WSKT trade ideas

Most of Construction Stocks still SidewaysMost of these Construction Sectors are still Sideways. However, there is one stocks that has the best signs of ending its Sideways and that stock is ADHI. Another promising stocks is PTPP then WSKT. WIKA is the least favourite.

ADHI has broken up its Resistance at IDR790. Though it is now below that level, ADHI still maintain Up Trendline from end of May 2022. I see an Uptrend based on Peak and Trough Analysis.

PTPP and WSKT shows the same signs but PTPP has more promising feature of an Uptrend (PTPP once broken up its Resistance at IDR990) while WSKT never break up its Resistance.

WIKA also once broken up its Resistance at IDR1,005 but I don't see Higher Low from end of May 2022 (which I believe is the strong sign of Uptrend).

WSKT Falling WedgeWSKT in the medium term forms a downtrend where the price continues to make lower lows. But here I see that the strength of the weakening trend is decreasing and the price is forming a "falling wedge" pattern where this pattern will bring the price up to the 920 area.

#RiskDisclaimer: Not suggest to buy or sell

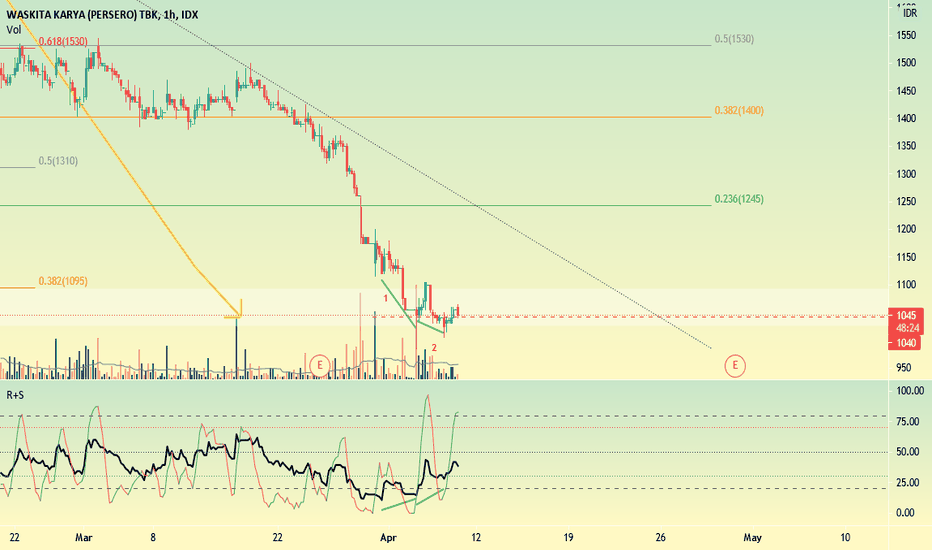

1 Hr TF DIV to DIV WSKTi think that WSKT is getting ready,

DIV 1 is considered failed then it formed 2nd DIV, lets see what it can do..

NB: DO MIND that These analyses I posted here are intended as my notes and not as investment recommendations or as financial advice! Please also note that you are always responsible for your own investments when trading on the stock exchange! The analyses are only based on my opinion and view. LETS CUANN!!!

WSKTNB: DO MIND that These analyses I posted here are intended as my notes and not as investment recommendations or as financial advice! Please also note that you are always responsible for your own investments when trading on the stock exchange! The analyses are only based on my opinion and view. LETS CUANN!!!

WSKTNB: DO MIND that These analyses I posted here are intended as my notes and not as investment recommendations or as financial advice! Please also note that you are always responsible for your own investments when trading on the stock exchange! The analyses are only based on my opinion and view. LETS CUANN!!!

-15 march 2021 trading analysis WSKT-15 march 2021 trading analysis WSKT

Disclaimer: This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

time to long possition for WSKT because rebound from strong support 1385 and go to next strong resistane 1525. take profit enought 3%

let's see

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

good luck, and happy profit see you for next update #keep learning bakkarianz metode

IDX: WSKT IT'S TIME!! YET, MAYBE YES/NOweak suport support at 1405

medium resistane at 1465

Weak resistance 1585

market close at 1460. maybe it's paralax from my study or it how it's. but when market surpass 1465 it's potensialy fly to 1585 .

I prefer green trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: WSKT BECAUSE WHY NOTWeak support at 1405

Medium resistance 1465

Long for tommorow, potentially go to its medium resistance if it surpass, can fly to 1600. Remember , dont push your luck, go at 1420 out at 1460 . N enjoy

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.