ICPUSD trade ideas

ICP: $20-$30 Next as Major B-Wave 'c' Leg Unfolds?Hey TradingView Community! 👋

I'm refining my Elliott Wave analysis on ICP, and after further review, I'm now leaning towards a Major ABC Zigzag Correction playing out for ICP's long-term structure. This is a significant shift from my previous Flat idea, and it has different implications!

My Current Hypothesis: A Major ABC Zigzag Correction is in Play

Looking at the larger degree, I'm interpreting ICP's initial significant decline from its highs as Major Wave A of a larger ABC Zigzag Correction.

A standard Zigzag is a 5-3-5 wave structure:

Major Wave A: A 5-wave impulse down.

Major Wave B: A 3-wave correction (a-b-c) that retraces only a portion of Wave A (typically 38.2% to 61.8%).

Major Wave C: A 5-wave impulse down, often extending significantly below the end of Wave A.

Focusing on the Current Price Action: The Major Wave B

I believe we are currently within Major Wave B of this larger Zigzag pattern. This Major B-wave should be a 3-wave corrective bounce (a-b-c) against the prevailing downtrend.

My read on the internal structure of this Major B-wave is as follows:

'a' wave (of Major B): The initial upward move of this 'B' wave (which itself is a 3-wave corrective pattern, typically a zigzag or flat).

'b' wave (of Major B): The recent price action, including the strong pump over the last few days/weeks, appears to be the completion of the 'b' wave within Major Wave B. This 'b' wave, being a part of a corrective B-wave, would be a 3-wave counter-trend move against the direction of 'a'.

'c' wave (of Major B): If my count holds, we are now either starting or are very early into the 'c' wave of Major Wave B. This 'c' wave, if it conforms to a zigzag structure, should be a downward-moving 5-wave impulse. This implies a decline to complete the Major B-wave, before the larger Major C-wave unfolds.

Key Difference from the Flat Scenario:

In a Zigzag, the 'B' wave is a corrective pullback that does not retrace significantly (unlike a Flat where it can be 80-100%+). Also, the 'c' wave within the 'B' wave of a Zigzag is typically a 5-wave move in the opposite direction of the 'a' wave.

What Happens Next? (The Big Picture After Major B)

If this Major B-wave (composed of its internal a-b-c corrective pattern) successfully completes its downward journey (with the 'c' wave I'm anticipating), my analysis suggests we should then anticipate the start of Major Wave C of the larger Zigzag correction.

Major Wave C in a Zigzag is typically a powerful, impulsive 5-wave decline, often taking prices significantly below the lows of Major Wave A. This implies a potentially steep decline for ICP to complete the overall correctional pattern.

Crucial Invalidation Point! 🚩

As always, invalidation levels are paramount for risk management.

My primary count for this Major B-wave as a corrective structure is invalidated if:

ICP breaks significantly start level of the 'a' wave of Major B. If 'B' retraces too much of 'A', it breaks the typical Zigzag rule.

What are your thoughts, community?

Do you agree with this shift to a Major Zigzag correction?

Are you seeing the same internal structures for the 'B' wave?

What key levels are you watching for ICP given this potential scenario?

Let's discuss respectfully and help each other gain better insights into ICP's future movements!

#ICP #InternetComputer #ElliottWave #TechnicalAnalysis #CryptoTrading #PricePrediction #TradingView

ICP Short-term Elliot Wave OutlookICP is currently in a short to medium term corrective phase which has lasted just over half of the year. In terms of the macro count it is completing the last leg of a zig-zag in either wave 2 or a B wave.

The primary count in white shows an impulse with five completed waves. In this instance, it is a non-overlapping ending diagonal where the impulse sub-divides as 3-3-3-3-3.

This count is invalidated if price breaks below the aqua support area.

If price breaks below the aqua support area the alternate count becomes more likely. In this case, we're looking at a WXYXZ in yellow.

Z can be either 61.8, 100.0, 123.6 or 138.2 of W. Generally targeting the area between 4.22 and 3.35

ICP accumulation?ICP bullish view?

accumulation is a pause—not a reversal—in an uptrend. It’s a methodical consolidation phase where strong hands absorb supply, setting the stage for the next upward move. Grasping its volume-pattern differences from distribution can mark the difference between missing a breakout and getting caught in a false reversal.

Long Trade Setup – ICPUSD!📈

🔹 Asset: Internet Computer (ICP/USD)

🔹 Timeframe: 30-Minute Chart

🔹 Setup Type: Trendline Retest + Bullish Continuation

📌 Trade Plan (Long Position)

✅ Entry Zone: Around $5.60 (Trendline + yellow support retest)

✅ Stop-Loss (SL): Below $5.53 (Wick zone + support break)

🎯 Take Profit Targets

📌 TP1: $5.72 – Local resistance (yellow line)

📌 TP2: $5.80 – Prior swing high

📌 TP3: $5.94 – Previous breakout zone

📊 Risk-Reward Estimation

📉 Risk: $5.60 - $5.53 = $0.07

📈 Reward to TP2: $5.80 - $5.60 = $0.20 → R:R ≈ 1:2.85 ✅

🔍 Technical Highlights

📌 Price bouncing from strong ascending trendline

📌 Bullish candle showing recovery at yellow zone

📌 Breakout retest structure playing out

📌 Good volume holding above lower support

🧠 Execution Strategy

📊 Enter after candle confirms bounce (green engulfing preferred)

📉 SL just under trendline at $5.53

💰 TP1 for safe profits, TP2 for continuation, TP3 for trend move

🚨 Invalidation Risk

❌ Close below $5.53 = exit, setup fails

❌ Breakdown with red volume = avoid entry

🚀 Final Take

✔ Solid bounce zone

✔ Higher timeframe uptrend support

✔ Controlled risk, multi-target reward

Long Trade Setup – ICPUSD!📈

Timeframe: 30-Minute Chart

Pattern: Symmetrical triangle breakout (bullish continuation)

📌 Trade Plan

📍 Entry Zone: Around $5.68 (Breakout confirmation)

🛑 Stop-Loss (SL): Below $5.59 (recent support + trendline invalidation)

🎯 Take Profit Targets:

TP1: $5.80 – Local resistance

TP2: $5.94 – Measured move target

🔍 Technical Highlights

Breakout from converging triangle structure

Candle closing above yellow breakout zone = bullish

Clean higher lows showing demand

🔻 Risk: $5.68 - $5.59 = $0.09

🔺 Reward to TP2: $5.94 - $5.68 = $0.26 → R:R ≈ 1:2.88

🚨 Execution Strategy

Enter only after confirmed breakout with volume

Place SL just under white trendline

Book partial profits near TP1 and trail rest to TP2

ICP / USDT: In the Macro Support Zone

The price has reached the target macro support zone for the formation of a long-term bottom.

As long as the price stays above the April 7th lows, my main scenario is that the macro correction (wave (2)) has ended and a new multi-year growth cycle has begun.

Weekly Projection:

Thank you for your attention and I wish you successful trading decisions!

Previous ideas on ICP :

Nov'24:

Jun'24:

Dec'23:

ICP: ICP to $30 Low Confidence High Risk High Reward TradeI’d put ICP a tier or two below XRP or LINK in regard to trade setups at the moment. Funny thing: ICP is apparently a very strong cryptocurrency project with strong fundamentals. This is another example of why Fundamentals and Financials don’t matter in Crypto as ICP has performed like utter crap this market cycle.

But…! A trade setup is still valid so long as the bear market low (Red Line) holds at $2.83.

The trade idea is that ICP is trading in an ABC Correction with Wave B in yellow finished or close to finishing. Wave C in Yellow should take ICP to either the 1:1 extension at $30.99 or the 1:1.618 extension at $106.80. Given how crap ICP has performed this market cycle, I don’t really have high hopes for $106.80, but anything can happen in cryptocurrency.

In the short term, IDEALLY ICP doesn’t break below the support area between $4.34 - $6.08. The current rally off the local low set on April 7th 2025 is limp and unconvincing hence this is a low confidence high risk high reward trade. Personally, I own far less ICP compared to BTC/LINK/XRP.

ICPUSDT READY TO FLY AGAIN ?? ICPUSDT is currently forming a classic falling wedge pattern on the chart, which is widely recognized as a bullish reversal signal. The price has been compressing within this narrowing range and is now approaching a key point where a breakout is highly likely. With strong support being respected and buyers gradually stepping in, the setup is aligning well for a potential upside move.

Volume levels have been steadily increasing, confirming growing investor interest in Internet Computer (ICP). This increasing participation from traders and investors alike can often serve as a reliable indicator that a breakout may occur soon. Technical indicators such as RSI and MACD are also hinting at a momentum shift that aligns with a bullish scenario.

Given the strength of this chart formation and the positive volume dynamics, ICPUSDT could potentially see a price gain in the range of 90% to 100%+ from current levels. The risk-to-reward ratio is favorable, especially for those who are entering early before the breakout confirms with stronger candles above resistance. A retest of the wedge breakout, if it happens, could also provide a second opportunity to enter.

ICP is also gaining traction among long-term investors due to its unique blockchain technology aimed at decentralizing the internet. The ongoing development and community support around the project adds more fundamental strength to this setup. Keep an eye on it for confirmation of the breakout!

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

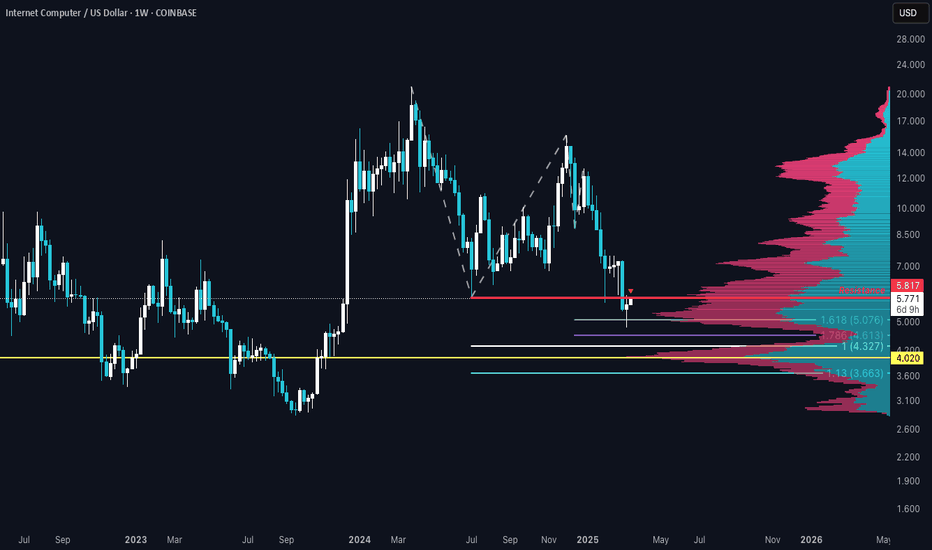

A Bounce off the 1.618?ICP has been a disappointment for many, I would imagine. Including myself...

A lot of social media hype behind this one, but the time may be coming soon for a real rally up.

A nice falling star through the 1:1.618 extension last week and currently fighting resistance from previous consolidation low.

A small chance that we will see lower local lows for this asset, but never impossible. If that were the case, a retracement to the larger time frame 1:1 would be an ideal area; and inside that ratio band is the POC.

With its market Cap currently at 2.7B, this Computing coin could have a nice topping area in the future.

-Not Financial Advice-

ICP Will Break UpwardI picked up a few hundred more at $6.25.

Trump's posts about the US investing in Crypto is creating a lot of enthusiasm for XRP, SOL and ADA. But even though coins like ICP were not mentioned by Trump does not mean money will not flow into ICP. It most definitely will. I expect the short/near term we will head back up to test the trend line. After that, if we break the trendline, we will move up to at least $20.

ICP Trading Plan: Buying Dips with a 1:3 Risk-Reward RatioLike most altcoins, ICP has been declining since December. At the beginning of February, it reached a key support level around $6. After this drop, the coin began to consolidate, but recent price action suggests a potential reversal to the upside.

A confirmed breakout above $7 would strengthen this outlook, potentially leading to a test of the psychologically significant $10 level.

I’m looking to buy dips in anticipation of this scenario, aiming for a minimum risk-to-reward ratio of 1:3.

Wave2 Nearing Completion: Bullish Momentum for Internet ComputerWave 2 Analysis

Wave structure analysis suggests that ICP has been following a five-wave impulse pattern. The first wave began in December after ICP hit a low of $2.70 in September. By March, ICP surged to a high of $21, marking the end of the first wave. The second wave, which is a corrective wave, saw ICP retracing to the 0.786 Fibonacci retracement level of $6.58 by July. This level has been retested multiple times, indicating strong support.

Current Market Sentiment

The recent price movements show that ICP has been trading sideways, forming an ascending triangle pattern. This pattern is typically a bullish continuation pattern, suggesting that the price might break out upwards. The Relative Strength Index (RSI) indicates that ICP is not overbought, providing room for further upward movement.

AI Narrative and Decentralized Cloud

The AI narrative and the shift towards decentralized cloud solutions are significant factors contributing to the bullish outlook for ICP. Centralized cloud providers like AWS, Microsoft Azure, and Google Cloud dominate the market, but they also pose challenges such as high costs, regulatory issues, and susceptibility to political pressures. Decentralized alternatives like Internet Computer aim to democratize cloud infrastructure, reducing reliance on centralized entities and fostering innovation.

Conclusion

Given the wave structure analysis, strong support levels, and the growing narrative around AI and decentralized cloud solutions, ICP is poised for a potential bullish breakout. If the price breaks above the ascending resistance, it could mark the beginning of the third wave in the five-wave impulse pattern, leading to significant price appreciation.

ICP rocket ride coming soon..ICP has great fundamentals but has under-performed the rest of the crypto market. With ICPanda (icp project) linked to deepseek, the potential for the upside is HUGE. Potential price manipulation by institutions to scoop up cheap ICP.

Technically, the chart looks poised for an explosive move up. It has broken out of a long term resistance (yellow down-trending line) and is now back testing. It has done this in the past and seems to be repeating a similar move. In addition, there's a confluence of technical signals as its also at price support (blue line) that is now at support which has held for a year after being resistance for a year. RSI is oversold and IMO, price should return back to $70s at the very least.

Nothing is a guarantee and anything could happen. This is not financial advice.

ICP's unique properties according to Grok

The Internet Computer Protocol (ICP) stands out from other cryptocurrencies due to several unique properties:

Decentralized Internet Infrastructure:

ICP aims to create a decentralized internet where traditional centralized services like cloud computing are replaced by a network of independent data centers worldwide. This structure is intended to reduce the control of big tech companies over internet services, offering a more open and less centralized internet model.

Scalability and Speed:

Unlike many traditional blockchains that face scalability issues, ICP uses a subnet system where each subnet operates as its own blockchain. This architecture allows for high scalability and the ability to process up to 30,000 transactions per second, matching web speeds for application performance.

Low Transaction Costs:

ICP implements a "reverse gas model" where users do not typically pay for transactions directly. Instead, developers pre-load "canisters" (ICP's version of smart contracts) with "cycles" which are used to pay for computation. This model reduces the cost for end-users, making it more attractive for developers to build decentralized applications (dApps).

Smart Contracts (Canisters):

ICP's smart contracts, called canisters, are more versatile than those on other platforms. They can handle HTTP requests, serve web assets directly from the blockchain, and run at web speed, allowing for complex, interactive web experiences without reliance on traditional hosting.

Chain Key Cryptography:

This is a unique cryptographic system that ensures the security and integrity of the network. It involves distributing cryptographic keys across data centers to prevent any single point of failure or control, enhancing the security of the blockchain.

Network Nervous System (NNS):

ICP includes the NNS, a decentralized autonomous organization (DAO) for governance. It allows token holders to vote on network changes, upgrades, and node participation, ensuring community-driven development and maintenance of the protocol.

Interoperability:

ICP has mechanisms like chain-key tokens (e.g., ckBTC) that allow for seamless interaction with other blockchains, such as Bitcoin, without intermediaries, thus promoting interoperability in a decentralized manner.

Energy Efficiency:

ICP is noted for being one of the more energy-efficient blockchains, consuming significantly less energy compared to Proof of Work blockchains like Bitcoin, making it more environmentally friendly.

Native Token Utility:

The ICP token serves multiple roles including governance, staking for rewards, and as a means to buy "cycles" for smart contract execution. This multifaceted utility provides economic incentives for participants to secure and expand the network.

Direct Web Hosting:

Developers can host decentralized websites directly on the ICP blockchain, providing an alternative to centralized hosting services where data and control are more transparent and less susceptible to censorship.

These properties collectively position ICP as a platform that not only aims to host cryptocurrency but also to fundamentally change how the internet and its applications are built, managed, and used.