BBTN trade ideas

Applying Technical Analysis in multiple time frames: $BBTNMonthly

• Trend and momentum using Joe Rabil Method:

- From May 2020, price made HH and HL and is now in transition phase. If it breaks 2100, it becomes presumptive Uptrend.

- In March 2024, price broke the downtrend line (Step 1), tested the low (Step 2) and is on its way to Step 3

• Harmonic Trading Method: N/A

Weekly

• Trend and momentum using Joe Rabil Method:

- Last leg is in presumptive uptrend and is on its way to Step 4. If it breaks 1545, it becomes an uptrend.

- Price is above 18-week MA and 40-week MA, 18-week MA is rising and starting to separate from 40-week MA.

- MACD is rising as per price

• Harmonic Trading Method: N/A

Daily

• Trend and momentum using Joe Rabil Method:

- MACD made 0-line reversal in every pullback

• Harmonic Trading Method: Bearish Bat was complete; price moved down and now is up to Step 4

1H

• Small bearish bat is complete, and price is in consolidation

• I will pay attention on MACD, whether it can make 0-line reversal or not.

10M

• Price moves in rectangular shape.

• I will pay attention on 18-10M MA, whether it will make GC and up or not, and MACD to be above 0 line

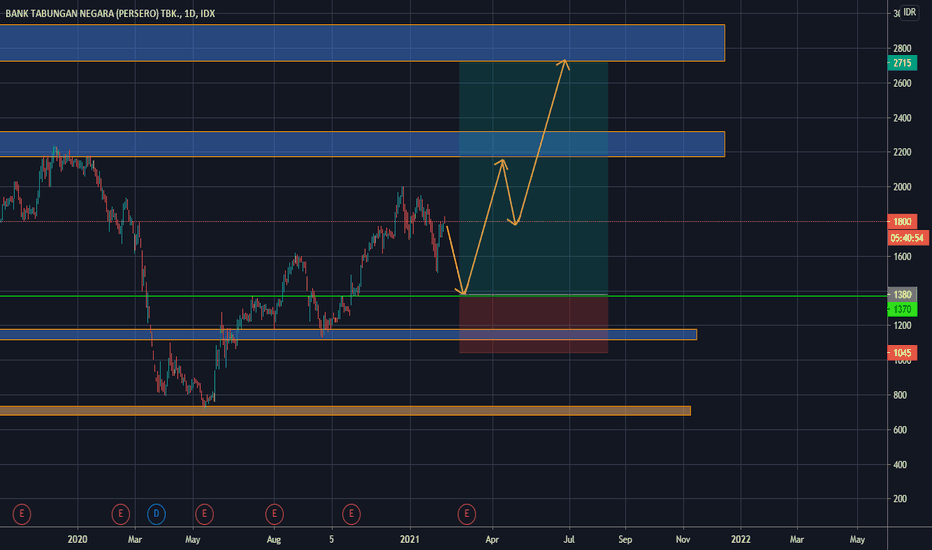

Bank Tabungan Negara (BTN / IDX:BBTN) is still bearishENGLISH:

Bank Tabungan Negara (idx:bbtn) is trying to get out of the yellow resistance's line, with direction to the white resistance's line or 1470 IDR. If the market successfully break out the white resistance and continue above the white line then the market is likely to be bullish again. But if it will be failed, the market will continue bearish to 850 IDR. This is strong support and can make market rebound to 3400 IDR. The analysis uses combination of the bat harmonic, falling wedge, and fibonacci.

BAHASA:

Bank Tabungan Negara (idx:bbtn) sedang berusaha keluar dari resisten garis kuning, untuk menuju resisten garis putih diangka 1470 IDR, Jika market berhasil berada diatas garis putih maka kemungkinan pasar akan kembali bullish. Tetapi jika gagal, market akan turun hingga ke harga 850 IDR. Area ini merupakan support kuat yang bisa mendorong pasar naik dan kembali bulish menuju harga 3400 IDR. Analisa ini menggunakan kombinasi pola harmonic kelelawar, falling wedge dan fibonoacci

BBTN ready to breakBBTN in the weekly timeframe shows a bullish trend and is forming a correction phase where the correction forms a chart pattern called the descending broadening wedge. A pattern that would indicate a continuation of the price increase with the rising height expected to match the width of the wedge.

#Disclaimer: Not a suggestion to buy or sell

February 4, 2022: Analisys BBTN: @Long February 4, 2022: Analisys BBTN: @Long

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

In our learning, we have three rules analisys before take action

1. Support & Resistant : now price 17xx rebound from strong support 16xx

2. Ema 55, Ema 144, Ema 377 : golden cross ema 144 & ema 377

3. Ganfan : free

Summary: very nice to entry because price rebound from strong support 16xx & golden cross ema144,ema377. So,we will follow yellow line complete with set up trading

Buy if price range @ 1650-17xx

Take Profit 1 @ 18xx

Cutloss @ 16xx

good luck guys , and happy profit ^^see you for next update

Thanks for Mr. Rudolf M. Bakkara for the sharing this knowledge metod.

#keep learning bakkarianz metod

IDX: BBTN FOR NEXT WEEK 8-12 NOV 2021WEAK SUPPORT AT 1755

WEAK RESISTANCE AT 1875

I PREFER RED TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

Time to Buy BBTNBBTN broke trendline on Monday, September 20 and in today's trading, BBTN was stuck at the support area at 1320 and formed a bullish reversal candle.

Will BBTN form a swing low in tomorrow's trading and continue strengthening until the end of the year?

Analysis technical using Fibonacci

Today's decline in bbtn shares is stuck in the 0.618 fibonacci area which is the sacred Fibonacci area.

Analysis Technical using Moon Phase

On September 7, there was a New Moon, which halted the increase in BBTN shares in the 1475 area, which is known as the primary trend.

Because the rate of increase in BBTN shares was halted during the new moon phase, will the retracement of BBTN shares also be halted during the Full Moon and return to form a new hoe body?

BBTN - Rebound to be Uptrend?Today, close price are above the weekly trendline and MACD looks divergence. and also stoch on the oversold area.

If tomorrow, the close price are even higher than today. BBTN have some uptrend potential as long as close price not below of the trendline .

From my point of view, there is some potential to be uptrend.

Target Price 1 : 1580

Target Price 2 : 1690

Target Price 3 : 1800

Stoploss : 1200.

Disc On.

-18 march 2021 trading analysis BBTN -18 march 2021 trading analysis BBTN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

For now wait no position and long possition for BBTN if confirm break from strong resist 1925 and go to next minor resistane 2025 and then to Strong resist 2155. let's see

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

good luck, and happy profit see you for next update #keep learning bakkarianz metode