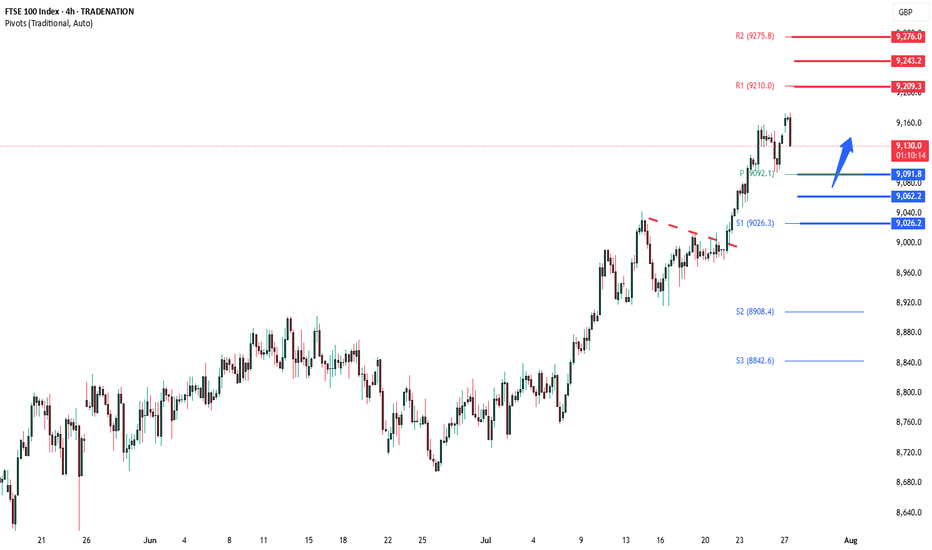

FTSE oversold bounce backThe FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 9026 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9026 would confirm ongoing ups

About FTSE 100 Cash (£10)

The FTSE UK Index Series is designed to represent the performance of UK companies, providing market participants with a comprehensive and complementary set of indices that measure the performance of all capital and industry segments of the UK equity market.

UK100 - TIME TO DESTRUCTION UK TO HELLTeam, UK100 market is tank,

the economy is SH*T, not in a great shape

unemployment rising, crime increasing, jobless

inflation is out of control, but the market has not recognised the effect.

TIME TO PUT AN END TO THIS ERA - short range at 9175-9186

STOP LOSS AT 9225

EASY target 1 at 9152-42 - tak

UK 100 – Moving Back Into the Spotlight It’s been a while since we covered the UK 100, but it feels like recent moves and the fact there is a Bank of England (BoE) rate decision next Thursday (August 7th) means it warrants some extra attention.

For much of 2025 the UK 100 has been the under achiever when compared to other European indic

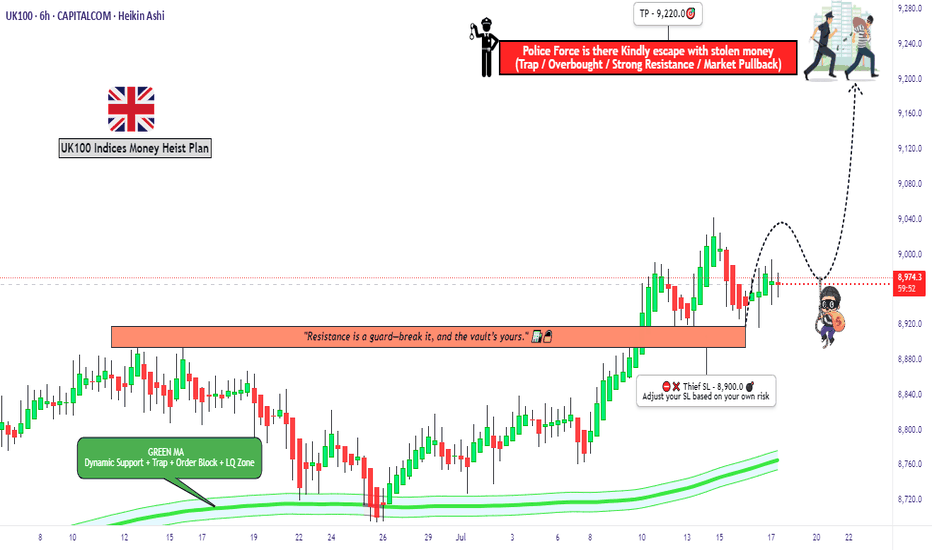

"UK100 Bulls Vault Open! Grab the Loot & Escape Early"🏴☠️💰"UK100 / FTSE100 Market Heist Blueprint" – A Thief Trading Operation for High-Profit Target Extraction 💼📈

🌍 Hola! Hi! Bonjour! Ola! Hallo! Marhaba!

To all the Market Robbers, Smart Thieves, and Strategic Money Makers — welcome to another Thief Trading Heist Plan™.

Ready your gear and charts —

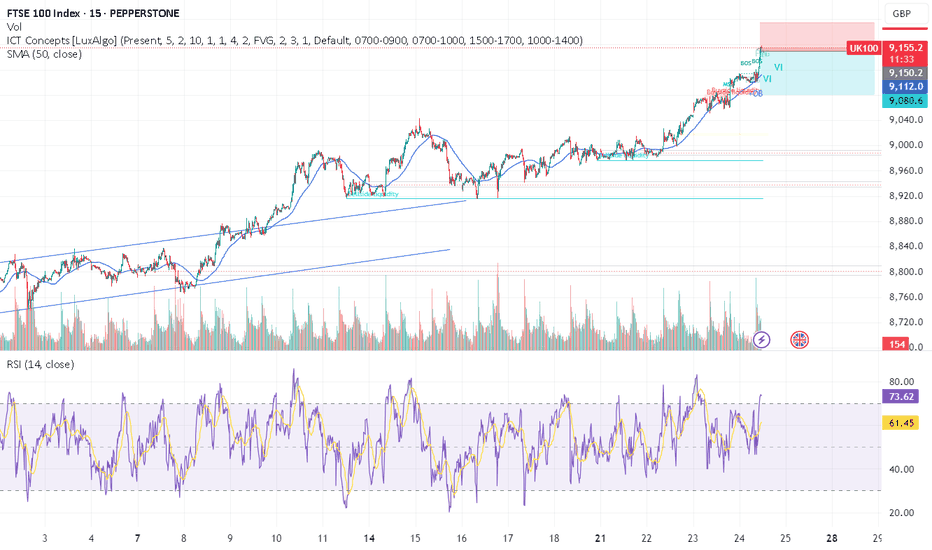

uk100 crazy pump - time to SHORTTeam, those who SHORT UK100, make sure stop loss at 9175

Target 1 at 9135-32

Target 2 at 9109-16

Last few months, UK100 has been aggressively cutting rate due to expose in recession. But now they are out of the wood.

The market has been over pricing and over value.

We expect the market to come

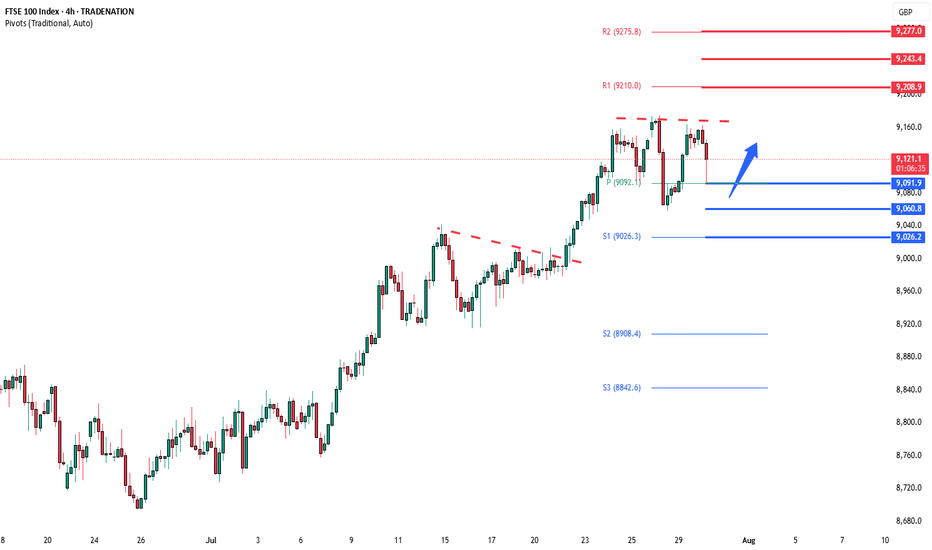

FTSE deeper corrective pullback supported at 9026The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 9026 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9026 would confirm ongoing ups

FTSE oversold bounce supported at 9092The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 9092 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9092 would confirm ongoing ups

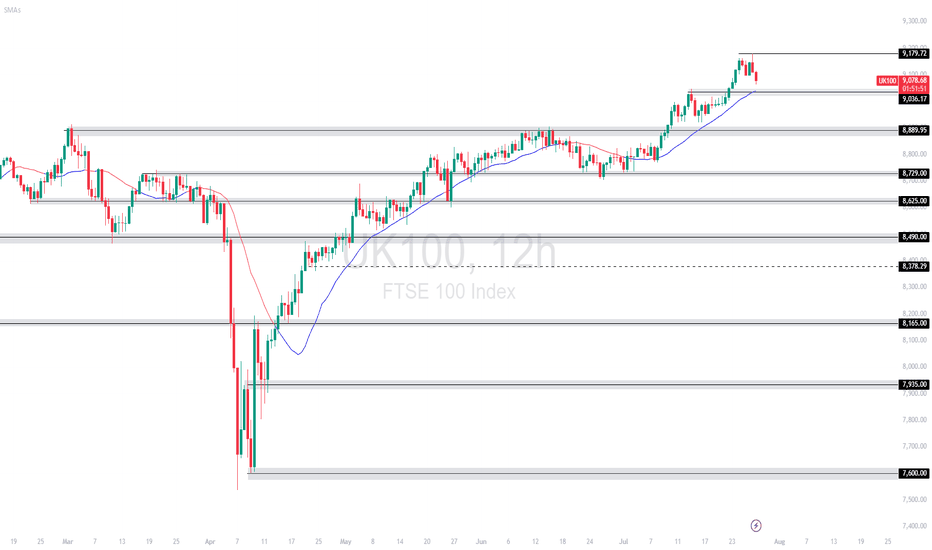

UK100 | Price Pulls Back After Testing 9,179.72 ResistanceThe FTSE 100 recently tagged 9,179.72, a fresh high, before pulling back slightly. Price remains above the 21-period SMA (blue), indicating the uptrend is still intact, though short-term weakness is surfacing. Immediate support sits at 9,036.17.

Support at: 9,036.17 / 8,889.95 🔽

Resistance at: 9,1

FTSE corrective pullback support at 9092The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 9092 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9092 would confirm ongoing ups

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

FTSE 100 Cash (£10) reached its highest quote on Jul 31, 2025 — 9,189.3 GBP. See more data on the FTSE 100 Cash (£10) chart.

The lowest ever quote of FTSE 100 Cash (£10) is 2,949.4 GBP. It was reached on Jan 23, 1995. See more data on the FTSE 100 Cash (£10) chart.

FTSE 100 Cash (£10) is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy FTSE 100 Cash (£10) futures or funds or invest in its components.