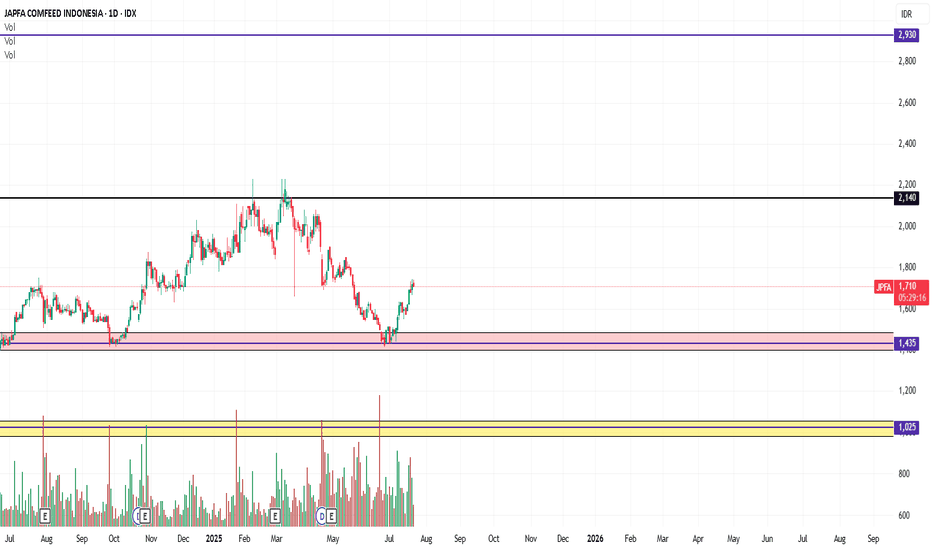

JPFA trade ideas

JPFA is callingAfter 22 April 2025, IDX:JPFA drop 190 (-9.97%) from the current price.

With the distributed dividen value Rp 70 (estimated 3% from the price)

Technical:

At the lowest area Fibb Retracement

Still above support line 1,740

Above EMA 200 (Weekly TF)

Fundamental

Growth Revenue each quarter

Good Debt to Equity Ratio (show good progress)

Target 1 : 1,945

Target 2 : 2,200

Thankyou for your time!

I hope everyone get the best for your life!

JPFA.JK MID-TERM INVESTMENT OUTLOOKIDX:JPFA

JAPFA COMFEED VALUATION

JPFA’s price/sales is 0.31.

JPFA’s price/forward earnings is 7.18.

JPFA’s price/book is 0.95.

JAPFA COMFEED TECHNICAL BREAKDOWN

Have a strong potential to continue the bullish movement, currently running in a bearish corrective movement

Rp1,050-1,175 is expected to be the end of Wave E movement

1st Buy price around @Rp1,175

Average Down @Rp,1,025

Cut loss @Rp990

Bearish channel corrective movement should be traded cautiously

Disclaimer On

IDX: JPFA FOR SEPTEMBER 2022weak support at 1450

weak resistance at 1540

I Prefer Yellow trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA FOR AGUST 2022Strong support at 1610

weak resistance at 1665

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA UNTIL THE OF APRIL 2022Strong support at 1610

weak resistance at 1665

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA UNTIL NEXT MONTHstrong support at 1670

weak resistance at 1610

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

JPFA my scenariosWe see a strong support in the highlighted area so here is my analysis, by looking at the oscillators it seems very over sold which made me think that it will bounce off the strong support.

But due to the double top we might see a downtrend continuation, by using external fib it will probably drop to 1.618 (The target I highlighted)

So I think we should wait for the test on the support to see which scenarios are going to be executed.

I suggest to wait for confirmations on the strong support

IDX: JPFA FOR NEXT WEEK 10-14 JAN 2021STRONG RESISTANCE AT 1875

MEDIUM SUPPORT AT 1755

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA FOR NEXT WEEK 15-19 NOV 2021STRONG SUPPORT AT 1610

MEDIUM RESISTANCE AT 1755

I PREFER YELLOW TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA FOR NEXT WEEK 8-12 NOV 2021STRONG SUPPORT AT 1610

MEDIUM RESISTANCE AT 1755

I PREFER RED TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: JPFA FOR NEXT WEEKSTRONG RESISTANCE AT 1875

MEDIUM SUPPORT AT 1755

I PREFER YELLOW TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.