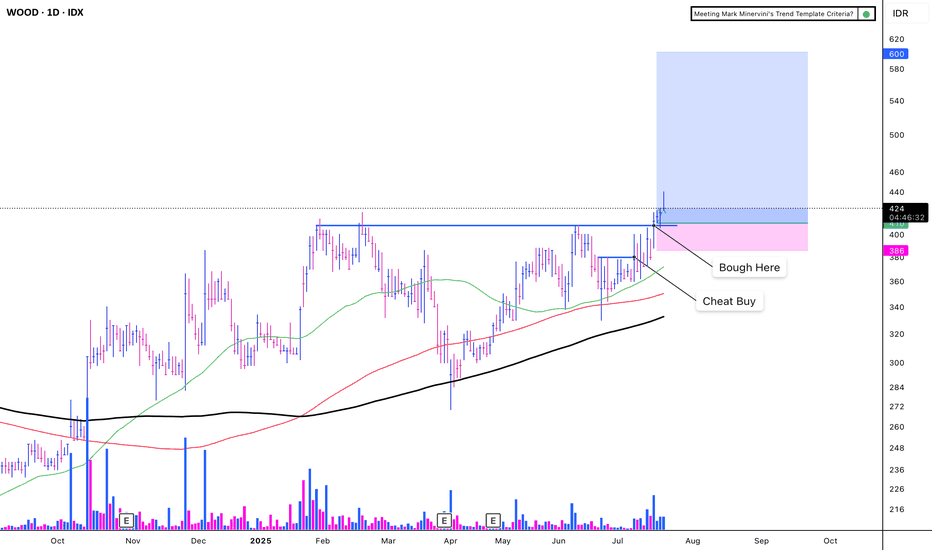

WOOD - CUP WITH HANDLEIDX:WOOD - CUP WITH HANDLE

(+):

1. Low risk entry point

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (85).

8. Carbon sales increase 503%

9. Price breakout with VCP criteria

EPS Growth:

a. Quarterly QoQ: -13.24%.

b. Quarterly YoY: +68.81%.

c. TTM YoY: +49.09%.

d. Annual YoY: +33.27%.

(-)

Trump Implements a 32% Increase in Tariffs on Indonesia

The market is volatile due to the ongoing war

WOOD trade ideas

$WOOD valid breakout on c&h patternSince trading on May 22 until today, Monday, August 19 2024, price movements have formed a cup and handle pattern with the neckline as the basis for price movement resistance for three months which has been breakout today and therefore can be used as a valid bullish signal.

The next movement we can set the target is 304 as the current resistance base with gain profit of 15.69%.

indicator:

- FIB fan speed resistence

- FIB Retracement

TechnoFundamental Analysis for IDX-WOOD IDX:WOOD is showing a clear sign of trend reversal.

Technical :

After making consistent higher low and higher high, IDX:WOOD is reaching a new high and hit EMA 90 (Sell Area 1) .

The price would retrace for a while and then hopefully it would bounce back higher to sell area 2.

Fundamental :

Sell Area 2 is similar with the stock's intrinsic value (around 640).

Good Luck!