XAUUSD – Daily (D1) Analysis🧱 Market Structure

The D1 structure is clearly bullish – price is printing HHs and HLs consistently.

Current push is a continuation from previous consolidation, breaking structure upwards.

No CHoCH or BOS bearish yet – buyers still in control.

🔵 Key Zones (marked on your chart)

1. Near-term Liquidity / Resistance

Price is approaching a marked supply zone / premium area at the top (same one from W1).

This is likely to act as a reaction point – either:

Sweep liquidity and reverse

Break through and continue higher

2. Imbalances / Mitigation Zones Below Price

These zones are clean mitigation targets if price rejects from the top:

Zone Level Description

2955 Fair value gap / inefficiency (imbalance)

2790–2800 Strong structure zone + FVG + OB

2740–2750 Potential OB + previous consolidation

2495 Deep retracement level – less likely short-term

🧩 Order Flow Observation

Very little sign of exhaustion in candles right now.

The only reason to expect reversal is if:

Price hits the extreme premium zone

We see a strong daily rejection or

Lower timeframes shift (CHoCH / BOS)

📉 EMA Perspective (implied)

Assuming EMA 21/50/200:

Price is well above EMA 21 & 50, indicating strong short-term bullish trend.

A return to EMA 21 (probably around ~2950–2970) would be a healthy pullback.

📌 Bias – Daily

Term Bias Reason Daily

✅ Bullish Clean bullish structure, no shift Short-term

⚠️ Watchful

If price hits supply zone with reaction

Ideal setup

Rejection from premium + CHoCH on H4/H1

🧠 Trade Ideas (based on D1)

🔼 Bullish Scenario

Price holds above 3060 and breaks 3090+

Entry on breakout + retest of minor OB on H1

Target: ATH sweep and continuation

SL: Below minor HL / reaction low

🔽 Bearish Scenario

Price enters supply zone → forms bearish D1 candle (engulfing / pinbar)

Look for CHoCH on H4/H1 to enter short

Target levels: 2950 ➝ 2800 ➝ 2750

SL: Above daily high or OB

USCGC trade ideas

XAUUSD – Weekly (W1) Trading Plan🧱 Market Structure

Clear bullish structure with sustained Higher Highs (HH) and Higher Lows (HL).

Strong impulsive candles show aggressive bullish momentum, no signs of exhaustion yet.

Order flow remains bullish until proven otherwise.

🔍 Key Zones (S&D, FVGs, Gaps)

🔝 Premium Zone

Current price is within this premium area, which contains a weekly FVG / imbalance.

Price is reacting inside this inefficiency (3064–3094) → draw on liquidity.

This is not a demand zone, but rather a sell-side trap area for late buyers.

Possibilities:

Price fully fills the gap to ~3094 → then reverses (bearish reaction).

Or, price continues pushing up for ATH sweep (liquidity above all-time-high).

🧩 Below Current Price – Mitigation Zones

🔵 2900–2950: Minor imbalance, could be used as short-term retracement target.

🔵 2750–2800: OB + structural retest zone → high-interest mitigation area.

🔵 ~2480–2550: Deep retracement zone – valid only if major structure breaks.

📈 EMA Overview

(Assuming standard 5/21/50/200 EMA stack)

Price is far above all EMAs → strong bullish sentiment.

A revisit to the 21 or 50 EMA (weekly) would represent healthy retracement.

⚖️ Bias

Term Direction Reason

Long-term ✅ Bullish Strong structure, unmitigated imbalances above

Medium-term ⚠️ Neutral-to-bullish Depends on reaction from 3064–3094

Short-term 🔄 Await reaction LTF confirmation needed for short setups

🎯 Trade Scenarios

🟩 Bullish Continuation

If price uses 3064–3094 as support (mitigation → continuation)

Targets: New ATH above 3100+

Strategy: Wait for bullish PA confirmation (engulfing / BOS on D1/H4)

🟥 Bearish Rejection

If price shows strong bearish reaction from 3064–3094 zone

Ideal confirmation: bearish engulfing / CHoCH on H4/H1

Targets:

TP1: 2950

TP2: 2800

SL above the high (once structure confirms)

⏳ What to Watch Next

Weekly close relative to the 3064–3094 zone

Daily/H4 candlestick behavior: rejection vs continuation

Look for divergence between price and momentum, or exhaustion candles

GOLD Trading Opportunity! SELL!

My dear followers,

This is my opinion on the GOLD next move:

The asset is approaching an important pivot point 3040.0

Bias - Bearish

Safe Stop Loss - 3047.4

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 3025.3

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD H1 Update: Pullback in Progress BUY DIPS TP 3 100 USD🏆 Gold Market Update (March 24th 2025)

📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2950 USD

🔸Price Target BULLS: 3075 USD - 3100 USD

📈 Market Performance & Price Action

🚀 Gold Hits All-Time High – Reached $3,057.21/oz this week

📊 Driven by: Geopolitical tensions + economic uncertainty

🏦 Federal Reserve Impact

🛑 Fed Keeps Interest Rates Steady at 4.25%–4.50%

🔮 Signals 2 rate cuts likely in 2025 due to slowing growth

📉 Lower rate outlook supports bullish gold sentiment

💹 Gold Investment Trends

📈 Gold ETFs Outperform Physical Gold

GDX (Gold Miners ETF) ↑ 32%

GLD (SPDR Gold Shares) ↑ 15.5%

📊 Investors leaning toward mining stocks & ETF exposure for higher returns

XAUUSD: 27/3 Today’s Market Share and StrategyGold technical analysis

Daily chart resistance 3057, support below 2999

Four-hour chart resistance 3048, support below 3036

Gold news analysis:

Gold operation suggestions: Gold continued to fluctuate in a narrow range of long and short positions yesterday. The price of the Asian and European sessions continued to rise and strengthen based on the 3015 mark. The European session accelerated to break through the 3035 mark and then fell back into a volatile consolidation.

From the current trend analysis, today's short-term resistance focuses on the four-hour chart 3048 and the daily chart 3057 line. The short-term support below focuses on the top and bottom conversion position of 3038. Rely on this range to sell high and buy low.

Buy: 3038near SL: 3033

Sell: 3057near SL: 3062

More signals shared daily

Long Ahead of U.S. GDP AnnouncementGold could see bullish momentum as the U.S. GDP Growth Rate (QoQ Final) is set to be announced on March 27, 2025. The U.S. economy showed signs of slowing down in Q4 2024, with GDP growth dropping from 3.1% to 2.3%. If this downward trend continues due to actual recession fears and given the market conditions up to today, the report is unlikely to be a major downside surprise. However, it could still fuel expectations of Federal Reserve rate cuts, making gold a more attractive asset.

🔥 Why is this bullish for Gold?

✅ Potential Fed Rate Cuts:

A weaker-than-expected GDP reading would increase expectations for Fed rate cuts in the coming months.

Lower interest rates reduce the opportunity cost of holding gold, making it more attractive.

✅ Falling Real Yields:

Inflation remains at 2.3%, slightly above the Fed’s target.

If the Fed moves towards rate cuts, real yields (nominal rates minus inflation) will decline – a strong bullish factor for gold.

✅ Weaker U.S. Dollar Potential:

A weaker GDP print could weaken the U.S. dollar as traders price in lower rates.

Gold has an inverse correlation with the dollar: a weaker USD typically pushes gold higher.

✅ Safe-Haven Demand:

If economic growth continues to slow, investors may hedge with gold.

Increased demand as a safe-haven asset would further support gold prices.

A stronger-than-expected GDP report could delay Fed rate cuts, pressuring gold.

A strong U.S. dollar due to global risk-off sentiment could weigh on gold.

Short-term technical corrections could trigger temporary pullbacks.

Conclusion: Bullish Outlook for Gold Ahead of GDP Data

With slowing U.S. growth, potential rate cuts, and weaker real yields, gold remains a strong long opportunity ahead of the March 27 GDP announcement. Fundamental data supports an upward move, and the technical setup provides a clear entry strategy.

🎯 Gold remains in a uptrend – dips could offer buying opportunities!

🔎 Key Events to Watch:

U.S. GDP Growth Rate (QoQ Final) – March 27, 2025

Fed policy statements & economic projections

U.S. Dollar Index reaction to GDP data

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Gold Market Wedges Through 3052 – Eyes on Unemployment ClaimsGold market surged past 3052, mitigating the serenity of the previous high. Traders, keep a close watch on upcoming unemployment claims, which could trigger an imbalance takeout around the 3040s through 3030s. Market sentiment remains key as price action unfolds. follow for more insight , comment , and boost idea

GOLD: Bullish pattern, Short first then LongIn the 4H chart, the bulls have not completely unloaded their strength. From the perspective of the pattern, it should be possible to reach the area around 3050-3058.

In the 30M chart, it is currently near resistance, focusing on the resistance of the 3037-3044 range. You can consider shorting around 3043, and the target is temporarily set around 3033.

Today there is initial jobless claims data, and I personally expect it to be bullish for gold, so I plan to hold long positions when the data is released.

CHECK XAUUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(XAUUSD) trading signals technical analysis satup👇🏼

I think now (XAUUSD) ready for(SELL)trade ( XAUUSD ) SELL zone

( TRADE SATUP) 👇🏼

ENTRY POINT (3052) to (3050) 📊

FIRST TP (3046)📊

2ND TARGET (3041) 📊

LAST TARGET (3035) 📊

STOP LOOS (3058)❌

Tachincal analysis satup

Fallow risk management

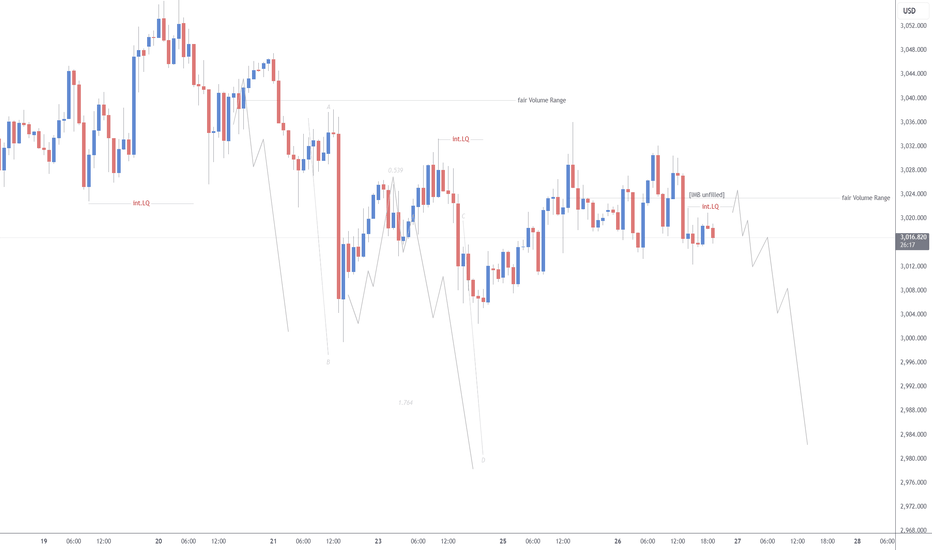

XAU/USD 27 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Bias and analysis remains the same as analysis dated 23 March 2025.

Price has printed a bearish CHoCH following printing further all time highs.

Price is now trading within an established internal range. I will however continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or nested Daily and H4 demand levels before targeting weak internal high priced at 3,057.590.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 24 March 2025.

As per analysis dated 19 March 2025 whereby I mentioned as an alternative scenario that internal range has significantly narrowed. All HTF's require a pullback, therefore, it would be completely viable if price printed a bearish iBOS.

This is how price printed, by printing a bearish iBOS.

Price has yet to print a bullish CHoCH to indicate bullish pullback phase initiation, however, price has traded into premium of 50% internal EQ, therefore, I am happy to confirm internal range.

Intraday Expectation:

Price has traded in to premium of 50% EQ and has mitigated M15 supply zone.

Technically, price to target weak internal low priced at 2,999.465.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Sell Gold from the resistance of the channel after confirmationTraders,

I am closely monitoring Gold (XAU/USD) for a potential selling opportunity. The price is currently forming a rising channel, and I anticipate a decline from the channel’s resistance. I will wait for further confirmation before considering a short position, with an initial target at 3012.

If you find this analysis valuable, your support with a boost would be greatly appreciated. Thank you!

March 26 – Wednesday Gold RecapStarted the day with a solid setup—but the market had other plans.

❌ First Trade

Took a confident entry based on the structure, but price didn’t follow through. Got stopped out for -70 pips. Not the start I hoped for, but losses happen.

✅ Midday Recovery

Price realigned, and a new opportunity formed. I stayed disciplined and took the trade—secured a clean +80 pip move. That brought the confidence back.

✅ Final Trade

Saw one more setup before the day ended. Clean reaction, great execution, and I closed it with another +60 pips.

📊 Total Result: +150 Pips

From red to green—discipline made the difference. The system stayed intact, and recovery was smooth.

💬 Takeaway: One loss doesn’t define the day. Focus. Reset. Re-enter.

XAUUSD H1 Short TermGold Prices—Ahead of Key PCE Report

- Gold remains in a consolidation phase after last week’s sharp pullback, with traders weighing economic data.

Fundamental View:

- A strengthening U.S. dollar and rising Treasury yields have pressured prices, but recent dollar weakness—down 3.4% for the month—has helped stabilise gold near the $3,000 level. Safe-haven demand remains elevated amid economic uncertainty, particularly around U.S. tariff policies. Markets are closely watching the potential impact of new tariffs set to take effect on April 2, with a more aggressive stance likely pushing gold toward $3,100, while a softer approach may lead to a temporary dip below $3,000.

- Last week, the Fed held rates steady and projected two cuts for the year, reinforcing gold’s appeal as a non-yielding asset. Traders are now turning to Friday’s PCE inflation report— the Fed’s preferred inflation gauge. A softer reading would likely fuel expectations of rate cuts, supporting gold, while a hotter-than-expected number could strengthen the dollar and pressure prices lower.

Technical View:

- Current price action suggests indecision, with gold trading at $3,027.49. Key support lies at $2,995 – $3,005, with a break below this range potentially triggering a move toward $2,930 – $2,940. The critical longer-term support remains at the 50-day moving average of $2,874.97.

- On the upside, a sustained move above $3,057.59 would signal a continuation of the broader uptrend, with targets at $3,100 and $3,150. As long as gold holds above $2,968.92, the bullish structure remains intact, and any pullbacks are likely to be short-lived.

Five powerful trading psychology tips to help youHere are five powerful trading psychology tips to help you cope with losses and stay in the game without giving up:

1. Accept Losses as Part of the Game

Losses are inevitable in trading—even the best traders lose. Instead of fearing them, see losses as the cost of doing business and a learning opportunity. Keep a trading journal to analyze your mistakes and improve over time.

2. Control Your Emotions & Stick to the Plan

Emotions like fear and greed lead to revenge trading and overleveraging. Set clear rules for stop-losses, position sizing, and risk per trade. Never move your stop loss out of desperation—respect your trading plan.

3. Manage Your Risk Like a Pro

Follow the 1-2% risk per trade rule to protect your capital. If you lose small, you can always come back. A good risk-to-reward ratio (at least 1:2 or 1:3) ensures that even a 40% win rate can still be profitable in the long run.

4. Take Breaks & Maintain a Strong Mindset

If you experience a streak of losses, step away from the charts for a while. Clear your mind, do something unrelated to trading, and return with a fresh perspective. Trading with a stressed or emotional mindset leads to bad decisions.

5. Focus on the Long-Term Vision

Trading success doesn't happen overnight. Many traders blow their accounts because they want quick riches. Instead, focus on consistency, discipline, and skill-building. If you trust the process and stay patient, the results will come.

Below is an example of a trading checklist that I follow before I take any trade, this helps me stay disciplined, manage risk, and avoid emotional decisions:

✅ Trading Psychology Checklist

🔹 Before Entering a Trade:

☐ Did I follow my trading plan? (No random trades, only high-probability setups)

☐ Am I trading based on logic, not emotions? (No FOMO, revenge trading, or overconfidence)

☐ Is my risk properly managed? (1-2% risk per trade, proper lot size)

☐ Does this trade have a good risk-to-reward ratio? (At least 1:2 or 1:3)

☐ Did I place my stop loss and take profit before executing the trade?

🔹 While in a Trade:

☐ Am I sticking to my original plan? (No moving stop losses or take profit out of emotions)

☐ Am I avoiding overtrading? (Only taking quality setups, not forcing trades)

☐ Am I managing my emotions? (Staying calm, not panicking over small fluctuations)

🔹 After Closing a Trade:

☐ Did I journal my trade? (Win or lose, record entry, exit, and emotions during the trade)

☐ Did I review what went right or wrong? (Learn from mistakes and improve)

☐ Am I sticking to my daily trading limit? (No excessive trading after wins or losses)

☐ Am I taking breaks and staying mentally refreshed? (Not glued to charts 24/7)

Feel free to copy. But remember to support this with a boost if you enjoyed reading it.

DeGRAM | GOLD forms an ascending wedgeGOLD is above the descending channel between the trend lines.

The price is moving away from the dynamic support.

The chart forms an ascending wedge.

We expect XAUUSD to rise further before continuing the correction.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAU / USd 4 Hour ChartHello traders. Just a quick post to show that we can go either way for a quick scalp trade. I am just watching for now as we have Pre NY volume starting an hour from now. Should be a good day. I have to check to see if we have news today. Lower time frame confirmation is always a must and one of many factors that need to be considered when taking a trade. Big G get a shout out. Happy Wednesday, be well and trade the trend.