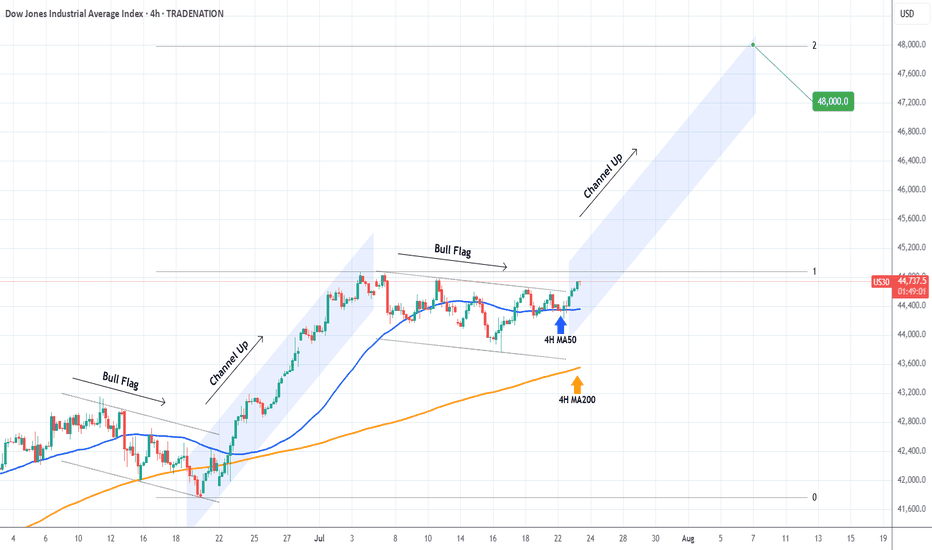

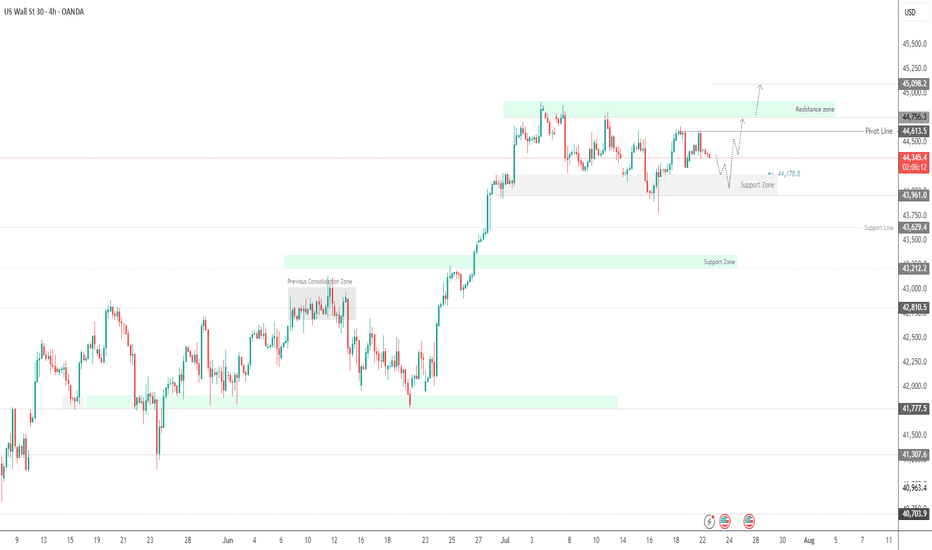

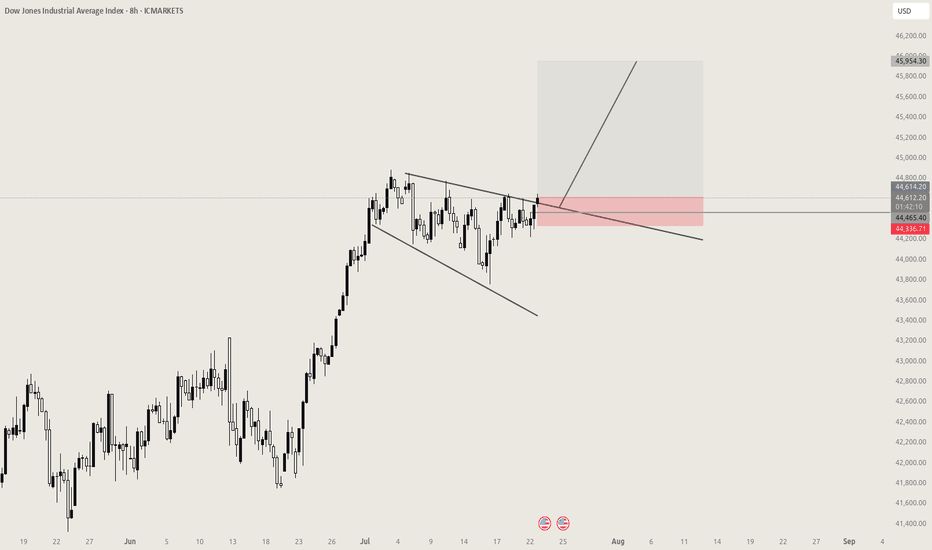

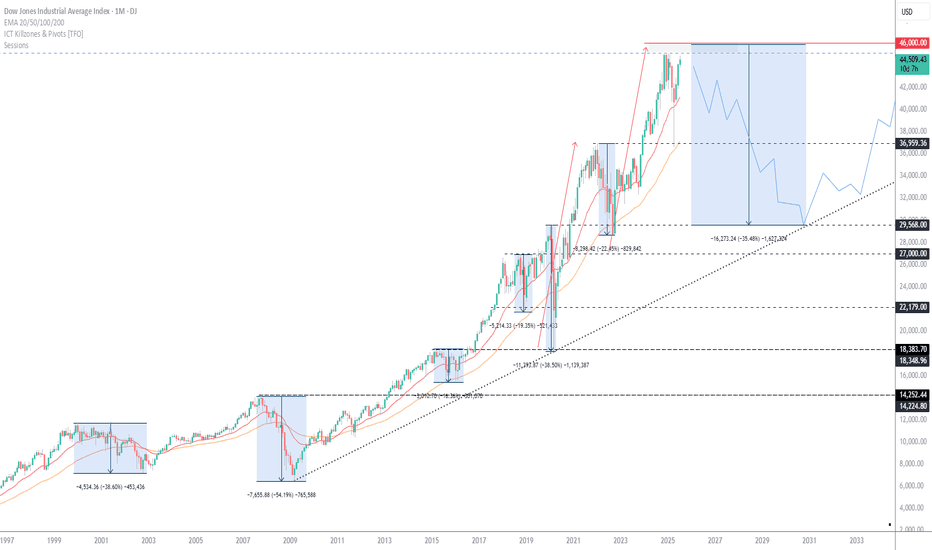

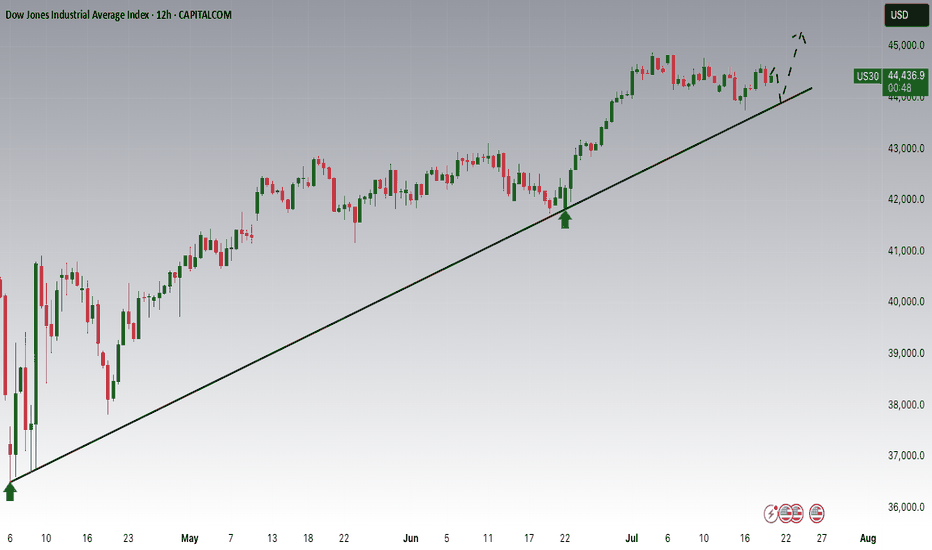

DOW JONES Strong rebound on its 4H MA50.Dow Jones (DJI) is having a strong rebound exactly on its 4H MA50 (blue trend-line). This is taking place just after the price broke above the Bull Flag that served as the accumulation pattern following the previous Channel Up.

This is a repetitive pattern and most likely we will now see the new Channel Up starting. The technical Target on such formations is the 2.0 Fibonacci extension at 48000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

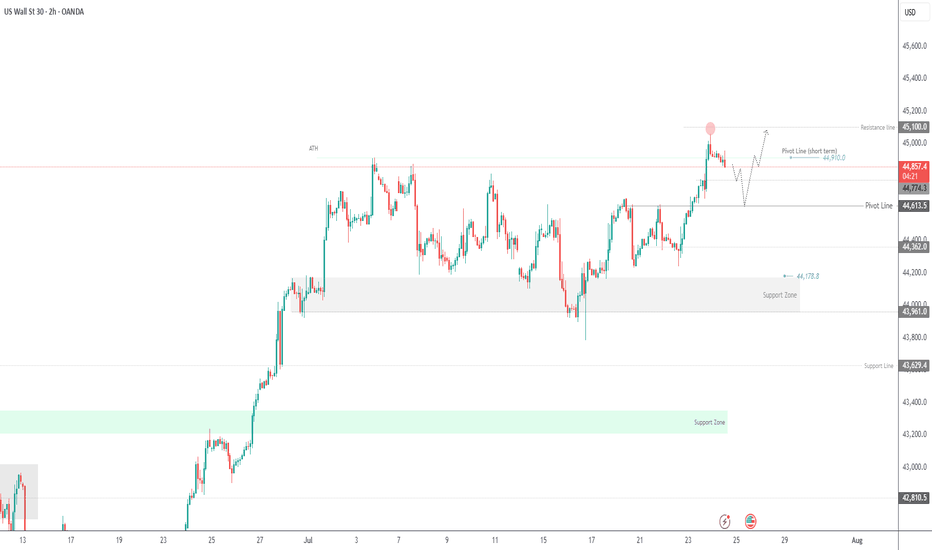

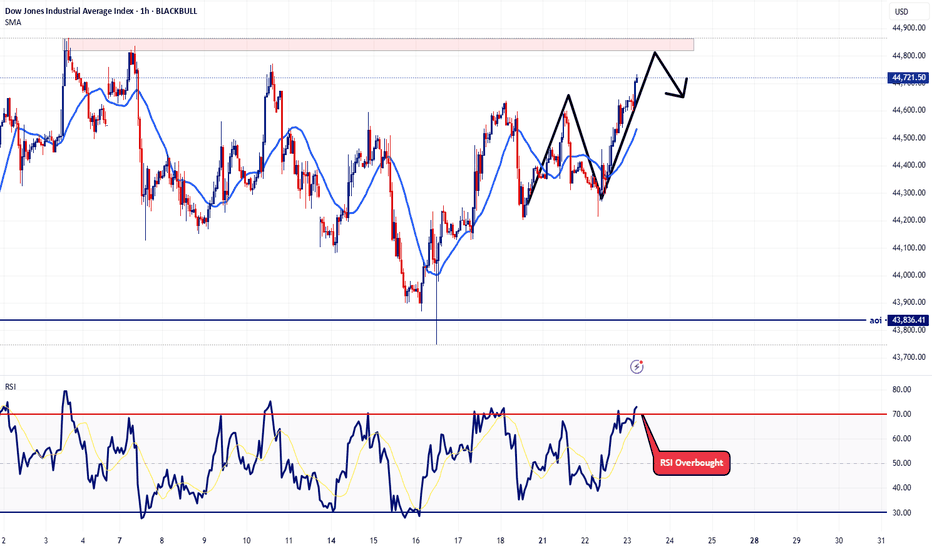

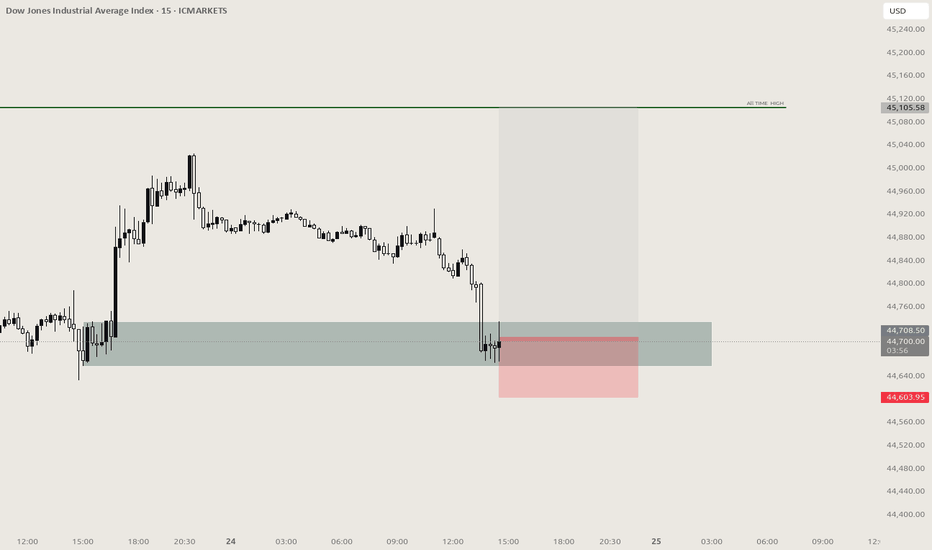

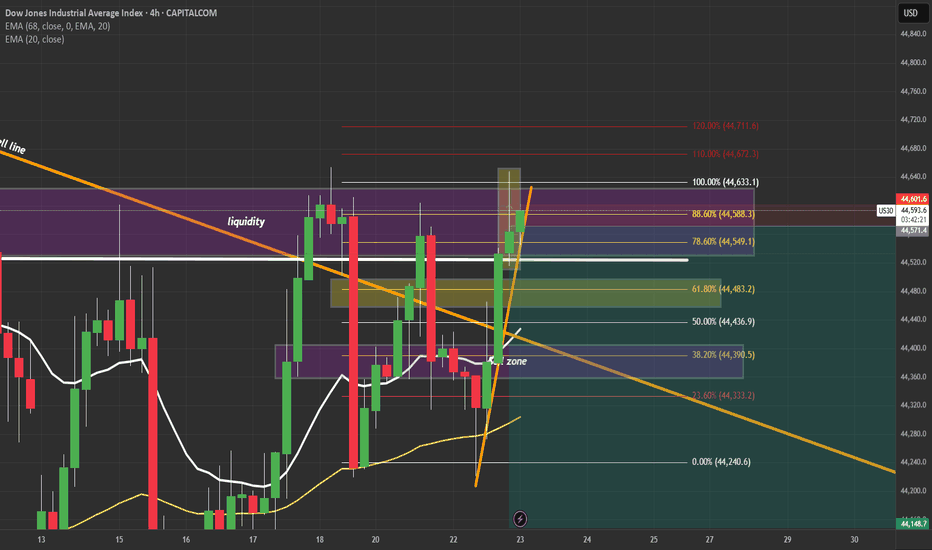

US30 Hits New All-Time High – What’s Next?US30 | OVERVIEW

The price has printed a new all-time high, exactly reaching our target at 45,090, as previously anticipated.

Today, we may see a correction toward 44,770 and 44,610. If the price stabilizes above these levels, another bullish leg is expected.

On the upside, a break above 44,910 would confirm a bullish continuation toward 45,090 and 45,250.

Key Levels:

Support: 44,770 · 44,610 · 44,370

Resistance: 45,090 · 45,250

previous idea:

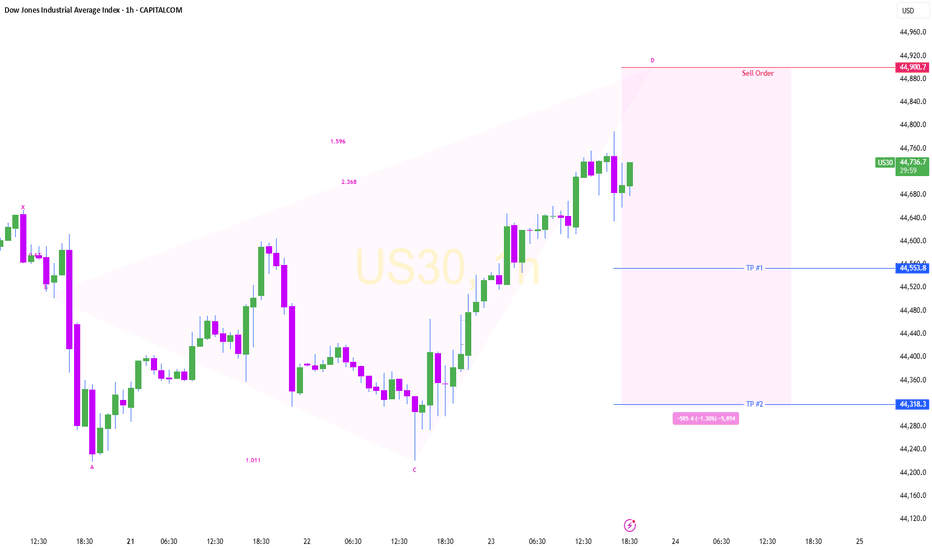

US30: Local Bearish Bias! Short!

My dear friends,

Today we will analyse US30 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 44,774.9 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

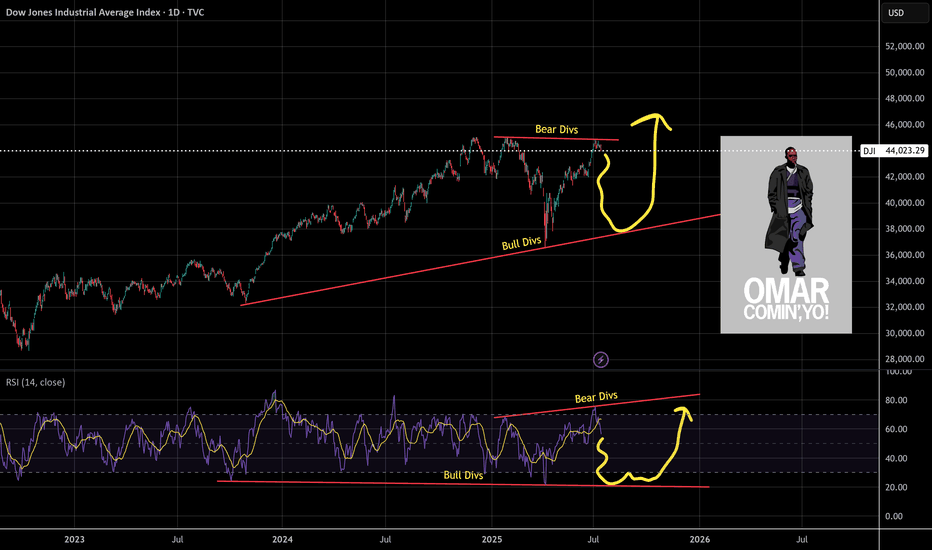

Shakeout On The WayUnlike the SPX, the DJI didn't make a higher-high. Why is this? I think partially because it's price weighted as opposed to market cap weighted like the Nasdaq or SPX. The other part would be CPI numbers.

So what's next for the DJI? I see hidden bullish divs long term and hidden bearish divs short term, this a common shake out tactic I see to liquidate longs and shorts. I'll be looking to load up on the trade at the bottom of the channel and play the range as it develops.

As always: stay calm, don't panic, and don't forget you can always use a stop loss

The fear and green index is at 74, when people are greedy be fearful.

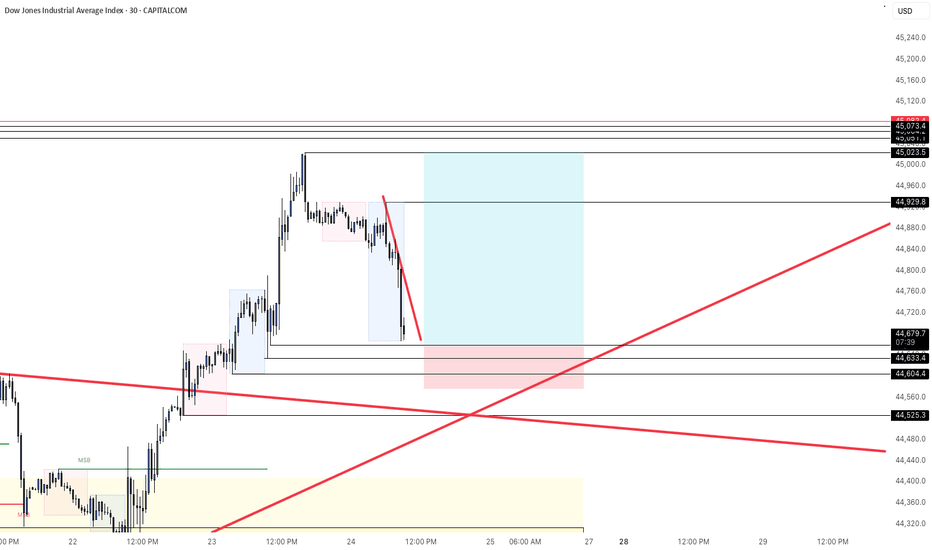

Dow Set for Volatile Move as Earnings, Tariff Risks CollideUS30 OVERVIEW

The price is currently consolidating between 44,180 and 44,620, awaiting a catalyst. Today’s earnings reports are expected to heavily influence Dow Jones price action.

If earnings come in strong, the index is likely to push toward 44,620 and 44,760. A confirmed stability above 44,620 would strengthen the bullish case, potentially opening the path toward a new all-time high near 45,100.

However, a break below 44,180 would signal bearish momentum, with potential downside toward 43,960. Additional pressure could come from escalating tariff tensions, further weakening sentiment.

Resistance: 44,620 · 44,760 · 45,100

Support: 44,180 · 43,960 · 43,630

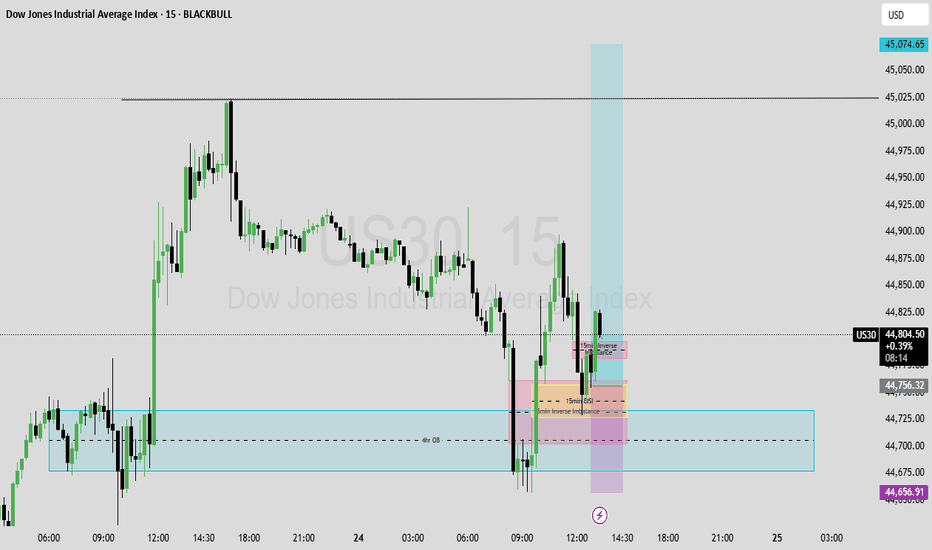

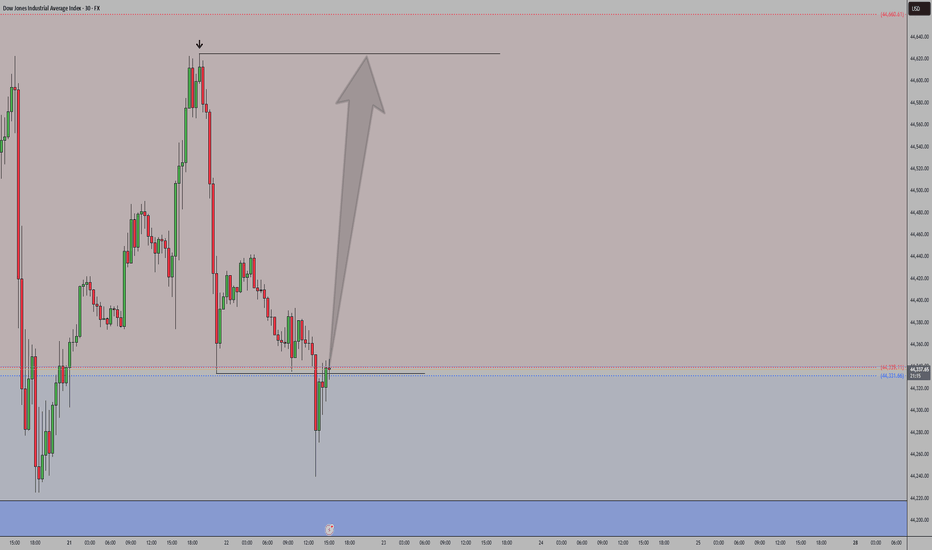

US30 - What I believe will happen todayConsidering today is now Wednesday and Wednesday's have a consistency of being one of those off days. Primarily because usually there are Fed speeches on this day that manipulate the market. With that said, I'm expecting price action to play out how I plotted the arrows on the chart. I believe there is still some further upside for today but then I believe we might get that intraday correction around 11:am - noon EST.

Let's see how today plays out. Trade safe

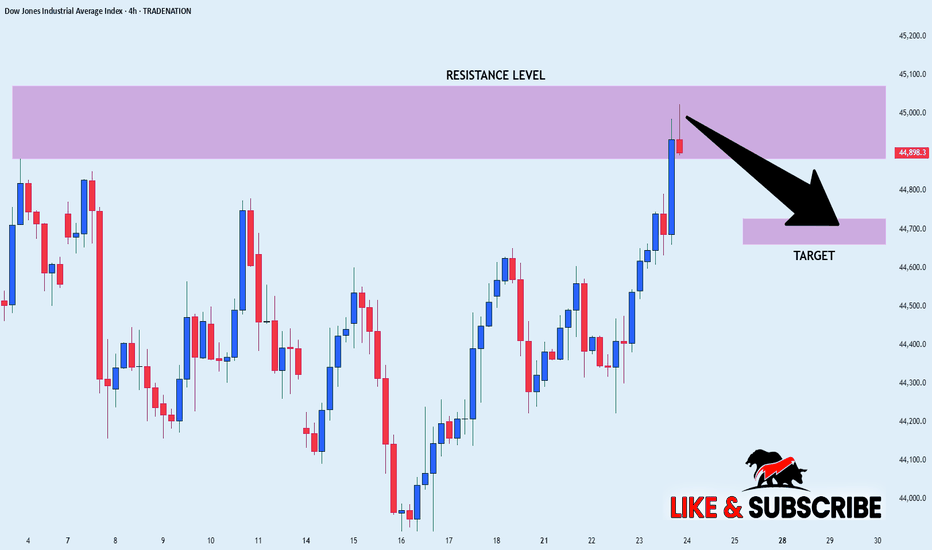

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

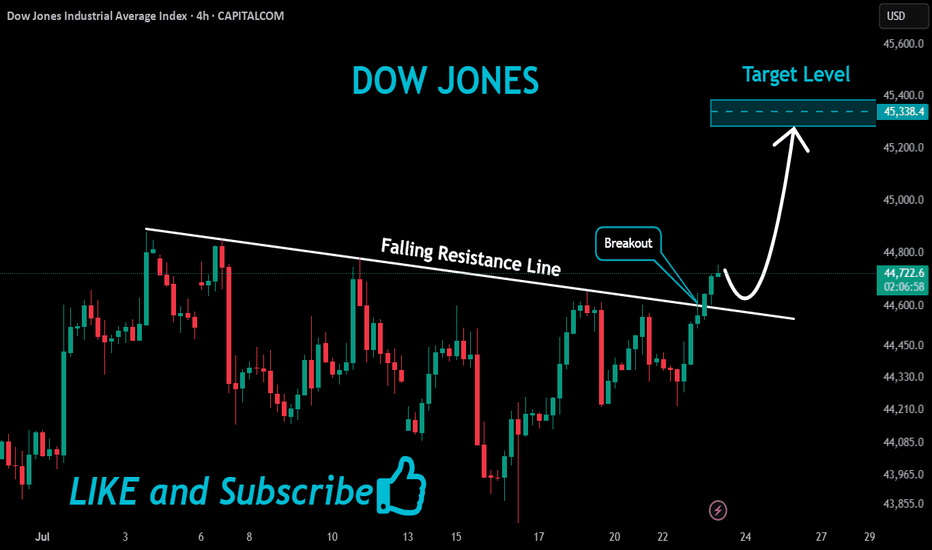

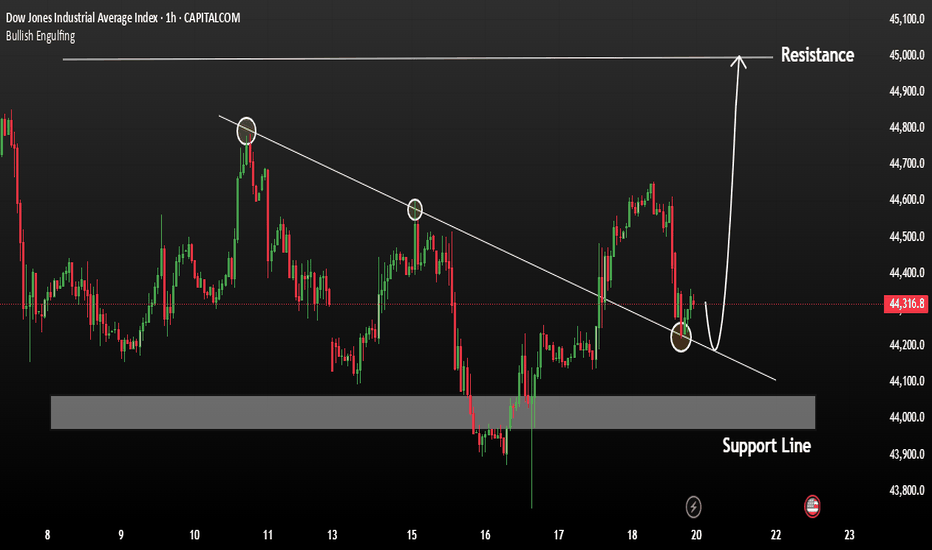

US30 Massive Bullish Breakout!

HI,Traders !

#US30 is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

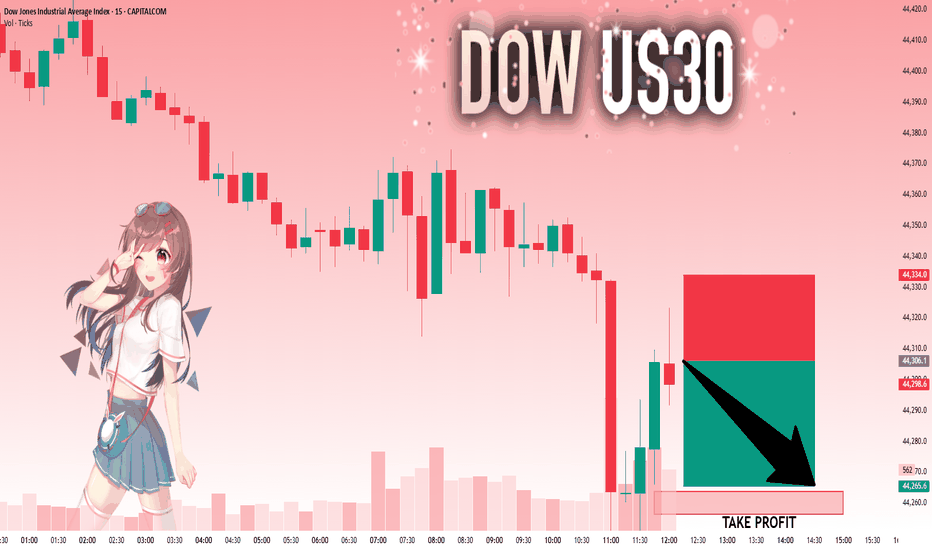

US30: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 44,306.1 will confirm the new direction downwards with the target being the next key level of 44,263.8..and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

US30 continues to exhibit bullish momentumThe US30 index continues to exhibit bullish momentum, driven by strong earnings reports and robust U.S. economic data. The key support zone around 44,300 has held firm, reinforcing confidence among buyers.

As long as the price remains above 44,300, the uptrend is expected to persist Upside target: 45,000 remains in focus. a focus on the 1H Candle close above 44,000 we could expect price could push more upside.

You may find more details in the chart Trade wisely best of luck buddies

Ps: Support with like and comments for better analysis Thanks for Supporting.

Dow Jones is Nearing an Important Support!!Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 43,950 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 43,950 support and resistance area.

Trade safe, Joe.

US30 | Inverted Hammer at Key Supply Zone – Reversal or BreakoutUS30 just printed an inverted hammer on the 4H at a major supply zone (44,550–44,600). This is a critical decision point:

✅ Bearish Case:

If price rejects and closes back below 44,530, sellers could take control with targets at 44,380 → 44,180 → 44,020.

✅ Bullish Fakeout:

If price breaks and holds above 44,620, expect a push toward 44,700 and 44,900.

📌 What I’m Watching:

Rejection candle + bearish close → short entries.

Strong breakout candle with retest → long continuation.

Key Levels:

🔴 Resistance: 44,550–44,600

🟢 Support: 44,380 → 44,020

⚠️ Manage risk carefully. Volatility is high and liquidity hunts are common in this zone.

💬 Do you think we reject here or break out higher? Drop your thoughts below!

#US30 #DowJones #PriceAction #SmartMoney #TradingView #TechnicalAnalysis #IndicesTrading