Some history....GOLD HISTORY:

1970 TO 1980:

Gold has a strong bubble rise that falls 50% when it breaks.

2001 to 2011:

10 year up trend

Gold rises further with virtually no setbacks until 1919, but then collapses to $1019.

2015 to 2025:

10 year up trend still at the moment.

The gold price has increased from $1019 in December 2015 to well over $3155 today without serious dips or pullbacks. It is easy to see why this attracts investors, especially when compared to the turbulence in the stock market over the same period of time. It is also easy to see why people might expect that gold will continue to rise after watching it gain consistently for well over a decade.

However, history shows that asset prices cannot continue to go up indefinitely. There are always pull backs, crashes, and bear markets. The last time this happened to gold is a distant memory, but we all remember recent examples such as the tech stocks in the '90s and home prices in the '00s.

Now, lets see Elliot wave principle. When an extending wave 5 ends ( we are at one at the moment), we will see a swift correction down to sub wave 2 of this wave 5. So, the opportunity presents in two ways. First, we know it will be a rapid correction, which means we will not have to wait long for realizing our profits. Secondly, we know approximately how far the down move will likely travel.

At this moment , we are looking for the same escenario as 2008. Wave 3 travels 5.618 from wave 1, then wave 4 made a correction to the 38.2% zone, and finally wave 5 was equal to the entire previous 1-3 movement. This is what is happening right now as welll.

It is always easier to identify assets that are bubbling than to predict when the bubble will pop. Gold has much more downside than upside at this point, but this has been true for years without slowing price gains. Home prices and tech stocks also suggest that bubbles can exist for years even after objective measures (e.g. P/E ratios or rent to buy ratios) show that markets are out of equilibrium.

It is anybody's guess when gold will correct, but it is very likely that it will be ugly when it does.

USCGC trade ideas

Gold (XAU/USD) Bullish Breakout: Next Target $3,181?"Key Observations:

Current Price: Gold is trading at $3,127.450 at the time of the chart.

Trend: The chart exhibits a strong uptrend, with higher highs and higher lows.

Support Levels: Several support levels are marked in the $3,010 - $2,999 range, extending down to around $2,906.

Resistance and Target:

The immediate price range is highlighted, suggesting possible consolidation.

A breakout above this range could lead to a target around $3,181.

Chart Annotations:

A retracement (red structure) indicates a short-term correction before continuation.

A breakout structure (black lines) suggests a previous significant upward movement.

The range and possible continuation are marked, indicating that the price may consolidate before attempting to reach the target.

Trading Perspective:

If price holds above the range, we may see bullish continuation towards $3,181.

A break below support levels could signal a deeper pullback towards $3,010 or lower.

This chart suggests a bullish outlook, with potential for more upside if momentum continues. Traders might look for confirmations before entering long positions.

Gold bulls encounter resistance, high-level adjustmentsYesterday, the gold market showed an abnormal trend. The Asian and European sessions broke the routine and showed a clear weak pattern, showing the characteristics of a bear market of "fast decline without rebound". It is particularly noteworthy that despite the positive US manufacturing data released in the evening, gold has abnormally fallen into the dilemma of "good news but no rise", which is often an important signal of trend reversal. Today, the market focus is on the change in tariff expectations. If the expectations are significantly reduced, it will be the last straw that breaks the camel's back for bulls - the previous rise was largely based on tariff expectations.

Key technical nodes

Bull-bear watershed:

Key resistance above: 3124-3128 area (rebound high after testing 3100 yesterday)

Secondary resistance: 3135-3140 area (strong pressure zone)

Ultimate resistance: 3160-3165 (trend line extension)

Downward target:

First look at the breakthrough of 3100

Main target area: 3077-3057 (previous intensive trading area)

Deep correction may touch 3030-3000

Trading strategy recommendations

Main strategy: short on rebound

Ideal shorting area:

Preferred 3124-3128 range

Focus on 3135-3140 area for strong rebound

Consider 3160-3165 range in extreme cases

Stop loss setting :

10-8 dollars above each resistance zone

Strict stop loss after breaking through the previous high

Target position:

Phase 1: 3100 mark

Phase 2: 3077-3057

Phase 3: 3030-3000

Key points for auxiliary observation

The strength of the rebound in the Asian session will determine the timing of shorting in the European session

If the rebound is too large (exceeding 3140), it may turn into high-level fluctuations

Tariff-related news needs to be paid attention to in real time, which may cause violent fluctuations

Risk warning

If Trump suddenly announces the expansion of the tariff scope, short positions need to be closed immediately

If the US economic data continues to weaken, it may slow down the pace of decline

Geopolitical emergencies may temporarily boost risk aversion demand

The current market has shown signs of fatigue, and investors are advised to remain vigilant and seize possible opportunities for trend reversals. Strict risk control and flexible position adjustments will be the key to dealing with potential violent fluctuations. Remember: when the market begins to become numb to positive news, it often indicates that the trend is about to change.

XAU/USD 02 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Since last analysis price has continued extremely bullish. This is most likely due to market jitters caused by Trump's tariff policy which is driving up the price of gold.

This solidifies gold as a safe haven asset and could lead to repricing.

Price has printed a bearish CHoCH indicating, but not confirming bearish pullback phase initiation.

Price is now contained within an established internal structure. I will however continue to monitor price to evaluate depth of pullback.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ or H4 demand zone before targeting weak internal high priced at 3,149.090.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

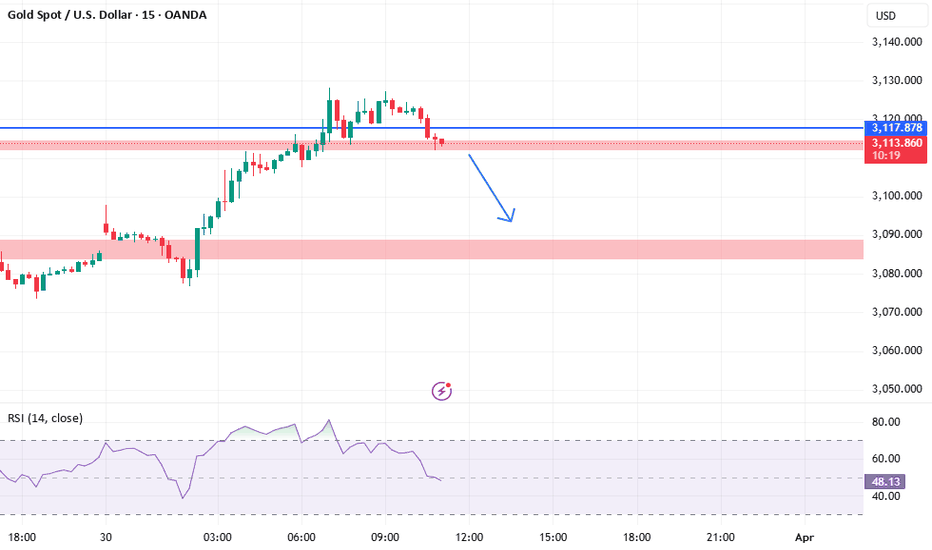

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as yesterday's analysis dated 01 April 2025

Since last analysis price has continued extremely bullish. This is most likely due to market jitters caused by the trump tariffs.

This solidifies gold as a safe haven asset and could lead to repricing.

You will note price has printed a bearish CHoCH which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of 50% internal EQ or M15 demand zone before targeting weak internal high, priced at 3,149.090.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

XAUUSD-GOLD can still break upward ? read captionGold (XAU/USD) has just soared to a new all-time high, reflecting heightened investor demand for safe-haven assets amid economic uncertainties. The surge comes as global markets react to inflation concerns, geopolitical tensions, and shifting monetary policies, further strengthening gold’s position as a premier store of value. With central banks increasing their reserves and investors seeking stability, the precious metal continues to shine, marking a historic moment in the financial markets.

Daily Analysis- XAUUSD (Tuesday, 1st April 2024)Bias: Bullish

USD News(Red Folder):

-ISM Manufacturing PMI

-JOLTS Job Openings

Analysis:

-Strong bullish closure on daily

-Looking for continuation to the upside after 4hr structure retest

-Potential BUY if there's confirmation on lower timeframe

-Pivot point: 3100

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

XAU/USD (Gold) AnalysisXAU/USD (Gold) 4H Analysis

Gold (XAU/USD) remains in a strong uptrend, trading around $3,128.41, well above the 50-period moving average (blue line). This moving average has been acting as dynamic support, reinforcing bullish momentum.

📈 Bullish Scenario:

As long as Gold remains above the 50-period moving average, the uptrend is intact.

A retracement to the highlighted support zone could provide potential buying opportunities before the next move higher.

📉 Bearish Scenario:

A break and close below the support zone could indicate a deeper pullback.

However, as long as price remains above the 50 MA, the overall trend remains bullish.

⚠️ Risk Disclaimer:

This is not financial advice or a trading signal. Always confirm market conditions using your own strategy before making any decisions.

XAU/USD 4 hour chart Hello traders. I had a buy limit set in the area for potential Long positions but it didn't get triggered as gold dropped as expected but I missed the trade. Pretty good analysis. Let's see how the rest of the day plays out. Tomorrow is a new trading day. Big G gets my thanks 🙏. Be well and trade the trend. Happy Monday.

XAU/USD BuyHello dear traders

I try to guide you in trading and creating trading positions and share my trading ideas with you so that if I make a profit, you can also make a profit with me.

These analyzes are done with great complexity and all technical parameters are taken into account as much as possible.

And finally, it is presented to you in a completely simple and practical way to use them.

Be sure to follow the capital management.

Do not risk more than 1% of the capital in any of the positions.

Keep in mind that you are responsible for all trades.

(Good luck)

Gold hits new highGold has recently seen a strong bullish rise, and the price has hit a new high. In the Asian session, gold retreated to the 3085 line and then rebounded and continued to rise. The current price is 3112.

In the 4-hour view, gold continued to rise to the 2830 line, breaking through after the previous two adjustments. This is also the third breakout and rising pattern. The price bullish trend is stable. The price is high, so we don’t blindly short at high levels, but we can’t aggressively chase more. In terms of operation, we still maintain the idea of low longs and high shorts as a supplement.

From the current trend of gold, the support below is 3085-3080. Don’t guess the top if the current trend above has not formed stagflation.

In terms of operation ideas, it is recommended to arrange long orders in the 3080-3085 area of gold, with a stop loss of 3070. The upward target is 3100 and 3120.

Xauusd/M15Gold is structurally bullish, so it's better to exercise caution when taking sell positions and avoid trading against the trend as much as possible. In the 15-minute timeframe, when the price reaches the specified zones, you can enter buy positions based on your trading style by observing the trigger.

GOLD:Short positions are dominant in New York sessionToday, gold jumped higher and opened higher. After filling the gap, it continued to rise, breaking through the 3100 mark and approaching 3130. The excessive and rapid rise caused the MACD indicator to diverge, giving us the opportunity to short this time, from which we gained 1000+ points of profit. Together with the profit of nearly 2000 points in the Asian session, we have gained more than 3000 points of profit today.

At present, the price is still falling, with weak support roughly around 3107 and strong support around 3098. Before the start of the US session, the price is expected to fluctuate in the 3100-3130 area. There will be large fluctuations after the opening, and the possibility of falling from a high position is greater, so the US session can pay more attention to the opportunity to short at a high position.

XAUUSD on correction As we can see that that weekly closing was above the 3080 however,market was not able to close above 3085.

For Now

Below 3080 we'll do sell and our retest target will 3065 then 3055.

if candle closes above 3085 we'll Buy and 3105 will be my target.

Entries should be taken if all the rules are applied

If market gives closing below 3080 again then stay with selling other wise stay our of sell.

Overall im expecting a retracement then continuing bullish trend.