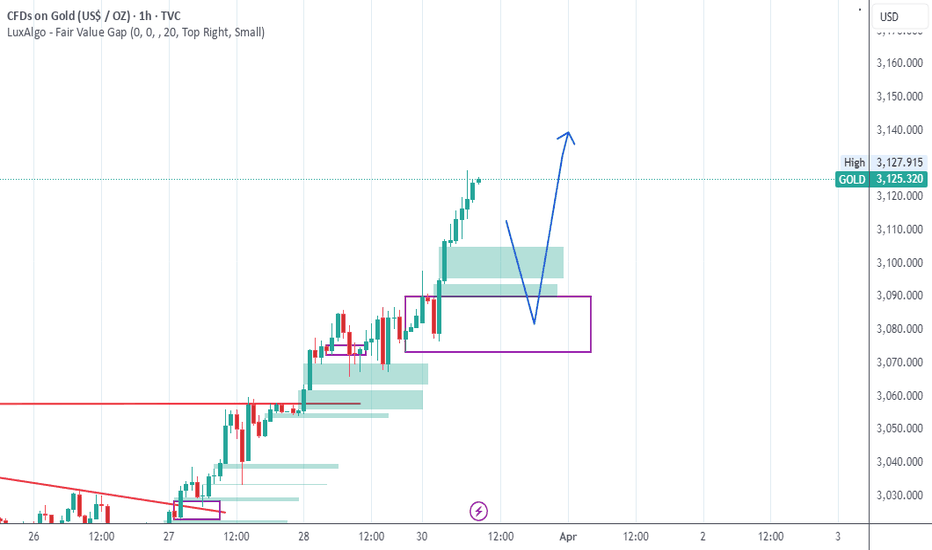

XAUUSD retracement for the long to another ATH📝 Key Observations:

Break of Structure (BoS) - Price recently broke previous support levels, indicating a shift in market direction.

Strong Bullish Momentum - The aggressive move up suggests that buyers are stepping in at the demand zone.

H1 Supply Zone - Price is currently reacting to an H1 supply zone, which may cause a pullback.

M15 Demand Zone - A key support area around $3,055 has been marked, where price may revisit before continuing upward.

Bullish Projection - The red arrow suggests a potential retracement into the demand zone before continuing higher.

📌 Trade Consideration:

✅ Entry Opportunity: If price retraces into the M15 demand zone and shows bullish confirmation (e.g., engulfing candles, wicks rejecting lower prices).

✅ Target: The next significant resistance level around $3,147.

✅ Stop-Loss: Below the M15 demand zone ($3,055) for a good risk-to-reward ratio.

⚠️ Risk Factors:

If price fails to hold at the demand zone, further downside movement is possible.

Supply zone rejection could trigger a deeper correction before continuing up.

USCGC trade ideas

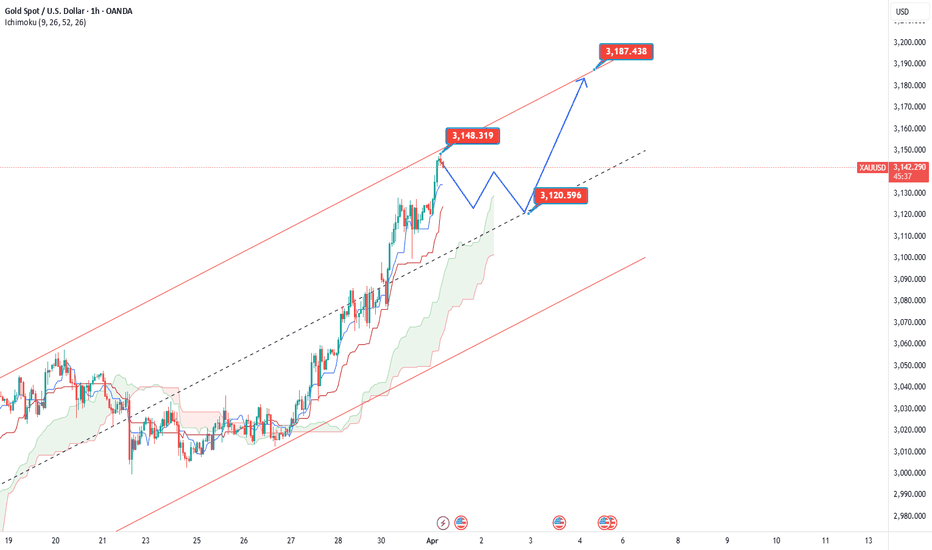

4-hr Gold: Targeting $130 Upward Momentum Gold is undergoing a correction, as investors take profits to offset losses from falling stock prices, impacting their margins. However, we anticipate a renewed wave of buyers entering soon, given Gold's strong safe-haven appeal in times of market uncertainty.

From a technical perspective, Gold is approaching a key support level, and we see an opportunity to capitalize on the upcoming rebound. Our buy order is set at $3,070, positioned slightly above the 38% Fibonacci retracement level, which often acts as strong support in an uptrend.

For risk management, our take-profit (TP) is set at $3,200, aligning with the next resistance zone, while our stop-loss (SL) is 3% below the entry price, ensuring a balanced risk-reward ratio.

Considering current market dynamics, we expect bullish momentum to resume soon, as investors seek stability and protection against ongoing economic uncertainty.

XAUUSD (Gold) is bearish scenario on Daily until 2,940.00 quote Hello guys and welcome one more time to my detailed yet simple strategies to make profit out of any situation in forex,

So, another month, another strategy, in fact, a modified strategy which I hope works better than my other previous 2 trades with simplified strategy. Maybe, it was too simple.

Let's go to the chart though. Daily chart is bearish, as I can see so we go to 15 min chart and seek for opportunity to sell.

So, from now on the next level to touch is a resistence point from March 25, 2025 which became a sort of support which is 3,070.00 and the next one stronger is 3,058.00.

So, let's see what happenes next.

You, what do you think?

Gold H1 | Approaching multi-swing-low supportGold (XAU/USD) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 3,106.58 which is a multi-swing-low support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 3,071.00 which is a level that lies underneath a multi-swing-low support and the 50.0% Fibonacci retracement.

Take profit is at 3,162.54 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Gold Market Surges to 3157 Amid Tariff Talks—3500/oz in Sight?Following the imbalance sweep to 3104, gold market sentiment shifts bullish as tariff concerns gain traction ahead of Trump’s policies. Prices now surge to 3157, with projections eyeing a potential climb toward 3500/oz. Will the bullish momentum hold? follow for more insights , comment for more , and boost idea .

(XAU/USD) 15-Minute Chart Analysis – April 2, 2025Market Structure & Key Zones

Current Price: 3,124.24

Selling Zone: 3,143.07 - 3,148.98

Buying Zone: 3,077.10 - 3,083.68

Observations & Key Market Behavior:

Compression Pattern:

Price is forming a descending triangle/consolidation range, indicating a possible breakout soon.

Liquidity is building up on both sides.

Potential Trade Scenarios:

🔻 Bearish Scenario (Preferred)

If price moves into the 3,143 - 3,149 supply zone, watch for rejection.

Ideal Entry: A break of structure at this zone with a strong bearish reaction.

Target: 3,094.63, then 3,083.68 demand zone.

🔺 Bullish Scenario (Alternative)

If price moves into the 3,077 - 3,083 demand zone, expect a bounce.

Ideal Entry: Confirmation via bullish price action (engulfing candles, wicks, etc.).

Target: 3,143.07, possibly higher to 3,148.98 before a reversal.

Key Takeaways:

✔ Current Price Action is Ranging → Breakout needed for clarity.

✔ High-probability Sell Setup at Supply (3,143 - 3,149)

✔ High-probability Buy Setup at Demand (3,077 - 3,083)

🚀 Best Play: Wait for price to enter either zone before taking action! 🚀

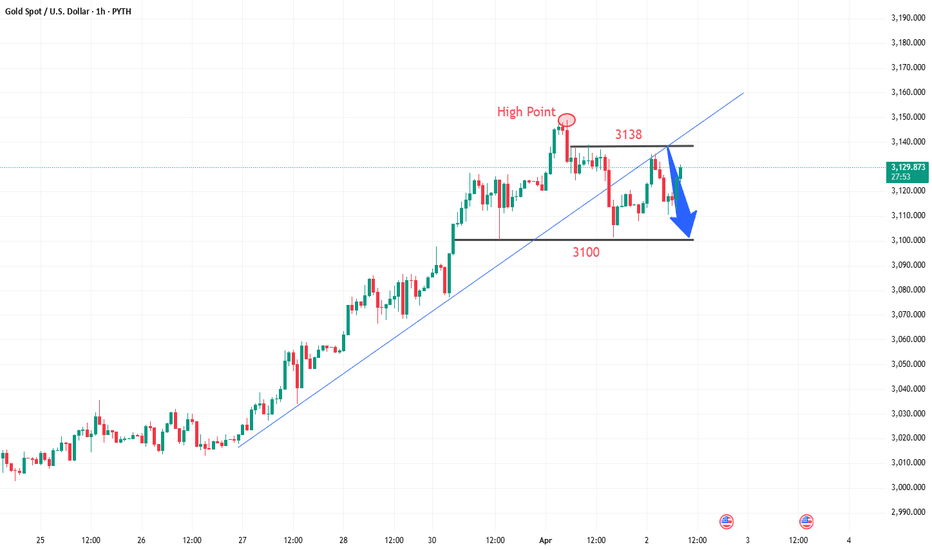

There may be a downward adjustment today!Yesterday, gold fell under pressure at 3150 and then tested the 3100 mark again in the evening, breaking the previous trend line that had been rising for several days. The market gradually slowed down from strong bullish trend, and the daily line turned negative.

Don’t expect the market to turn to bearish and fall sharply at this point. The long-short conversion needs time to brew, and now it is still a bullish trend, so the probability of forming a volatile trend here is relatively high, with a range of 3138-3100. Only when it breaks below 3100 can we see the market turning to bearish.

If the daily line is just a single negative correction, it will not change the overall upward trend. It depends on whether it can continue to close negative today.

The previous trend line support broke and turned into a pressure line, basically coinciding with the 3135-3138 pressure line. This morning's three consecutive positive waves just touched it. The key depends on the performance of the European session:

If the European session suppresses the decline and weakens, then the third test of 3100 may break.

If the European session continues to strengthen and break through 3138, it will also hit the high point of 3148-3149

In terms of trading,

1. Directly push up and break the high, aggressively chase long at 3132, stop profit at 3145;

2. Continue to buy after falling back to 3133, stop loss at 3125 if the callback is too large

3. The European session rebounded several times but failed to maintain sideways, lightly short at 3132 in the evening, and automatically stop profit at 3110 around midnight.

Gold Next 24 to 48 hours (02/04/2025)OANDA:XAUUSD

Gold is likely to remain within a tight range, possibly edging slightly higher due to ongoing geopolitical tensions and U.S. economic data focus and Tariff, but a significant breakout seems unlikely in just 24 hours. Our estimate is 60% probability that the price stays between $3,105 and $3,150, with a 30% chance of inching above $3,150 and a 10% chance of dropping below $3,105. This is a short-term view only

Check our Profile

Happy Tradding

Gold short 2.0Here we have the chart of my last 2 gold trades.

First trade was took at the top of the first down trend with an entry of 3053, here I was anticipating a move to the 2950 area, at least. It was a profitable trade, I closed half of the position for a 400 pip gain, with my SL then moved to 200 pips in profit - which was then hit on the break of the trend.

Following that price action we hit a massive 3 bar surge on the daily, massive move, massive momentum and unfortunately I was not in it! However this morning we seen more crazy move before the London open and I entered another short at 3145 when the STF was showing weakness, this is nicely in profit approaching 400 pips as I write this, SL at entry.

On the close of this latest hourly we see we have broke below the major trend, and next I will be looking for a re test of the trend line/area of consolidation where I will add to my position with the overall retracement target remaining a massive 2950 - will i hold it until then? Doubtful!

Is Gold about to enter resistance? !XAU/USD is rising towards the resistance level which is an overlap resistance that lie sup with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 3,124.63

Why we like it:

There is an overlap resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 3,146.29

Why we like it:

There is a pullback resistance level.

Take profit: 3,097.69

Why we like it:

There is a pullback support level that lines up with the 38.2% Fibonacci retracement.

XAUUSD:Adhere to the strategy of selling at high levelsI have consistently adhered to the strategy of shorting gold. Today, after the gold price spiked upwards, it showed a pattern of being under pressure. The price reached a peak of 3149 and then pulled back. After fluctuating during the U.S. trading session, it continued to decline. Currently, it has broken below the intraday demarcation level of 3120, which in the short term indicates that the bullish trend has temporarily come to an end, and a retracement and adjustment trend has started.

This is also the risk that has been repeatedly highlighted. One should not be blindly carried away by the bullish sentiment and should always maintain a sense of reverence for the market. In the early morning, when the price tested the resistance level around 3135, short positions could be initiated. Now, the price has plummeted rapidly to the resistance level of 3100. It is estimated that most long positions have been stopped out, but we have still achieved the take-profit.

In the subsequent trading, focus on the resistance level around 3130. If this level is not breached, one can continue to chase short positions.

XAUUSD Trading Strategy:

sell@3130

TP:3110-3100

XAUUS SHORTStubborn XAUUSD, played with my TP1 a few times, almost hitting it but never really reached and instead it went the other way and touched my SL. However Im still on a strong sell in this. Opening at 3078 and still maintaining my previous TP 3005 because I know that's the direction that it will head to, if this reaches, it will cover 3days loss, and setting my SL on a much further rate. Personally, I dont use SL's but for Tradingview Im opting to put one as a good practice

Day12of100

L:4

W:1

Such a shame that my L days are way more than my W's but still believing in my trade and I know this will pick up. let's see how this new trade rolls. XAUUSD is already in it's all time high, so I believe soon enough my much awaited correction will happen, Il be patient :)

XAUUSD Bearish Breakdown: Riding the Rising Wedge to Profit1. Chart Pattern: Rising Wedge (Bearish Reversal)

The Rising Wedge is a technical pattern that occurs when price makes higher highs and higher lows within converging trendlines. This pattern is considered bearish, as it usually precedes a breakdown when price fails to sustain the higher levels.

The pattern is clearly visible as price moves within two upward-sloping black trendlines.

The narrowing range suggests that buying pressure is weakening, and sellers are gaining control.

A confirmed breakdown occurs when price breaks below the lower trendline, indicating potential further downside.

2. Key Technical Levels

Resistance Level (Highlighted in Beige, Top Box)

This area represents a strong supply zone where price has struggled to move higher.

Each time the price reaches this level, selling pressure increases, pushing the price lower.

The chart labels this as the Resistance Level, suggesting a potential reversal zone.

Support Level (Highlighted in Beige, Lower Box)

This is the previous demand zone, where price has rebounded multiple times.

Once price reaches this level, buyers may attempt to push it higher.

However, if this level fails to hold after the breakdown, further downside is expected.

Stop Loss Level (~3,150)

The stop loss is placed just above the recent highs.

If price moves beyond this level, it would invalidate the bearish setup.

Traders use stop losses to limit risk in case the market moves against the position.

Target Level (~3,080)

This is the projected downside target based on the height of the wedge.

A measured move (calculated from the highest to the lowest point of the wedge) aligns with this target.

It represents a potential 1.78% decline from the breakdown level.

3. Price Action & Trade Setup

Breakout Confirmation:

The price broke below the lower trendline, confirming a wedge breakdown.

The bearish momentum suggests sellers are in control.

Entry Zone:

A good short-selling opportunity is identified after the breakdown and potential retest of the lower trendline.

Risk Management:

Stop loss at 3,150 (above resistance).

Profit target at 3,080 (expected support).

This gives a favorable risk-to-reward ratio.

4. Market Psychology Behind the Pattern

Rising Wedge Psychology:

The pattern forms as buyers push price higher, but each new high has weaker momentum.

Eventually, selling pressure outweighs buying interest, leading to a breakdown.

Resistance & Support Psychology:

The resistance area acts as a supply zone where big traders sell their positions.

The support zone may hold temporarily, but if it breaks, panic selling could accelerate the decline.

5. Possible Scenarios After the Breakdown

Bearish Case (Most Likely Outcome)

Price continues downward after breakdown.

It reaches the 3,080 target with increased selling momentum.

Confirmation of a bearish reversal pattern.

Bullish Case (Invalidation of Setup)

Price reclaims the wedge and moves back above resistance.

It invalidates the bearish breakdown, stopping out sellers.

A potential bullish continuation toward new highs.

Final Thoughts

This chart presents a high-probability short trade based on the Rising Wedge breakdown and resistance rejection. Traders can manage risk by setting a tight stop loss above resistance while aiming for a target at the next key support zone. The pattern suggests a bearish sentiment in the short term, favoring sell setups over buying opportunities.

Would you like me to add further insights, such as Fibonacci levels or RSI analysis, to strengthen the trade idea? 🚀

XAUUSD:Place short positions during the rebound I conducted resistance tests at the levels of 3,100 and 3,115. However, in the early trading session, the price of gold surged rapidly, soaring all the way to around 3,027. In the later period, choosing to stand by and observe to avoid risks could also be regarded as a sound strategy. Now, the market has approached a stable state. The resistance test at 3,027 has proven to be effective. One can place a short position near 3,025 during the rebound.

XAUUSD Trading Strategy:

sell@3125

TP:3115-3105

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Gold Long Trade Setup Analysis (5H Timeframe - IGSB)📍Gold has made significant moves upwards since January, climbing an additional $300.

📍Currently Gold is showing signs of a reversal, however technicals inform us that this is not yet time for a larger retracement.

📍Below is our previous Gold idea, executed in January 2025 at the break out of a long term triangle pattern. Our entry was $2695, with a target (determined by the triangles range) falls at $3100, just slightly above a key psychological level of $3000.

📍At the moment Gold has not yet tested $3000, an we expect to see this happen before a deeper retracement occurs.

📍As of Friday Gold hit our Entry target of $2840, which was identified by higher timeframe dynamic support (high validity) which falls inline with lower timeframe price structure. The confluence adds confidence to our trade execution. We can, as a result of precise, high validity higher time frame dynamic support add another position onto our original from January. We can do so with a very tight stop just slightly below this dynamic support of 2840 as it is very unlikely to be broken at this time.

Current Outlook:

Risk/Reward = 1:15.8

📈 Bullish Scenario (Breakout Play)

- 🟢 Entry: Price has tested our higher timeframe dynamic support, which represents a significant, highly valid resistance level that is likely to hold its weight. This sits at $2840.

- A bounce from this level would see Gold return to the all-time high price, likely moving beyond this to $3000, $3050, $3100 before a potential larger retracement is seen.

✅ Justification:

- 🔹 Gold broke out of a long term triangle structure which formed between October 2024 and January 2025. This significant price consolidation range once broken gives a rough estimate of a future price target, determined by the height of the range. This when plotted from the breakout point gives us a rough target of $3100, which falls in line with key psychological levels and a more recent fib extension.

📍 Key Resistance Levels (Potential Rejection Zones):

- 🎯 $2880, $2919, $2942 (Previous horizontal structure)

- 📍 Key Support Levels:

- ❗ $2840 (higher timeframe dynamic support)

- 🔻 $2800 (key psychological level)

- 📉 Deeper Target: $3000 - $3100 (Projected based on Fibonacci extensions, previous long term triangle breakout and key psychological levels)

📉 Bearish Scenario (Does not fit our strategy)

- ❌ Invalidation Level: Below $2800

- 🔻 Downside Targets:

We are not shorting Gold at this time. We would wait for another buy, aligning our direction with higher timeframe trend direction.

✅ Justification:

⚡ Key Takeaways:

- 🔹 Gold is yet to test the key psychological level of $3000 which has multiple confluecing endpoints.

- 🔹 The recent fall gives us an opportunity to add to our previous position after testing a high validity higher timeframe dynamic support of $2840.

- 🔹 Gold still remains in a long term bullish direction, therefore we will not consider any shorts.

- 🔹 Expect price to move upwards to test $3000 before a potential higher timeframe reversal.

Previous idea: Gold breaks long term triangle

❗ Fundamental outlook: ❗

📍The recent meeting between former U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy revealed key geopolitical tensions that could have significant implications for gold prices.

❗ 1. Geopolitical Uncertainty and Safe-Haven Demand

The discussions between Trump and Zelenskyy highlighted the ongoing instability in Ukraine. Trump's comments suggested that Ukraine is in a vulnerable position and reliant on U.S. support, while Zelenskyy pushed back against the notion of "playing cards" with his country’s fate. This kind of uncertainty, combined with threats of a broader conflict (Trump warning about "World War III"), increases global investor anxiety, leading to greater demand for gold as a safe-haven asset.

❗ 2. U.S. Policy Shifts and Potential Impact on Gold

Trump's remarks indicated that if he returns to power, U.S. support for Ukraine may be conditional or reduced. This could have ripple effects on global markets:

If the U.S. withdraws or reduces military aid to Ukraine, Russia could gain more leverage, intensifying the conflict and causing further instability in Europe.

Increased geopolitical risk would push investors toward gold, historically a hedge against uncertainty.

❗ 3. Economic and Trade Factors Affecting Gold Prices

The second and third images describe how U.S. trade policies, particularly Trump's tariffs, have influenced gold markets.

Key points include:

The threat of tariffs on European goods led to a price drop in London’s gold market, while New York prices surged, creating arbitrage opportunities.

JPMorgan and other major banks are capitalizing on this price discrepancy by moving billions in gold from London to New York.

This suggests that U.S. economic policies, particularly those under Trump, could further impact gold's valuation. If he resumes a protectionist trade stance, increased economic uncertainty could drive gold prices even higher.

❗ 4. Central Bank and Institutional Moves

With banks like JPMorgan and HSBC heavily involved in gold arbitrage, it’s evident that financial institutions are positioning themselves ahead of potential major economic shifts. This increased activity in gold markets often signals expectations of rising prices.

Fundamental Analysis Conclusion

📍Increased geopolitical tensions (Trump’s stance on Ukraine, potential shift in U.S. foreign policy) add uncertainty, boosting gold demand.

📍Trade and tariff policies under Trump could further impact global economic stability, leading to gold being a preferred hedge.

📍Institutional involvement in gold arbitrage suggests smart money is already betting on future price increases.

📍Macroeconomic risks such as potential wars, inflationary pressures, and central bank gold accumulation reinforce a bullish gold outlook.

Outlook: Bullish for Gold

📈Given the combination of political instability, economic policy uncertainty, and institutional gold positioning, the fundamentals point toward continued strength in gold prices. Investors should monitor how U.S. policy under a potential Trump administration could further impact global markets and gold's role as a hedge against volatility.

XAU/USD Chart Analysis (GOLD)XAU/USD Chart Analysis

1️⃣ Current Price Action:

- Gold (XAU/USD) is trading around **$3,073.42**.

- The price is consolidating after a strong upward move.

2️⃣ Key Indicators:

- **EMA (7) at $3,073.27** (short-term trend)

- **EMA (21) at $3,069.34** (medium-term trend)

- **EMA (50) at $3,061.97** (long-term trend)

- Price is currently above all three EMAs, indicating a bullish trend.

3️⃣ Potential Scenarios:

📈 **Bullish Case (Green Path)**:

- If the price holds above **$3,065–$3,073**, a rally towards **$3,080–$3,100** is likely.

- Buyers may step in at the trendline support.

📉 **Bearish Case (Red Path)**:

- If the price breaks below **$3,065**, a move towards **$3,050–$3,040** could occur.

- Increased selling pressure could push gold lower, especially if key support zones fail.

4️⃣ Trading Strategy:

- **Buy on dips** near **$3,065–$3,073** with targets at **$3,080–$3,100**.

- **Sell below** **$3,065** if confirmed, targeting **$3,050–$3,040**.

- Watch **volume and price action** for confirmation of direction.

🚀 **Final Thought:** Bulls are in control, but a break below $3,065 may shift momentum to the bears.

XAUUSD Weekly Overview | March 24–28, 2025This week offered clean technical setups on Gold (XAUUSD), with multiple opportunities aligning with higher-timeframe bullish structure. Price action respected key intraday levels, and overall momentum leaned bullish throughout the sessions.

Daily Breakdown:

🔹 Monday

Several trades were triggered, including a +70 pip partial and +120 pip take-profit. One setup hit the stop-loss (-50 pips), ending the session with a net gain of +140 pips.

🔹 Tuesday

Focused on structure continuation trades. Took profits at +50 and +100 pips. One trade closed at +130 pips. Net gain: +130 pips.

🔹 Wednesday

Despite an early SL (-70 pips), price later respected a key demand zone. Recovered with +86 and +60 pip trades. Total: +150 pips.

🔹 Thursday

Strong momentum with clean execution. Trades closed at +150, +30, and multiple +50 pip targets. Net: +186 pips.

🔹 Friday

Ended the week with a break-even outcome. A sell limit was triggered but invalidated due to structure change. Buy limit was placed but not filled before market close.

📊 Weekly Summary:

🔼 Total Net P/L: +606 pips

📍 Directional Bias: Bullish

⚙️ Market Structure: Higher highs and higher lows

📰 Context: Upward trend aligned with broader sentiment reported by major financial outlets regarding continued interest in Gold as uncertainty persists.

🧠 Note: This post is for educational purposes only and is not financial advice. Always manage your own risk and validate trades with your own strategy and analysis.